In a world where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. For educational purposes, creative projects, or just adding personal touches to your home, printables for free have become a valuable source. Through this post, we'll take a dive into the world "Can I Claim My 401k Contributions On My Taxes," exploring the benefits of them, where to get them, as well as how they can be used to enhance different aspects of your life.

Get Latest Can I Claim My 401k Contributions On My Taxes Below

Can I Claim My 401k Contributions On My Taxes

Can I Claim My 401k Contributions On My Taxes -

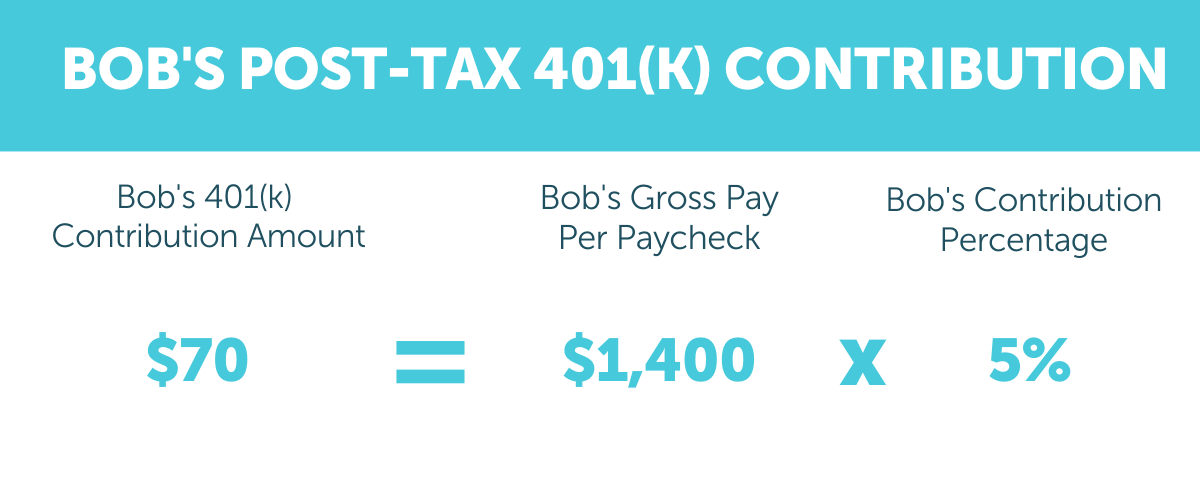

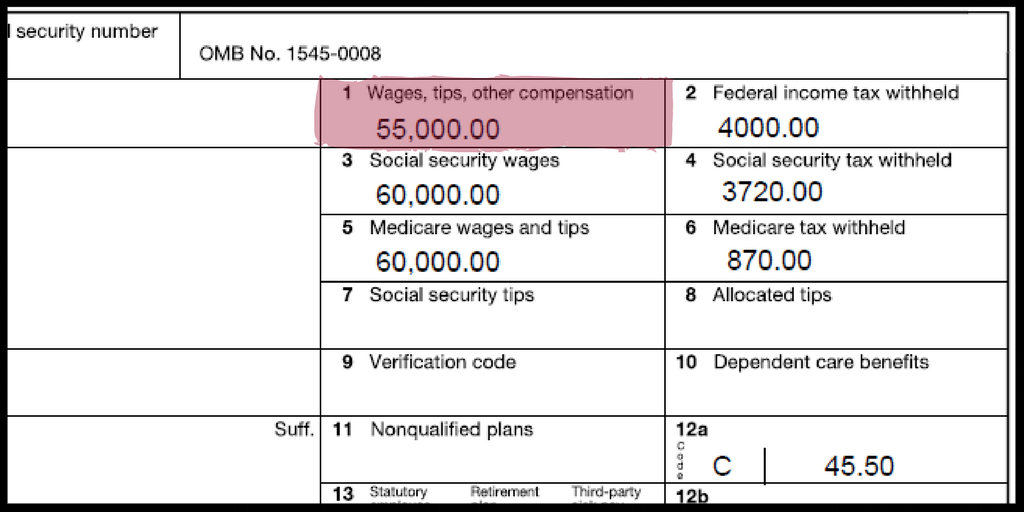

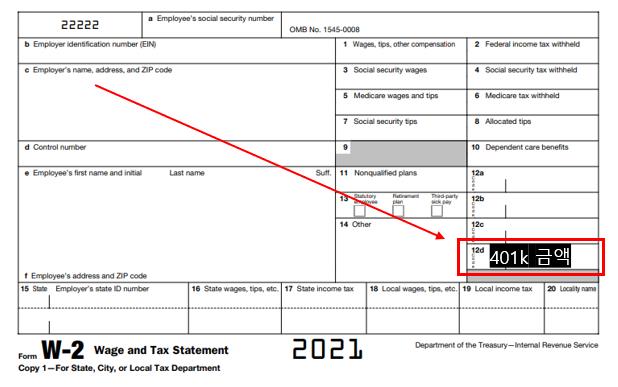

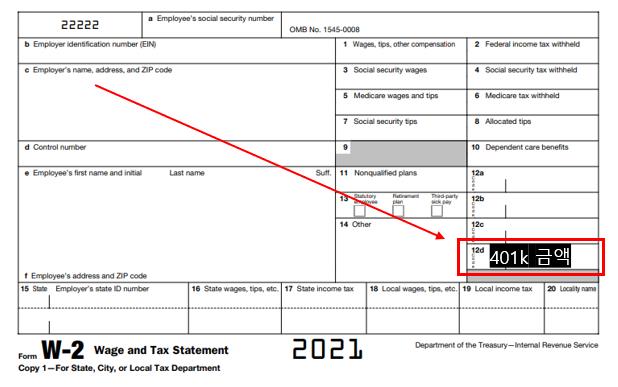

You won t pay income tax on 401 k money until you withdraw it Since your employer considers your contributions when calculating your taxable income on your W 2 you don t need to deduct

The short answer is no Because 401 k contributions are taken out of your paycheck before being taxed they are not included in

Can I Claim My 401k Contributions On My Taxes encompass a wide assortment of printable documents that can be downloaded online at no cost. They come in many designs, including worksheets templates, coloring pages and more. The benefit of Can I Claim My 401k Contributions On My Taxes is in their versatility and accessibility.

More of Can I Claim My 401k Contributions On My Taxes

Understanding Your Forms W 2 Wage Tax Statement Tax Refund Tax

Understanding Your Forms W 2 Wage Tax Statement Tax Refund Tax

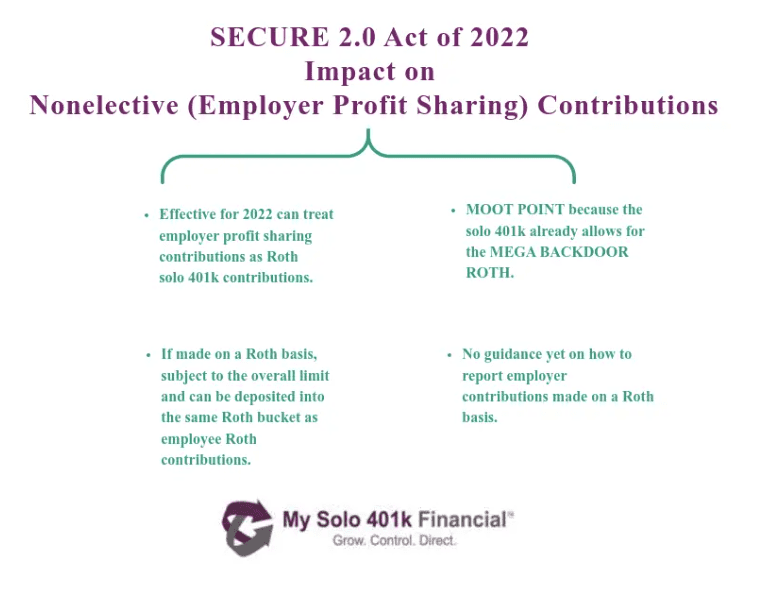

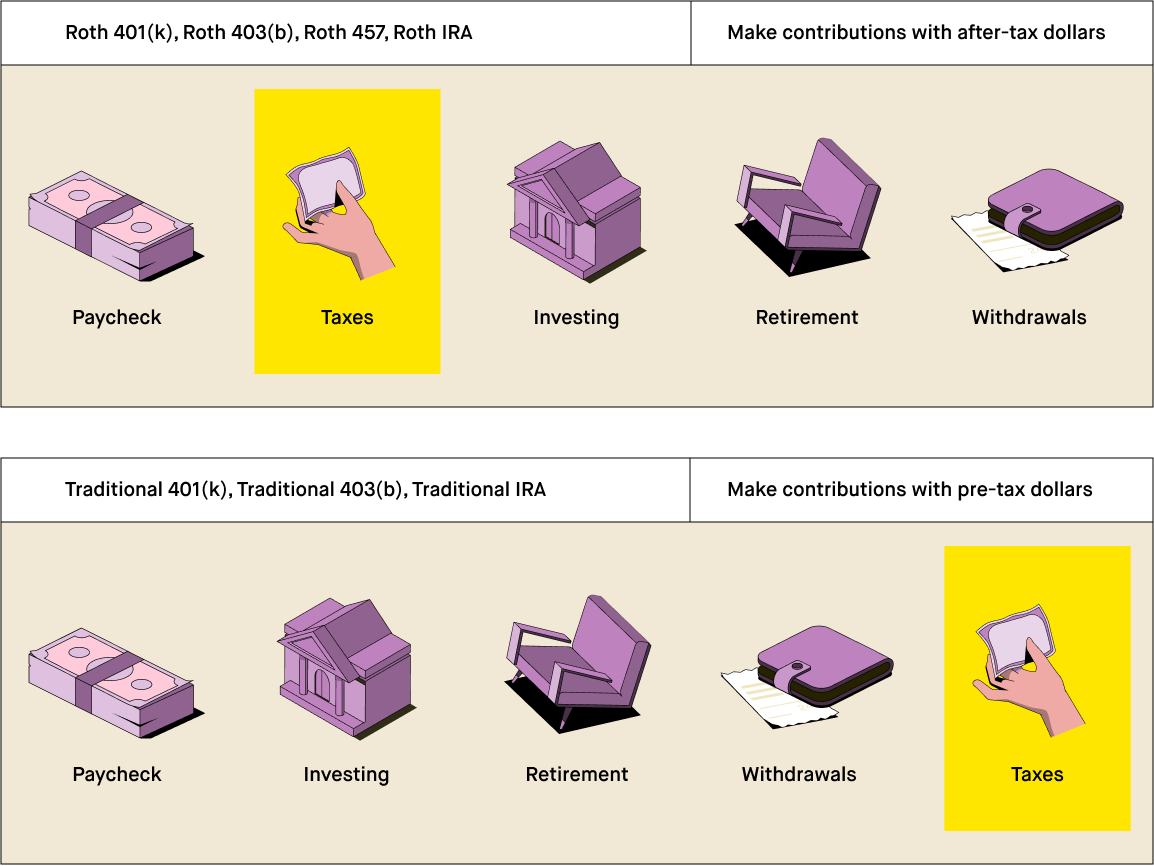

Employers can contribute to employees accounts Distributions including earnings are includible in taxable income at retirement except for qualified distributions

When you make contributions to your 401 k you do it on a pretax basis Essentially some of the money earned through your work goes directly into the account

Can I Claim My 401k Contributions On My Taxes have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: They can make print-ready templates to your specific requirements, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Benefits: Printing educational materials for no cost can be used by students of all ages, which makes them an essential source for educators and parents.

-

Easy to use: immediate access a myriad of designs as well as templates saves time and effort.

Where to Find more Can I Claim My 401k Contributions On My Taxes

Making Year 2023 Annual Solo 401k Contributions Pretax Roth And

Making Year 2023 Annual Solo 401k Contributions Pretax Roth And

You can t claim your 401 k as a deduction on your taxes 401 K Tax Deduction Claims It can be confusing when you hear that contributing to a 401 k will

Contributions to a traditional 401 k plan as well as any employer matches and earnings in the account such as gains interest or dividends are considered tax deferred This means you won t

Now that we've piqued your curiosity about Can I Claim My 401k Contributions On My Taxes Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Can I Claim My 401k Contributions On My Taxes suitable for many motives.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free including flashcards, learning tools.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a broad range of interests, all the way from DIY projects to party planning.

Maximizing Can I Claim My 401k Contributions On My Taxes

Here are some ways that you can make use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Can I Claim My 401k Contributions On My Taxes are an abundance of practical and innovative resources designed to meet a range of needs and preferences. Their accessibility and flexibility make these printables a useful addition to both professional and personal life. Explore the endless world of Can I Claim My 401k Contributions On My Taxes today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes you can! You can print and download these resources at no cost.

-

Can I utilize free printables in commercial projects?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions regarding their use. Always read the terms and conditions set forth by the designer.

-

How do I print Can I Claim My 401k Contributions On My Taxes?

- You can print them at home with a printer or visit a local print shop for top quality prints.

-

What program must I use to open printables free of charge?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software such as Adobe Reader.

Social Security Cost Of Living Adjustments 2023

W 2 Doctored Money

Check more sample of Can I Claim My 401k Contributions On My Taxes below

Percentage Taken Out Of Paycheck DeonneWishe

Can I Withdraw Money From My 401 k Before I Retire

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

What Is A Roth 401 k 2023 Robinhood

Form 8889 Instructions Information On The HSA Tax Form

Traditional 401k USA

W2 Form Example 2022

https://www.sofi.com/learn/content/401k-tax-d…

The short answer is no Because 401 k contributions are taken out of your paycheck before being taxed they are not included in

https://humaninterest.com/learn/articles/do-i-need...

Can you deduct your 401 k contributions Generally yes you can deduct 401 k contributions Per IRS guidelines your employer doesn t include your pre tax

The short answer is no Because 401 k contributions are taken out of your paycheck before being taxed they are not included in

Can you deduct your 401 k contributions Generally yes you can deduct 401 k contributions Per IRS guidelines your employer doesn t include your pre tax

Form 8889 Instructions Information On The HSA Tax Form

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire

Traditional 401k USA

W2 Form Example 2022

Should I Cash Out My 401k To Pay Off Debt Bariatrx

How Much Should I Have In My 401k During My 20 s 30 s 40 s And 50 s

How Much Should I Have In My 401k During My 20 s 30 s 40 s And 50 s

How Much Should I Have Saved In My 401k By Age