In the digital age, with screens dominating our lives but the value of tangible printed materials hasn't faded away. Whether it's for educational purposes as well as creative projects or just adding an individual touch to your space, Arkansas Sales Tax Discount have become a valuable source. The following article is a take a dive through the vast world of "Arkansas Sales Tax Discount," exploring what they are, where to find them, and how they can enhance various aspects of your lives.

Get Latest Arkansas Sales Tax Discount Below

Arkansas Sales Tax Discount

Arkansas Sales Tax Discount -

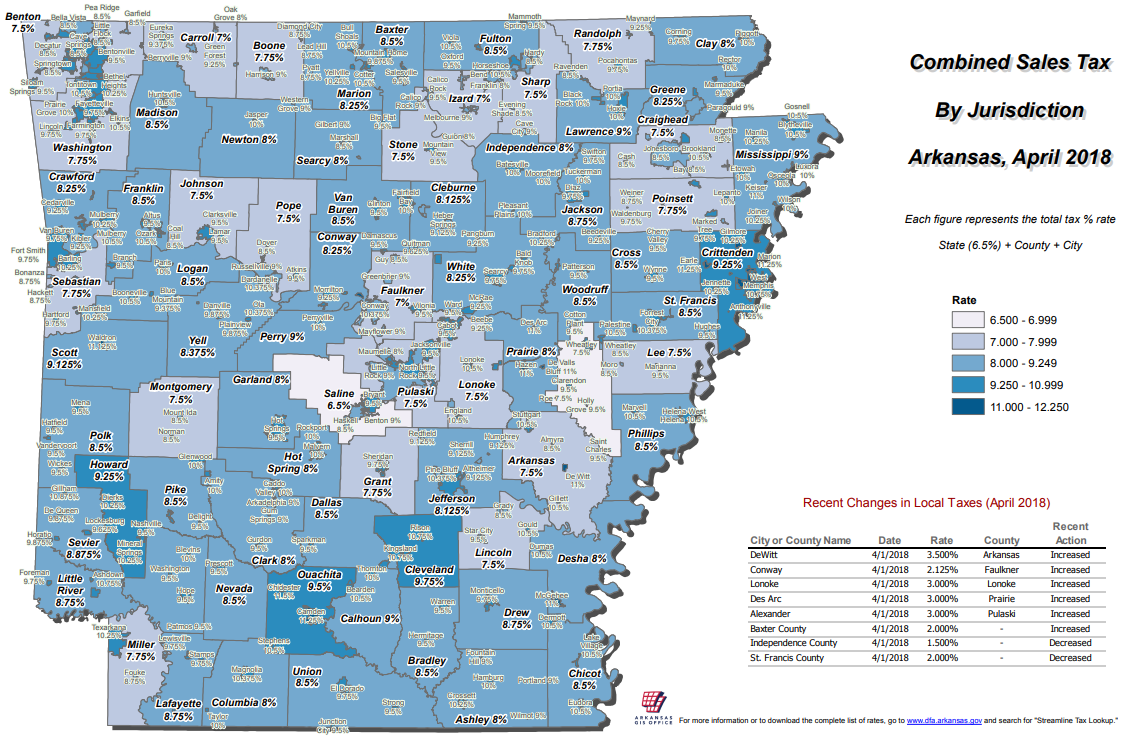

The state sales tax rate in Arkansas is 6 500 With local taxes the total sales tax rate is between 6 500 and 12 625 Arkansas has recent rate changes Thu Jul 01 2021 Select the Arkansas city from the list of popular

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 5 percent Currently combined sales tax rates in Arkansas range from 6 5 percent to 11 5 percent depending on the location of the sale

Arkansas Sales Tax Discount include a broad range of downloadable, printable documents that can be downloaded online at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and more. The beauty of Arkansas Sales Tax Discount is in their versatility and accessibility.

More of Arkansas Sales Tax Discount

Arkansas Sales Tax Sales Tax Arkansas AR Sales Tax Rate

Arkansas Sales Tax Sales Tax Arkansas AR Sales Tax Rate

Arkansas has a statewide sales tax rate of 6 5 which has been in place since 1935 Municipal governments in Arkansas are also allowed to collect a local option sales tax that ranges from 0 to 6 125 across the state with an average local tax of 2 648 for a total of 9 141 when combined with the state sales tax

1065 00 What is the sales tax rate in Arkansas How much is sales tax in Arkansas The base state sales tax rate in Arkansas is 6 5 Local tax rates in Arkansas range from 0 to 5 making the sales tax range in Arkansas 6 5 to 11 5 Find your Arkansas combined state and local tax rate

Arkansas Sales Tax Discount have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Individualization It is possible to tailor designs to suit your personal needs whether it's making invitations or arranging your schedule or decorating your home.

-

Educational Impact: Printables for education that are free provide for students of all ages, making them an essential instrument for parents and teachers.

-

It's easy: immediate access various designs and templates reduces time and effort.

Where to Find more Arkansas Sales Tax Discount

Missouri s Annual Sales Tax Holiday Pierce City Schools

Missouri s Annual Sales Tax Holiday Pierce City Schools

What is the Arkansas sales tax for 2022 Arkansas state sales tax is 6 5 percent Businesses also have to add taxes for their local jurisdictions at the city and county levels What is ATAP ATAP is the Arkansas Taxpayer Access Point You can register a new business and file and pay monthly sales tax reports for the sales of tangible

Sales Tax Fundamentals States Arkansas Sales Tax Guide for Businesses Statewide sales tax rate 6 5 Economic Sales Threshold 100 000 Transactions Threshold 200 Website Department of Finance and Administration Tax Line 501 682 7104 Arkansas Sales Tax Calculator Calculate

We hope we've stimulated your interest in printables for free Let's see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Arkansas Sales Tax Discount to suit a variety of goals.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing Arkansas Sales Tax Discount

Here are some ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Arkansas Sales Tax Discount are a treasure trove of fun and practical tools for a variety of needs and desires. Their accessibility and versatility make them a great addition to any professional or personal life. Explore the plethora of Arkansas Sales Tax Discount today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can download and print these tools for free.

-

Can I utilize free printables for commercial purposes?

- It is contingent on the specific conditions of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions in use. You should read the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in the local print shops for superior prints.

-

What software do I need in order to open printables that are free?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost programs like Adobe Reader.

2018 Arkansas Sales Tax Holiday KATV

Arkansas Sales And Use Tax Rates April 2018 Arkansas GIS Office

Check more sample of Arkansas Sales Tax Discount below

Arkansas Sales Tax Guide

Report Arkansas 6th In Nation For State Local Sales Tax Rates The

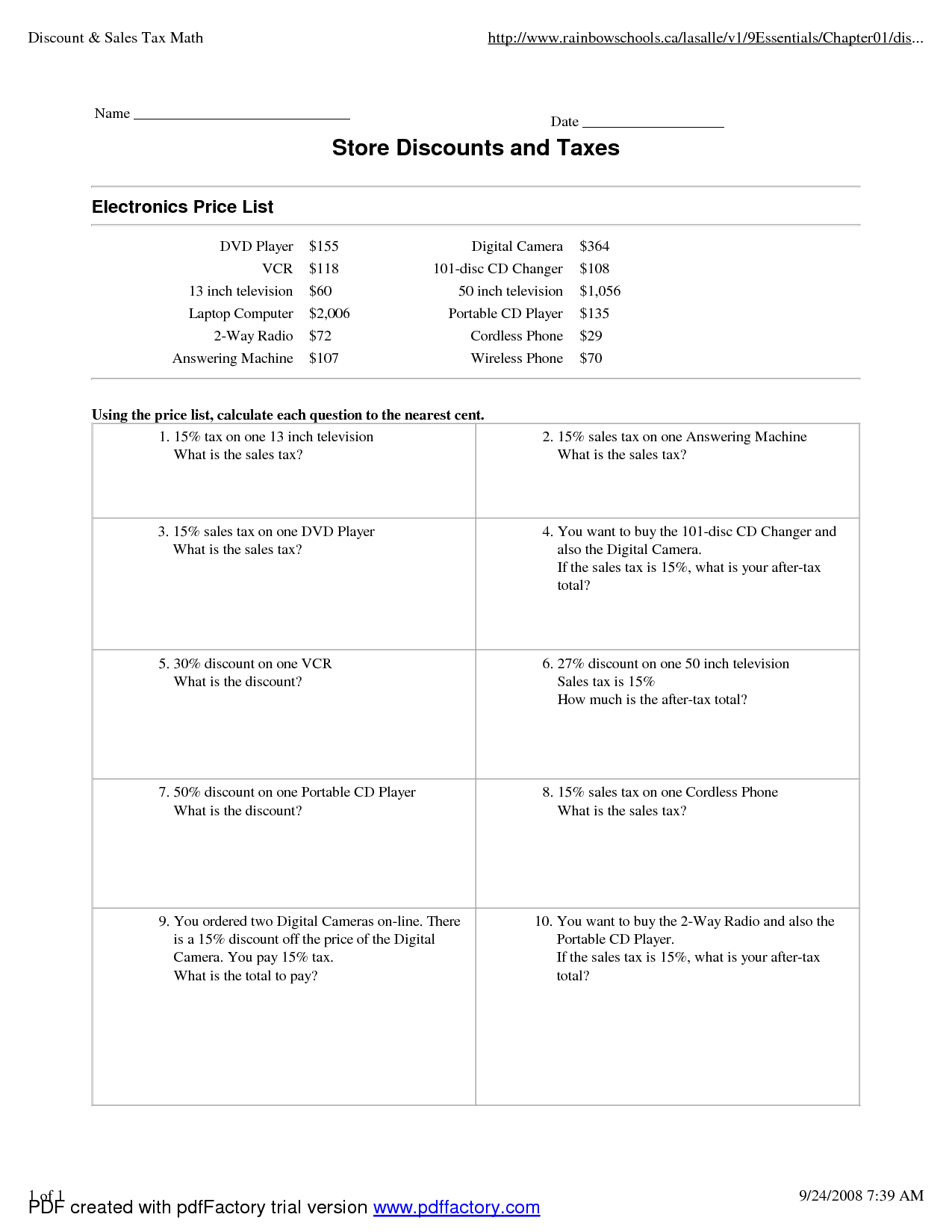

15 Tax Discount Percent Worksheets Worksheeto

Sales Tax Finevolution

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Arkansas Sales Tax Holiday Archives Tax Free Weekend 2021 Sales Tax

https://www.avalara.com/taxrates/en/state-rates/...

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 5 percent Currently combined sales tax rates in Arkansas range from 6 5 percent to 11 5 percent depending on the location of the sale

https://www.dfa.arkansas.gov/excise-tax/sales-and...

If you legally paid sales tax on the items in the other state you may be entitled to a reduction in tax for the tax paid to the other state against the tax due Arkansas If you pay less than the Arkansas tax rate to the other state you must pay Arkansas the difference excludes motor vehicles

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 5 percent Currently combined sales tax rates in Arkansas range from 6 5 percent to 11 5 percent depending on the location of the sale

If you legally paid sales tax on the items in the other state you may be entitled to a reduction in tax for the tax paid to the other state against the tax due Arkansas If you pay less than the Arkansas tax rate to the other state you must pay Arkansas the difference excludes motor vehicles

Sales Tax Finevolution

Report Arkansas 6th In Nation For State Local Sales Tax Rates The

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Arkansas Sales Tax Holiday Archives Tax Free Weekend 2021 Sales Tax

Sales Tax Holiday Arkansas House Of Representatives

15 Tax Discount Percent Worksheets Worksheeto

15 Tax Discount Percent Worksheets Worksheeto

Resale Certificate Nc Ten Quick Tips Regarding Resale