Today, in which screens are the norm The appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add an individual touch to the home, printables for free can be an excellent source. We'll dive into the sphere of "Are Vendor Rebates Taxable," exploring their purpose, where they are available, and how they can enrich various aspects of your daily life.

Get Latest Are Vendor Rebates Taxable Below

Are Vendor Rebates Taxable

Are Vendor Rebates Taxable -

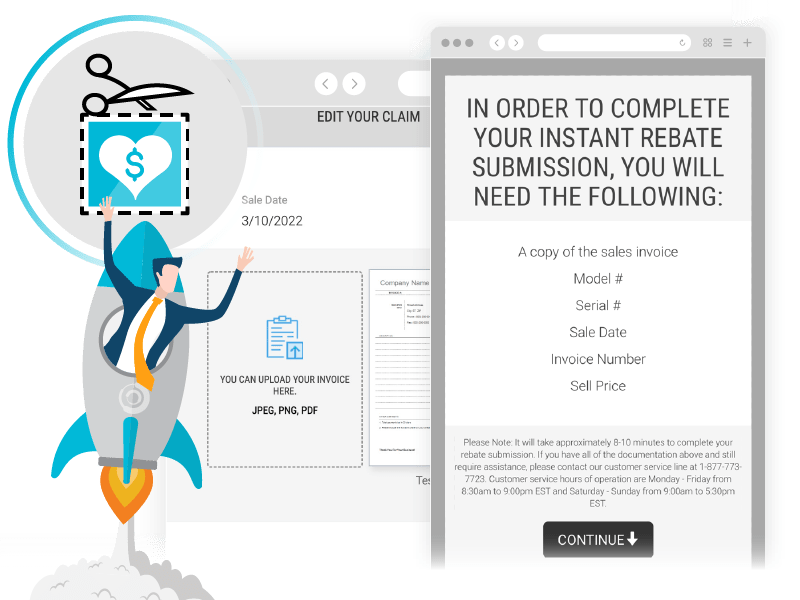

Rebates When products are sold with a rebate and the rebate is paid directly to the customer by the manufacturer the sales tax base is normally the full sales price of the product Because the product is sold for the full retail price the retailer is compensated fully by the customer and the sales tax applies to the amount received

Rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

The Are Vendor Rebates Taxable are a huge collection of printable materials that are accessible online for free cost. They are available in numerous designs, including worksheets templates, coloring pages and many more. One of the advantages of Are Vendor Rebates Taxable is their flexibility and accessibility.

More of Are Vendor Rebates Taxable

Tax Reductions Rebates And Credits

Tax Reductions Rebates And Credits

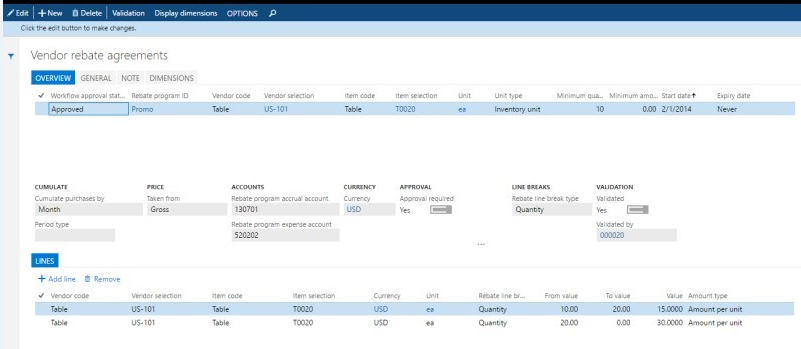

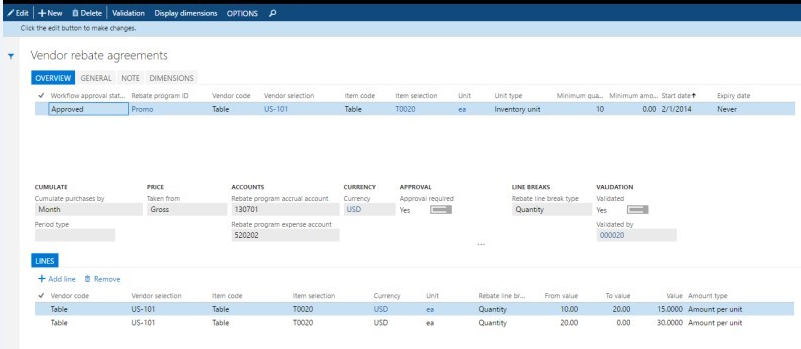

What are Supplier and Vendor Rebates 3 How to Account for Vendor Rebates 4 How to Account for Customer Rebates 5 What is Vendor Rebates Accounting Treatment 6 What are Unclaimed Rebates 7 How to Account for Coupons 8 How to Pay Rebates to Vendors 9 What are Accounting Challenges of Vendor Rebates 10

Many companies offer cash back rewards for purchasing their product but is this reward considered taxable income Watch this video to learn more about cash back rewards and taxable income Don t miss your chance to save up to 40

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor the design to meet your needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Printables for education that are free can be used by students of all ages, making the perfect resource for educators and parents.

-

An easy way to access HTML0: instant access various designs and templates saves time and effort.

Where to Find more Are Vendor Rebates Taxable

Rebates For Seniors Mark Coure MP

Rebates For Seniors Mark Coure MP

The taxation of frequent flyer miles and other points taxpayers receive from rewards programs is a vexing problem involving questions of timing amount and reporting of income When a customer is awarded points that can be redeemed for merchandise is the award itself a taxable event Or must the points be redeemed first

Based on the forgoing the IRS was faced with the following question Does the liability to provide rebates become fixed and determinable when 1 customers purchase the goods from Taxpayer 2 customers purchase the minimum amount of the goods necessary to earn a rebate or 3 customers submit the required claim forms for the

In the event that we've stirred your interest in Are Vendor Rebates Taxable, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of applications.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs covered cover a wide range of topics, everything from DIY projects to planning a party.

Maximizing Are Vendor Rebates Taxable

Here are some unique ways how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are Vendor Rebates Taxable are a treasure trove of fun and practical tools for a variety of needs and preferences. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the vast world of Are Vendor Rebates Taxable and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can download and print these items for free.

-

Do I have the right to use free printables for commercial purposes?

- It depends on the specific rules of usage. Always review the terms of use for the creator before using their printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables could be restricted on usage. You should read the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home using an printer, or go to a local print shop for superior prints.

-

What software is required to open printables for free?

- A majority of printed materials are in PDF format. They is open with no cost software like Adobe Reader.

Are ACA Rebates Taxable HealthPlanRate Healthplanrate

Mendota Reporter Income Property Tax Rebates Begin In Illinois

Check more sample of Are Vendor Rebates Taxable below

Accounting For Vendor Rebates Procedures Challenges

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc

Taxable Payments Annual Report Bosco Chartered Accountants

B2B Vendor Rebates Software 360insights

Are Cash For Clunkers Rebates Taxable The Truth About Cars

Tax Rebates Services

https://donotpay.com/learn/are-rebates-taxable

Rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

https://www.vendavo.com/glossary/what-are-vendor-rebates

To recap manufacturer and vendor rebates are not taxable However rebates issued by a person other than the vendor or nonseller may not be excluded from gross income The taxability of rebates often depends on the specific circumstances of the rebate and the nature of the transaction

Rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

To recap manufacturer and vendor rebates are not taxable However rebates issued by a person other than the vendor or nonseller may not be excluded from gross income The taxability of rebates often depends on the specific circumstances of the rebate and the nature of the transaction

B2B Vendor Rebates Software 360insights

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc

Are Cash For Clunkers Rebates Taxable The Truth About Cars

Tax Rebates Services

Are State Tax Refunds And Rebates Federally Taxable It Depends Https

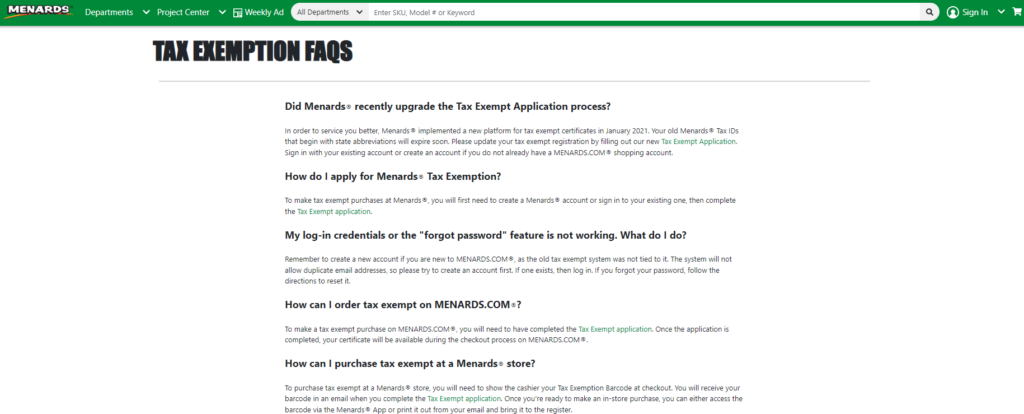

Are Menards Rebates Taxable Menards Rebate Form 2023

Are Menards Rebates Taxable Menards Rebate Form 2023

Taxable Vs Non taxable Benefits What You Should Know About Them Talk