In the digital age, where screens have become the dominant feature of our lives The appeal of tangible printed items hasn't gone away. If it's to aid in education as well as creative projects or just adding personal touches to your area, Do I Pay Social Security On 401k Contributions have proven to be a valuable source. Here, we'll dive deep into the realm of "Do I Pay Social Security On 401k Contributions," exploring the benefits of them, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Do I Pay Social Security On 401k Contributions Below

Do I Pay Social Security On 401k Contributions

Do I Pay Social Security On 401k Contributions -

Contributions to a 401 k are not subject to income taxes but are subject to Medicare and Social Security taxes You pay income taxes on withdrawals

While 401 k contributions are exempt from federal and generally state income taxes they aren t exempt from payroll taxes and as such you ll see two separate amounts on your W2 and paystub if you contributed the amount that is subject to those taxes and the amount that is subject to income tax

Do I Pay Social Security On 401k Contributions encompass a wide selection of printable and downloadable items that are available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and much more. The beauty of Do I Pay Social Security On 401k Contributions lies in their versatility and accessibility.

More of Do I Pay Social Security On 401k Contributions

How To Calculate Social Security Wages From Pay Stub

How To Calculate Social Security Wages From Pay Stub

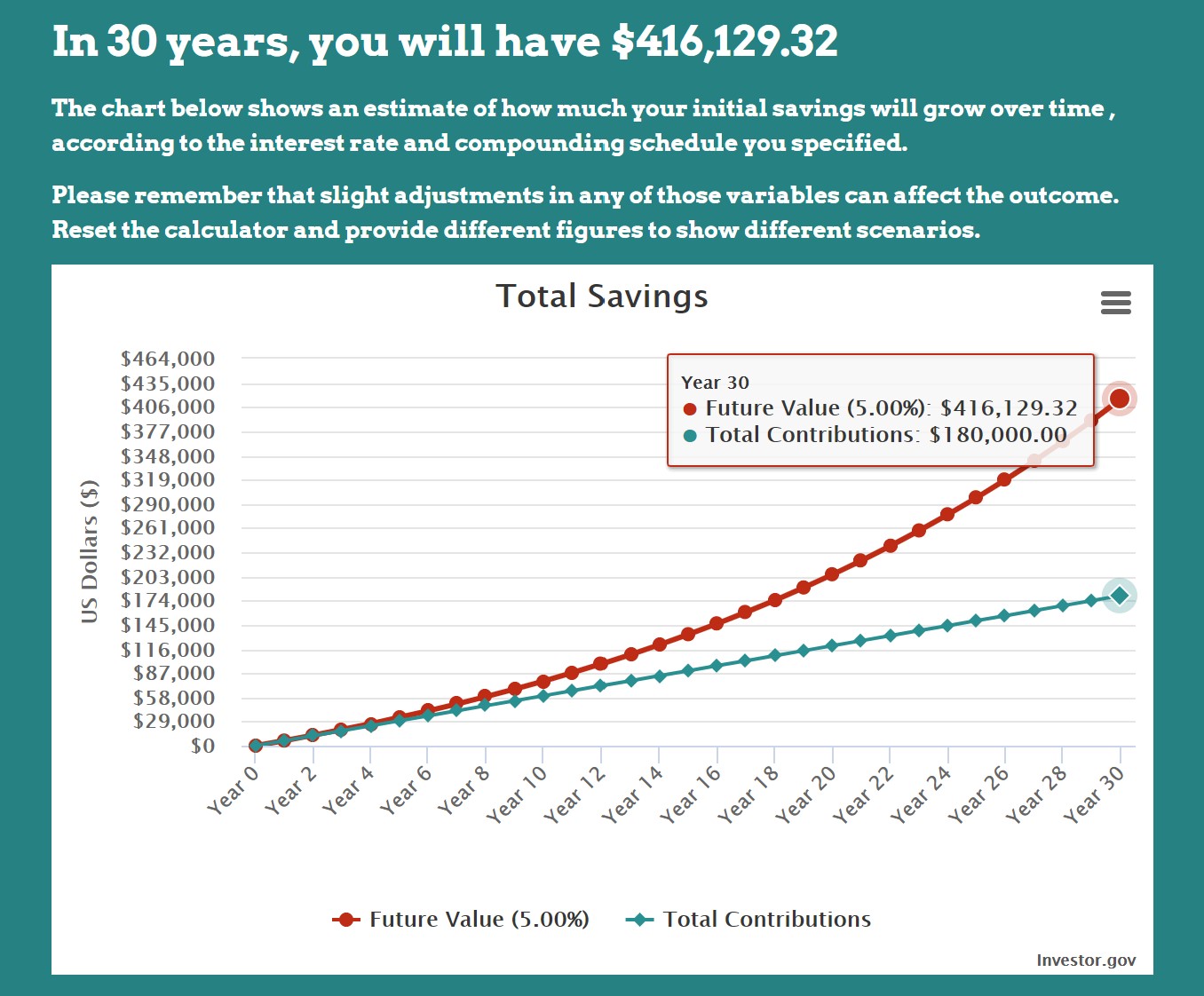

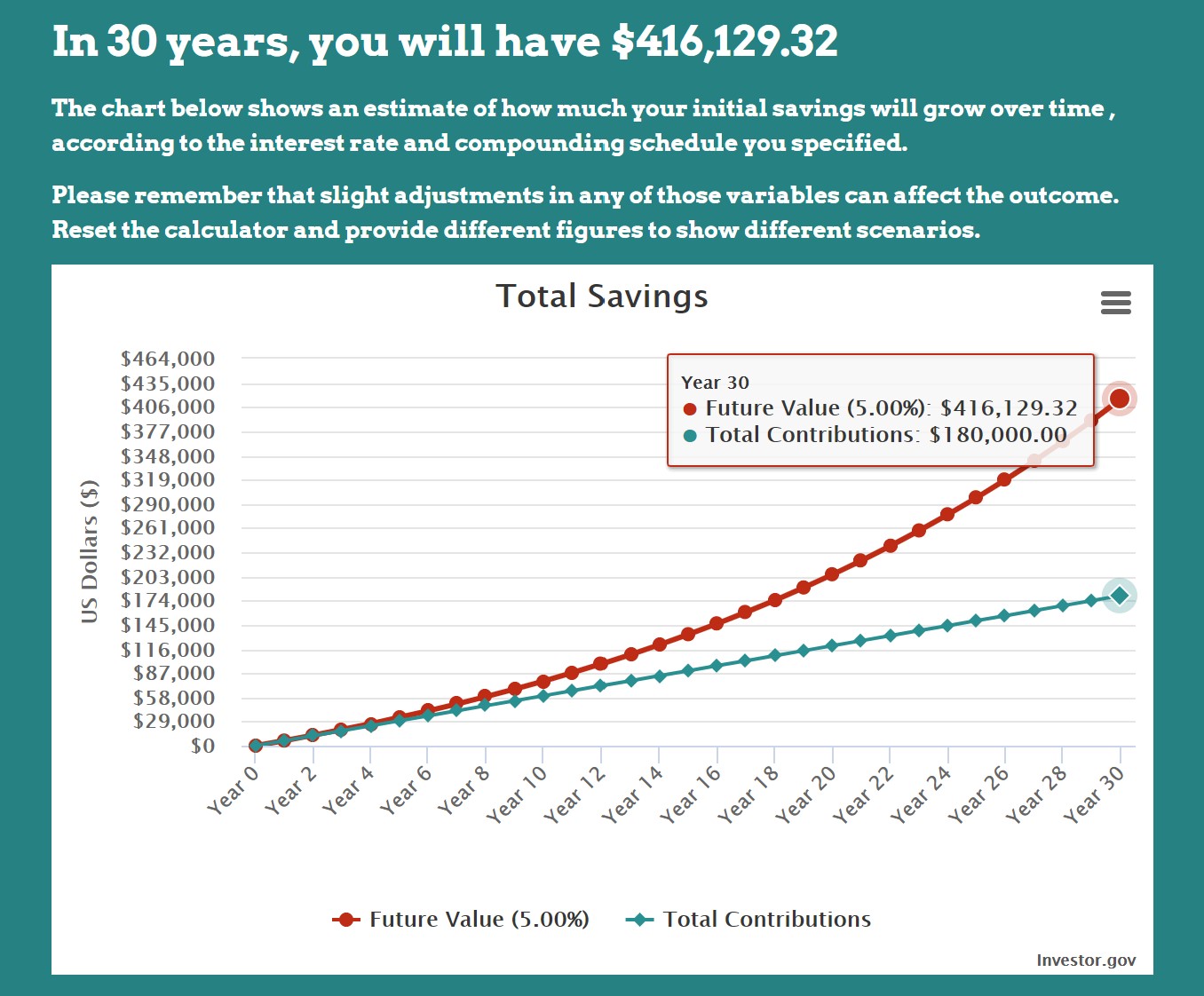

So making contributions to a 401 k will not reduce your Social Security benefits in any way And it s a good idea to contribute to your 401 k for retirement even if you re counting on taking Social

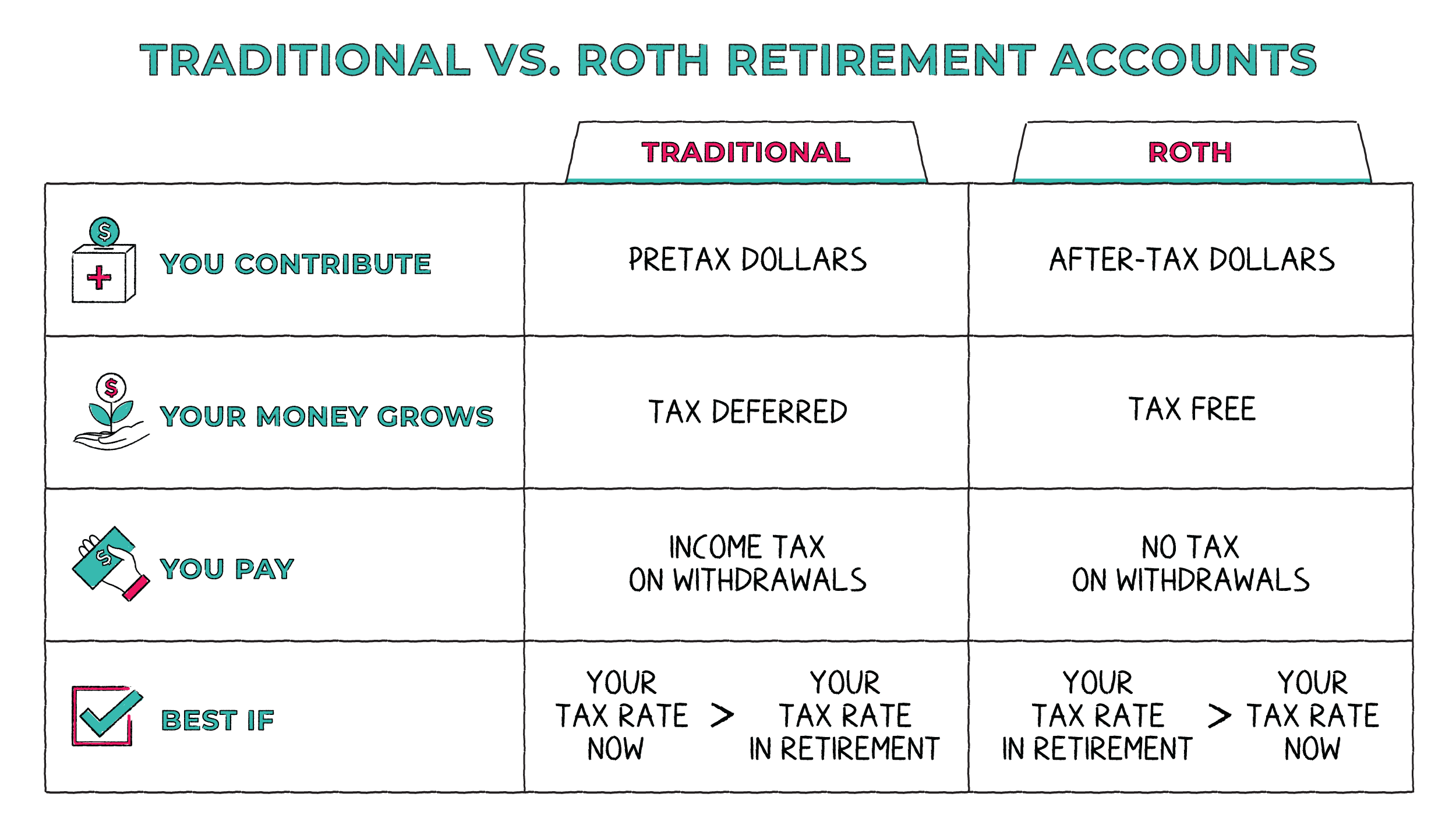

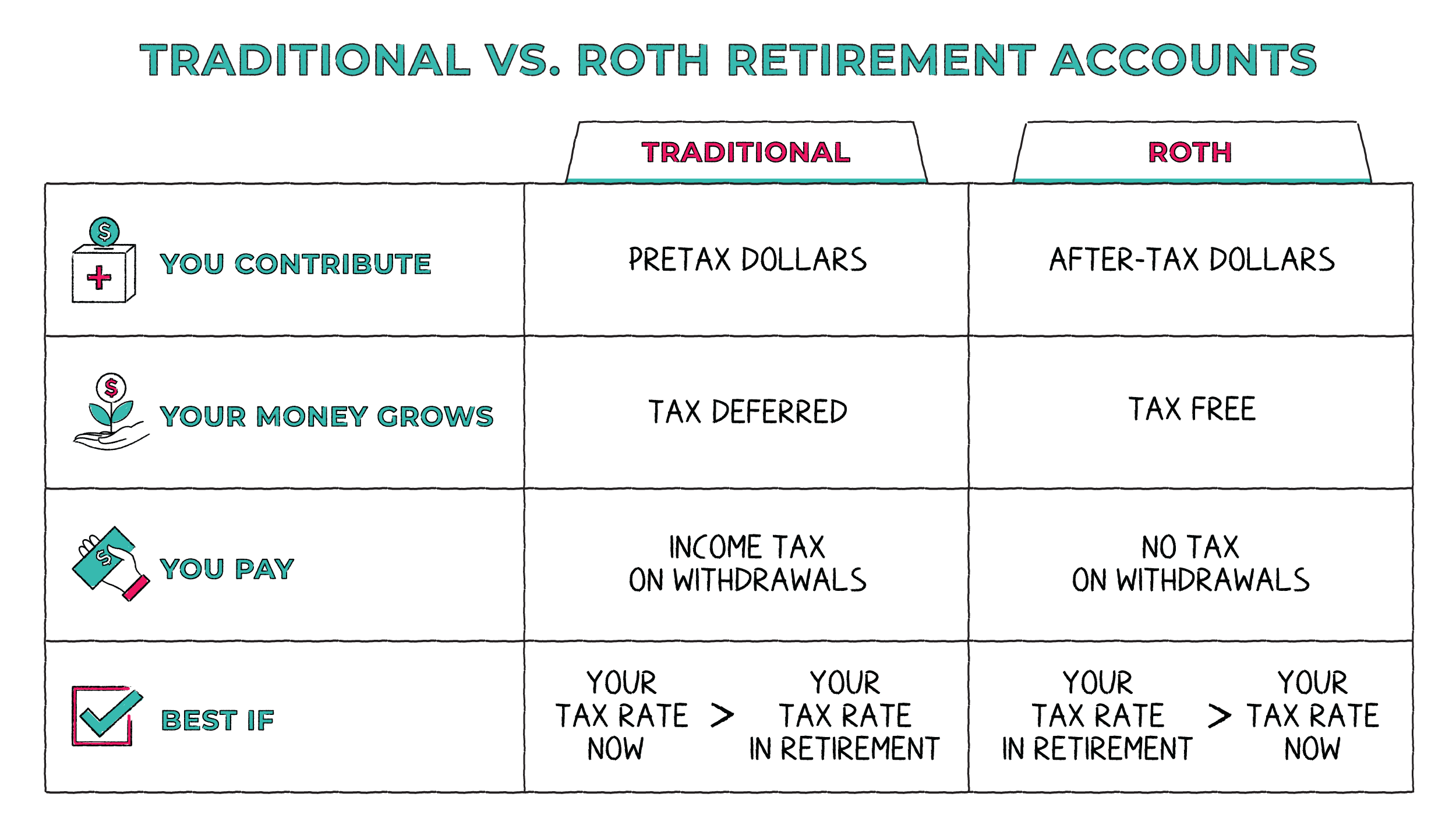

Traditional 401 k plans are tax deferred You don t have to pay income taxes on your contributions though you will have to pay other payroll taxes like Social Security and Medicare taxes You won t pay

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization The Customization feature lets you tailor print-ready templates to your specific requirements such as designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value: The free educational worksheets offer a wide range of educational content for learners of all ages, which makes them a vital device for teachers and parents.

-

An easy way to access HTML0: immediate access a variety of designs and templates saves time and effort.

Where to Find more Do I Pay Social Security On 401k Contributions

401k Basics Strategy To Increase Contributions And Your Paycheck

401k Basics Strategy To Increase Contributions And Your Paycheck

Fact checked by Suzanne Kvilhaug Contributions to qualified retirement plans such as traditional 401 k s tax deductible However you don t have to report them on your tax return as your

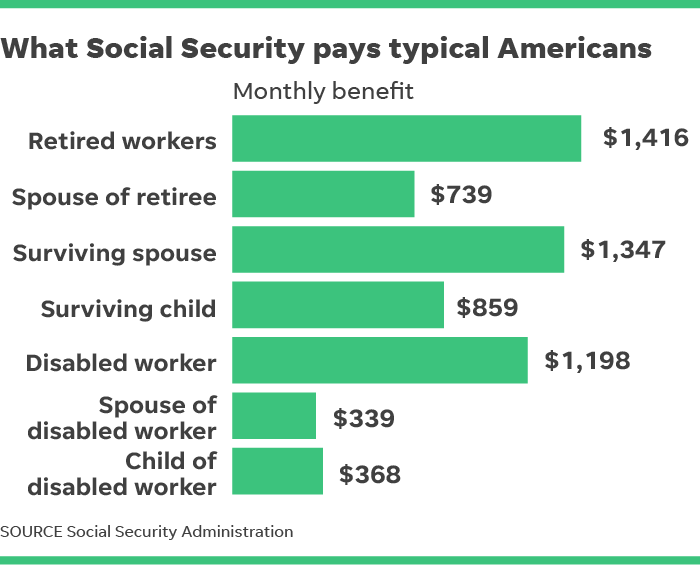

Social Security payments rise gradually from age 62 when participants can first claim them until they max out at 70 The longer people wait the higher their eventual benefits Tax tips

In the event that we've stirred your curiosity about Do I Pay Social Security On 401k Contributions Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of motives.

- Explore categories like interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a broad array of topics, ranging everything from DIY projects to planning a party.

Maximizing Do I Pay Social Security On 401k Contributions

Here are some ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Do I Pay Social Security On 401k Contributions are an abundance filled with creative and practical information that satisfy a wide range of requirements and passions. Their availability and versatility make them a valuable addition to both personal and professional life. Explore the vast collection of Do I Pay Social Security On 401k Contributions today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes you can! You can print and download these items for free.

-

Can I use the free printables in commercial projects?

- It's based on the rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright concerns with Do I Pay Social Security On 401k Contributions?

- Certain printables might have limitations regarding their use. Be sure to review these terms and conditions as set out by the designer.

-

How do I print Do I Pay Social Security On 401k Contributions?

- Print them at home with an printer, or go to a local print shop for more high-quality prints.

-

What software do I need to run printables at no cost?

- A majority of printed materials are as PDF files, which is open with no cost software like Adobe Reader.

401 k Maximum Employee Contribution Limit 2020 19 500

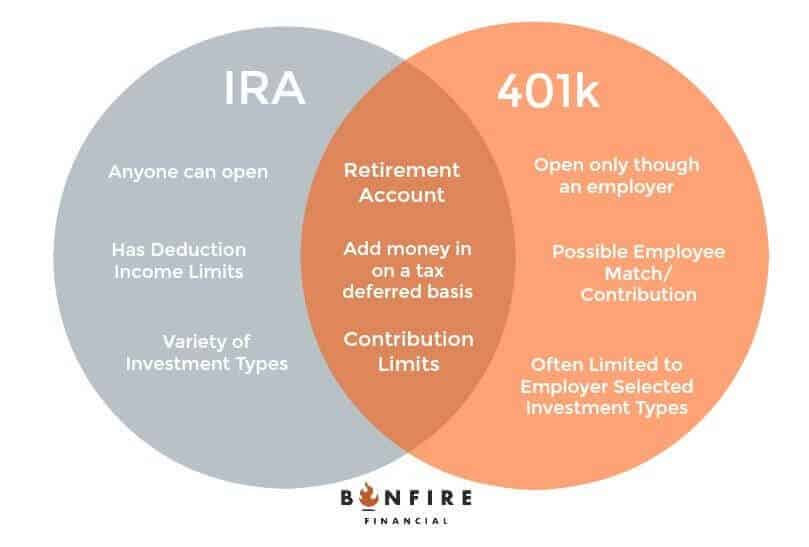

Differences Between An IRA And 401k A Simple Guide

Check more sample of Do I Pay Social Security On 401k Contributions below

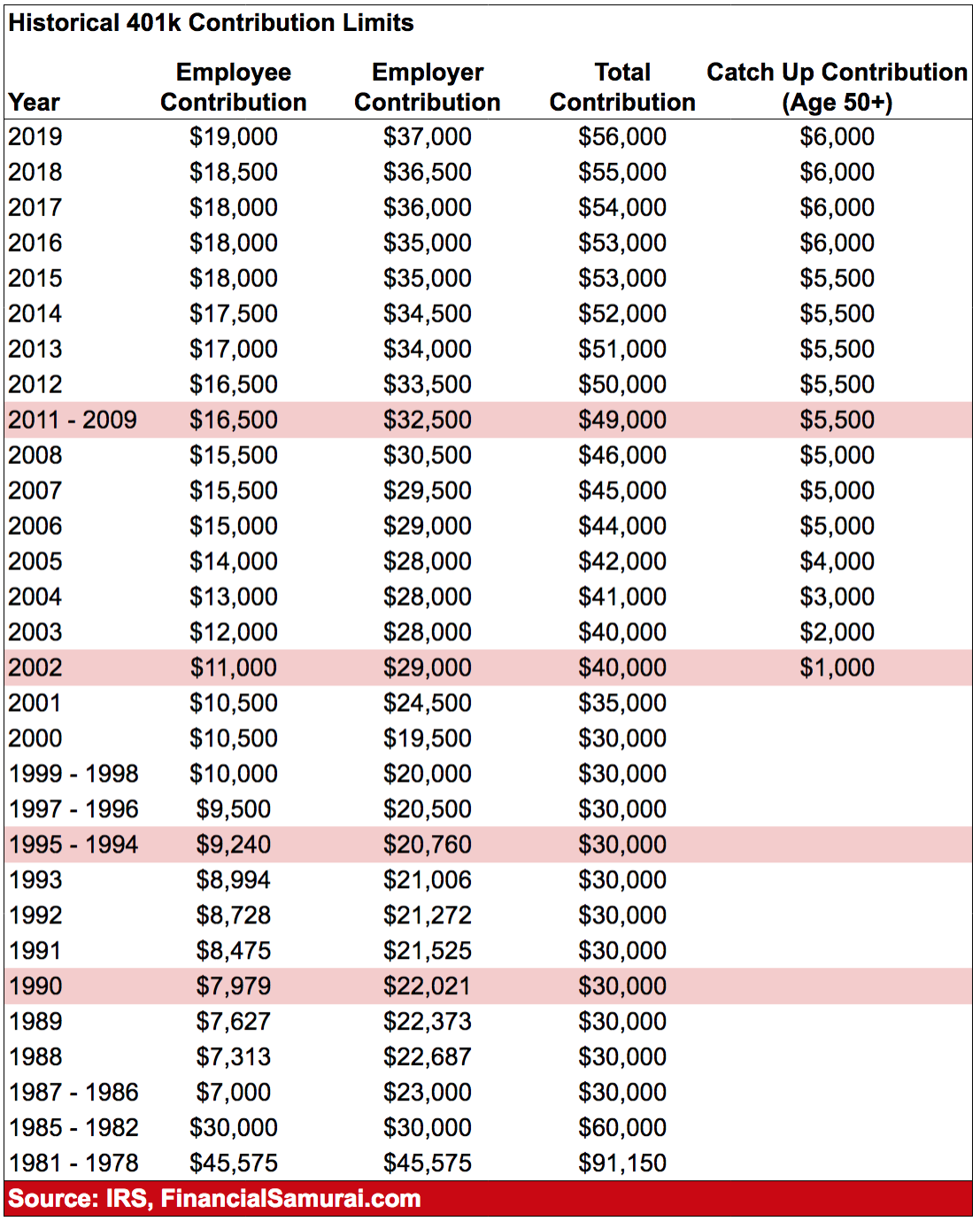

The Maximum 401k Contribution Limit Financial Samurai

How Much Can I Contribute To My Self Employed 401k Plan

How Do I Pay Back A Social Security Overpayment

What Is 401K IRA Vs 401K Retirement Answers From Napkin Finance

Social Security Tax Withholding What Do YOU Pay YouTube

How To Calculate Federal Income Taxes Social Security Medicare

https://money.stackexchange.com/questions/55170

While 401 k contributions are exempt from federal and generally state income taxes they aren t exempt from payroll taxes and as such you ll see two separate amounts on your W2 and paystub if you contributed the amount that is subject to those taxes and the amount that is subject to income tax

https://finance.zacks.com/social-security-taxes...

Social Security withholding is required on all 401 k contributions Social Security Rate The federal government sets the annual Social Security tax withholding rate You may obtain the rate

While 401 k contributions are exempt from federal and generally state income taxes they aren t exempt from payroll taxes and as such you ll see two separate amounts on your W2 and paystub if you contributed the amount that is subject to those taxes and the amount that is subject to income tax

Social Security withholding is required on all 401 k contributions Social Security Rate The federal government sets the annual Social Security tax withholding rate You may obtain the rate

What Is 401K IRA Vs 401K Retirement Answers From Napkin Finance

How Much Can I Contribute To My Self Employed 401k Plan

Social Security Tax Withholding What Do YOU Pay YouTube

How To Calculate Federal Income Taxes Social Security Medicare

The Big List Of 401k FAQs For 2020 Workest

What Is A 401 k Match OnPlane Financial Advisors

What Is A 401 k Match OnPlane Financial Advisors

How Much Does Social Security Pay On Average To Retired Workers