Today, with screens dominating our lives yet the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses, creative projects, or simply to add the personal touch to your home, printables for free are now an essential source. The following article is a take a dive into the sphere of "Child Care Reimbursement Tax Credit," exploring what they are, how to find them, and how they can improve various aspects of your lives.

Get Latest Child Care Reimbursement Tax Credit Below

Child Care Reimbursement Tax Credit

Child Care Reimbursement Tax Credit -

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with

IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Printables for free cover a broad range of printable, free items that are available online at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and more. The beauty of Child Care Reimbursement Tax Credit is their versatility and accessibility.

More of Child Care Reimbursement Tax Credit

Program Resource How To Ensure Your Reimbursement Is Accurate

Program Resource How To Ensure Your Reimbursement Is Accurate

Child and dependent care tax credit If you paid for your child s or a dependent s care while you worked or looked for a job you may be eligible for a credit on your tax return Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent

Child and Dependent Care Credit Expenses In 2021 for the first time the credit is fully refundable if the taxpayer or the taxpayer s spouse if married filing jointly had a principal place of abode in the United States for more than one half of 2021 This means that an eligible family can get it even if they owe no federal income tax

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: The Customization feature lets you tailor printables to fit your particular needs such as designing invitations, organizing your schedule, or decorating your home.

-

Education Value Printables for education that are free cater to learners from all ages, making them a vital resource for educators and parents.

-

It's easy: You have instant access numerous designs and templates is time-saving and saves effort.

Where to Find more Child Care Reimbursement Tax Credit

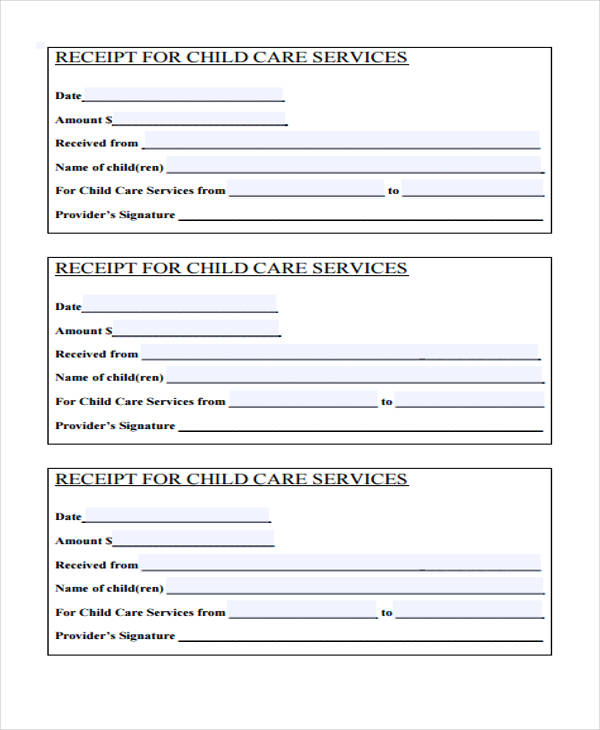

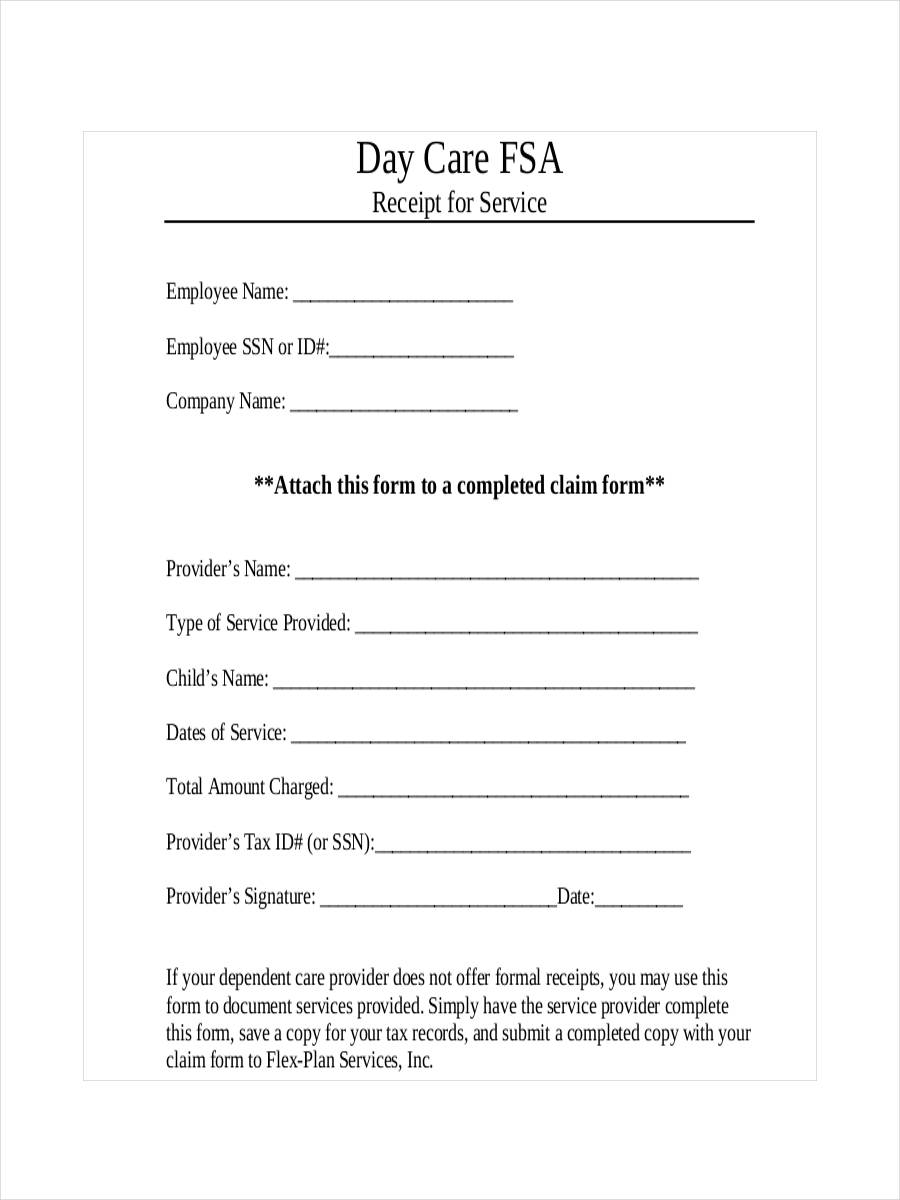

Daycare Or Dependent Care Receipt Templates Word Excel

Daycare Or Dependent Care Receipt Templates Word Excel

Credit for Child and Dependent Care Expenses For tax year 2021 only the top credit percentage of qualifying expenses increased from 35 to 50 Some taxpayers receive dependent care benefits from their employers which may also be called flexible spending accounts or reimbursement accounts

6 min read Share If you re a parent or caretaker of disabled dependents or spouses listen up you may qualify for a special tax credit used for claiming child care expenses It s called the Child and Dependent Care Credit and with it you might be able to get back some of the money you spent on these expenses by claiming it

Now that we've ignited your interest in printables for free We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Child Care Reimbursement Tax Credit designed for a variety objectives.

- Explore categories like design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast variety of topics, from DIY projects to party planning.

Maximizing Child Care Reimbursement Tax Credit

Here are some new ways of making the most use of Child Care Reimbursement Tax Credit:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Child Care Reimbursement Tax Credit are a treasure trove of practical and imaginative resources catering to different needs and interest. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can print and download these documents for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may have restrictions on their use. You should read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using printing equipment or visit any local print store for superior prints.

-

What software will I need to access printables for free?

- The majority of printables are with PDF formats, which can be opened using free software like Adobe Reader.

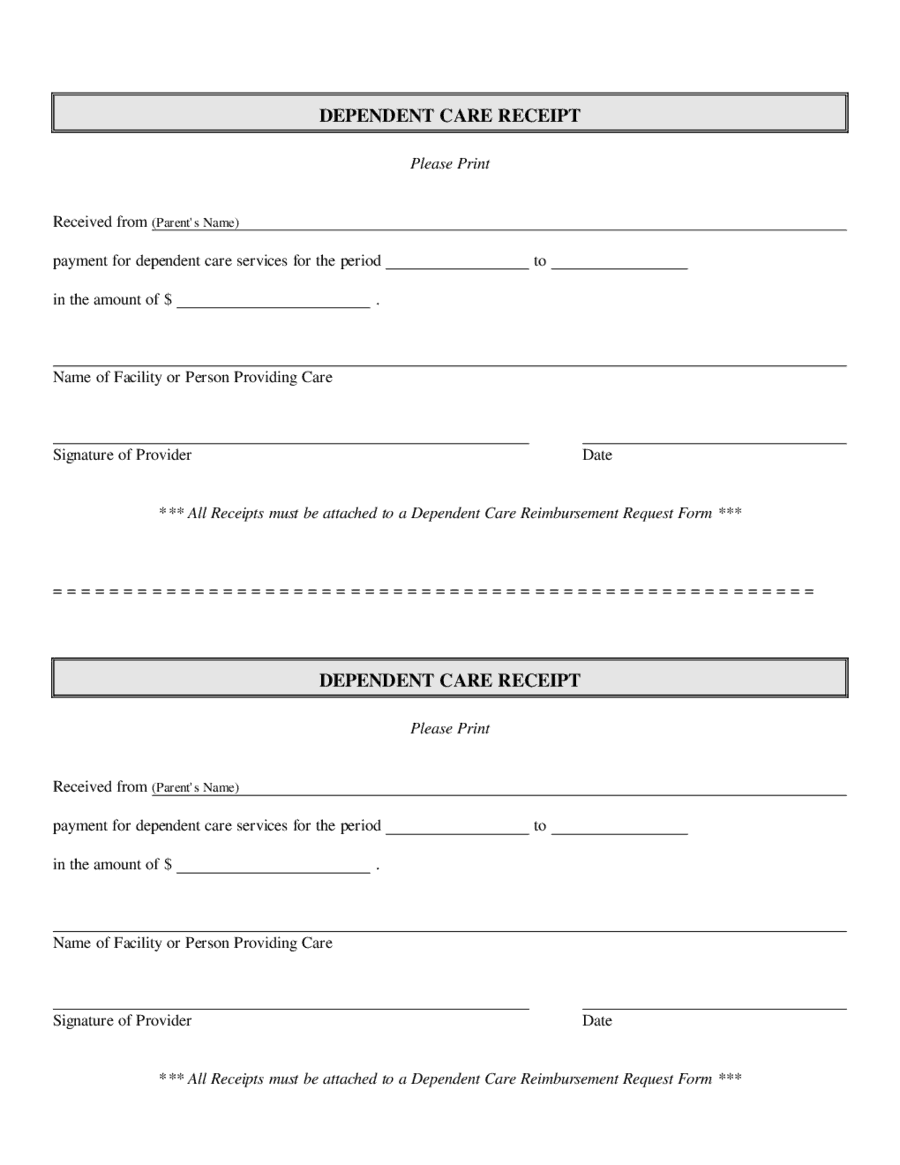

4 Dependent Care Receipt Templates Word Excel Templates

Family Foster Care Reimbursement Rates In The U S DeVooght Child

Check more sample of Child Care Reimbursement Tax Credit below

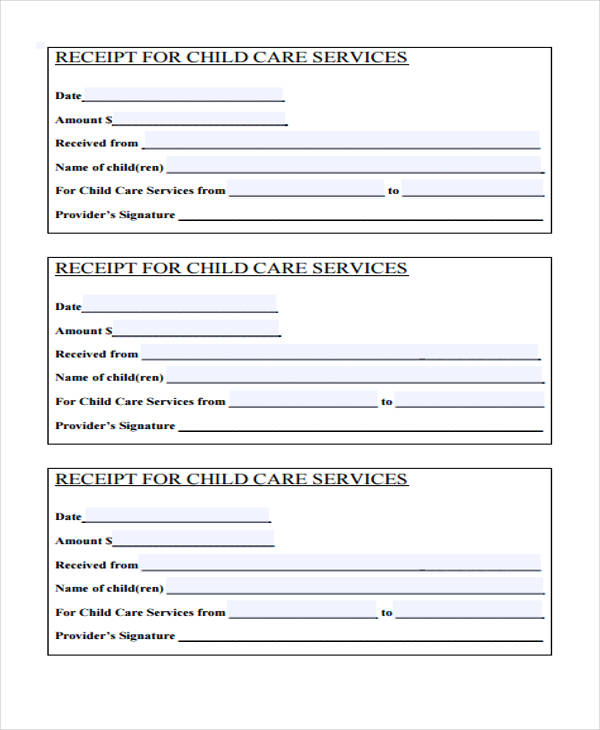

Childcare Receipt Fill Out Printable PDF Forms Online Daycare

Updated Child Care Reimbursement Guidelines Legal Services Staff

Quick Guide To The Child And Dependent Care Tax Credit

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Free Printable Daycare Receipt Template Printable Templates

https://www.irs.gov/newsroom/understanding-the...

IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

https://www.nerdwallet.com/article/taxes/child-and...

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Updated Child Care Reimbursement Guidelines Legal Services Staff

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Free Printable Daycare Receipt Template Printable Templates

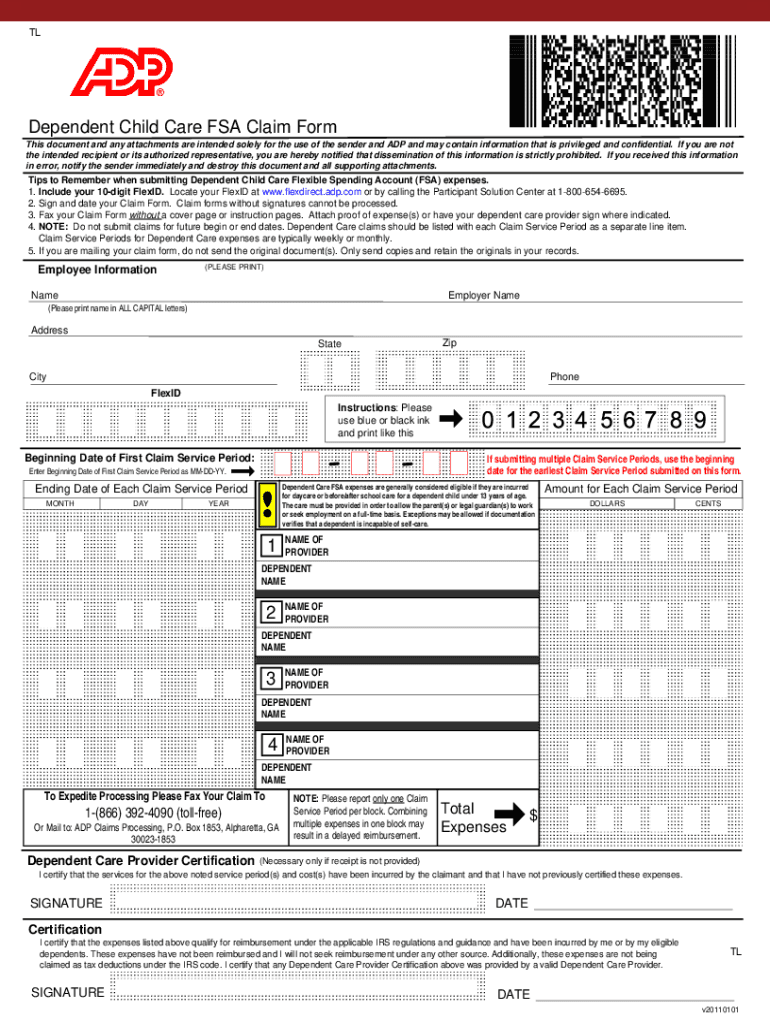

Adp Dependent Care Fsa Claim Form Fill Online Printable Fillable

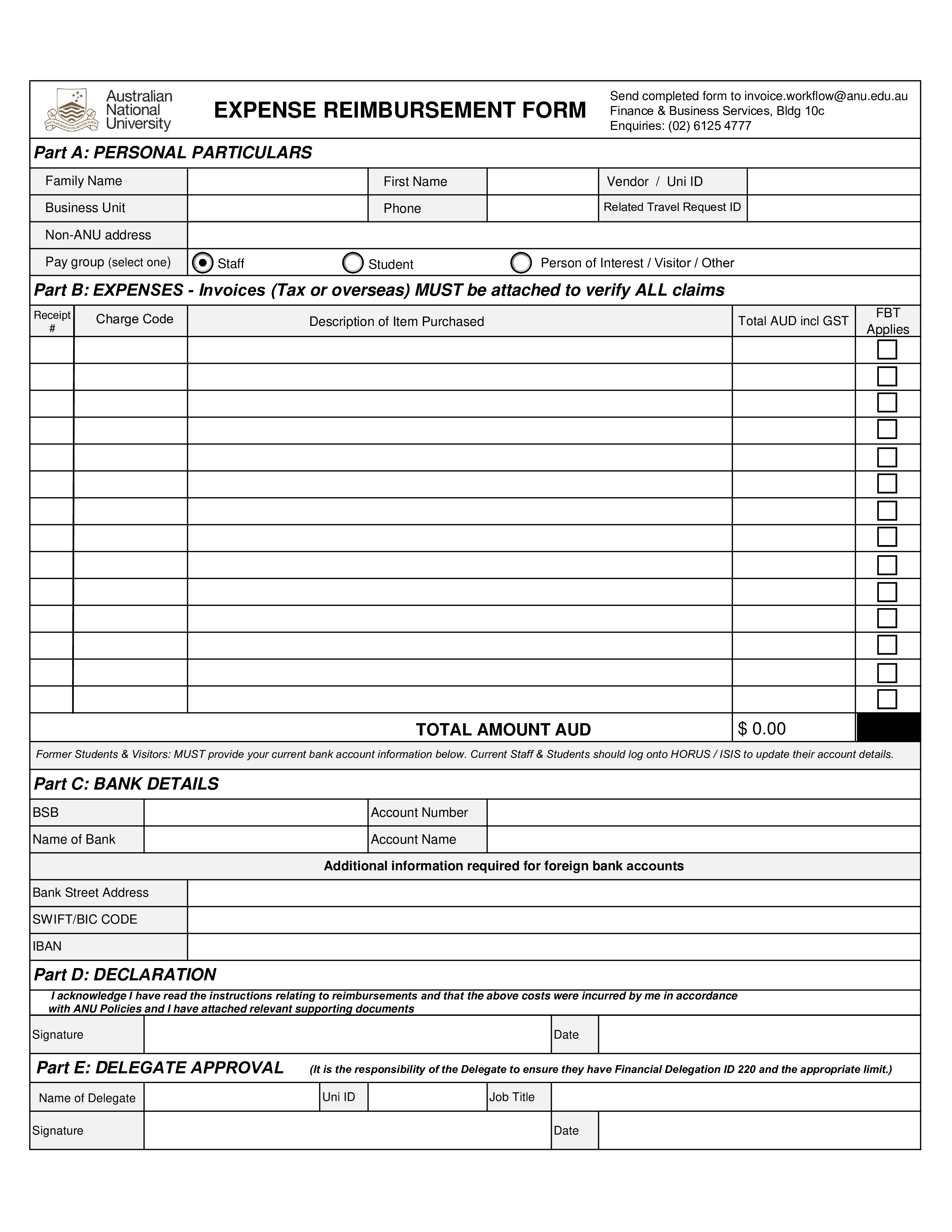

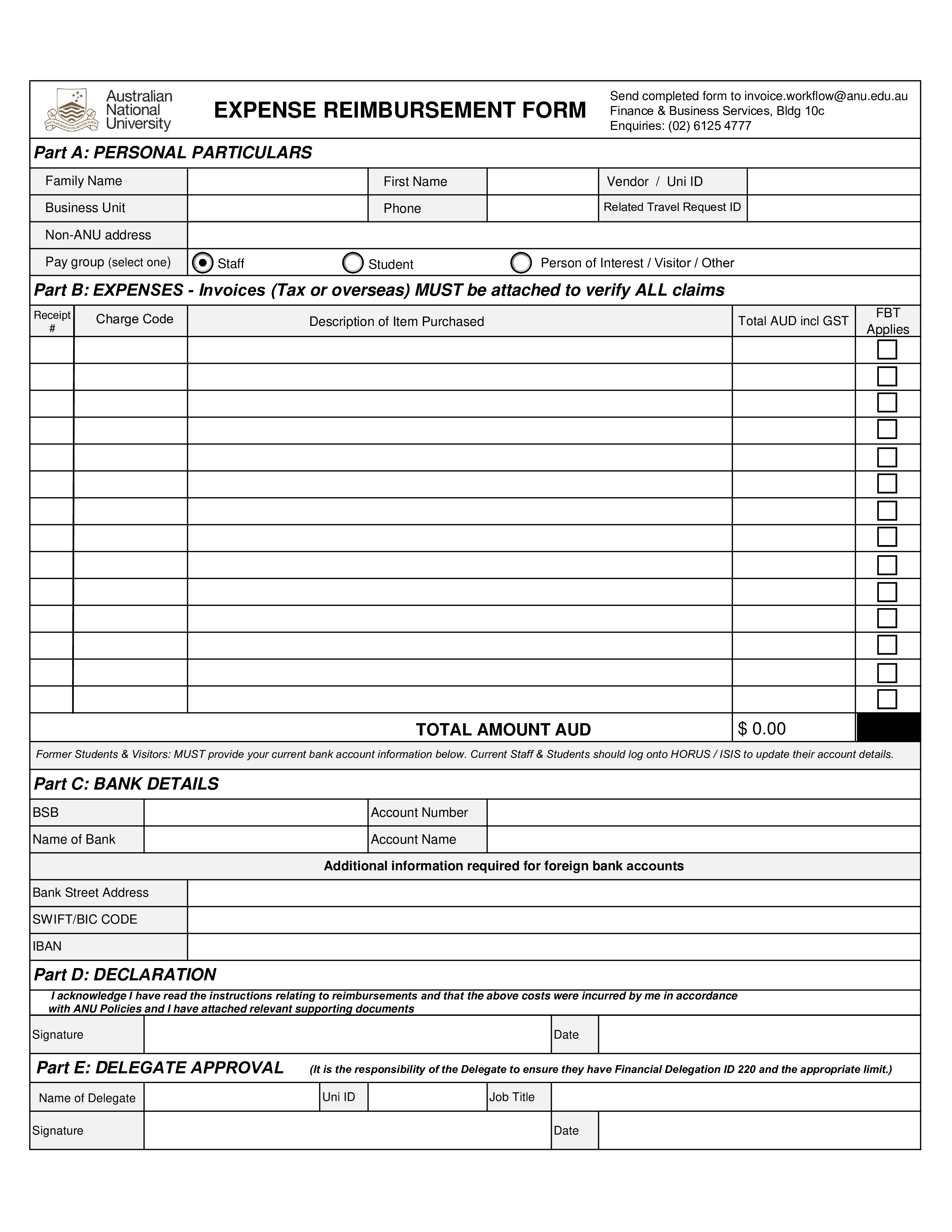

PDF Pwc Cfa Reimbursement PDF T l charger Download

PDF Pwc Cfa Reimbursement PDF T l charger Download

Dependent Care Reimbursement Receipt Template Glamorous Receipt Forms