In this age of electronic devices, where screens dominate our lives but the value of tangible printed materials hasn't faded away. For educational purposes for creative projects, just adding personal touches to your space, Are Simple Ira Contributions Subject To Fica can be an excellent source. For this piece, we'll take a dive into the world "Are Simple Ira Contributions Subject To Fica," exploring their purpose, where they are available, and how they can enhance various aspects of your daily life.

Get Latest Are Simple Ira Contributions Subject To Fica Below

Are Simple Ira Contributions Subject To Fica

Are Simple Ira Contributions Subject To Fica -

For employees the biggest differences between a SIMPLE IRA vs 401 k are contribution limits In 2023 total contributions employer and employee to a 401 k

In 2024 the contributions to SIMPLE IRAs will continue to be subject to FICA taxes This means that while these contributions can reduce your income tax burden they do not

Printables for free include a vast collection of printable materials available online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages and much more. The value of Are Simple Ira Contributions Subject To Fica is in their versatility and accessibility.

More of Are Simple Ira Contributions Subject To Fica

SIMPLE IRA Contribution Limits

SIMPLE IRA Contribution Limits

They are however still subject to FICA and unemployment taxes Employee SIMPLE IRA contributions do not preclude contributions to other employer sponsored retirement plans an employee may have

Simplified employee pension SEP individual retirement accounts IRAs are tax deferred retirement savings plans designed to allow business owners a more straightforward method of contributing

Are Simple Ira Contributions Subject To Fica have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

customization: You can tailor printables to fit your particular needs in designing invitations making your schedule, or even decorating your home.

-

Educational Impact: Printables for education that are free are designed to appeal to students of all ages, making them a useful source for educators and parents.

-

Convenience: The instant accessibility to the vast array of design and templates cuts down on time and efforts.

Where to Find more Are Simple Ira Contributions Subject To Fica

SIMPLE IRA Contribution Limits 2023 How To Maximize Them

SIMPLE IRA Contribution Limits 2023 How To Maximize Them

SIMPLE IRA contributions are not subject to federal income tax withholding However the salary reduction contributions are subject to Social Security

How does a SIMPLE IRA work SIMPLE IRAs offer employees the tax benefits of a 401 K with the convenience of a personal IRA Each year employees can choose how much of

We've now piqued your curiosity about Are Simple Ira Contributions Subject To Fica We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of needs.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast range of topics, all the way from DIY projects to planning a party.

Maximizing Are Simple Ira Contributions Subject To Fica

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Are Simple Ira Contributions Subject To Fica are an abundance of useful and creative resources designed to meet a range of needs and interests. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast array of Are Simple Ira Contributions Subject To Fica now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can print and download these resources at no cost.

-

Do I have the right to use free printouts for commercial usage?

- It's determined by the specific terms of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables might have limitations in use. Be sure to review the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- Print them at home using either a printer or go to the local print shops for top quality prints.

-

What program do I need to open Are Simple Ira Contributions Subject To Fica?

- Most printables come in PDF format, which can be opened with free software, such as Adobe Reader.

IRA Contribution Limits In 2023 Meld Financial

When Are SIMPLE IRA Contributions Due

:max_bytes(150000):strip_icc()/simple_ira_-5bfc2f0c46e0fb00511a52d9.jpg)

Check more sample of Are Simple Ira Contributions Subject To Fica below

IRA Contributions Explained Everything You Need To Know YouTube

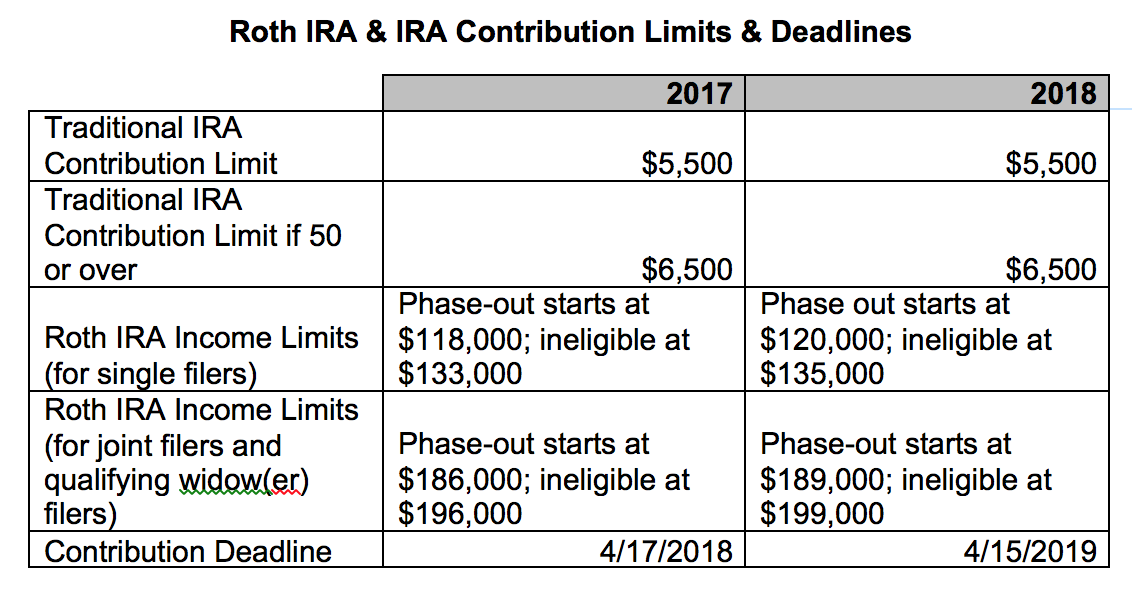

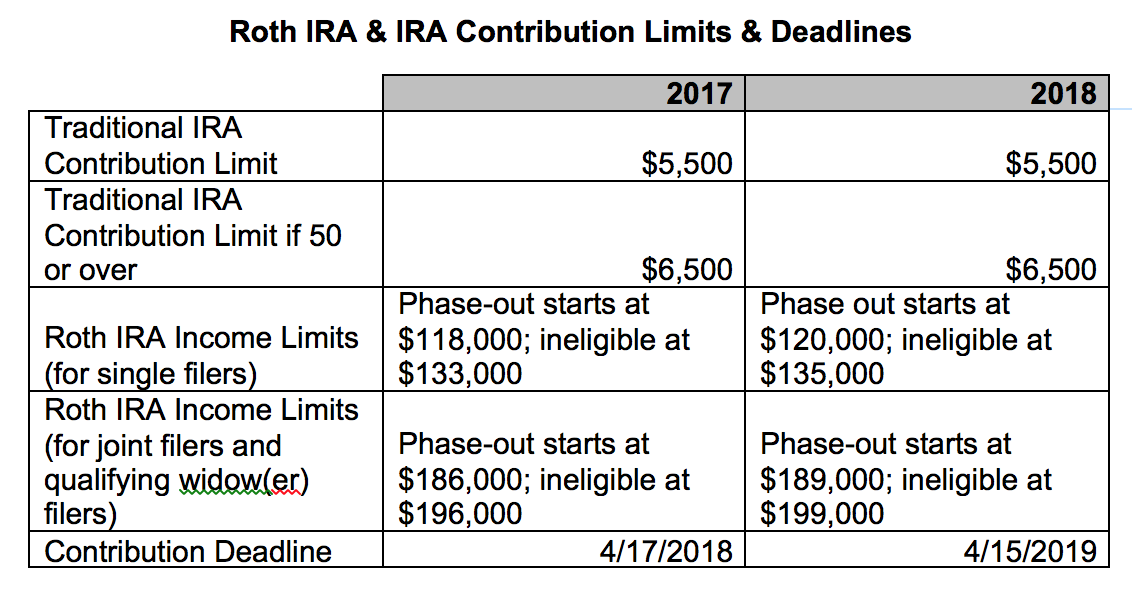

Reminder IRA Contribution Deadlines Financial Plans Strategies Inc

What Is FICA

/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

SIMPLE IRA St Louis SIMPLE IRA Business Plans

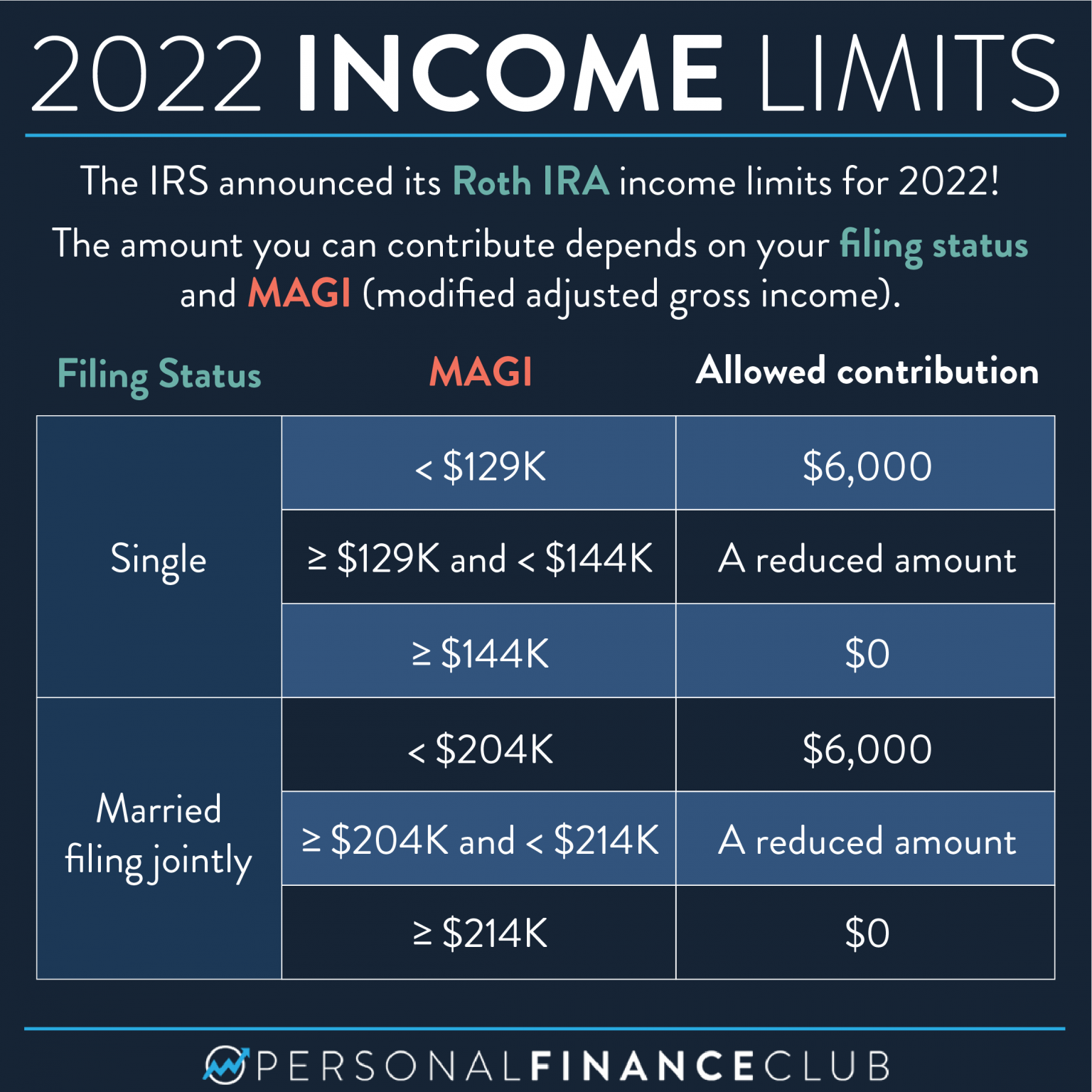

TRADITIONAL IRA VS ROTH IRA

The Perfect Time To Contribute To Your IRA Might Be TODAY Quest IRA

https://www.creative-advising.com/are...

In 2024 the contributions to SIMPLE IRAs will continue to be subject to FICA taxes This means that while these contributions can reduce your income tax burden they do not

https://www.investopedia.com/articles/…

While salary deferral contributions to a SIMPLE IRA are not subject to income tax withholding they are subject to tax under the Social Security Medicare and the Federal Unemployment

In 2024 the contributions to SIMPLE IRAs will continue to be subject to FICA taxes This means that while these contributions can reduce your income tax burden they do not

While salary deferral contributions to a SIMPLE IRA are not subject to income tax withholding they are subject to tax under the Social Security Medicare and the Federal Unemployment

SIMPLE IRA St Louis SIMPLE IRA Business Plans

Reminder IRA Contribution Deadlines Financial Plans Strategies Inc

TRADITIONAL IRA VS ROTH IRA

The Perfect Time To Contribute To Your IRA Might Be TODAY Quest IRA

RE403 IRA Account Fundamentals

2015 SIMPLE IRA Contribution Limits The Motley Fool

2015 SIMPLE IRA Contribution Limits The Motley Fool

2019 IRA Contribution Limits Unchanged For 2020 401k And HSA Caps Rise