In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. For educational purposes as well as creative projects or simply adding an element of personalization to your area, Can You Contribute To A Traditional Ira With No Earned Income are now a useful resource. For this piece, we'll take a dive in the world of "Can You Contribute To A Traditional Ira With No Earned Income," exploring the different types of printables, where to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Can You Contribute To A Traditional Ira With No Earned Income Below

Can You Contribute To A Traditional Ira With No Earned Income

Can You Contribute To A Traditional Ira With No Earned Income -

No there is no maximum traditional IRA income limit Anyone can contribute to a traditional IRA While a Roth IRA has a strict income limit and those with earnings above it

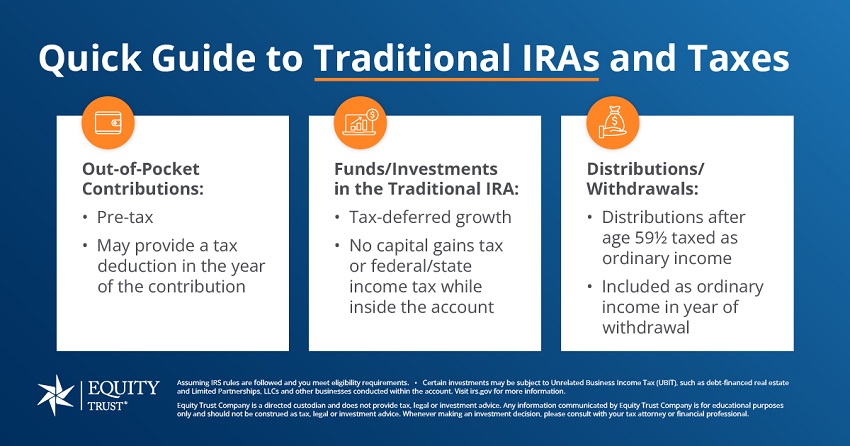

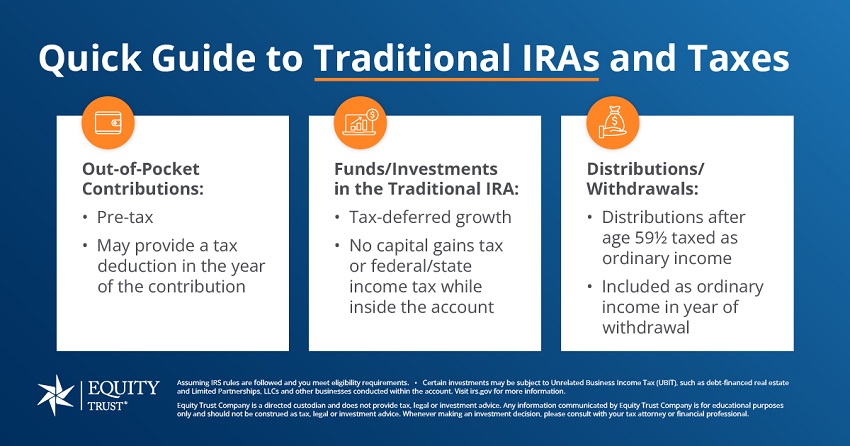

A traditional IRA is funded with pre tax dollars and can allow for deductible contributions Roth IRAs are funded with after tax dollars and allow you to withdraw money tax free in retirement The IRS limits how much you can contribute to an IRA each year As of 2024 the IRA contribution limit is 7 000

Printables for free include a vast range of printable, free resources available online for download at no cost. They come in many kinds, including worksheets templates, coloring pages and many more. The attraction of printables that are free is in their variety and accessibility.

More of Can You Contribute To A Traditional Ira With No Earned Income

Roth IRA Who Can Contribute The TurboTax Blog

Roth IRA Who Can Contribute The TurboTax Blog

If you and your spouse are not eligible to contribute to an employer plan you can deduct your contribution as long as you earn income during the year For purposes of the IRA deduction earned income excludes interest dividends and similar types of investment income

Key Takeaways You can contribute to a Roth IRA if you have earned income and meet the income limits Even if you don t have a conventional job you may have income that

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Flexible: You can tailor printed materials to meet your requirements in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value These Can You Contribute To A Traditional Ira With No Earned Income can be used by students of all ages, which makes them an invaluable tool for parents and educators.

-

Simple: immediate access various designs and templates cuts down on time and efforts.

Where to Find more Can You Contribute To A Traditional Ira With No Earned Income

Simple Ira Contribution Rules Choosing Your Gold IRA

Simple Ira Contribution Rules Choosing Your Gold IRA

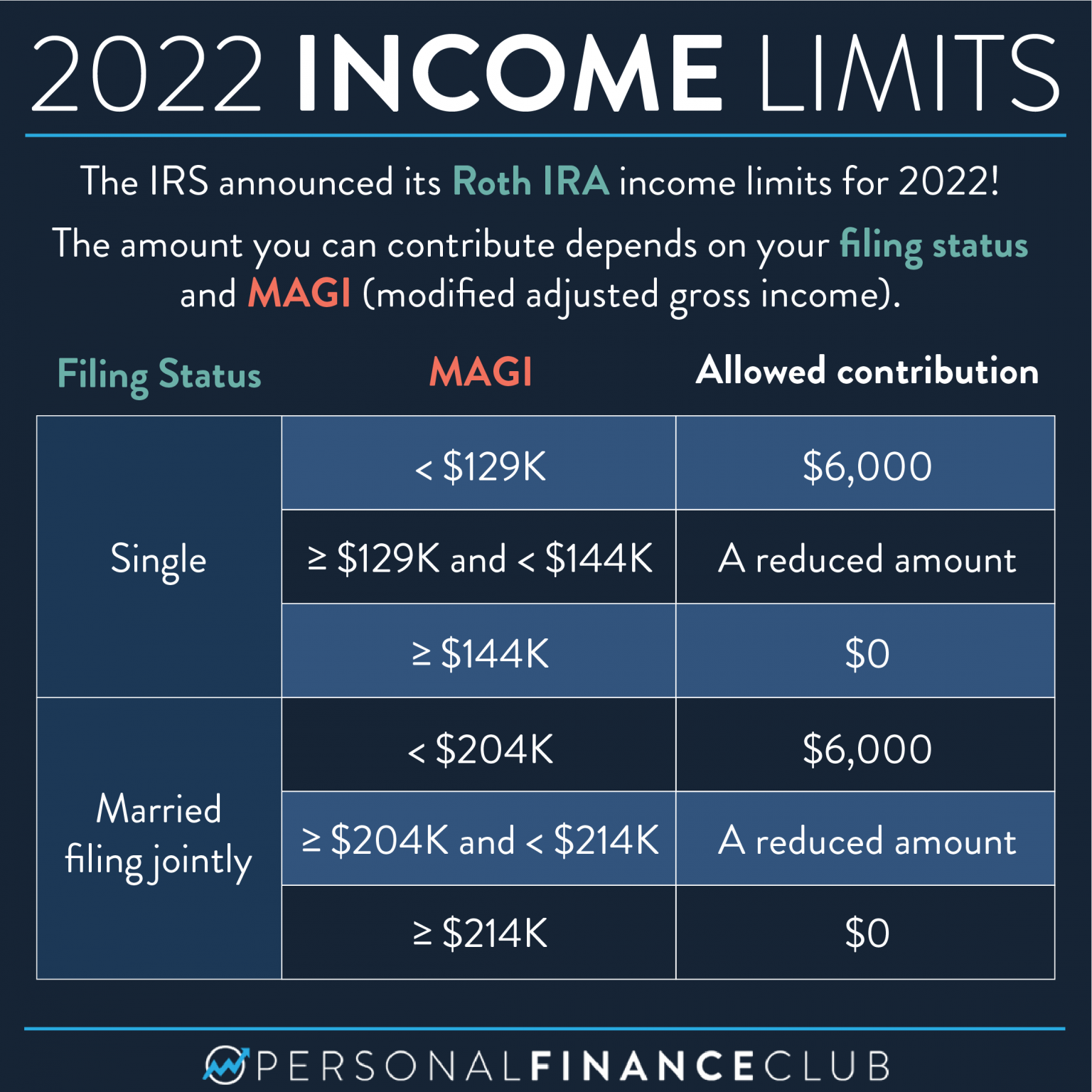

You can contribute at any age if you or your spouse if filing jointly have taxable compensation and your modified adjusted gross income is below certain amounts see and 2022 and 2023 limits Are my contributions deductible Traditional IRA You can deduct your contributions if you qualify Roth IRA Your contributions aren t deductible

Unlike with a Roth IRA there s no income limit for those who can contribute to a traditional IRA But your income and your as well as your spouse s affects whether you can deduct your traditional IRA contributions from your taxable income for the year If you and your spouse do not have access to a workplace retirement savings plan then

After we've peaked your curiosity about Can You Contribute To A Traditional Ira With No Earned Income Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Can You Contribute To A Traditional Ira With No Earned Income suitable for many applications.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning materials.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, including DIY projects to planning a party.

Maximizing Can You Contribute To A Traditional Ira With No Earned Income

Here are some inventive ways to make the most of Can You Contribute To A Traditional Ira With No Earned Income:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home and in class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Can You Contribute To A Traditional Ira With No Earned Income are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make they a beneficial addition to each day life. Explore the endless world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes they are! You can download and print these free resources for no cost.

-

Can I use free printing templates for commercial purposes?

- It depends on the specific conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues with Can You Contribute To A Traditional Ira With No Earned Income?

- Certain printables may be subject to restrictions regarding their use. Be sure to check the terms and regulations provided by the author.

-

How do I print Can You Contribute To A Traditional Ira With No Earned Income?

- You can print them at home with the printer, or go to a print shop in your area for high-quality prints.

-

What software is required to open printables at no cost?

- A majority of printed materials are as PDF files, which can be opened with free software such as Adobe Reader.

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

Check more sample of Can You Contribute To A Traditional Ira With No Earned Income below

Should You Invest In An IRA Or A Roth IRA SmartZone Finance

How Do Employees Contribute To The Success Of A Business Businesser

:max_bytes(150000):strip_icc()/what-can-you-contribute-to-the-company-2061254-Final-02fd463ecabe4e9b88da8cd88b36f62b.png)

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

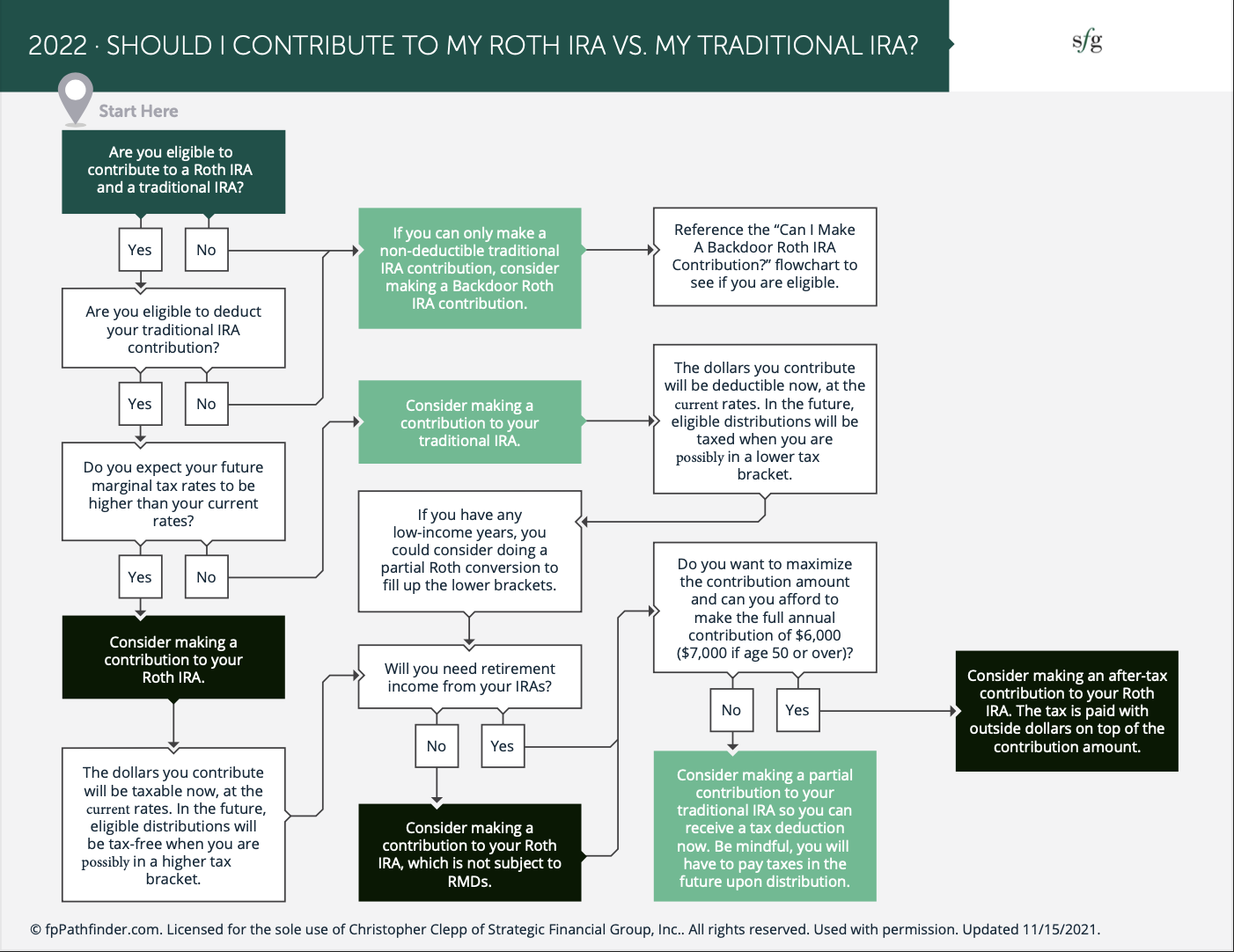

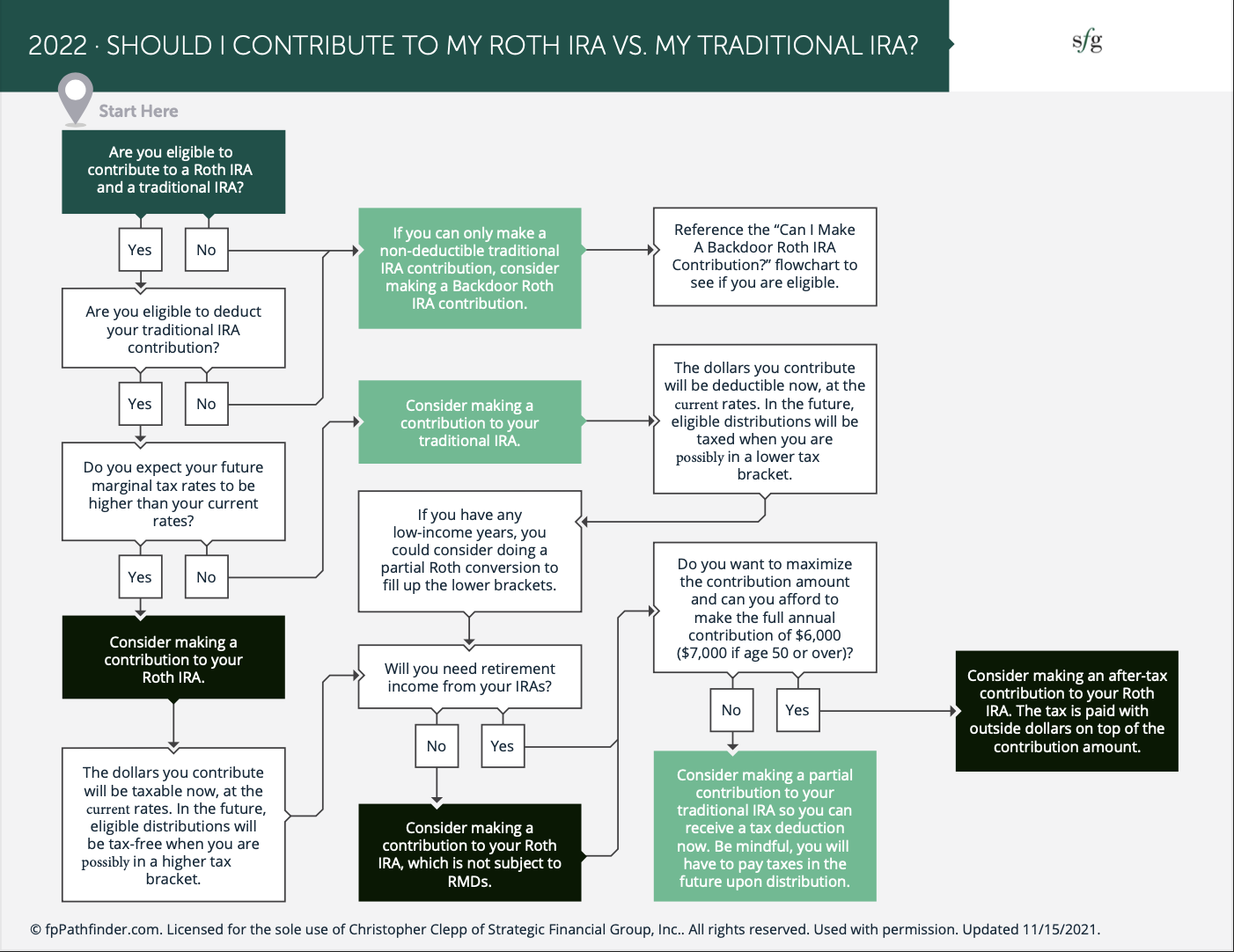

Should I Contribute To My Roth IRA Vs My Traditional IRA Building

Self Directed Ira Withdrawal Rules Choosing Your Gold IRA

What Can You Contribute To Our Company Showcase Your Value

https://smartasset.com/retirement/what-is...

A traditional IRA is funded with pre tax dollars and can allow for deductible contributions Roth IRAs are funded with after tax dollars and allow you to withdraw money tax free in retirement The IRS limits how much you can contribute to an IRA each year As of 2024 the IRA contribution limit is 7 000

https://www.nerdwallet.com/article/investing/traditional-ira-rules

Contribution limits for each type of account apply If you don t qualify to make a deductible contribution you can still put money in a traditional IRA With a Roth IRA if you make

A traditional IRA is funded with pre tax dollars and can allow for deductible contributions Roth IRAs are funded with after tax dollars and allow you to withdraw money tax free in retirement The IRS limits how much you can contribute to an IRA each year As of 2024 the IRA contribution limit is 7 000

Contribution limits for each type of account apply If you don t qualify to make a deductible contribution you can still put money in a traditional IRA With a Roth IRA if you make

Should I Contribute To My Roth IRA Vs My Traditional IRA Building

:max_bytes(150000):strip_icc()/what-can-you-contribute-to-the-company-2061254-Final-02fd463ecabe4e9b88da8cd88b36f62b.png)

How Do Employees Contribute To The Success Of A Business Businesser

Self Directed Ira Withdrawal Rules Choosing Your Gold IRA

What Can You Contribute To Our Company Showcase Your Value

How To Become A Millionaire By Investing In A Roth IRA Become A

No Earned Income Here s How Some May Still Contribute To An IRA

No Earned Income Here s How Some May Still Contribute To An IRA

Why Most Pharmacists Should Do A Backdoor Roth IRA