In this day and age with screens dominating our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Whatever the reason, whether for education in creative or artistic projects, or just adding some personal flair to your home, printables for free are now a useful source. Through this post, we'll take a dive into the world of "Claim Tax Credits," exploring the benefits of them, where they are, and how they can improve various aspects of your daily life.

Get Latest Claim Tax Credits Below

Claim Tax Credits

Claim Tax Credits -

Making a claim You can make a claim for working tax credits by phoning the HMRC tax credits helpline You should do this as soon as you can as it can take up to 6 weeks to process your claim HM Revenue and Customs HMRC tax credits helpline Telephone 0345 300 3900

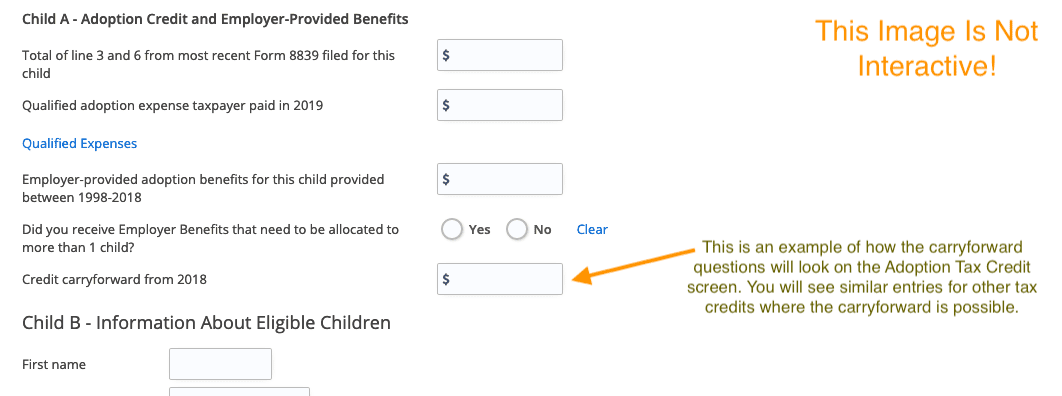

Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in

Printables for free cover a broad range of printable, free items that are available online at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and many more. The value of Claim Tax Credits is their versatility and accessibility.

More of Claim Tax Credits

Can I claim Tax Credits Low Incomes Tax Reform Group

Can I claim Tax Credits Low Incomes Tax Reform Group

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions because they reduce

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: There is the possibility of tailoring printed materials to meet your requirements such as designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value The free educational worksheets provide for students of all ages. This makes them a valuable tool for teachers and parents.

-

An easy way to access HTML0: Quick access to a variety of designs and templates helps save time and effort.

Where to Find more Claim Tax Credits

How To Claim Tax Credits

How To Claim Tax Credits

Are you already claiming Working Tax Credit Then how and when you move to Universal Credit depends on if you have to make a new claim because of a change in circumstances Tax credits and a change in circumstances You must tell HMRC the government department that issues Tax Credits within 30 days if you have a change of circumstances

Claiming deductions credits and expenses Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay Most requested Disability tax credit Medical expenses Moving expenses Digital news subscription expenses Home office expenses for employees Canada training credit

In the event that we've stirred your interest in Claim Tax Credits Let's see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Claim Tax Credits designed for a variety needs.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning materials.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to party planning.

Maximizing Claim Tax Credits

Here are some unique ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Claim Tax Credits are a treasure trove filled with creative and practical information which cater to a wide range of needs and pursuits. Their availability and versatility make these printables a useful addition to both professional and personal life. Explore the wide world of Claim Tax Credits right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can download and print these items for free.

-

Do I have the right to use free printables in commercial projects?

- It is contingent on the specific terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to check these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home using a printer or visit the local print shops for premium prints.

-

What program do I need to open Claim Tax Credits?

- The majority of PDF documents are provided in PDF format. These can be opened with free software such as Adobe Reader.

Reminder Properly Document FFCRA Leave To Claim Tax Credits HRWatchdog

Bootstrap Business How To Claim Tax Credits A Step By Step Guide

Check more sample of Claim Tax Credits below

Education Tax Credits And Deductions Can You Claim It

What Is A Tax Credit Tax Credits Explained

How Tax Credits Work File And Claim Tax Credits On Your Return

Tax Credits Claim Form Concept Stock Photo Alamy

Tax Credits Vs Deductions What s The Difference Swag Of Beauty

6 Tax Credits That Anyone Can Claim

https://www.irs.gov/credits

Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in

https://www.gov.uk/working-tax-credit

Eligibility You can only make a claim for Working Tax Credit if you already get Child Tax Credit If you cannot apply for Working Tax Credit you can apply for Universal Credit

Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in

Eligibility You can only make a claim for Working Tax Credit if you already get Child Tax Credit If you cannot apply for Working Tax Credit you can apply for Universal Credit

Tax Credits Claim Form Concept Stock Photo Alamy

What Is A Tax Credit Tax Credits Explained

Tax Credits Vs Deductions What s The Difference Swag Of Beauty

6 Tax Credits That Anyone Can Claim

Are You Claiming The Correct Tax Credits Claim My Tax Back

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

Tax Credit Vs Tax Deduction What s The Difference Guide