Today, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed material hasn't diminished. In the case of educational materials as well as creative projects or simply adding personal touches to your area, Can I Claim Childcare Costs For A Nanny have become a valuable source. We'll dive through the vast world of "Can I Claim Childcare Costs For A Nanny," exploring what they are, where to locate them, and the ways that they can benefit different aspects of your life.

Get Latest Can I Claim Childcare Costs For A Nanny Below

Can I Claim Childcare Costs For A Nanny

Can I Claim Childcare Costs For A Nanny -

As of 2019 which accounts for the recent changes under the Tax Cuts and Jobs Act you can deduct between 20 and 35 of up to 3 000 that you spent on your nanny for one child If you had more than one child regardless of how many more the maximum that you can include is 6 000

For 2023 this credit can reduce the cost of childcare expenses from hiring a nanny and can be worth as much as 20 to 35 of up to 3 000 of childcare or similar costs for a child under 13 or up to 6 000 for two or more dependents

The Can I Claim Childcare Costs For A Nanny are a huge collection of printable materials online, at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and many more. The appealingness of Can I Claim Childcare Costs For A Nanny lies in their versatility and accessibility.

More of Can I Claim Childcare Costs For A Nanny

Can I Claim Childcare Costs As A Business Expense In NZ SMYD

Can I Claim Childcare Costs As A Business Expense In NZ SMYD

Services that may qualify as work related expenses include nanny share arrangements day care preschool and day camp for your qualifying persons and the care can be provided either at your home or outside your home See IRS Publication 503 Child and Dependent Care Expenses for more information

Yes you can claim your childcare expenses whether you pay your babysitter using cash check bank transfers or any other payment method As long as you have proof that the expenses are for childcare

Can I Claim Childcare Costs For A Nanny have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: You can tailor printed materials to meet your requirements whether it's making invitations, organizing your schedule, or decorating your home.

-

Educational Value The free educational worksheets can be used by students of all ages. This makes them a valuable tool for parents and teachers.

-

Convenience: Instant access to various designs and templates cuts down on time and efforts.

Where to Find more Can I Claim Childcare Costs For A Nanny

Can I Claim Childcare Costs As A Business Expense In NZ SMYD Ask

Can I Claim Childcare Costs As A Business Expense In NZ SMYD Ask

Introduction This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves

27 June 2022 Last updated 8 April 2024 See all updates Get emails about this page Applies to England Scotland and Wales Contents How childcare costs payments work on Universal Credit

Since we've got your interest in printables for free, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Can I Claim Childcare Costs For A Nanny suitable for many applications.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs are a vast array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Can I Claim Childcare Costs For A Nanny

Here are some new ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to enhance learning at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Can I Claim Childcare Costs For A Nanny are an abundance of useful and creative resources that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make them a wonderful addition to both personal and professional life. Explore the vast collection of Can I Claim Childcare Costs For A Nanny to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Can I Claim Childcare Costs For A Nanny really for free?

- Yes, they are! You can print and download these documents for free.

-

Can I use free printables for commercial use?

- It's determined by the specific rules of usage. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Can I Claim Childcare Costs For A Nanny?

- Certain printables might have limitations on their use. Always read the terms of service and conditions provided by the designer.

-

How do I print Can I Claim Childcare Costs For A Nanny?

- Print them at home with an printer, or go to an area print shop for high-quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in PDF format, which can be opened with free software like Adobe Reader.

6 In 10 Women Who Have Had An Abortion Claim Childcare Costs Influenced

Tiny Nation Nannies Childcare Quality Home Based Early Learning

Check more sample of Can I Claim Childcare Costs For A Nanny below

Quick Tips Child Care Costs And Hiring A Nanny

Claiming Childcare Expenses In Canada Blueprint Accounting

Can I Claim Childcare Costs As A Business Expense Business Plus Baby

How To Claim Childcare Costs As A Contractor SG Accounting

What Is Nanny Sharing And How Does It Work In NoVA

Who Can I Claim As A Dependent

https://turbotax.intuit.com/tax-tips/self...

For 2023 this credit can reduce the cost of childcare expenses from hiring a nanny and can be worth as much as 20 to 35 of up to 3 000 of childcare or similar costs for a child under 13 or up to 6 000 for two or more dependents

https://www.freshbooks.com/hub/expenses/write-off-nanny-expenses

April 7 2023 A taxpayer can partially write off nanny expenses as long as the nanny is paid legally the child is under 13 years of age and both spouses are working This tax break is typically applied one of two ways through a tax credit when filing income taxes or through a Dependent Care Flexible Spending Account

For 2023 this credit can reduce the cost of childcare expenses from hiring a nanny and can be worth as much as 20 to 35 of up to 3 000 of childcare or similar costs for a child under 13 or up to 6 000 for two or more dependents

April 7 2023 A taxpayer can partially write off nanny expenses as long as the nanny is paid legally the child is under 13 years of age and both spouses are working This tax break is typically applied one of two ways through a tax credit when filing income taxes or through a Dependent Care Flexible Spending Account

How To Claim Childcare Costs As A Contractor SG Accounting

Claiming Childcare Expenses In Canada Blueprint Accounting

What Is Nanny Sharing And How Does It Work In NoVA

Who Can I Claim As A Dependent

The Importance Of Childcare In Reopening The Economy Econofact

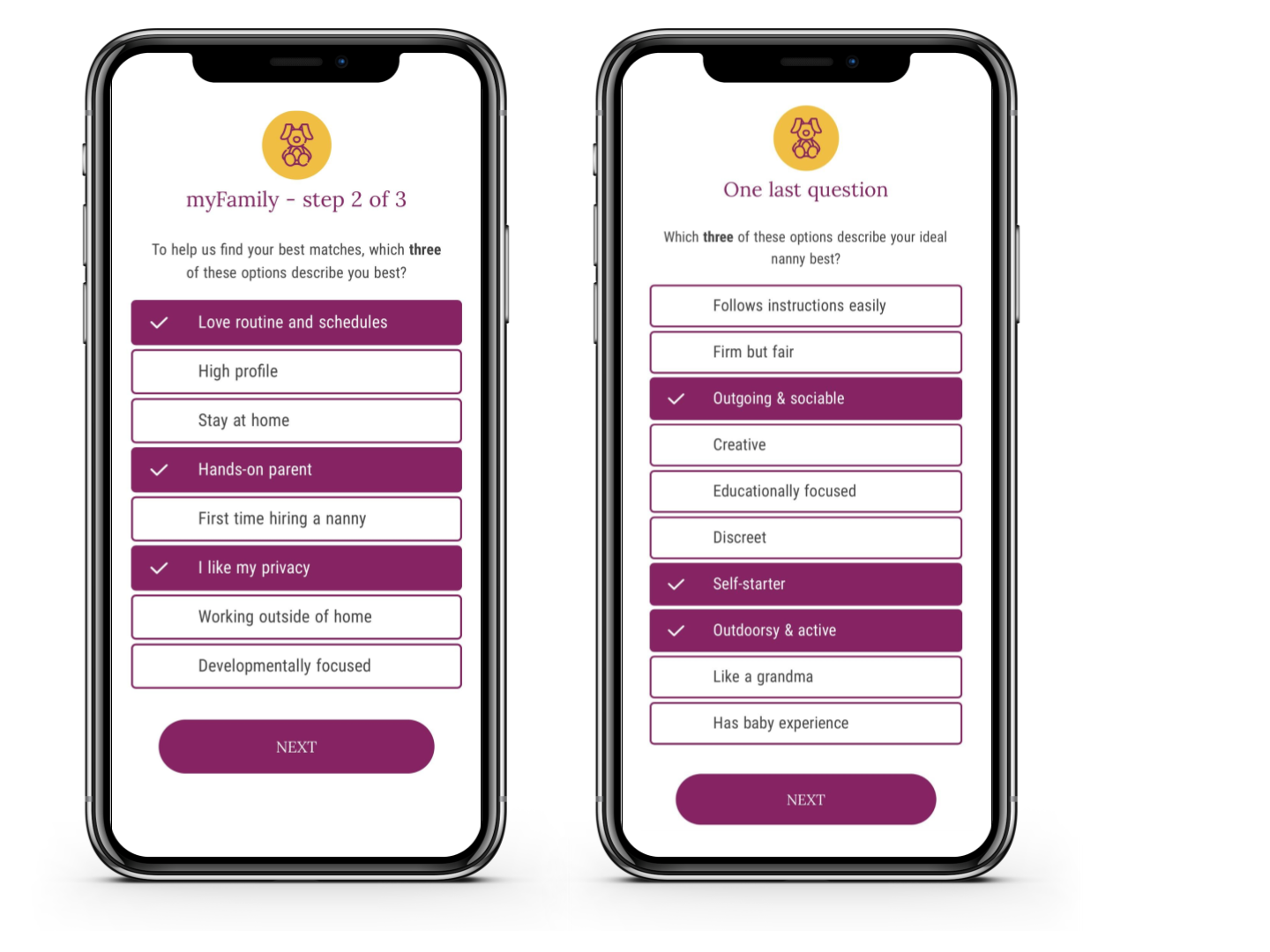

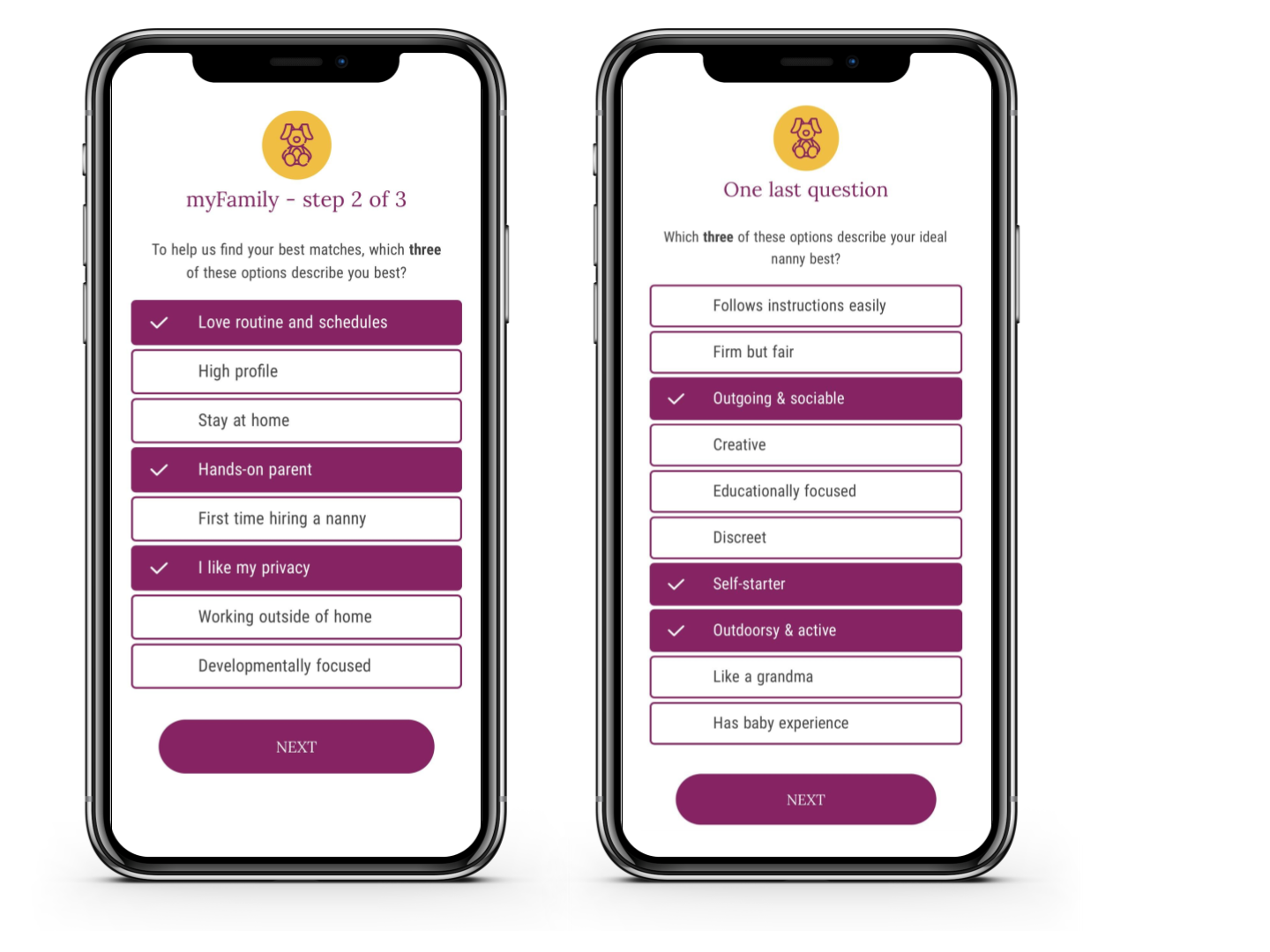

Why Is Finding A Good Nanny Harder Than Finding Your Romantic Partner

Why Is Finding A Good Nanny Harder Than Finding Your Romantic Partner

5 Essentials Of A Nanny Work Agreement Work Agreement Nanny Agreement