In this age of electronic devices, when screens dominate our lives and the appeal of physical printed objects isn't diminished. No matter whether it's for educational uses for creative projects, simply to add an individual touch to the home, printables for free can be an excellent resource. In this article, we'll dive to the depths of "Can I Make A Non Deductible Ira Contribution In 2022," exploring their purpose, where to get them, as well as how they can improve various aspects of your lives.

Get Latest Can I Make A Non Deductible Ira Contribution In 2022 Below

Can I Make A Non Deductible Ira Contribution In 2022

Can I Make A Non Deductible Ira Contribution In 2022 -

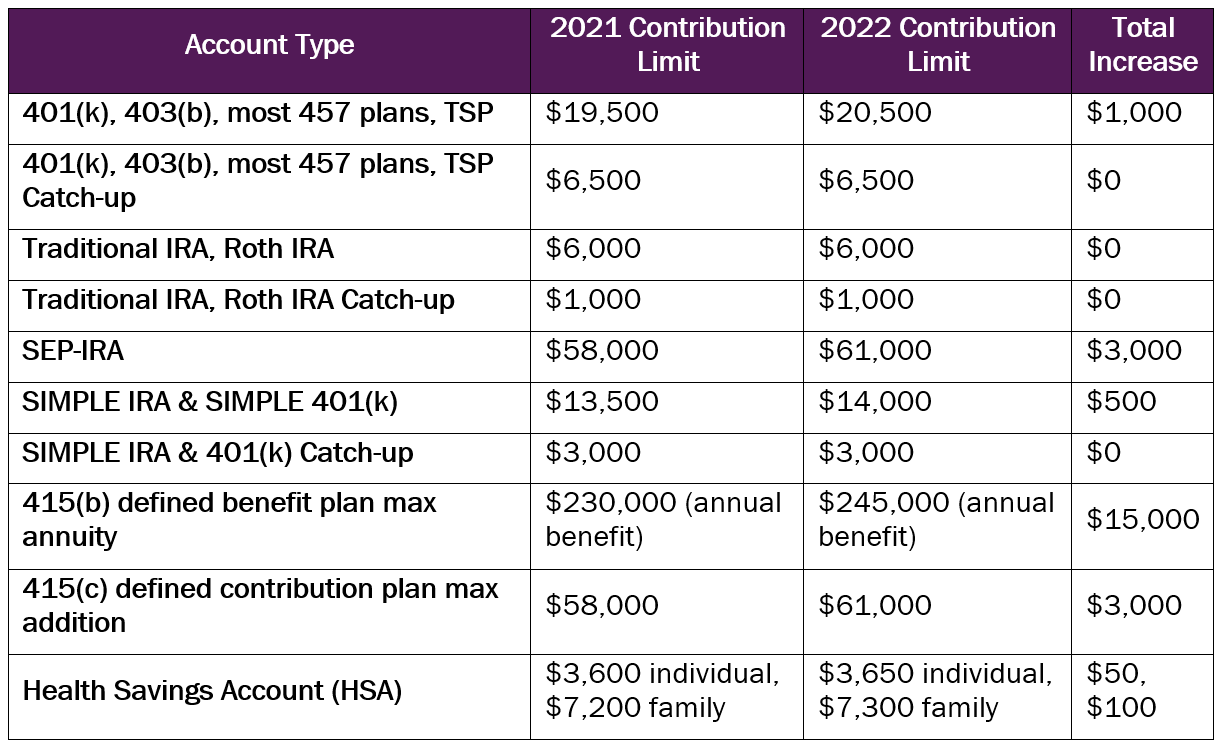

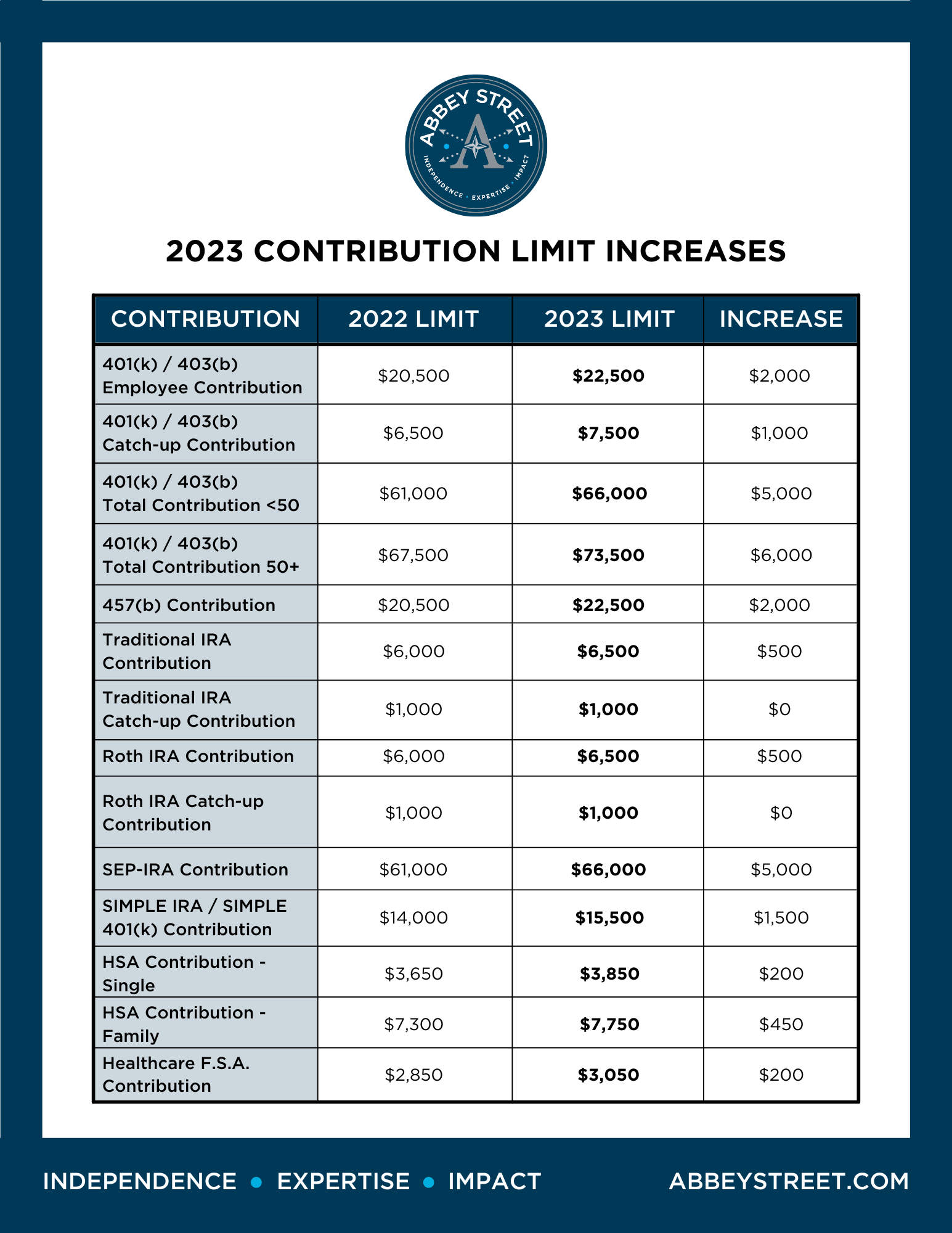

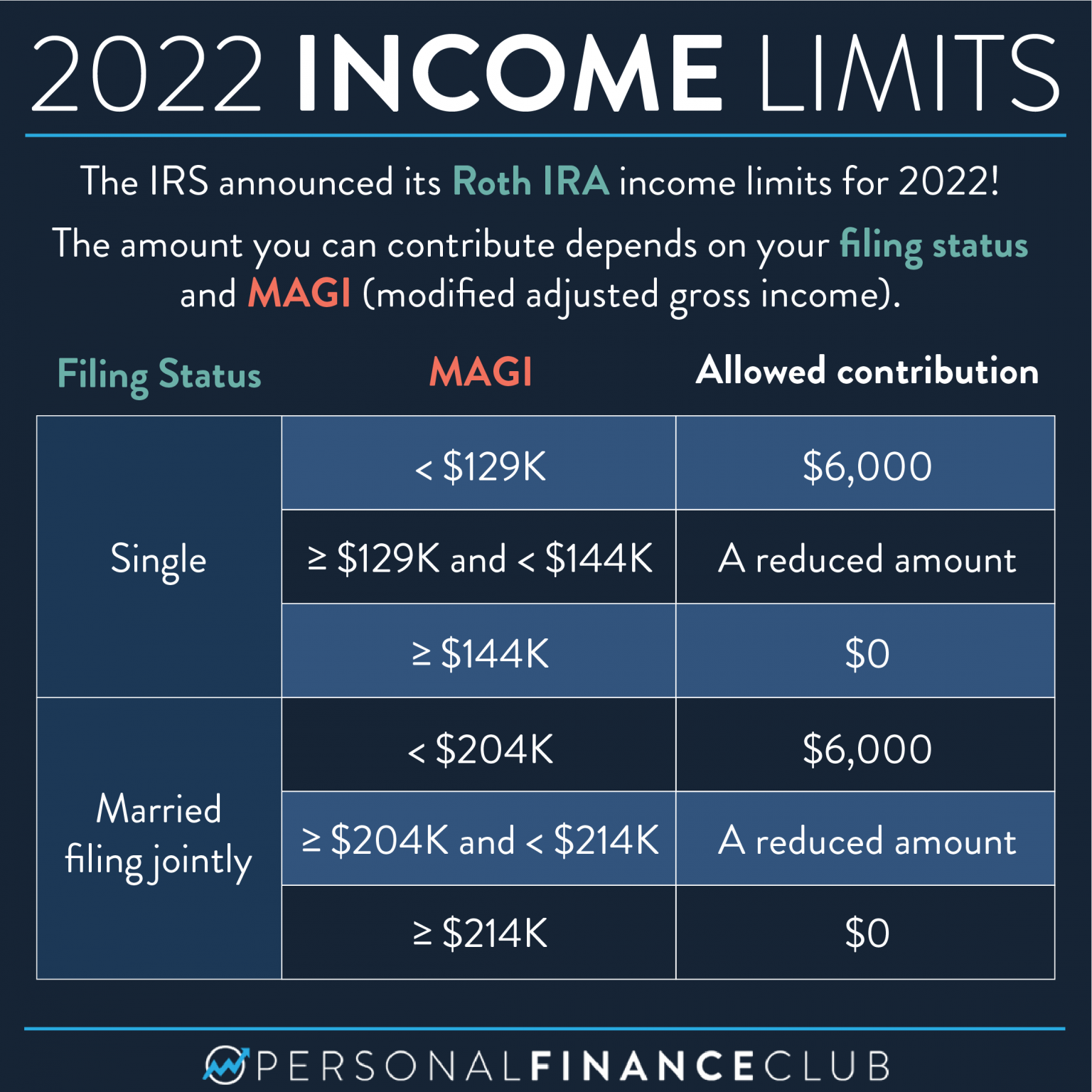

How much can I contribute to an IRA The annual contribution limit for 2023 is 6 500 or 7 500 if you re age 50 or older 2019 2020 2021 and 2022 is 6 000 or 7 000 if you re age

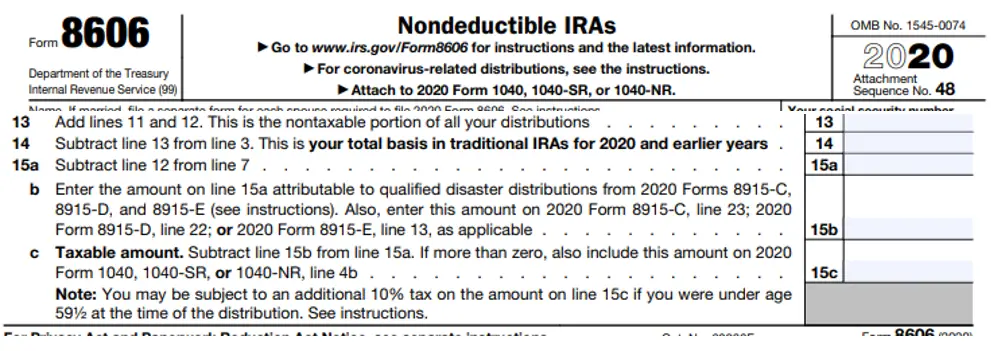

IRA deduction limits Internal Revenue Service You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your IRA See IRA

Can I Make A Non Deductible Ira Contribution In 2022 include a broad range of printable, free resources available online for download at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and much more. One of the advantages of Can I Make A Non Deductible Ira Contribution In 2022 is their flexibility and accessibility.

More of Can I Make A Non Deductible Ira Contribution In 2022

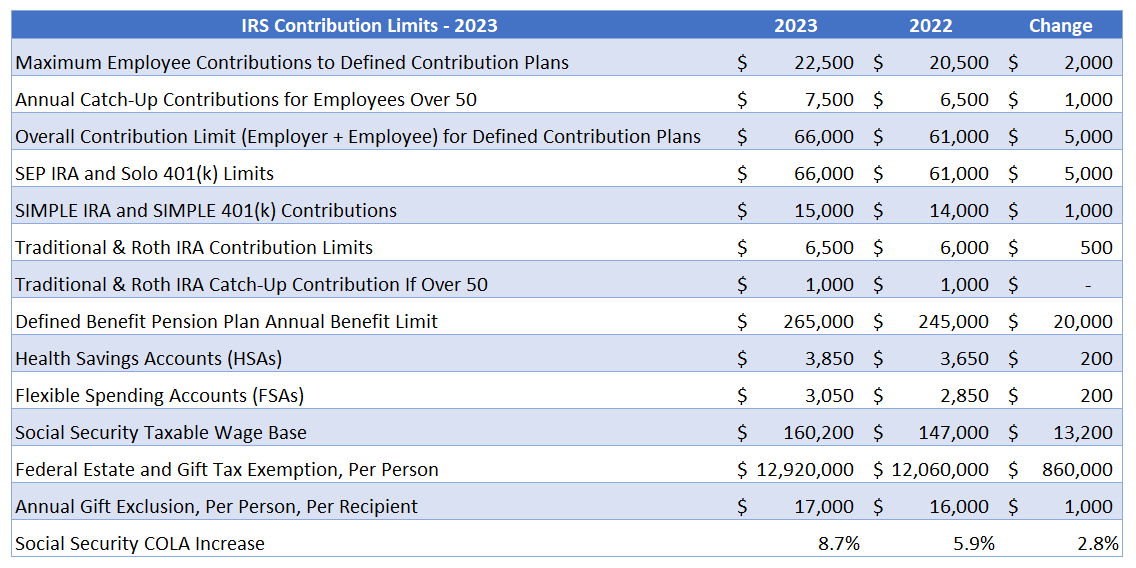

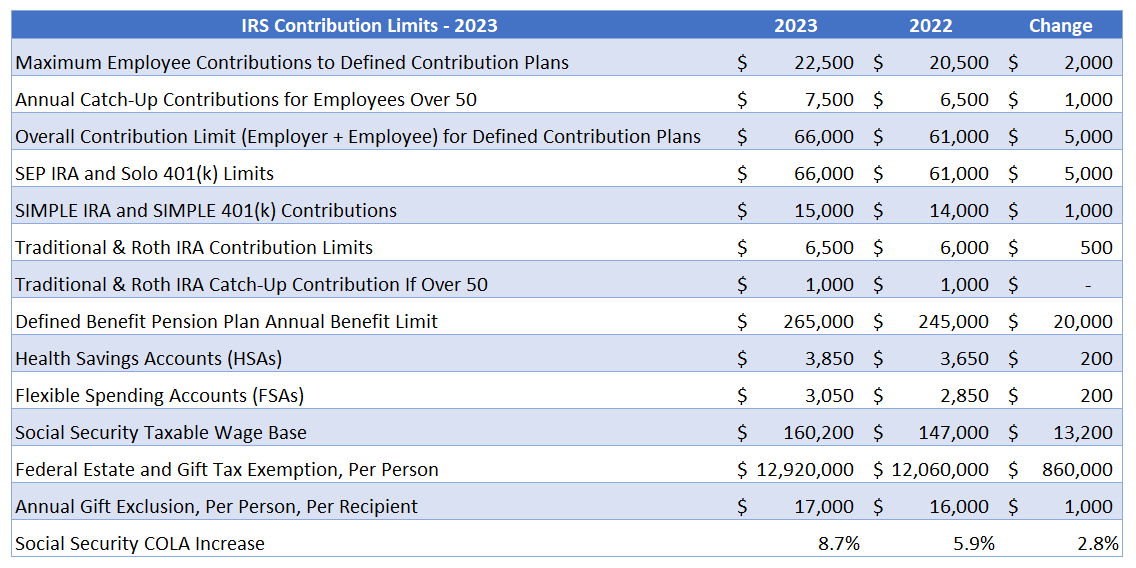

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Contributions can be made to your traditional IRA for each year that you receive compensation For any year in which you don t work contributions can t be made to your IRA unless you

Here are the main facts you need to know For 2023 the maximum contribution allowed is the lesser of 100 of your earned income for the year or 6 500 an increase of 1 000 from 2022

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: They can make print-ready templates to your specific requirements when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Education Value These Can I Make A Non Deductible Ira Contribution In 2022 are designed to appeal to students from all ages, making them a great instrument for parents and teachers.

-

Accessibility: Fast access an array of designs and templates reduces time and effort.

Where to Find more Can I Make A Non Deductible Ira Contribution In 2022

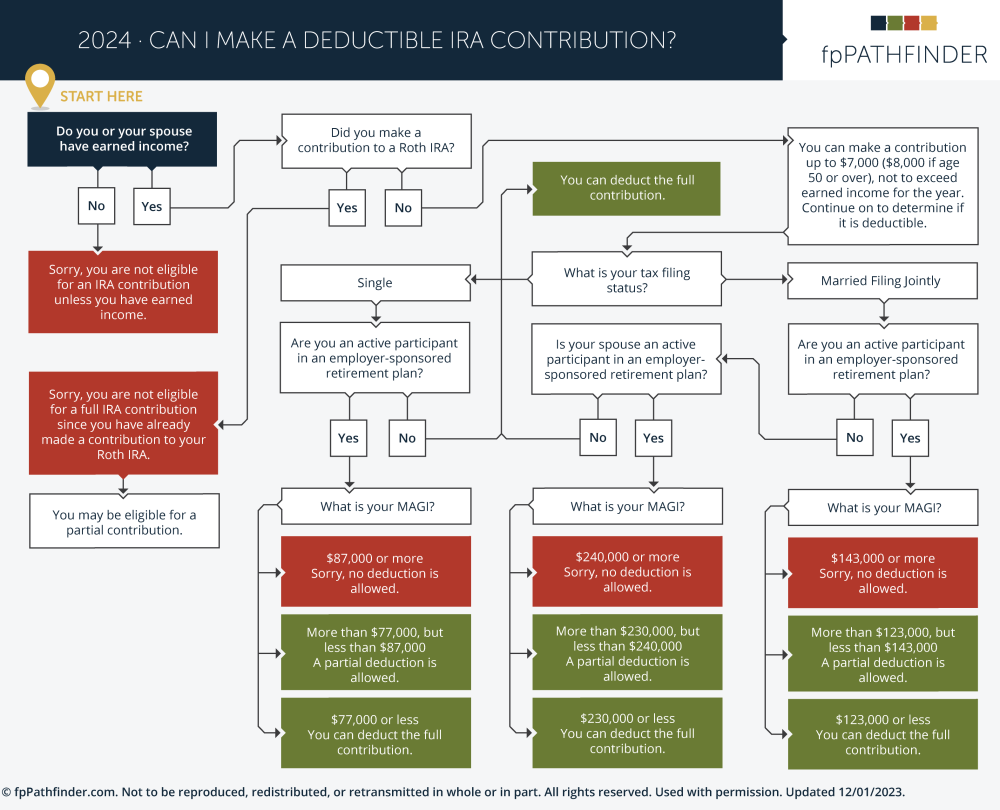

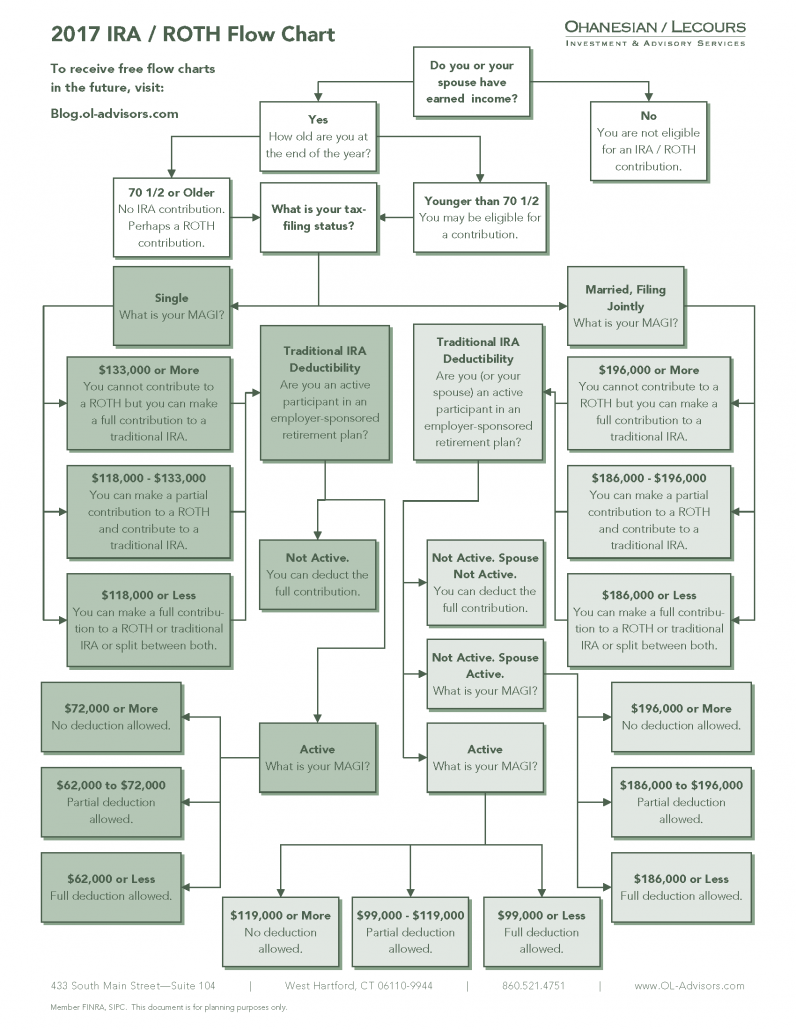

Can I Make A Deductible IRA Contribution FpPathfinder Guides

Can I Make A Deductible IRA Contribution FpPathfinder Guides

You can take an IRA deduction for up to 6 000 in contributions for tax year 2022 if you re age 49 or under This increases to 7 000 if you re age 50 or older The limit is 6 500 for the 2023 tax year and 7 500 for those

You can contribute to an IRA based on your income and the IRS contribution limits Your ability to deduct IRA contributions depends on factors including your income and tax filing status

After we've peaked your interest in printables for free Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Can I Make A Non Deductible Ira Contribution In 2022 for a variety uses.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a broad range of interests, starting from DIY projects to party planning.

Maximizing Can I Make A Non Deductible Ira Contribution In 2022

Here are some inventive ways that you can make use use of Can I Make A Non Deductible Ira Contribution In 2022:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Can I Make A Non Deductible Ira Contribution In 2022 are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and pursuits. Their accessibility and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the endless world of Can I Make A Non Deductible Ira Contribution In 2022 right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes, they are! You can print and download the resources for free.

-

Can I download free printables in commercial projects?

- It's based on specific usage guidelines. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with Can I Make A Non Deductible Ira Contribution In 2022?

- Certain printables may be subject to restrictions regarding usage. Make sure to read these terms and conditions as set out by the creator.

-

How do I print Can I Make A Non Deductible Ira Contribution In 2022?

- You can print them at home using printing equipment or visit a print shop in your area for the highest quality prints.

-

What software do I require to view printables for free?

- The majority of printables are with PDF formats, which is open with no cost software, such as Adobe Reader.

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

Simple Ira Contribution Rules Choosing Your Gold IRA

Check more sample of Can I Make A Non Deductible Ira Contribution In 2022 below

Can I Make A Deductible IRA Contribution Echo45 Advisors

What Is A Non deductible IRA Empower

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

2023 Irs Contribution Limits And Tax Rates By Kristin Mckenna Harvest

Must Know 2023 Roth Ira Limits Article 2023 BGH

What Is A Non Deductible IRA SoFi

https://www.irs.gov/retirement-plans/ira-deduction-limits

IRA deduction limits Internal Revenue Service You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your IRA See IRA

https://smartasset.com/retirement/what-is-a …

A non deductible IRA is a retirement account that behaves like a traditional IRA except that it is funded with after tax dollars Here s how it works Definition and Contribution Limits

IRA deduction limits Internal Revenue Service You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your IRA See IRA

A non deductible IRA is a retirement account that behaves like a traditional IRA except that it is funded with after tax dollars Here s how it works Definition and Contribution Limits

2023 Irs Contribution Limits And Tax Rates By Kristin Mckenna Harvest

What Is A Non deductible IRA Empower

Must Know 2023 Roth Ira Limits Article 2023 BGH

What Is A Non Deductible IRA SoFi

Contribute To A Solo 401k Roth IRA And Traditional IRA For 2022 My

Can I Make A Deductible IRA Contribution A Helpful Flowchart

Can I Make A Deductible IRA Contribution A Helpful Flowchart

Visualizing IRA Rules Using Flowcharts