In this age of electronic devices, in which screens are the norm but the value of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons for creative projects, simply to add an individual touch to the space, Claiming Tax Rebate On Pension Contributions can be an excellent source. We'll take a dive into the world of "Claiming Tax Rebate On Pension Contributions," exploring the different types of printables, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Claiming Tax Rebate On Pension Contributions Below

Claiming Tax Rebate On Pension Contributions

Claiming Tax Rebate On Pension Contributions - Claim Tax Rebate On Pension Contributions, Claiming Tax Relief On Pension Contributions For Previous Years, Claiming Tax Relief On Pension Contributions For Previous Years Letter Template, Claiming Tax Relief On Pension Contributions For Previous Years Hmrc, Claiming Tax Relief On Pension Contributions For Previous Years Calculator, Claiming Tax Back On Pension Payments, How Do I Claim Higher Rate Tax On Pension Contributions, Do You Get Tax Relief On Pension Contributions

Web 31 mai 2023 nbsp 0183 32 If you re paying into a workplace pension scheme organised by your employer and are earning under 163 50 270 you won t need to declare your pension

Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax

The Claiming Tax Rebate On Pension Contributions are a huge array of printable content that can be downloaded from the internet at no cost. They are available in numerous types, like worksheets, coloring pages, templates and more. The benefit of Claiming Tax Rebate On Pension Contributions is in their variety and accessibility.

More of Claiming Tax Rebate On Pension Contributions

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Give Tax Relief Pre approval Save The Thorold Arms

Web 5 d 233 c 2016 nbsp 0183 32 You can get relief on your contributions up to the value of your earnings that are subject to UK Income Tax You must report the payments to your pension scheme

Web There are two ways you can get tax relief on your pension contributions If you re in a workplace pension scheme your employer chooses which method to use and must

Claiming Tax Rebate On Pension Contributions have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization Your HTML0 customization options allow you to customize printed materials to meet your requirements for invitations, whether that's creating them to organize your schedule or even decorating your home.

-

Educational Benefits: The free educational worksheets offer a wide range of educational content for learners of all ages, making them a vital tool for teachers and parents.

-

Affordability: Quick access to numerous designs and templates cuts down on time and efforts.

Where to Find more Claiming Tax Rebate On Pension Contributions

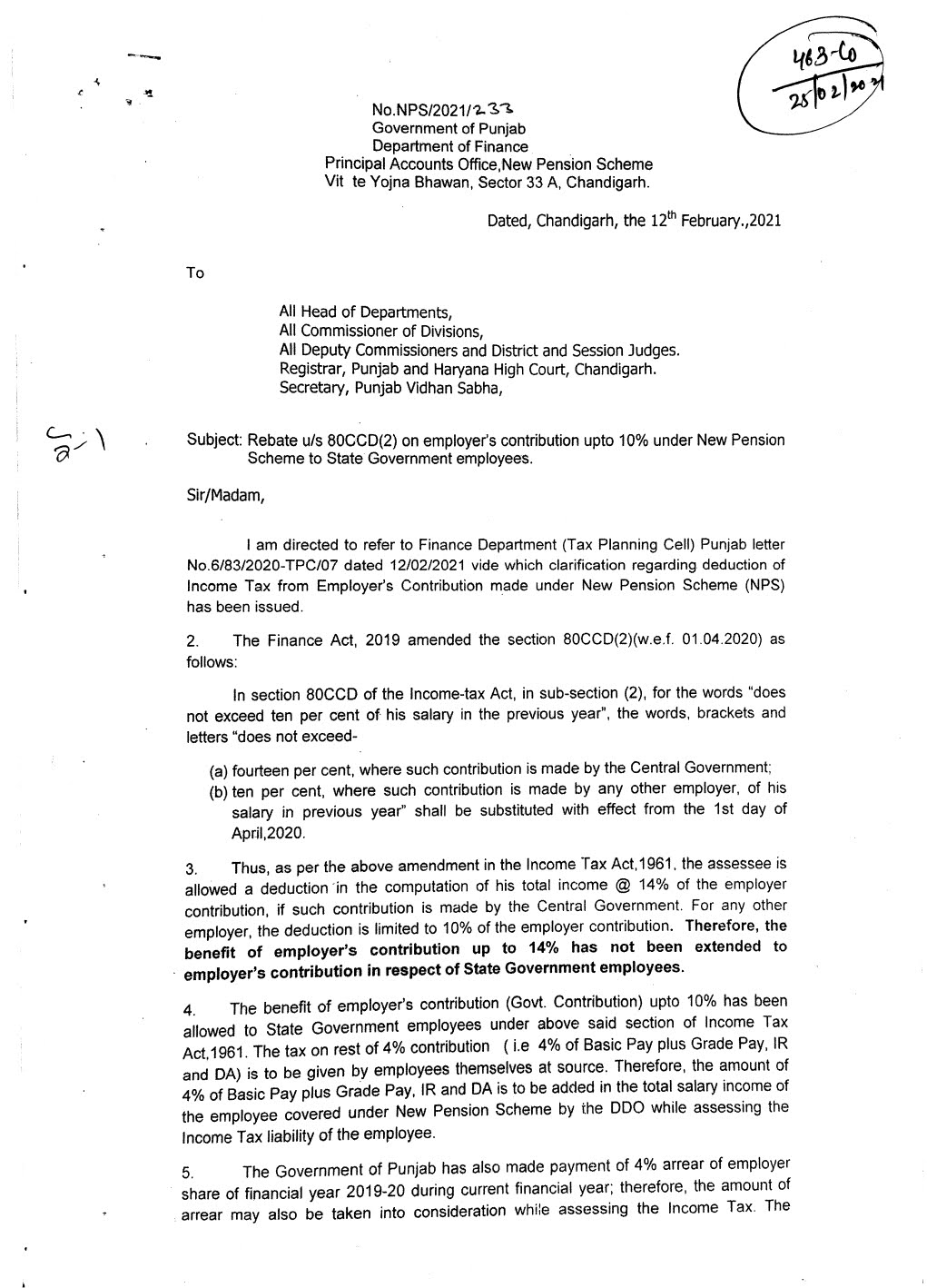

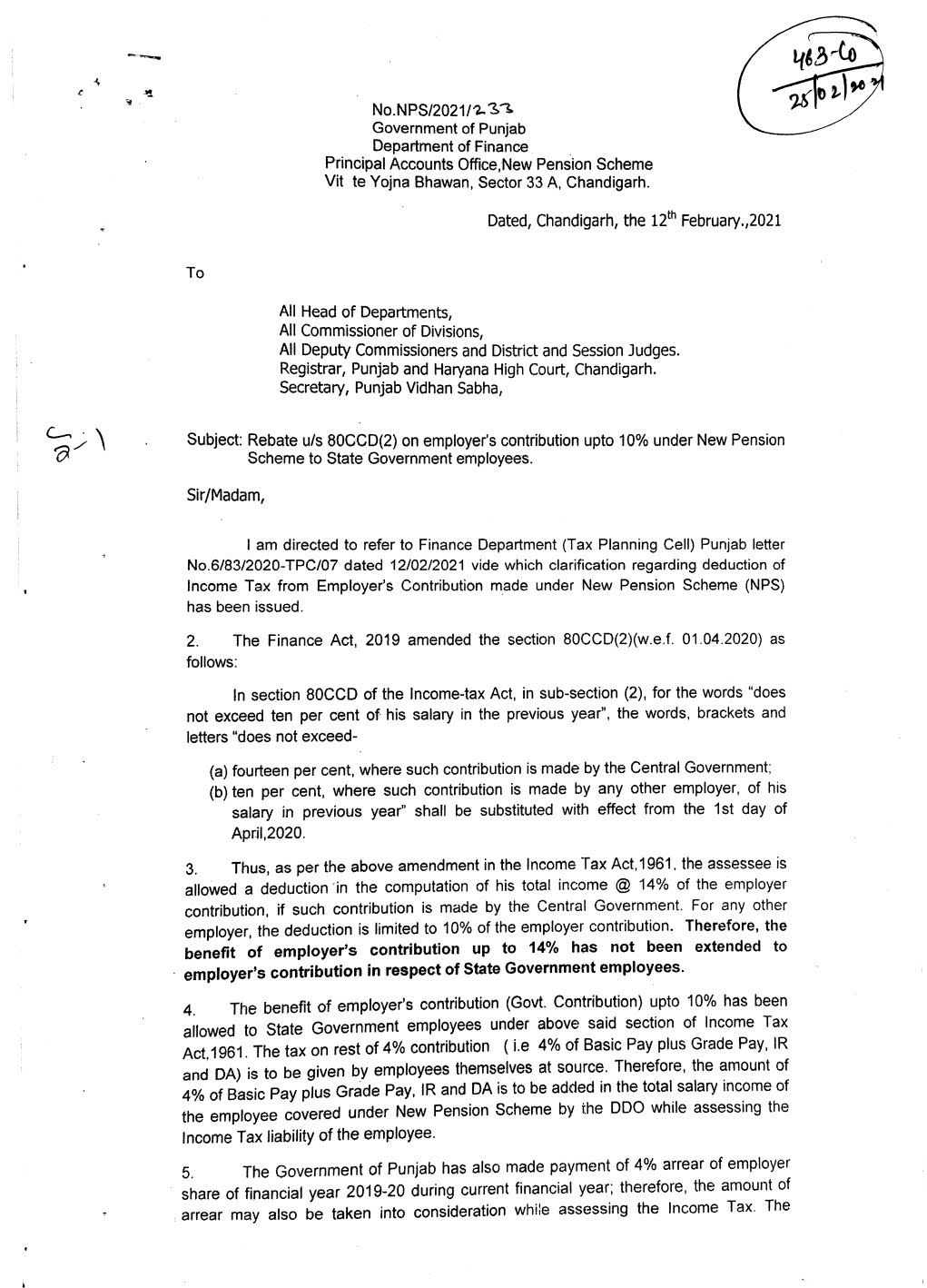

Rebate Under Employers Contribution New Pension Scheme Real Info Blog

Rebate Under Employers Contribution New Pension Scheme Real Info Blog

Web Higher rate tax payers paid 40 tax on their 163 100 and so receive 163 40 back for every 163 60 they contribute to a pension For additional rate income tax payers who earn more than 163 150 000 a year tax relief is 45 so they

Web 16 sept 2014 nbsp 0183 32 Your scheme members who are Scottish taxpayers liable to Income Tax at the Scottish intermediate rate of 21 can claim the additional 1 relief due on some or

If we've already piqued your curiosity about Claiming Tax Rebate On Pension Contributions we'll explore the places the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection in Claiming Tax Rebate On Pension Contributions for different uses.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a broad spectrum of interests, that includes DIY projects to party planning.

Maximizing Claiming Tax Rebate On Pension Contributions

Here are some new ways to make the most of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free for teaching at-home, or even in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Claiming Tax Rebate On Pension Contributions are a treasure trove of practical and imaginative resources that cater to various needs and interest. Their accessibility and flexibility make these printables a useful addition to both personal and professional life. Explore the endless world of Claiming Tax Rebate On Pension Contributions right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes you can! You can download and print these materials for free.

-

Do I have the right to use free printables for commercial uses?

- It's all dependent on the terms of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Claiming Tax Rebate On Pension Contributions?

- Some printables could have limitations on usage. You should read the terms and conditions set forth by the author.

-

How can I print Claiming Tax Rebate On Pension Contributions?

- Print them at home using your printer or visit an in-store print shop to get higher quality prints.

-

What software do I need to run Claiming Tax Rebate On Pension Contributions?

- The majority are printed in the format of PDF, which can be opened with free software such as Adobe Reader.

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

NPS National Pension Scheme A Beginners Guide For Rules Benefits

Check more sample of Claiming Tax Rebate On Pension Contributions below

Claiming Tax Back On Pension Contributions Irish Tax Rebates

Authorization Letter Claim Tax Refund For Sample Printable Formats

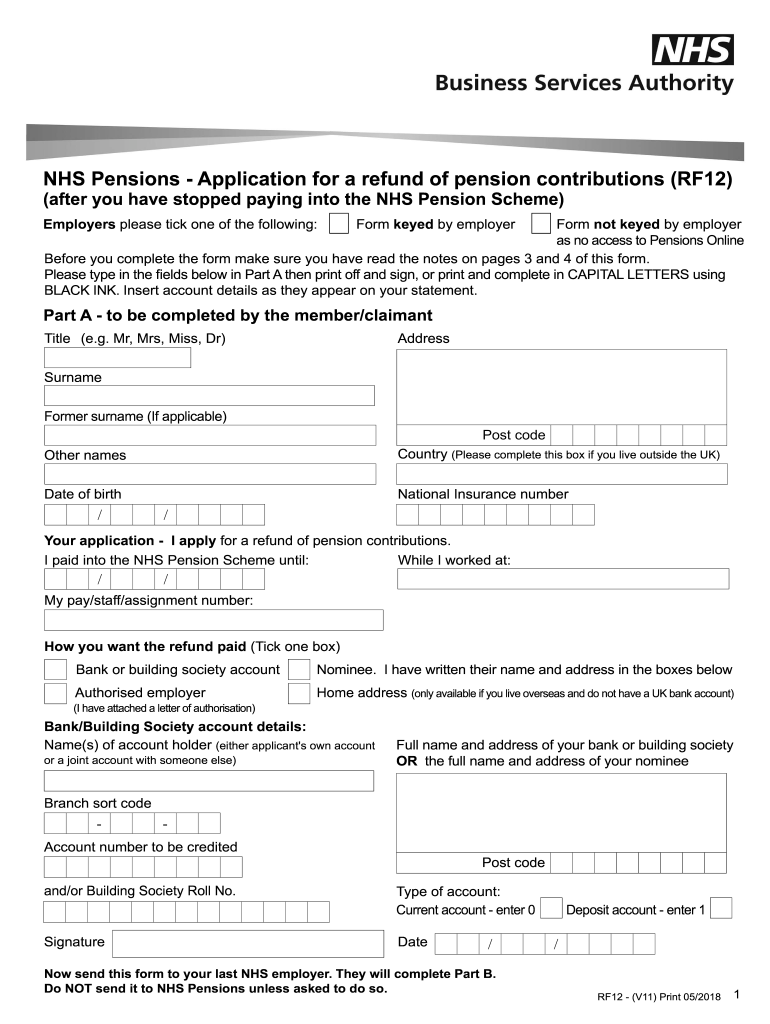

Rf12 Pension Form Nhs Fill Out And Sign Printable PDF Template SignNow

NPS Tax Relief 24 Tax Rebate On NPS For Private Employees Too Relief

Claiming Tax Back When Working From Home Tax Rebates

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

https://www.unbiased.co.uk/discover/pensions-retirement/managing-a...

Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax

https://www.which.co.uk/money/pensions-an…

Web 3 avr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax

Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax

Web 3 avr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax

NPS Tax Relief 24 Tax Rebate On NPS For Private Employees Too Relief

Authorization Letter Claim Tax Refund For Sample Printable Formats

Claiming Tax Back When Working From Home Tax Rebates

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

Track Your Recovery Rebate With This Worksheet Style Worksheets

Income Tax Relief On Pension Contributions Menzies

Income Tax Relief On Pension Contributions Menzies

Do You Get Tax Relief On Pension Payments Tax Walls