In this day and age with screens dominating our lives, the charm of tangible printed material hasn't diminished. No matter whether it's for educational uses for creative projects, simply to add an extra personal touch to your home, printables for free have become a valuable source. Here, we'll take a dive through the vast world of "Do I Have To Pay Taxes On Inherited Ira Distribution," exploring the benefits of them, where they are available, and what they can do to improve different aspects of your life.

Get Latest Do I Have To Pay Taxes On Inherited Ira Distribution Below

Do I Have To Pay Taxes On Inherited Ira Distribution

Do I Have To Pay Taxes On Inherited Ira Distribution -

If you inherit a Roth IRA it is completely tax free if the Roth IRA was held for at least five years starting Jan 1 of the tax year for which the first Roth IRA contribution was made

Tax wise the new IRA recipient is subject to the same tax rules that any IRA holder would be You ll have to pay taxes on any distributions taken out of the account at current income tax rates If you

Do I Have To Pay Taxes On Inherited Ira Distribution offer a wide collection of printable items that are available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages, and much more. The great thing about Do I Have To Pay Taxes On Inherited Ira Distribution lies in their versatility and accessibility.

More of Do I Have To Pay Taxes On Inherited Ira Distribution

2022 Year End Tax Tips Richard Russell Law

2022 Year End Tax Tips Richard Russell Law

COVID 19 Relief for Retirement Plans and IRAs Information on this page may be affected by coronavirus relief for retirement plans and IRAs Table 1 Single Life

Inherited IRA How It Works Distribution Rules An inherited IRA is an account opened for someone inherits an IRA or retirement plan from a deceased owner

Do I Have To Pay Taxes On Inherited Ira Distribution have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization Your HTML0 customization options allow you to customize printables to your specific needs whether it's making invitations to organize your schedule or even decorating your house.

-

Educational Benefits: Printables for education that are free can be used by students of all ages, which makes them a useful tool for parents and educators.

-

Convenience: Quick access to a plethora of designs and templates helps save time and effort.

Where to Find more Do I Have To Pay Taxes On Inherited Ira Distribution

Paying Taxes 101 What Is An IRS Audit

Paying Taxes 101 What Is An IRS Audit

If you inherit an IRA and take money out of it you ll pay income taxes on it If the withdrawal is big enough to lift your income into a higher bracket you may owe more taxes on the rest of your income as

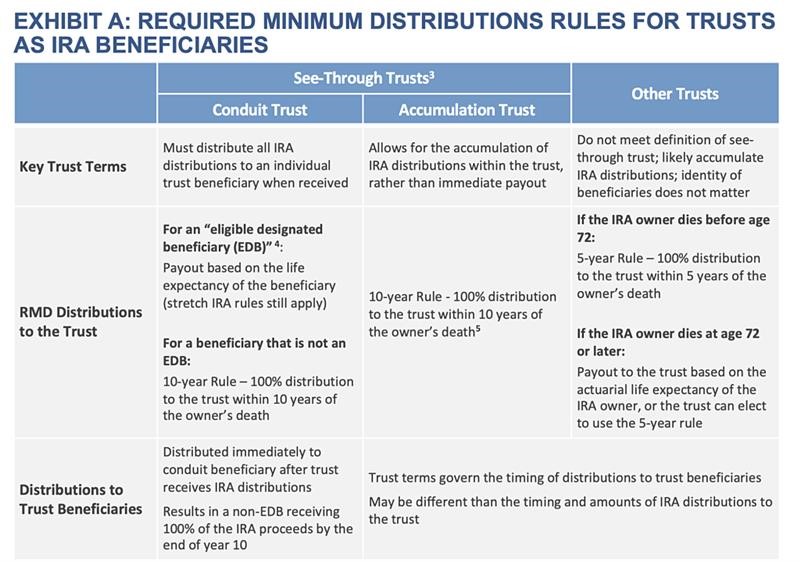

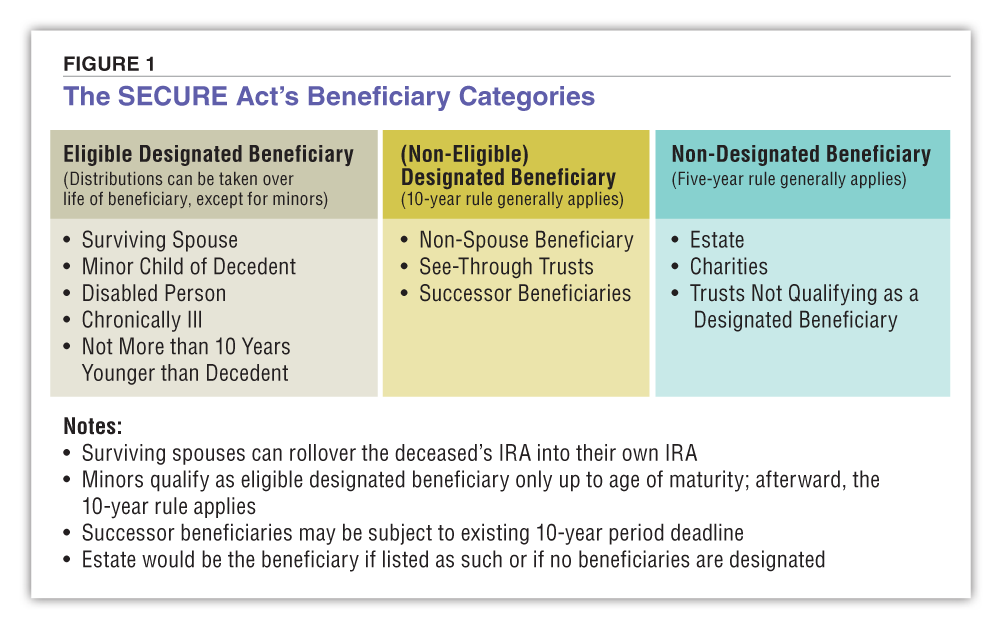

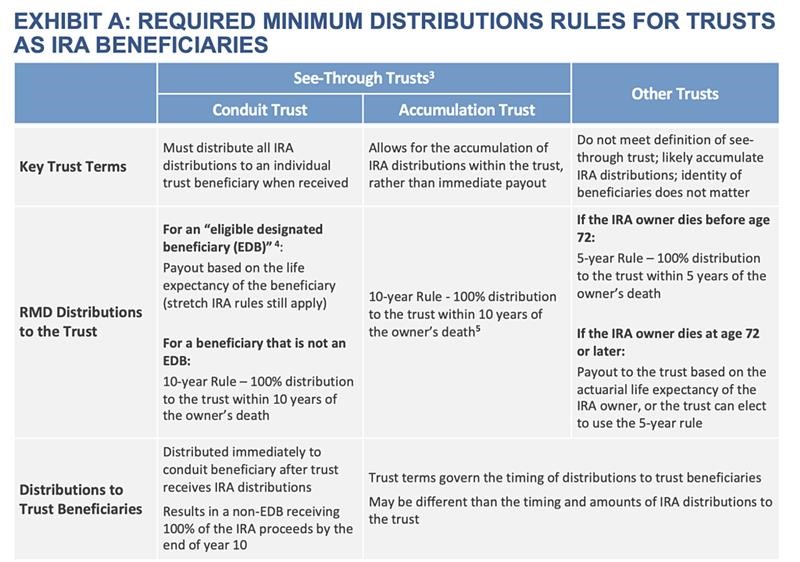

When you inherit an IRA many of the IRS rules for required minimum distributions RMDs still apply However there may be additional rules based on your relationship to the

If we've already piqued your curiosity about Do I Have To Pay Taxes On Inherited Ira Distribution and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Do I Have To Pay Taxes On Inherited Ira Distribution for all needs.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning tools.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide range of interests, that range from DIY projects to planning a party.

Maximizing Do I Have To Pay Taxes On Inherited Ira Distribution

Here are some creative ways of making the most of Do I Have To Pay Taxes On Inherited Ira Distribution:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Do I Have To Pay Taxes On Inherited Ira Distribution are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and preferences. Their accessibility and versatility make they a beneficial addition to your professional and personal life. Explore the vast collection of Do I Have To Pay Taxes On Inherited Ira Distribution today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes they are! You can download and print these files for free.

-

Can I use the free printables in commercial projects?

- It's dependent on the particular rules of usage. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may contain restrictions in use. Make sure to read these terms and conditions as set out by the designer.

-

How do I print Do I Have To Pay Taxes On Inherited Ira Distribution?

- You can print them at home with printing equipment or visit a local print shop to purchase premium prints.

-

What program do I require to view printables free of charge?

- Most PDF-based printables are available in the format PDF. This can be opened with free programs like Adobe Reader.

The Benefits Of Dividend Investing Moneyweb Free Download Nude Photo

You ve Inherited An IRA What Happens Next CD Wealth Management

Check more sample of Do I Have To Pay Taxes On Inherited Ira Distribution below

Do I Need To Pay Taxes The Minimum Income To File Taxes

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Inherited Ira Calculator MadisonCaitie

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

How To Increase The Value Of A Business By Paying More Taxes

https://smartasset.com/.../taxes-on-inherited …

Tax wise the new IRA recipient is subject to the same tax rules that any IRA holder would be You ll have to pay taxes on any distributions taken out of the account at current income tax rates If you

https://www.fool.com/retirement/plans/inherited-iras/taxes

Since distributions are taxed at ordinary income tax rates this change to the rule now ensures inherited IRA funds will be taxed within a decade when not inherited by a

Tax wise the new IRA recipient is subject to the same tax rules that any IRA holder would be You ll have to pay taxes on any distributions taken out of the account at current income tax rates If you

Since distributions are taxed at ordinary income tax rates this change to the rule now ensures inherited IRA funds will be taxed within a decade when not inherited by a

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

How To Increase The Value Of A Business By Paying More Taxes

Ira Required Minimum Distribution Table Ii Elcho Table

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

How Much Can You Inherit And Not Pay Taxes Johnson Law Firm