In this age of electronic devices, where screens rule our lives yet the appeal of tangible printed products hasn't decreased. Be it for educational use or creative projects, or simply to add an extra personal touch to your area, Corporation Tax Loss Relief Carry Back have become an invaluable resource. The following article is a take a dive into the world of "Corporation Tax Loss Relief Carry Back," exploring their purpose, where you can find them, and what they can do to improve different aspects of your lives.

Get Latest Corporation Tax Loss Relief Carry Back Below

Corporation Tax Loss Relief Carry Back

Corporation Tax Loss Relief Carry Back -

Corporation Tax Guidance Current year relief for trading losses Trading losses can be offset against total profits of the same period Total profits covers for

Share Companies may carry back unutilised capital allowances and trade losses arising in a Year of Assessment YA to reduce the amount of taxes payable in the immediate

Corporation Tax Loss Relief Carry Back cover a large collection of printable materials available online at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and much more. The great thing about Corporation Tax Loss Relief Carry Back lies in their versatility and accessibility.

More of Corporation Tax Loss Relief Carry Back

Loss Relief Carry Back Extension Accountant Coventry Cheylesmore

Loss Relief Carry Back Extension Accountant Coventry Cheylesmore

New rules Trading losses for tax years 2020 21 and 2021 22 will be allowed to be carried back and set against profits of the same trade for three years before the tax year of the

Loss carry back rules temporarily extended The rules explained plus worked examples The existing carry back rule relief for trading losses can be found in section 37

Corporation Tax Loss Relief Carry Back have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: They can make printing templates to your own specific requirements when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: These Corporation Tax Loss Relief Carry Back provide for students of all ages, which makes them a useful instrument for parents and teachers.

-

Affordability: immediate access many designs and templates saves time and effort.

Where to Find more Corporation Tax Loss Relief Carry Back

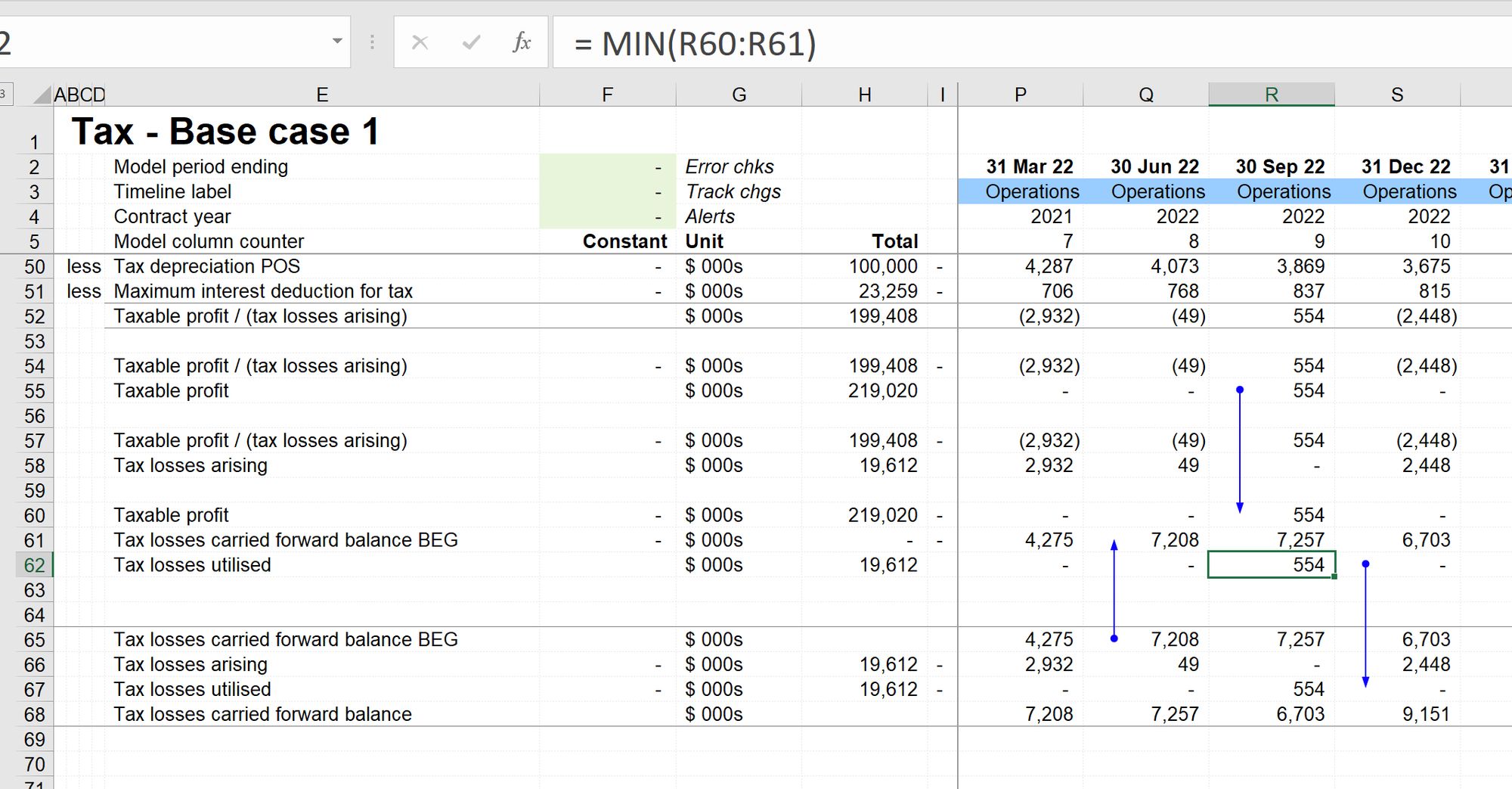

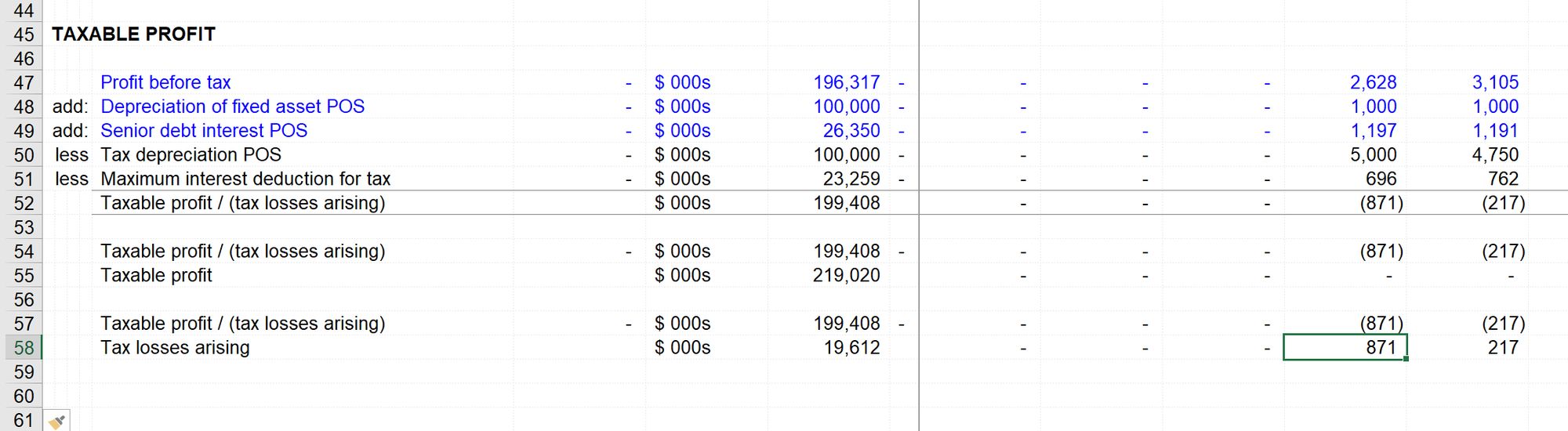

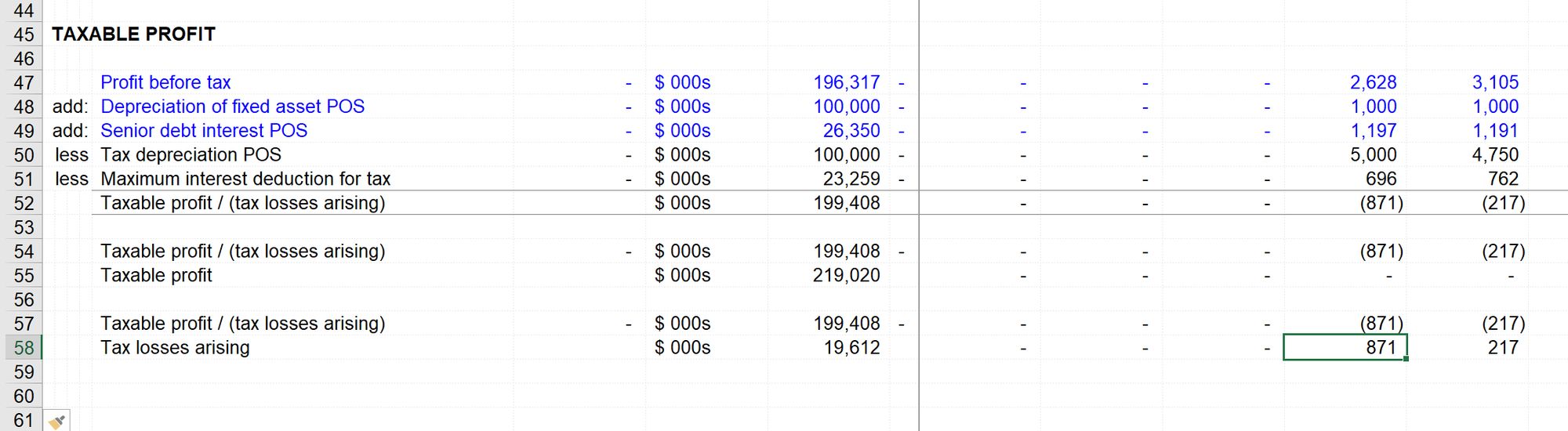

Modelling Tax Loss Carry Forward

Modelling Tax Loss Carry Forward

Temporary extension to carry back of trading losses for Corporation Tax and Income Tax Work out and claim relief from Corporation Tax trading losses

Section 18 of and Schedule 2 to the Finance Act 2021 provide for a temporary extension to the carry back of trading losses from one year to three years for losses up to

We've now piqued your curiosity about Corporation Tax Loss Relief Carry Back Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of objectives.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free or flashcards as well as learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide variety of topics, that includes DIY projects to planning a party.

Maximizing Corporation Tax Loss Relief Carry Back

Here are some ways that you can make use use of Corporation Tax Loss Relief Carry Back:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home and in class.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Corporation Tax Loss Relief Carry Back are an abundance of creative and practical resources for a variety of needs and passions. Their accessibility and versatility make these printables a useful addition to each day life. Explore the wide world of Corporation Tax Loss Relief Carry Back today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can print and download these documents for free.

-

Does it allow me to use free printables for commercial use?

- It depends on the specific terms of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright rights issues with Corporation Tax Loss Relief Carry Back?

- Some printables may contain restrictions on usage. Be sure to read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- Print them at home with the printer, or go to the local print shops for better quality prints.

-

What program must I use to open printables for free?

- Most printables come in PDF format. These can be opened with free programs like Adobe Reader.

Get Ready For Corporation Tax Loss Relief Changes

Corporation Tax Loss Relief For Losses Carried Forward Makesworth

Check more sample of Corporation Tax Loss Relief Carry Back below

How To Claim Terminal Loss Relief Taxoo

Corporate Tax Loss Carry Forward What When And How Much

Tax Loss Relief Everything You Need To Know Chippendale And Clark

Peridot Tax PeridotTax Twitter

Modelling Tax Loss Carry Forward

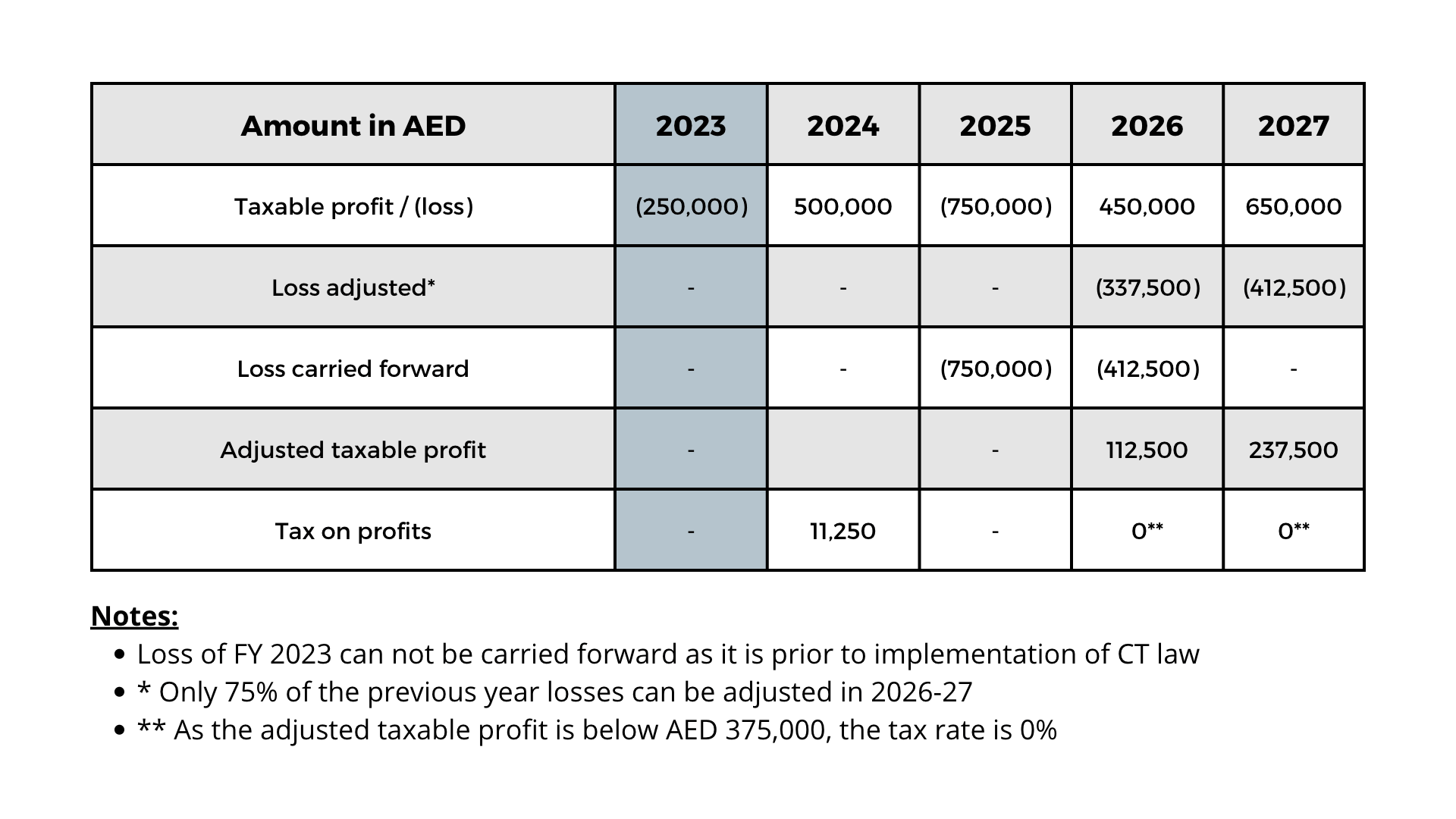

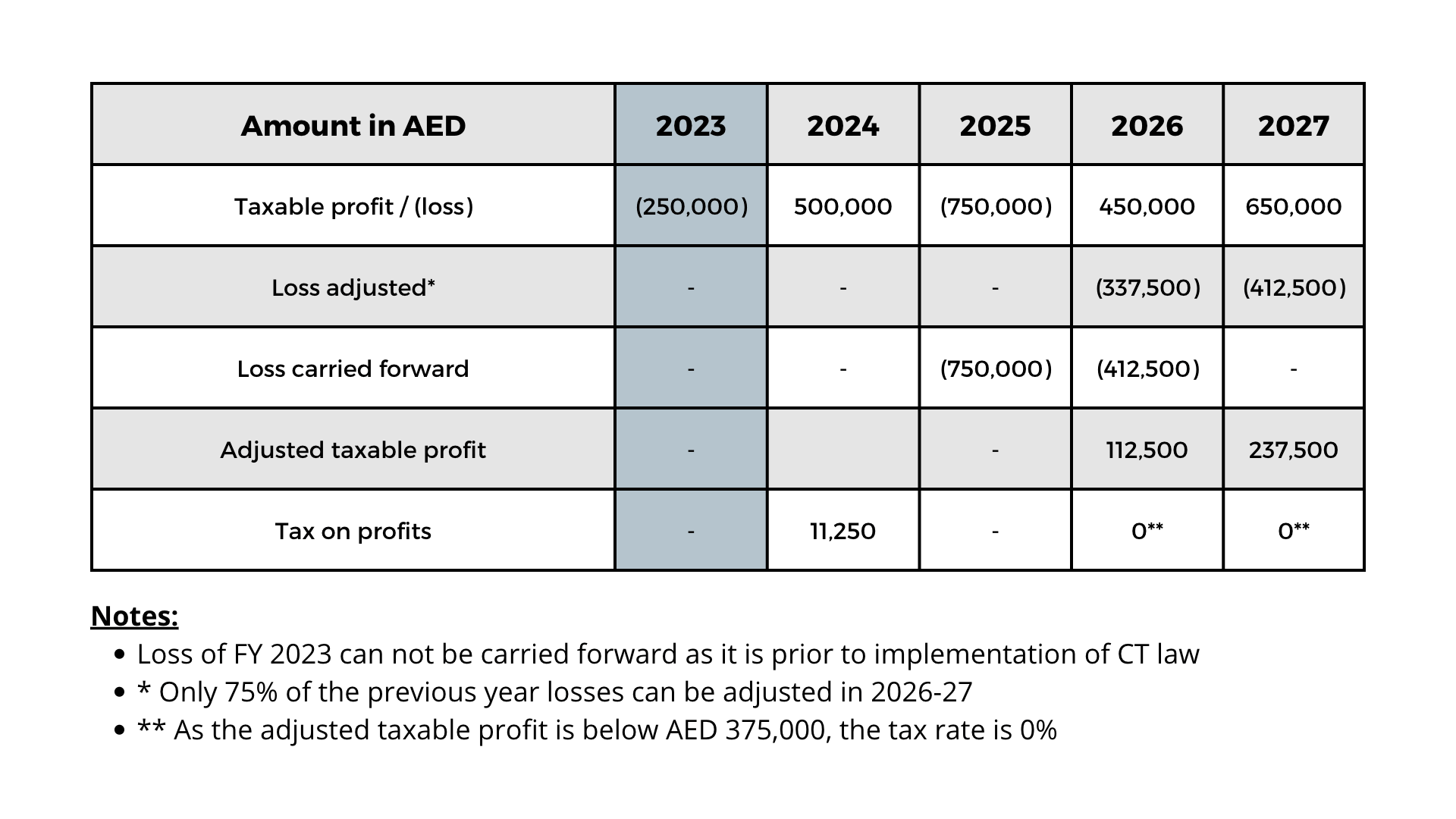

Corporate Tax In Dubai KGRN Chartered Accountants

https://www. iras.gov.sg /.../claiming-reliefs/loss-carry-back-relief

Share Companies may carry back unutilised capital allowances and trade losses arising in a Year of Assessment YA to reduce the amount of taxes payable in the immediate

https://www. theaccountancy.co.uk /tax/c…

You may be able to carry a trading loss back to a previous tax year or forward to a subsequent one In this article we ll take a look at how businesses can offset trading losses against different years

Share Companies may carry back unutilised capital allowances and trade losses arising in a Year of Assessment YA to reduce the amount of taxes payable in the immediate

You may be able to carry a trading loss back to a previous tax year or forward to a subsequent one In this article we ll take a look at how businesses can offset trading losses against different years

Peridot Tax PeridotTax Twitter

Corporate Tax Loss Carry Forward What When And How Much

Modelling Tax Loss Carry Forward

Corporate Tax In Dubai KGRN Chartered Accountants

Tax Loss Carry Forward How Does Tax Loss Carry Forward Work

Income Tax Relief For Trading Losses

Income Tax Relief For Trading Losses

Tax Loss Harvesting Rules And Examples Of A Year Round Strategy