In this age of technology, where screens rule our lives, the charm of tangible printed materials hasn't faded away. For educational purposes project ideas, artistic or just adding some personal flair to your space, Are Roth Iras Taxed On Earnings are now an essential source. In this article, we'll take a dive into the sphere of "Are Roth Iras Taxed On Earnings," exploring what they are, where to find them and how they can be used to enhance different aspects of your life.

Get Latest Are Roth Iras Taxed On Earnings Below

Are Roth Iras Taxed On Earnings

Are Roth Iras Taxed On Earnings -

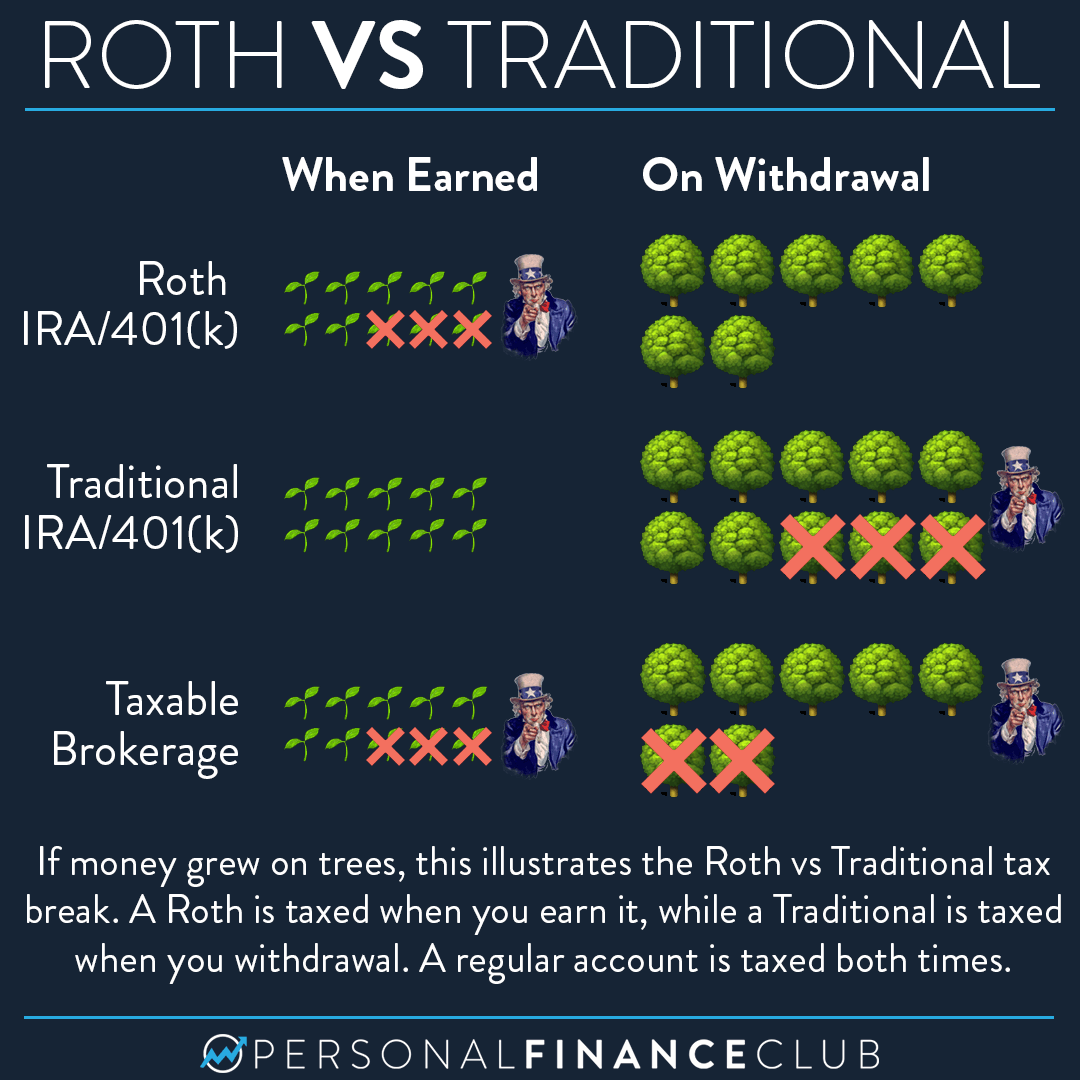

Sep 12 2022 in a nutshell You get the tax break on the back end of the investment when you withdraw from the Roth IRA Since you pay taxes upfront on the money you put into a Roth IRA all the returns your investment earns over the years are tax free

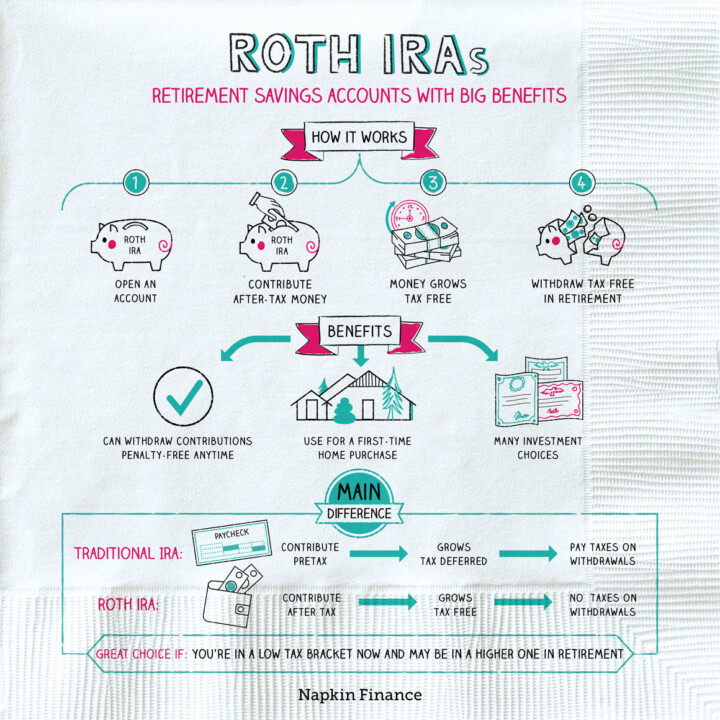

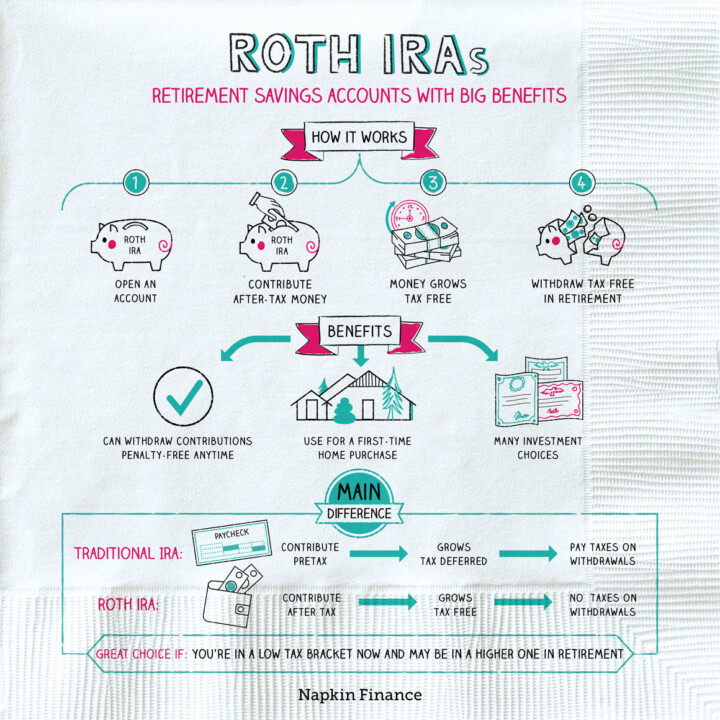

Roth IRAs offer tax free growth on both the contributions and the earnings that accrue over the years If you play by the rules you won t pay taxes when you take the money out Here is some of

The Are Roth Iras Taxed On Earnings are a huge range of printable, free material that is available online at no cost. These printables come in different forms, including worksheets, coloring pages, templates and many more. The attraction of printables that are free is their versatility and accessibility.

More of Are Roth Iras Taxed On Earnings

Qualified Vs Non Qualified Roth IRA Distributions

Qualified Vs Non Qualified Roth IRA Distributions

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA You cannot deduct contributions to a Roth IRA If you satisfy the requirements qualified distributions are tax free You can make contributions to your Roth IRA after you reach age 70

For Roth IRAs you can pay taxes on contributions upfront and benefit from tax free growth and withdrawals during your retirement Here s a table with a fuller tax breakdown for each account Bottom Line

Are Roth Iras Taxed On Earnings have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

customization We can customize the design to meet your needs for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Educational Value Downloads of educational content for free are designed to appeal to students of all ages. This makes them a useful tool for parents and teachers.

-

It's easy: You have instant access a plethora of designs and templates will save you time and effort.

Where to Find more Are Roth Iras Taxed On Earnings

A Roth IRA s Many Benefits Kendall Capital

A Roth IRA s Many Benefits Kendall Capital

In general you can withdraw Roth IRA contributions any time without tax or penalty 1 But to withdraw any earnings tax free you must be 59 or older and have had your account for at least five years If you withdraw them before this time you may owe a 10 penalty and ordinary income tax on the earnings

A Roth IRA allows you to pay the taxes on your retirement savings while you are still working but there are rules regarding contributions and eligibility for tax free withdrawals in

Now that we've ignited your interest in Are Roth Iras Taxed On Earnings Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Are Roth Iras Taxed On Earnings for different needs.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a broad variety of topics, everything from DIY projects to planning a party.

Maximizing Are Roth Iras Taxed On Earnings

Here are some innovative ways ensure you get the very most of Are Roth Iras Taxed On Earnings:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Roth Iras Taxed On Earnings are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and preferences. Their availability and versatility make they a beneficial addition to any professional or personal life. Explore the wide world of Are Roth Iras Taxed On Earnings right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Roth Iras Taxed On Earnings really for free?

- Yes they are! You can download and print these resources at no cost.

-

Can I utilize free printables in commercial projects?

- It's all dependent on the terms of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables might have limitations concerning their use. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using an printer, or go to a print shop in your area for higher quality prints.

-

What program must I use to open Are Roth Iras Taxed On Earnings?

- The majority are printed in the format PDF. This is open with no cost software, such as Adobe Reader.

Roth Vs Traditional How Do The Taxes Work Personal Finance Club

Roth IRAs Are Ultra flexible Here s Why That s A Bad Thing

Check more sample of Are Roth Iras Taxed On Earnings below

What Is A 401k Vs Roth Ira 401kInfoClub

Roth IRAs Benefits Napkin Finance

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

Roth IRA Withdrawal Rules Oblivious Investor

https://www. investopedia.com /how-roth-ira-taxes-work-4769988

Roth IRAs offer tax free growth on both the contributions and the earnings that accrue over the years If you play by the rules you won t pay taxes when you take the money out Here is some of

https://www. investopedia.com /ask/answers/05/iraearningsmagi.asp

The easy answer is that earnings from a Roth IRA do not count toward income If you keep the earnings within the account they definitely are not taxable And if you withdraw them

Roth IRAs offer tax free growth on both the contributions and the earnings that accrue over the years If you play by the rules you won t pay taxes when you take the money out Here is some of

The easy answer is that earnings from a Roth IRA do not count toward income If you keep the earnings within the account they definitely are not taxable And if you withdraw them

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Roth IRAs Benefits Napkin Finance

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

Roth IRA Withdrawal Rules Oblivious Investor

What Is A Roth IRA Here s What You Need To Know For 2022 Personal

Traditional IRAs And Roth IRAs Taxed Right

Traditional IRAs And Roth IRAs Taxed Right

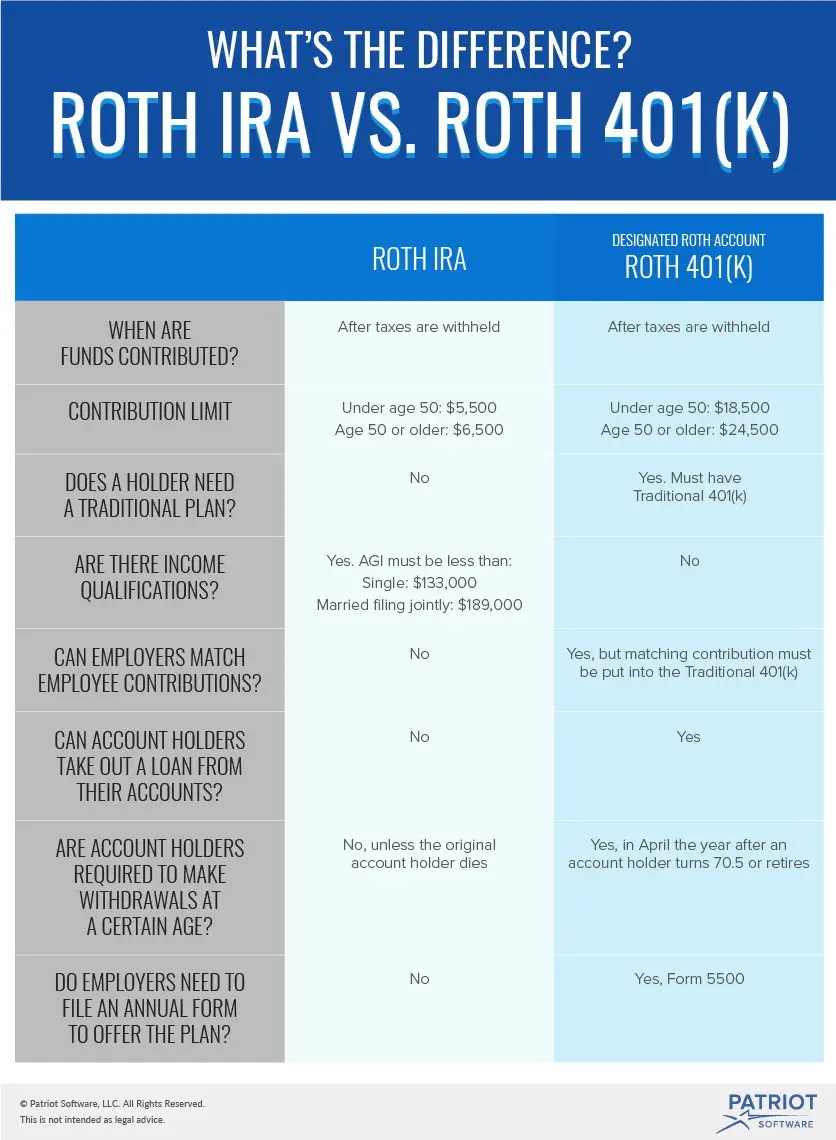

Roth 401 k Vs Roth IRA Which Is Best For You The Motley Fool