Today, in which screens are the norm The appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education or creative projects, or just adding a personal touch to your space, Do I Have To Pay State Taxes On A Roth Ira Withdrawal are a great resource. For this piece, we'll dive in the world of "Do I Have To Pay State Taxes On A Roth Ira Withdrawal," exploring the different types of printables, where they can be found, and how they can enrich various aspects of your daily life.

Get Latest Do I Have To Pay State Taxes On A Roth Ira Withdrawal Below

Do I Have To Pay State Taxes On A Roth Ira Withdrawal

Do I Have To Pay State Taxes On A Roth Ira Withdrawal -

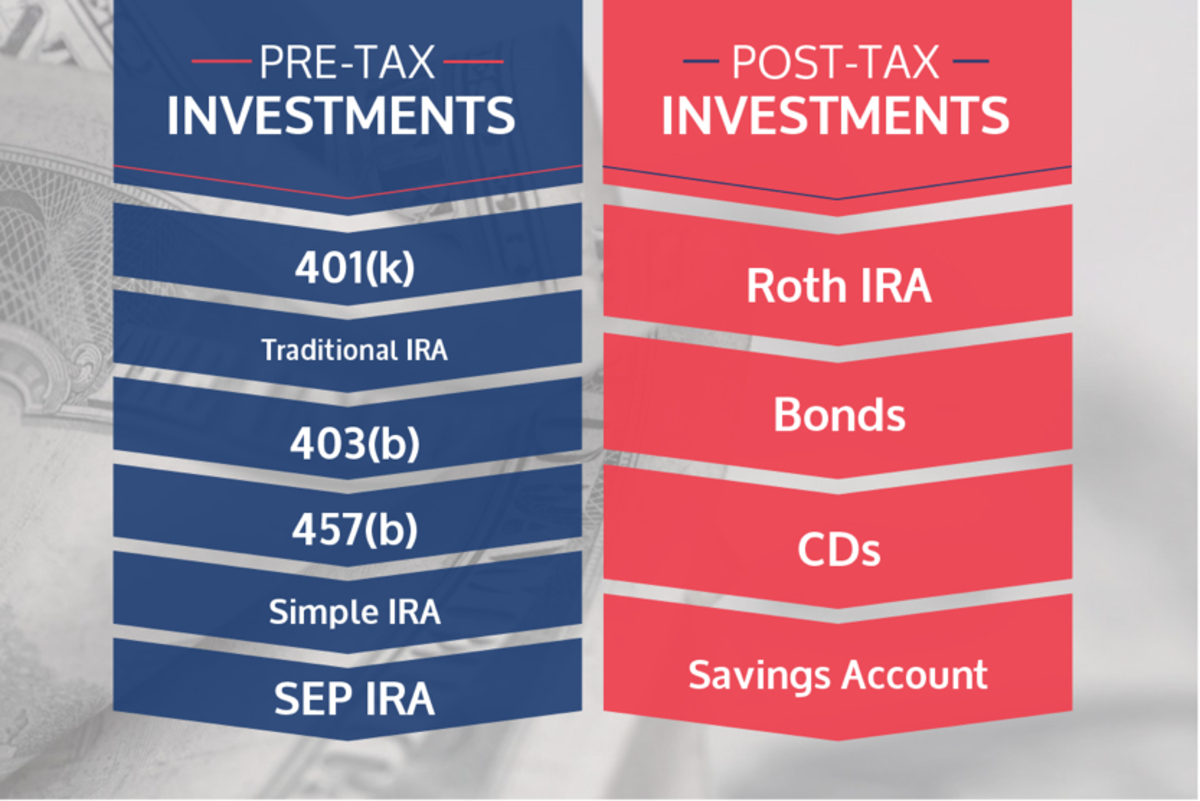

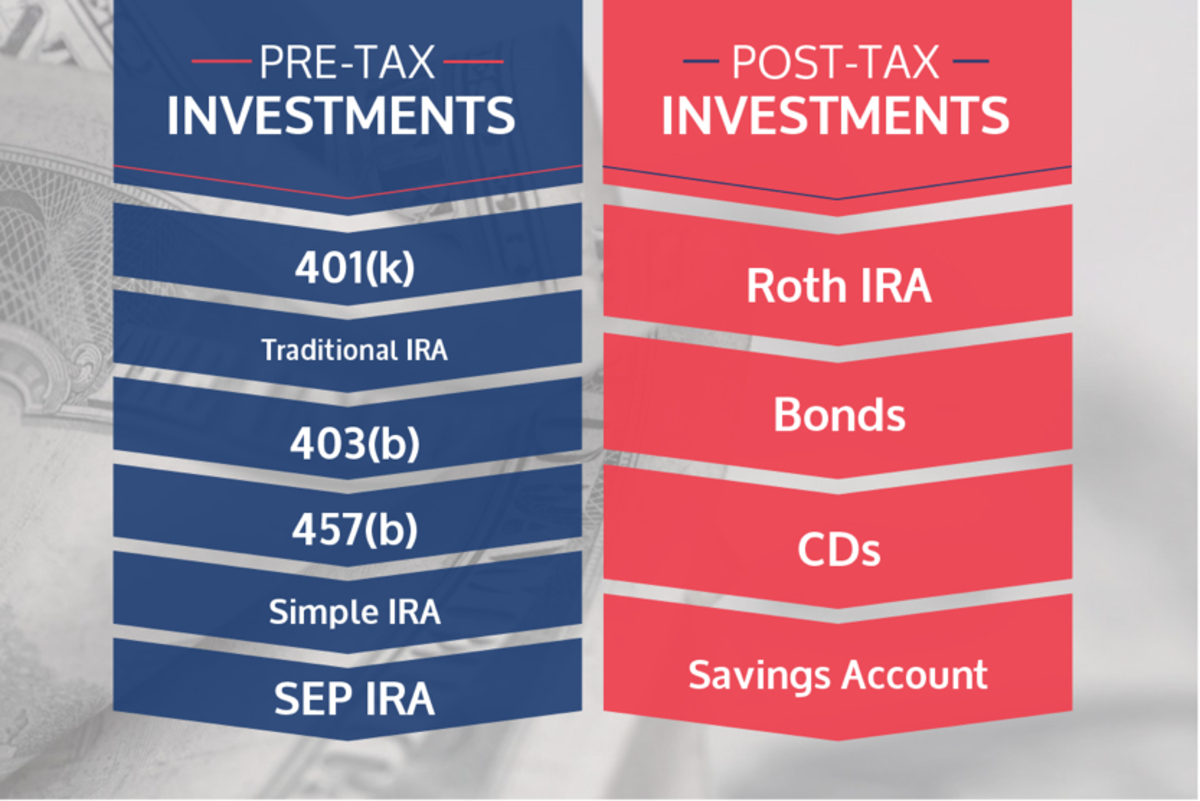

You can withdraw contributions you made to your Roth IRA anytime tax and penalty free However you may have to pay taxes and penalties on earnings in your Roth IRA Withdrawals from a Roth IRA you ve had less than five years

Qualified distributions from a Roth individual retirement account Roth IRA are tax free However you may have to pay income tax and or an early withdrawal penalty on non

Do I Have To Pay State Taxes On A Roth Ira Withdrawal encompass a wide range of printable, free materials that are accessible online for free cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and many more. The appeal of printables for free is their flexibility and accessibility.

More of Do I Have To Pay State Taxes On A Roth Ira Withdrawal

Understanding Roth IRA Withdrawal Rules Helps You Avoid Taking Money

Understanding Roth IRA Withdrawal Rules Helps You Avoid Taking Money

Also if you prefer to avoid mandatory minimum distributions the Roth makes sense In either case your withdrawals from a Roth IRA won t be taxed at the federal or state level Instead you will pay the applicable taxes

However with a Roth IRA there is no tax due when you withdraw contributions or earnings provided you meet certain requirements Early withdrawals those that happen before age 59 from any

Do I Have To Pay State Taxes On A Roth Ira Withdrawal have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization The Customization feature lets you tailor printed materials to meet your requirements whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Free educational printables offer a wide range of educational content for learners from all ages, making them an invaluable tool for parents and teachers.

-

Easy to use: Instant access to many designs and templates reduces time and effort.

Where to Find more Do I Have To Pay State Taxes On A Roth Ira Withdrawal

Tax Free Roth IRA Withdrawal Options What Every Roth IRA Account

Tax Free Roth IRA Withdrawal Options What Every Roth IRA Account

However depending on when you withdraw your Roth IRA earnings you might have to pay taxes and penalties If you re withdrawing Roth IRA earnings to avoid triggering a 10 early withdrawal penalty you must be

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA You cannot deduct contributions to a Roth IRA If you satisfy the

In the event that we've stirred your interest in printables for free Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Do I Have To Pay State Taxes On A Roth Ira Withdrawal suitable for many applications.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide range of interests, that range from DIY projects to party planning.

Maximizing Do I Have To Pay State Taxes On A Roth Ira Withdrawal

Here are some fresh ways of making the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Do I Have To Pay State Taxes On A Roth Ira Withdrawal are an abundance of innovative and useful resources that can meet the needs of a variety of people and desires. Their availability and versatility make they a beneficial addition to both personal and professional life. Explore the plethora of Do I Have To Pay State Taxes On A Roth Ira Withdrawal today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can download and print these items for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It depends on the specific conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright concerns with Do I Have To Pay State Taxes On A Roth Ira Withdrawal?

- Certain printables could be restricted concerning their use. Make sure you read the terms and regulations provided by the author.

-

How can I print printables for free?

- Print them at home with the printer, or go to an area print shop for more high-quality prints.

-

What program do I need in order to open printables that are free?

- Many printables are offered with PDF formats, which can be opened using free software such as Adobe Reader.

How Tapping Home Equity Can Pay The Taxes On A Roth IRA Conversion

What Is The Average Rate Of Return On A Roth IRA

Check more sample of Do I Have To Pay State Taxes On A Roth Ira Withdrawal below

Roth IRA Withdrawal Rules Taxes Exceptions To Know

Do You Have To Pay Taxes On A Roth IRA Rollover

Pin On Financial Planning Tips

Using A Roth IRA As An Emergency Fund Loans For Bad Credit Monthly

When Do I Have To Pay Tax On A Roth Conversion NJMoneyHelp

Tax Free Roth Conversion YouTube

https://www.investopedia.com/are-roth-ira...

Qualified distributions from a Roth individual retirement account Roth IRA are tax free However you may have to pay income tax and or an early withdrawal penalty on non

https://www.fool.com/investing/how-to-…

Withdrawals from a Roth IRA Since Roth IRA contributions are made on an after tax basis qualified withdrawals are completely tax free A qualified Roth IRA withdrawal includes

Qualified distributions from a Roth individual retirement account Roth IRA are tax free However you may have to pay income tax and or an early withdrawal penalty on non

Withdrawals from a Roth IRA Since Roth IRA contributions are made on an after tax basis qualified withdrawals are completely tax free A qualified Roth IRA withdrawal includes

Using A Roth IRA As An Emergency Fund Loans For Bad Credit Monthly

Do You Have To Pay Taxes On A Roth IRA Rollover

When Do I Have To Pay Tax On A Roth Conversion NJMoneyHelp

Tax Free Roth Conversion YouTube

Roth IRA Withdrawal Rules Oblivious Investor

Should You Invest In A Roth IRA A Traditional IRA Or A 401k

Should You Invest In A Roth IRA A Traditional IRA Or A 401k

Roth IRA Rules What You Need To Know In 2019 Roth Ira Rules Roth