In a world with screens dominating our lives however, the attraction of tangible printed items hasn't gone away. Whether it's for educational purposes such as creative projects or just adding an extra personal touch to your area, Cvrp Rebate Income Tax Return Deduction are now a vital resource. For this piece, we'll take a dive to the depths of "Cvrp Rebate Income Tax Return Deduction," exploring the different types of printables, where they can be found, and what they can do to improve different aspects of your daily life.

Get Latest Cvrp Rebate Income Tax Return Deduction Below

Cvrp Rebate Income Tax Return Deduction

Cvrp Rebate Income Tax Return Deduction -

Web 2 mars 2023 nbsp 0183 32 Just to double confirm The timeline application for rebates assuming you qualify if you buy a Tesla in 2023 before March 31 2023 Federal Rebate 7500 You

Web Consumers are not eligible for CVRP rebates if their gross annual incomes are above the thresholds listed below The income cap applies to all eligible vehicle types except fuel

Printables for free cover a broad range of downloadable, printable documents that can be downloaded online at no cost. They are available in numerous forms, like worksheets coloring pages, templates and many more. The great thing about Cvrp Rebate Income Tax Return Deduction lies in their versatility and accessibility.

More of Cvrp Rebate Income Tax Return Deduction

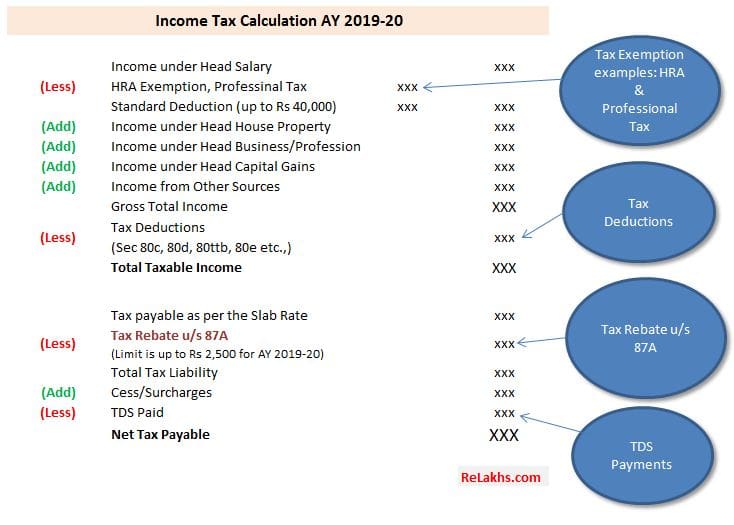

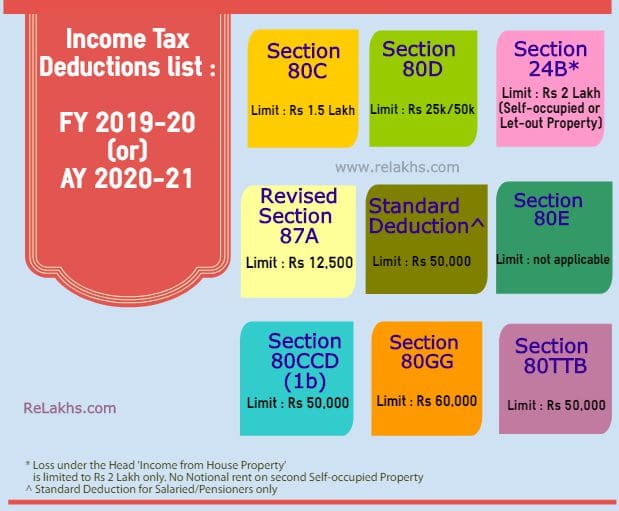

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Web CVRP considers an applicant s most recent federal tax return to be the one most recently required to be filed by the IRS CVRP switches to requesting a new tax filing year for

Web CVRP enables a purchaser or lessee of an eligible vehicle to apply for a CVRP rebate of up to 7 000 for fuel cell electric vehicles FCEVs up to 4 500 for all battery electric

Cvrp Rebate Income Tax Return Deduction have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization We can customize printing templates to your own specific requirements for invitations, whether that's creating them making your schedule, or even decorating your house.

-

Educational Value Downloads of educational content for free provide for students of all ages. This makes them a great tool for parents and educators.

-

The convenience of Fast access a myriad of designs as well as templates saves time and effort.

Where to Find more Cvrp Rebate Income Tax Return Deduction

California s EV Rebate Changes A Good Model For The Federal EV Tax

California s EV Rebate Changes A Good Model For The Federal EV Tax

Web The CVRP Increased Rebate makes it easier for more Californians to afford a new EV Browse Eligible Vehicles Do you qualify If your income and household size fall within

Web 8 juin 2023 nbsp 0183 32 10 des revenus professionnels de 2021 nets de cotisations sociales et de frais professionnels avec une d 233 duction maximale de 35 194 4 114 192 savoir

In the event that we've stirred your curiosity about Cvrp Rebate Income Tax Return Deduction Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Cvrp Rebate Income Tax Return Deduction for a variety needs.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing Cvrp Rebate Income Tax Return Deduction

Here are some inventive ways ensure you get the very most of Cvrp Rebate Income Tax Return Deduction:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Cvrp Rebate Income Tax Return Deduction are a treasure trove of creative and practical resources that meet a variety of needs and needs and. Their availability and versatility make them a fantastic addition to any professional or personal life. Explore the vast collection of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes they are! You can print and download these documents for free.

-

Can I use the free printouts for commercial usage?

- It's determined by the specific terms of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright issues with Cvrp Rebate Income Tax Return Deduction?

- Certain printables might have limitations regarding their use. Be sure to check the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit a local print shop to purchase superior prints.

-

What program do I need in order to open printables at no cost?

- A majority of printed materials are in the PDF format, and can be opened using free software such as Adobe Reader.

Clean Vehicle Rebate Project CVRP California Income Question Tesla

Does The Solo Electric Car Qualify For A Tax Credit OsVehicle

Check more sample of Cvrp Rebate Income Tax Return Deduction below

Marginal Tax Rate Definition TaxEDU Tax Foundation

Solved Janice Morgan Age 24 Is Single And Has No Chegg

What Is Income Tax Exemption Deduction And Rebate Inuranse

11 Section 80GGC SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Program Reports Clean Vehicle Rebate Project

https://cleanvehiclerebate.org/en/faqs/what-are-income-requirements

Web Consumers are not eligible for CVRP rebates if their gross annual incomes are above the thresholds listed below The income cap applies to all eligible vehicle types except fuel

https://cleanvehiclerebate.org/en/eligibility-guidelines

Web CVRP considers an applicant s most recent federal tax return to be the one most recently required to be filed by the IRS CVRP switches to requesting a new tax filing year for

Web Consumers are not eligible for CVRP rebates if their gross annual incomes are above the thresholds listed below The income cap applies to all eligible vehicle types except fuel

Web CVRP considers an applicant s most recent federal tax return to be the one most recently required to be filed by the IRS CVRP switches to requesting a new tax filing year for

11 Section 80GGC SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Program Reports Clean Vehicle Rebate Project

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

9 Section 80E SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

9 Section 80E SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

What Is An Updated Income Tax Return TheBuyt