Today, where screens have become the dominant feature of our lives yet the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes for creative projects, simply adding a personal touch to your home, printables for free can be an excellent source. In this article, we'll dive into the sphere of "Capital Gains Tax Relief," exploring the benefits of them, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Capital Gains Tax Relief Below

Capital Gains Tax Relief

Capital Gains Tax Relief -

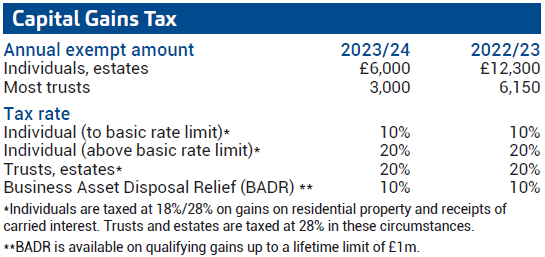

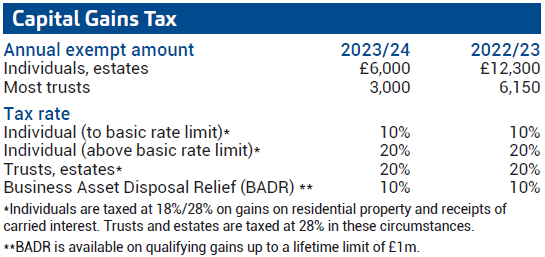

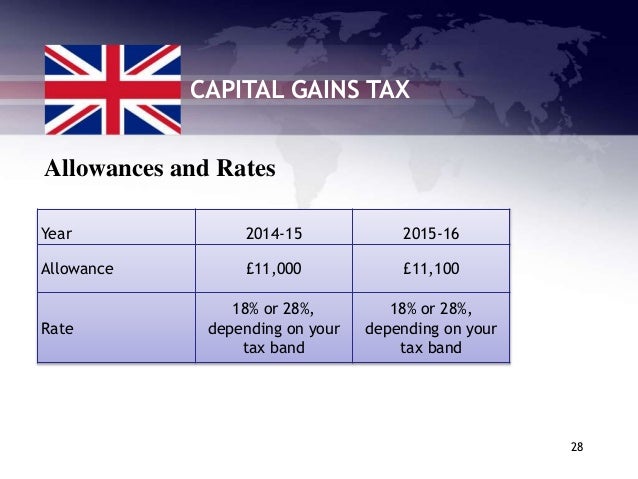

Cuts to the capital gains tax CGT exemption mean that arranging your investments as tax efficiently as possible is more important than ever Previously investors could make tax free gains of up to 12 300 a year but this exemption has been slashed to 6 000 for the 2023 24 tax year and is due to be cut again to 3 000 in 2024 25

The following Capital Gains Tax rates apply 18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you 28 for trustees or for personal representatives of someone who has died 10 for gains qualifying for Entrepreneurs Relief 28 for

Capital Gains Tax Relief provide a diverse variety of printable, downloadable material that is available online at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and much more. The appeal of printables for free lies in their versatility and accessibility.

More of Capital Gains Tax Relief

Capital Gains Tax Relief On The Disposal Of Small Business Assets

Capital Gains Tax Relief On The Disposal Of Small Business Assets

First published on December 15th 2021 and most recently revised on December 4th 2023 Capital Gains Tax CGT is a tax normally charged when a person disposes of an asset and makes a profit gain that is of a capital nature The disposal of an asset occurs when it is no longer owned for example following an exchange for

Capital gains tax rates for 2023 24 and 2022 23 If you make a gain after selling a property you ll pay 18 capital gains tax CGT as a basic rate taxpayer or 28 if you pay a higher rate of tax Gains from selling other assets are charged at 10 for basic rate taxpayers and 20 for higher rate taxpayers You ll only need to pay these rates

Capital Gains Tax Relief have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: There is the possibility of tailoring designs to suit your personal needs such as designing invitations, organizing your schedule, or even decorating your home.

-

Educational Use: Printables for education that are free offer a wide range of educational content for learners from all ages, making these printables a powerful tool for teachers and parents.

-

Accessibility: Access to a variety of designs and templates saves time and effort.

Where to Find more Capital Gains Tax Relief

Companies Seek capital Gains Tax Relief In Law As Rate Triples

Companies Seek capital Gains Tax Relief In Law As Rate Triples

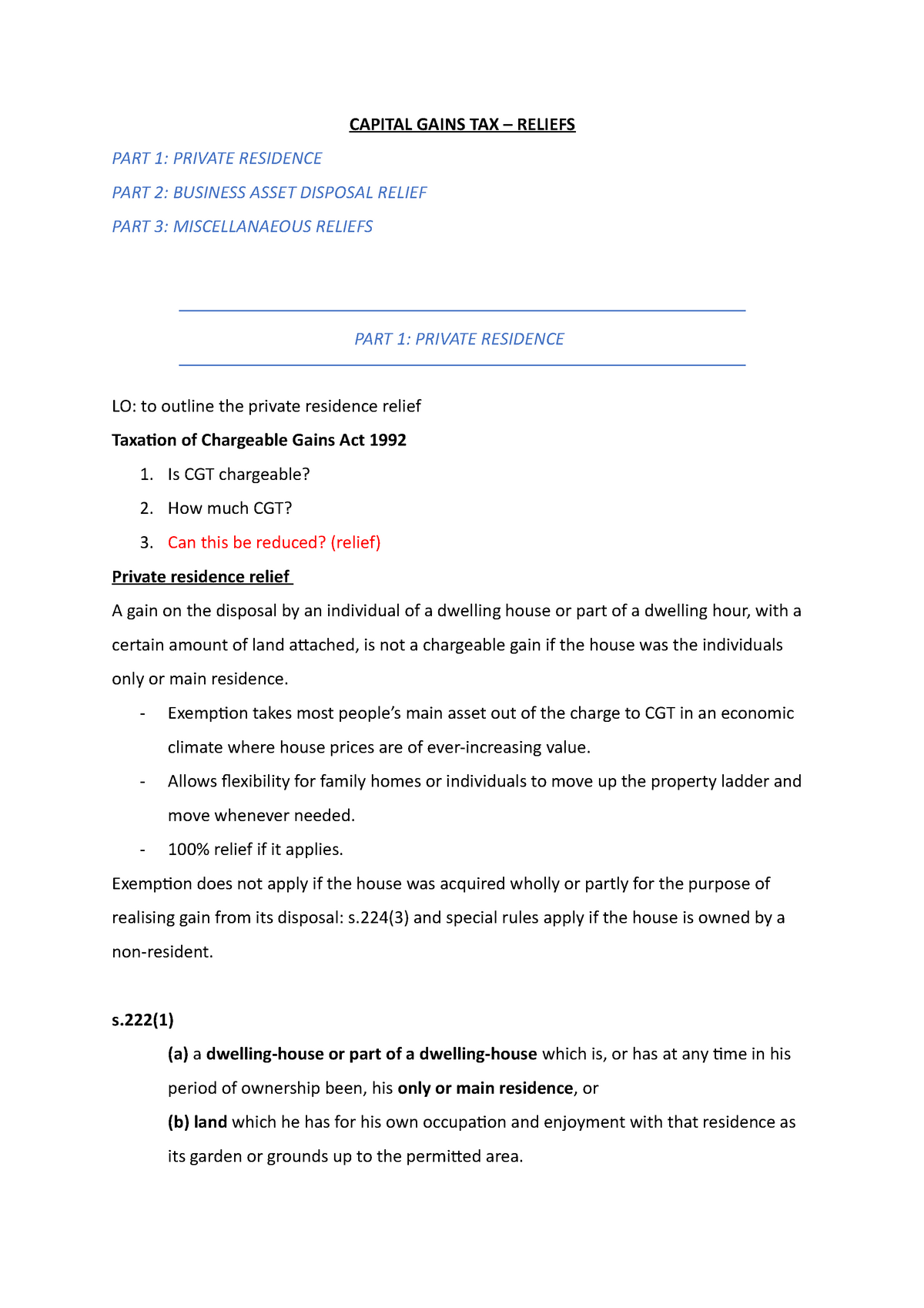

Capital Gains Tax CGT reliefs Overview Indexation Relief Farm Restructuring Relief Revised Entrepreneur Relief Principal Private Residence PPR Relief Property acquired between 7 December 2011 and 31 December 2014 Disposal of a business or farm Retirement Relief Transfer of a site from a parent

CGT reliefs allowances exemptions 6 April 2023 Key points Gains that fall within annual exempt amount are tax free There s no CGT on gifts between spouses and civil partners Your main residence is usually exempt from CGT Gains can deferred by investing proceeds in EIS shares Gifts into certain trusts can be heldover

Now that we've piqued your interest in printables for free, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of objectives.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs are a vast spectrum of interests, that includes DIY projects to planning a party.

Maximizing Capital Gains Tax Relief

Here are some new ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Capital Gains Tax Relief are a treasure trove filled with creative and practical information that cater to various needs and interest. Their accessibility and versatility make them a wonderful addition to both personal and professional life. Explore the wide world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes, they are! You can download and print the resources for free.

-

Can I utilize free printables in commercial projects?

- It's all dependent on the usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues in Capital Gains Tax Relief?

- Certain printables may be subject to restrictions on their use. Make sure you read the terms and conditions set forth by the author.

-

How can I print Capital Gains Tax Relief?

- Print them at home using the printer, or go to a print shop in your area for top quality prints.

-

What software do I need to run Capital Gains Tax Relief?

- Many printables are offered in PDF format, which can be opened using free software such as Adobe Reader.

50 CAPITAL GAINS TAX RELIEF FOR LANDLORDS EMBARQ

Want To Know How The capital Gains Tax Relief Works YouTube

Check more sample of Capital Gains Tax Relief below

Capital Gains Tax Reliefs CAPITAL GAINS TAX RELIEFS PART 1

Short Term Capital Gains Tax EQUITYMULTIPLE

Retirement Relief Capital Gains Tax Relief In Ireland 2 000 Clients

How Capital Gains Tax Is Calculated DG Institute

Capital Gains Tax

Capital Gains Tax Relief For SMSFs Is Here Now Mark To Market Rules

https://www.gov.uk/guidance/capital-gains-tax-rates-and-allowances

The following Capital Gains Tax rates apply 18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you 28 for trustees or for personal representatives of someone who has died 10 for gains qualifying for Entrepreneurs Relief 28 for

https://www.gov.uk/tax-sell-home

Relief from Capital Gains Tax CGT when you sell your home Private Residence Relief time away from your home what to do if you have 2 homes nominating a home Letting Relief

The following Capital Gains Tax rates apply 18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you 28 for trustees or for personal representatives of someone who has died 10 for gains qualifying for Entrepreneurs Relief 28 for

Relief from Capital Gains Tax CGT when you sell your home Private Residence Relief time away from your home what to do if you have 2 homes nominating a home Letting Relief

How Capital Gains Tax Is Calculated DG Institute

Short Term Capital Gains Tax EQUITYMULTIPLE

Capital Gains Tax

Capital Gains Tax Relief For SMSFs Is Here Now Mark To Market Rules

What Is Capital Allowance What Is The Capital Of South Carolina

Startup Investors Don t Get The Same Tax Breaks With Crowd funding

Startup Investors Don t Get The Same Tax Breaks With Crowd funding

Capital Gains Tax Relief On Properties Owned For Longer Than 7 Years