Today, where screens rule our lives and the appeal of physical printed materials isn't diminishing. For educational purposes project ideas, artistic or just adding an individual touch to your space, Costa Rica Income Tax Rate have become an invaluable source. With this guide, you'll dive into the world of "Costa Rica Income Tax Rate," exploring the benefits of them, where to get them, as well as how they can enhance various aspects of your daily life.

Get Latest Costa Rica Income Tax Rate Below

Costa Rica Income Tax Rate

Costa Rica Income Tax Rate -

The Income tax rates and personal allowances in Costa Rica are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in

The Costa Rican income tax rate varies based on your income type Dividend and interest income are generally taxed at 15 while most capital gains are exempt from taxation For residents of Costa Rica salaries and self employment are taxed at progressive rates as shown below

Printables for free include a vast range of printable, free materials that are accessible online for free cost. These printables come in different kinds, including worksheets coloring pages, templates and many more. One of the advantages of Costa Rica Income Tax Rate lies in their versatility and accessibility.

More of Costa Rica Income Tax Rate

Costa Rica Total Tax Rate Of Commercial Profits

Costa Rica Total Tax Rate Of Commercial Profits

The new brackets are for corporate income income from profitable activities and the salary tax The brackets went into effect 1 January 2022 On 23 December 2021 Costa Rica s Tax Authority published Executive Decree No 43375 H which contains the income tax brackets applicable for tax year 2022

The income tax rate in Costa Rica varies based on income type with dividend and interest income taxed at 15 Expats in Costa Rica may also encounter other types of taxes such as property tax property transfer tax value added tax and corporate tax

Costa Rica Income Tax Rate have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization The Customization feature lets you tailor printables to your specific needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Use: Printables for education that are free are designed to appeal to students of all ages. This makes them a great device for teachers and parents.

-

Accessibility: Quick access to various designs and templates saves time and effort.

Where to Find more Costa Rica Income Tax Rate

Government Could Lower Costa Rica Income Tax Brackets Because Of Deflation

Government Could Lower Costa Rica Income Tax Brackets Because Of Deflation

Money Income Tax Tax Rates in Costa Rica Find out about taxation on income in Costa Rica Information on who qualifies for resident and non resident taxation as well as standard income tax rate guidelines

Welcome to the iCalculator CR Costa Rica Tax Tables page Understanding the tax system is essential for individuals and businesses residing or operating in Costa Rica On this page you will find links to current and historical tax tables for Costa Rica which provide detailed information on different tax rates and how they may affect you

Now that we've ignited your interest in Costa Rica Income Tax Rate Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Costa Rica Income Tax Rate for different objectives.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Costa Rica Income Tax Rate

Here are some new ways of making the most of Costa Rica Income Tax Rate:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Costa Rica Income Tax Rate are a treasure trove of fun and practical tools for a variety of needs and interests. Their accessibility and versatility make they a beneficial addition to any professional or personal life. Explore the endless world of Costa Rica Income Tax Rate and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can print and download these free resources for no cost.

-

Does it allow me to use free printables to make commercial products?

- It's determined by the specific usage guidelines. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues in Costa Rica Income Tax Rate?

- Some printables may contain restrictions in use. You should read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home using either a printer or go to any local print store for high-quality prints.

-

What program do I require to view printables at no cost?

- The majority of printed documents are in PDF format, which can be opened with free software, such as Adobe Reader.

Income Tax In Costa Rica RelocationCostarica

Income Tax Malaysia 2022 Who Pays And How Much

Check more sample of Costa Rica Income Tax Rate below

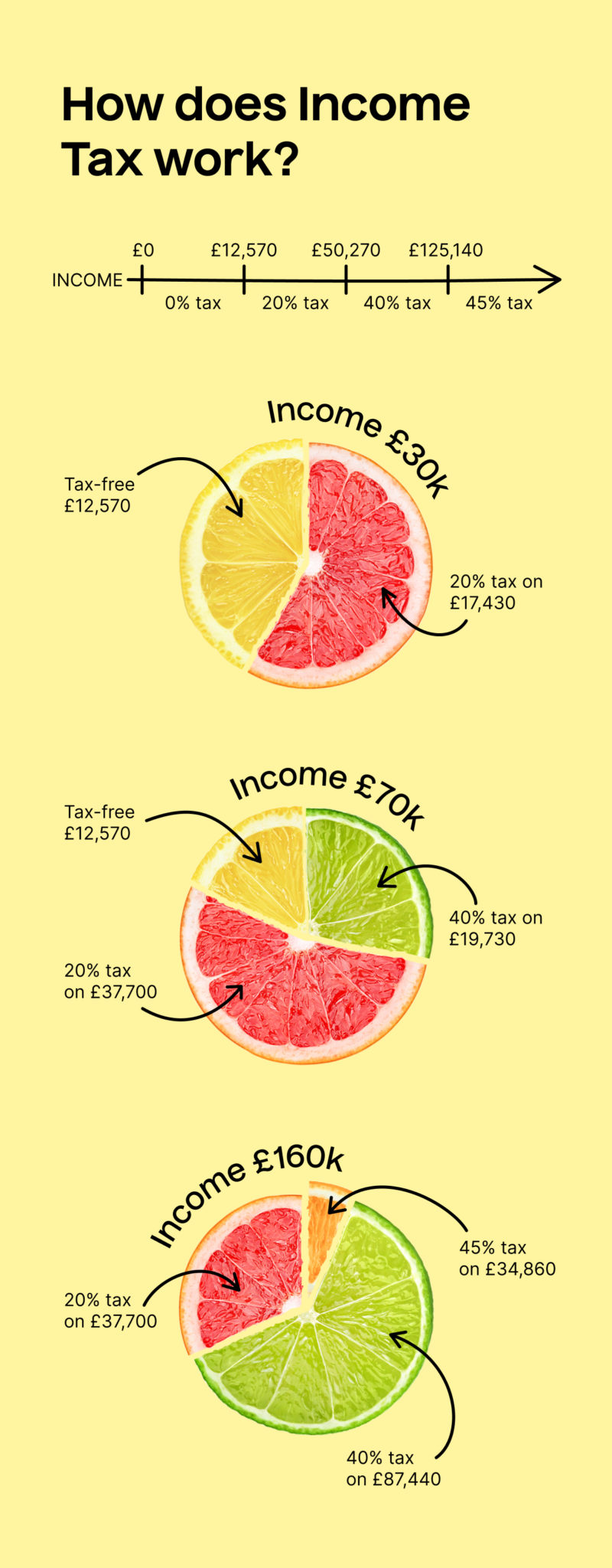

Income Tax Rates In The UK TaxScouts

How To File US Income Taxes When Living In Costa Rica Online Taxman

Live In A High Tax State Like Oregon Here Are 9 Ways To Lower Your Tax

Effective Income Tax Rate By State Tokocute

The Taxation System In Costa Rica Costa Rica Guide Expat

How Are Foreigners Affected By The Income Tax Laws In Costa Rica

https://www.greenbacktaxservices.com/country-guide/...

The Costa Rican income tax rate varies based on your income type Dividend and interest income are generally taxed at 15 while most capital gains are exempt from taxation For residents of Costa Rica salaries and self employment are taxed at progressive rates as shown below

https://crie.cr/about-costa-rica-income-tax-rates-for-expats

Discover Costa Rica income tax rates for expats including residency rules filing requirements and tax obligations Navigate the Costa Rican tax system with confidence

The Costa Rican income tax rate varies based on your income type Dividend and interest income are generally taxed at 15 while most capital gains are exempt from taxation For residents of Costa Rica salaries and self employment are taxed at progressive rates as shown below

Discover Costa Rica income tax rates for expats including residency rules filing requirements and tax obligations Navigate the Costa Rican tax system with confidence

Effective Income Tax Rate By State Tokocute

How To File US Income Taxes When Living In Costa Rica Online Taxman

The Taxation System In Costa Rica Costa Rica Guide Expat

How Are Foreigners Affected By The Income Tax Laws In Costa Rica

Read This Legal Breakdown Of Costa Rica s Global Income Tax Project

Costa Rica Income Tax KPMG GLOBAL

Costa Rica Income Tax KPMG GLOBAL

Alabama Income Tax Rate 2021 2022 W4 Form