In a world where screens rule our lives yet the appeal of tangible printed objects isn't diminished. In the case of educational materials in creative or artistic projects, or simply to add an individual touch to your area, Business Travel Tax Return Australia are now an essential source. Through this post, we'll dive into the world "Business Travel Tax Return Australia," exploring the benefits of them, where to find them, and what they can do to improve different aspects of your life.

Get Latest Business Travel Tax Return Australia Below

Business Travel Tax Return Australia

Business Travel Tax Return Australia -

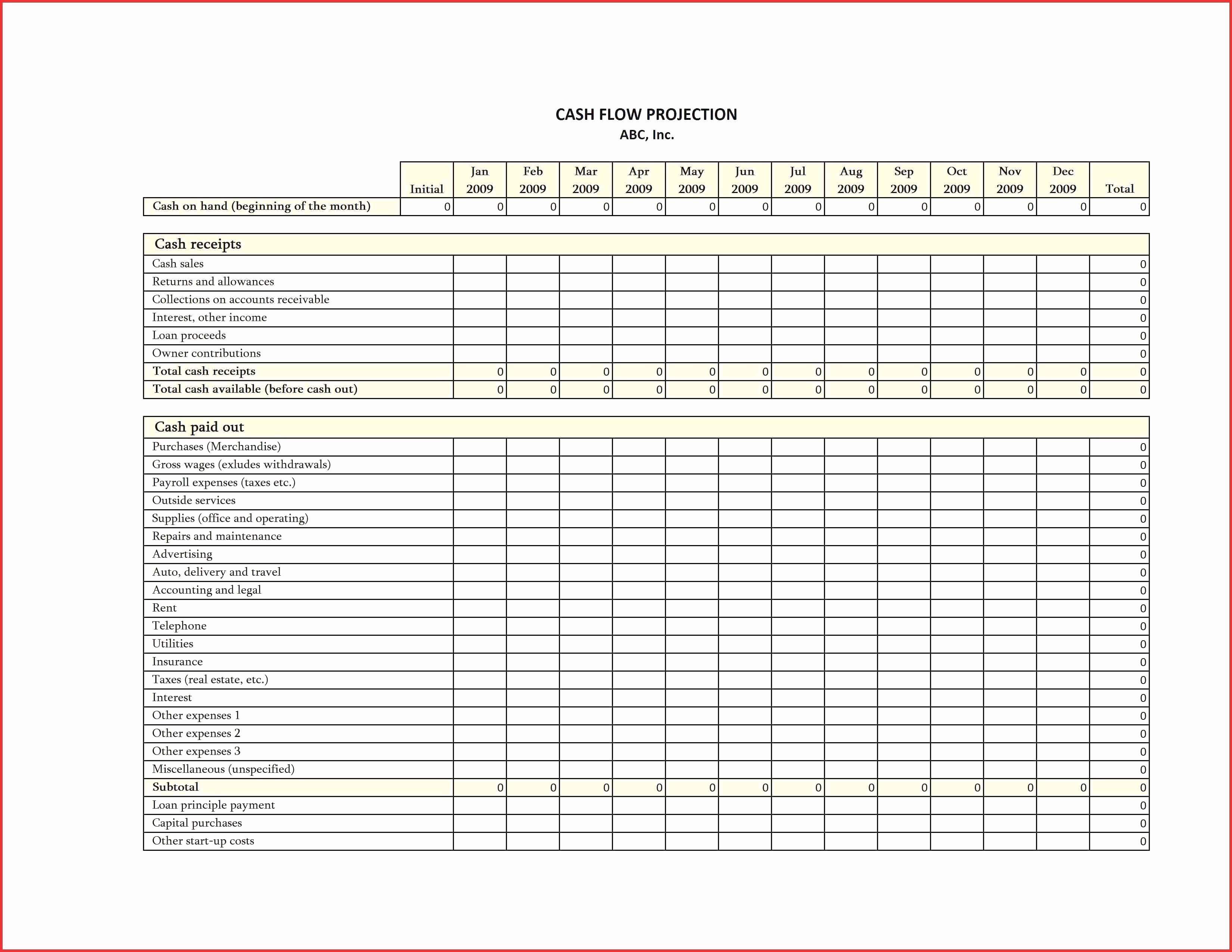

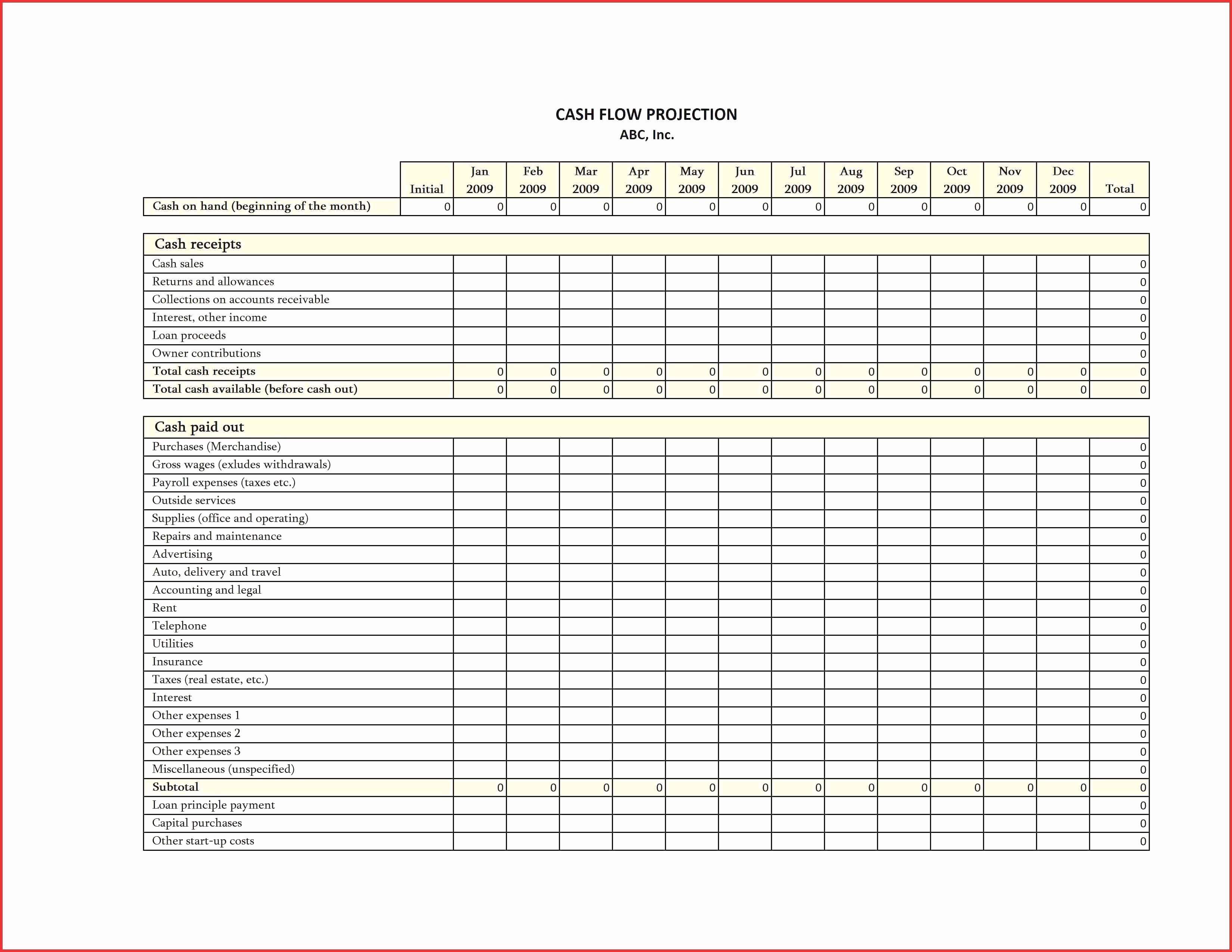

What work related travel expenses can I claim Transport expenses you incur while travelling between work locations are usually deductible The travel must occur while gaining or producing your assessable income

How to claim tax deductions for home based business expenses if you operate some or all of your business from home Deductions for travel expenses You can claim a tax deduction for expenses you incur travelling for your business

Printables for free include a vast array of printable items that are available online at no cost. These printables come in different designs, including worksheets templates, coloring pages, and many more. The great thing about Business Travel Tax Return Australia is their flexibility and accessibility.

More of Business Travel Tax Return Australia

Small Business Owner Travel And Entertainment Tax Deductions 2019

Small Business Owner Travel And Entertainment Tax Deductions 2019

So If the main purpose of your trip was for business or professional development then 100 of the airfare is tax deductible If however you spend additional time at your location that is not related to your business then you would need to

In brief On 17 February 2021 the Australian Taxation Office ATO released the following new guidance in relation to whether an employee is travelling on work or otherwise and the income tax and fringe benefits tax FBT treatment of associated travel expenses

Business Travel Tax Return Australia have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization They can make designs to suit your personal needs whether it's making invitations planning your schedule or even decorating your house.

-

Educational Value: Printables for education that are free are designed to appeal to students of all ages, which makes them a useful device for teachers and parents.

-

Easy to use: Instant access to the vast array of design and templates cuts down on time and efforts.

Where to Find more Business Travel Tax Return Australia

The Ultimate Guide To Business Travel Tax Deductions

The Ultimate Guide To Business Travel Tax Deductions

Taxation International tax Last Updated 18 January 2024 Understand your tax requirements if you re an Australian doing business overseas or a non resident doing business in Australia Find out about international taxes that could affect your business such as goods and services tax GST and Value Added Tax VAT

In this article we discuss the types of tax deductions you can declare when you fill out your tax return Cost of Meals Flights and Accommodation If you are travelling you may be able to deduct the costs of meals flights and accommodation if the following conditions apply

After we've peaked your interest in Business Travel Tax Return Australia we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in Business Travel Tax Return Australia for different needs.

- Explore categories like furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing Business Travel Tax Return Australia

Here are some innovative ways ensure you get the very most of Business Travel Tax Return Australia:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home and in class.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Business Travel Tax Return Australia are an abundance of fun and practical tools that cater to various needs and pursuits. Their accessibility and versatility make these printables a useful addition to each day life. Explore the many options of Business Travel Tax Return Australia and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes, they are! You can print and download these documents for free.

-

Does it allow me to use free printables in commercial projects?

- It's based on specific usage guidelines. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with Business Travel Tax Return Australia?

- Some printables may contain restrictions on use. Be sure to read the conditions and terms of use provided by the creator.

-

How can I print Business Travel Tax Return Australia?

- You can print them at home using an printer, or go to an area print shop for premium prints.

-

What program will I need to access Business Travel Tax Return Australia?

- The majority of printables are in PDF format. These can be opened using free software such as Adobe Reader.

Tax Tips For Your Tax Return As A Sole Trader In Australia

A Guide To Tax Time In Australia For International Students

Check more sample of Business Travel Tax Return Australia below

Business Travel Tax Deductions

/Tax-form-56a0d5af3df78cafdaa57849.jpg)

Kf On Twitter RT ankitkr0 TIL In Australia The Tax Return Document

PAY YOUR TRAVEL TAX ONLINE Tourism Infrastructure And Enterprise Zone

Tax Return In Australia How To Do It Step By Step Atlas Migration

How To Pay Your Travel Tax Online Lumina Homes

Publication Details

https://www.ato.gov.au/businesses-and...

How to claim tax deductions for home based business expenses if you operate some or all of your business from home Deductions for travel expenses You can claim a tax deduction for expenses you incur travelling for your business

https://www.ato.gov.au/individuals-and-families/...

You can claim a tax deduction for the cost of transport on trips to perform your work duties for example if you travel from your regular place of work to meet with a client attend work related conferences or meetings away from your regular place of work deliver items or collect supplies

How to claim tax deductions for home based business expenses if you operate some or all of your business from home Deductions for travel expenses You can claim a tax deduction for expenses you incur travelling for your business

You can claim a tax deduction for the cost of transport on trips to perform your work duties for example if you travel from your regular place of work to meet with a client attend work related conferences or meetings away from your regular place of work deliver items or collect supplies

Tax Return In Australia How To Do It Step By Step Atlas Migration

Kf On Twitter RT ankitkr0 TIL In Australia The Tax Return Document

How To Pay Your Travel Tax Online Lumina Homes

Publication Details

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Australia

Tax Expenses Template

Tax Expenses Template

How To Pay For Philippine Travel Tax Online AB And Me