In the age of digital, where screens rule our lives The appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses as well as creative projects or simply to add personal touches to your space, Can I Deduct State Taxes Paid For Previous Year have become an invaluable resource. For this piece, we'll take a dive deep into the realm of "Can I Deduct State Taxes Paid For Previous Year," exploring what they are, where they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Can I Deduct State Taxes Paid For Previous Year Below

Can I Deduct State Taxes Paid For Previous Year

Can I Deduct State Taxes Paid For Previous Year -

1 Best answer jerry2000 Alumni Federal taxes penalties and interest paid for a prior year are not deductible State taxes paid for a prior year are deductible on your Federal return in the year paid but only the taxes Penalties and interest are not deductible View solution in original post May 31 2019 4 49 PM 0 Reply Bookmark Icon

You may deduct as an itemized deduction state and local income taxes withheld from your wages during the year as reported on your Form W 2 Wage and Tax Statement and estimated state and local income taxes and prior years state and local income taxes paid during the year

Can I Deduct State Taxes Paid For Previous Year encompass a wide range of downloadable, printable content that can be downloaded from the internet at no cost. These resources come in various formats, such as worksheets, templates, coloring pages and much more. The appeal of printables for free is in their variety and accessibility.

More of Can I Deduct State Taxes Paid For Previous Year

Can I Deduct Donations Of My Time To Charitable Organizations Amy

Can I Deduct Donations Of My Time To Charitable Organizations Amy

You cannot deduct Federal taxes paid for a prior year on your current year s Federal return Some states do allow a deduction for Federal taxes paid To go to the section of the tax return to enter your state balance due amounts paid in

You can deduct all state income tax payments you make during the year for tax years before 2018 Beginning in 2018 the deduction limit is 10 000 which includes the withholding amounts reported on your W 2s and 1099s

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Individualization This allows you to modify printables to your specific needs be it designing invitations making your schedule, or even decorating your house.

-

Educational Worth: Free educational printables offer a wide range of educational content for learners of all ages. This makes them an invaluable tool for teachers and parents.

-

Simple: You have instant access a variety of designs and templates, which saves time as well as effort.

Where to Find more Can I Deduct State Taxes Paid For Previous Year

Can You Deduct State Taxes YouTube

Can You Deduct State Taxes YouTube

Updated on December 25 2022 Reviewed by Ebony J Howard Fact checked by Ariana Ch vez In This Article View All Photo The Balance Miguel Co State and local taxes can be deducted on your return subject to some rules but you must itemize rather than claim the standard deduction

If you itemize deductions you can deduct state and local taxes you paid during the year These taxes can include state and local income taxes or state and local sales taxes but not both Note Beginning with 2018 returns the deduction for all state and local taxes is limited to 10 000 5 000 if married filing separately

We hope we've stimulated your interest in printables for free and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Can I Deduct State Taxes Paid For Previous Year for a variety objectives.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide array of topics, ranging that range from DIY projects to party planning.

Maximizing Can I Deduct State Taxes Paid For Previous Year

Here are some innovative ways for you to get the best use of Can I Deduct State Taxes Paid For Previous Year:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Can I Deduct State Taxes Paid For Previous Year are a treasure trove of useful and creative resources that can meet the needs of a variety of people and interests. Their availability and versatility make them a valuable addition to both personal and professional life. Explore the vast array that is Can I Deduct State Taxes Paid For Previous Year today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can download and print these documents for free.

-

Can I download free printables in commercial projects?

- It's based on specific rules of usage. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright problems with Can I Deduct State Taxes Paid For Previous Year?

- Some printables may come with restrictions on usage. Be sure to read the terms and regulations provided by the author.

-

How do I print Can I Deduct State Taxes Paid For Previous Year?

- You can print them at home using any printer or head to any local print store for high-quality prints.

-

What software is required to open printables that are free?

- Most PDF-based printables are available in the format PDF. This can be opened with free programs like Adobe Reader.

Can I Deduct Property Taxes On My State Tax Return Tip No 53

Can I Deduct Investment Fees In 2018 Invest Walls

Check more sample of Can I Deduct State Taxes Paid For Previous Year below

How To Deduct State And Local Taxes Above SALT Cap

WHAT CAN I DEDUCT FOR SURPLUS INCOME IN BANKRUPTCY

Can I Deduct Expenses For Growing Food That I Donate Nj

What Can I Deduct From My Taxes Hylen CPA Inc

4 Tax Deductions What Can I Deduct YouTube

What You Can t Deduct On Your Taxes

https://www.irs.gov/taxtopics/tc503

You may deduct as an itemized deduction state and local income taxes withheld from your wages during the year as reported on your Form W 2 Wage and Tax Statement and estimated state and local income taxes and prior years state and local income taxes paid during the year

https://ttlc.intuit.com/community/after-you-file/...

If the taxes you paid this year related to a prior year was for state or local income taxes and if you are taking a deduction for state and local income taxes paid as part of your itemized deductions on Schedule A rather than the standard deduction you can enter those prior year state and local income taxes as part of your state and local

You may deduct as an itemized deduction state and local income taxes withheld from your wages during the year as reported on your Form W 2 Wage and Tax Statement and estimated state and local income taxes and prior years state and local income taxes paid during the year

If the taxes you paid this year related to a prior year was for state or local income taxes and if you are taking a deduction for state and local income taxes paid as part of your itemized deductions on Schedule A rather than the standard deduction you can enter those prior year state and local income taxes as part of your state and local

What Can I Deduct From My Taxes Hylen CPA Inc

WHAT CAN I DEDUCT FOR SURPLUS INCOME IN BANKRUPTCY

4 Tax Deductions What Can I Deduct YouTube

What You Can t Deduct On Your Taxes

Employees Can Deduct Workplace Expenses From Their Taxes ExpensePoint

List Of Tax Deductions Here s What You Can Deduct

List Of Tax Deductions Here s What You Can Deduct

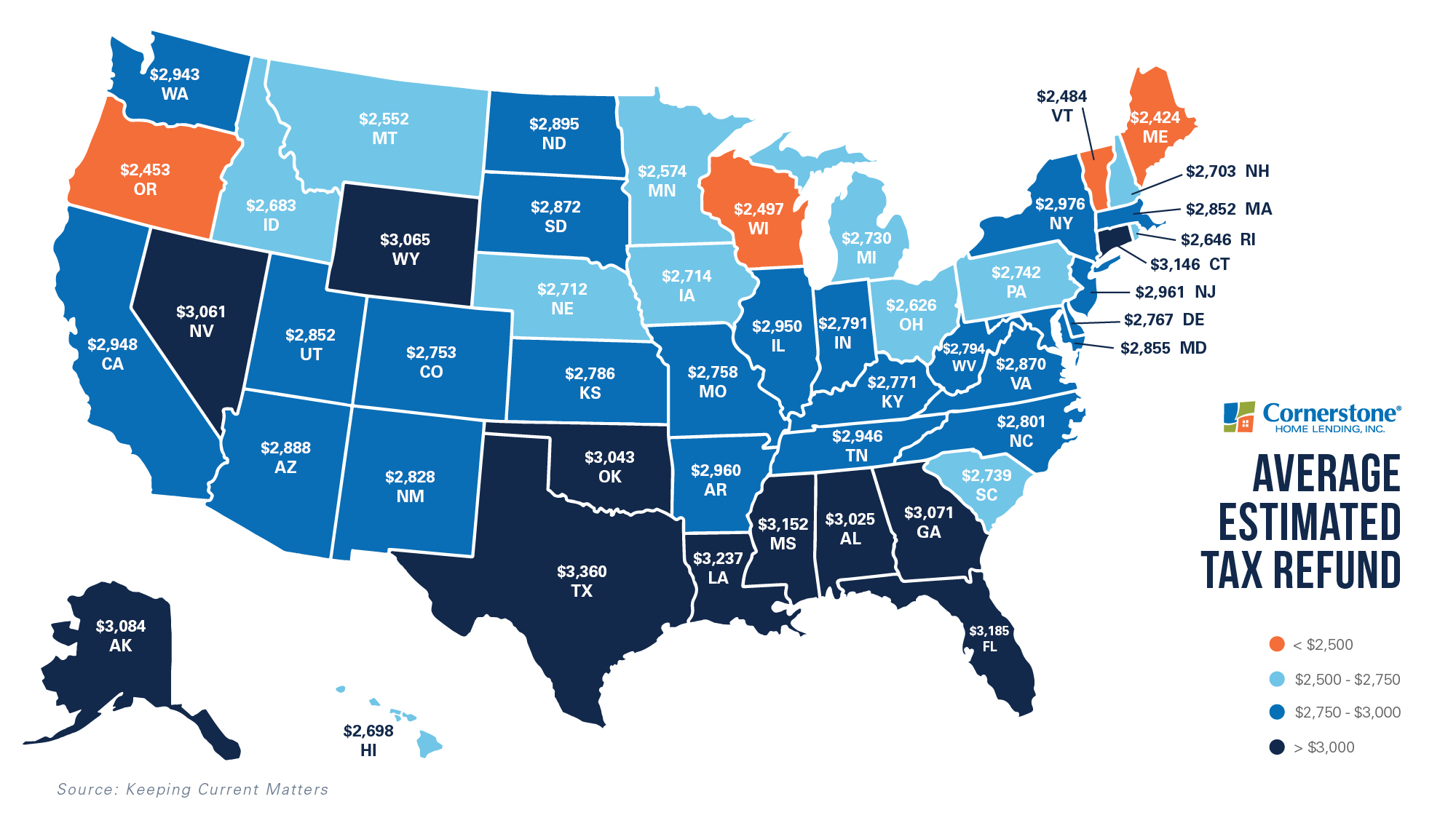

Tax Return 2021 Could Your Refund Make Homeownership A Reality