Today, with screens dominating our lives, the charm of tangible printed objects hasn't waned. For educational purposes as well as creative projects or just adding an individual touch to your home, printables for free are now a vital resource. This article will dive into the world of "Are Roth Ira Distributions Subject To State Taxes," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest Are Roth Ira Distributions Subject To State Taxes Below

Are Roth Ira Distributions Subject To State Taxes

Are Roth Ira Distributions Subject To State Taxes -

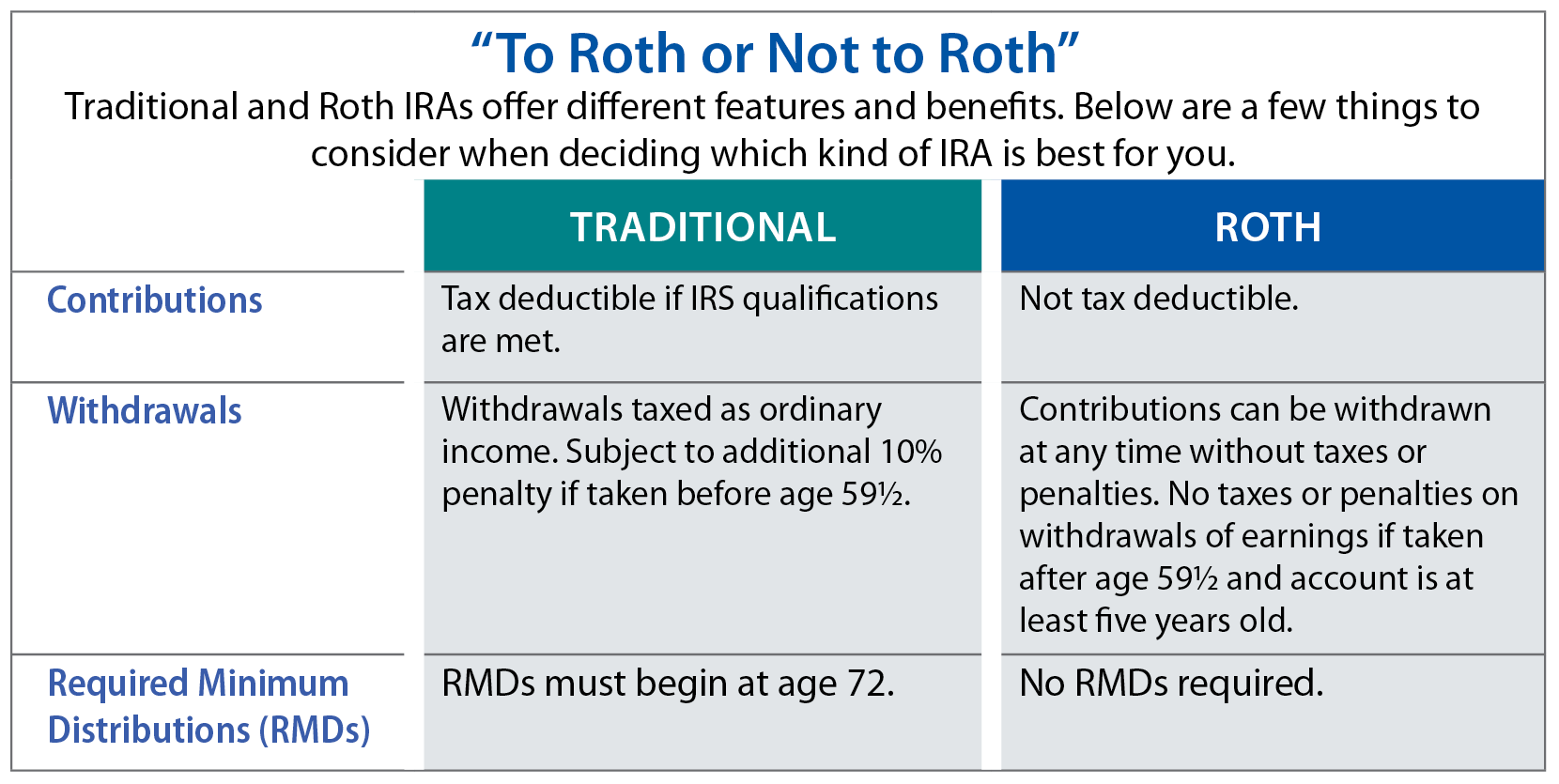

Pension income and IRA distributions may also be exempt or partially exempt for taxpayers meeting income requirements Income Tax on Taxable Income Low of 2 on up to 10 000 for single

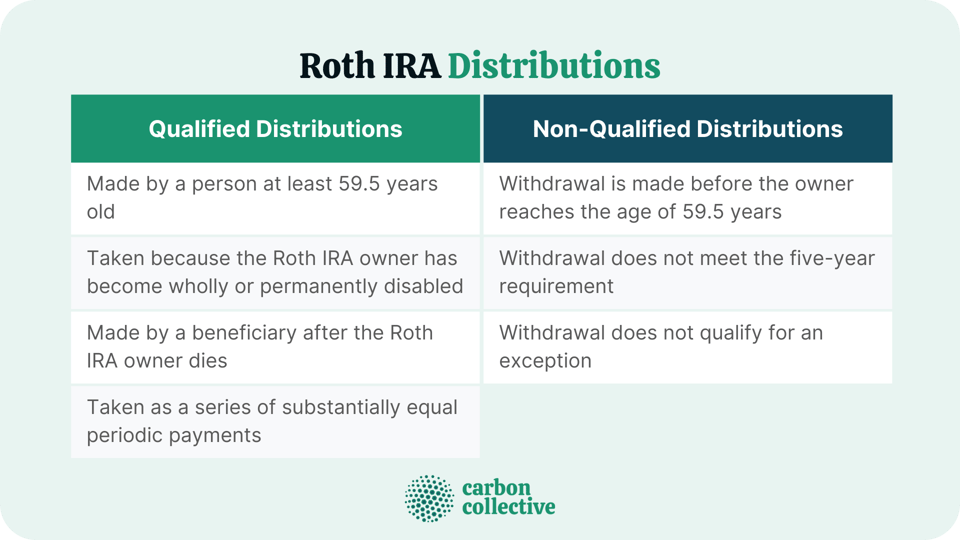

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However distributions on

Are Roth Ira Distributions Subject To State Taxes offer a wide range of downloadable, printable content that can be downloaded from the internet at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and much more. The attraction of printables that are free is in their variety and accessibility.

More of Are Roth Ira Distributions Subject To State Taxes

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

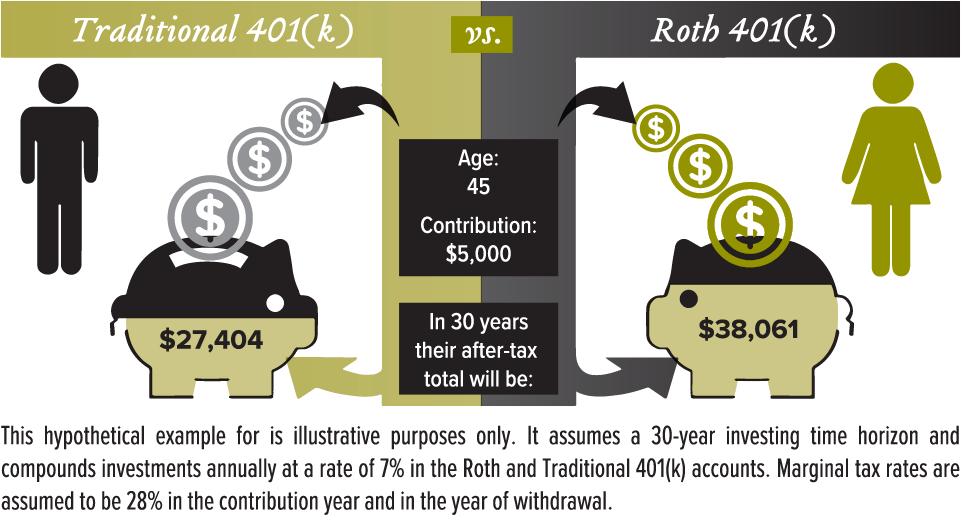

In 2023 that was 1 312 per citizen The federal government considers distributions from pensions 401 k s and traditional individual retirement accounts IRAs as income the same as it does the income you get

If you take a distribution of Roth IRA earnings before you reach age 59 and before the account is five years old the earnings may be subject to taxes and a 10 federal tax penalty A rollover of retirement plan assets

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Modifications: They can make the design to meet your needs whether it's making invitations planning your schedule or even decorating your house.

-

Educational Use: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes them an invaluable device for teachers and parents.

-

The convenience of Fast access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Are Roth Ira Distributions Subject To State Taxes

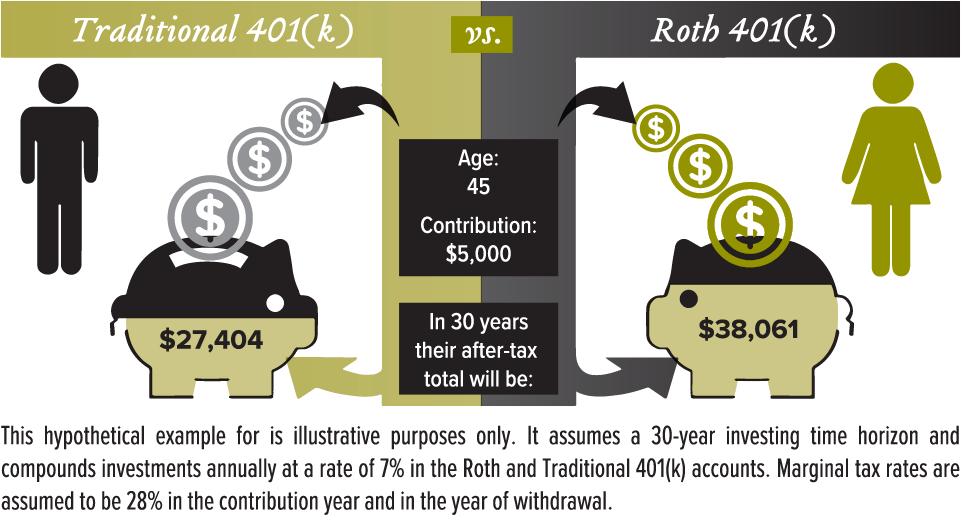

Are Roth Contributions Right For Me

Are Roth Contributions Right For Me

This interview will help you determine if your distribution from a Roth IRA or designated Roth account is taxable This topic doesn t address either the return of a Roth IRA

When you withdraw money from your IRA or employer sponsored retirement plan your state may require you to have income tax withheld from your distribution Your

After we've peaked your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Are Roth Ira Distributions Subject To State Taxes for various applications.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Are Roth Ira Distributions Subject To State Taxes

Here are some inventive ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are Roth Ira Distributions Subject To State Taxes are an abundance of innovative and useful resources that meet a variety of needs and interest. Their availability and versatility make them a great addition to each day life. Explore the vast collection that is Are Roth Ira Distributions Subject To State Taxes today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I make use of free printables for commercial uses?

- It's dependent on the particular terms of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues in Are Roth Ira Distributions Subject To State Taxes?

- Certain printables might have limitations on their use. Make sure you read these terms and conditions as set out by the author.

-

How do I print printables for free?

- Print them at home with a printer or visit any local print store for top quality prints.

-

What software is required to open printables at no cost?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software, such as Adobe Reader.

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

Qualified Vs Non Qualified Roth IRA Distributions

Check more sample of Are Roth Ira Distributions Subject To State Taxes below

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

When Can I Withdraw From Roth IRA Retirement News Daily

Roth IRA Withdrawal Rules Oblivious Investor

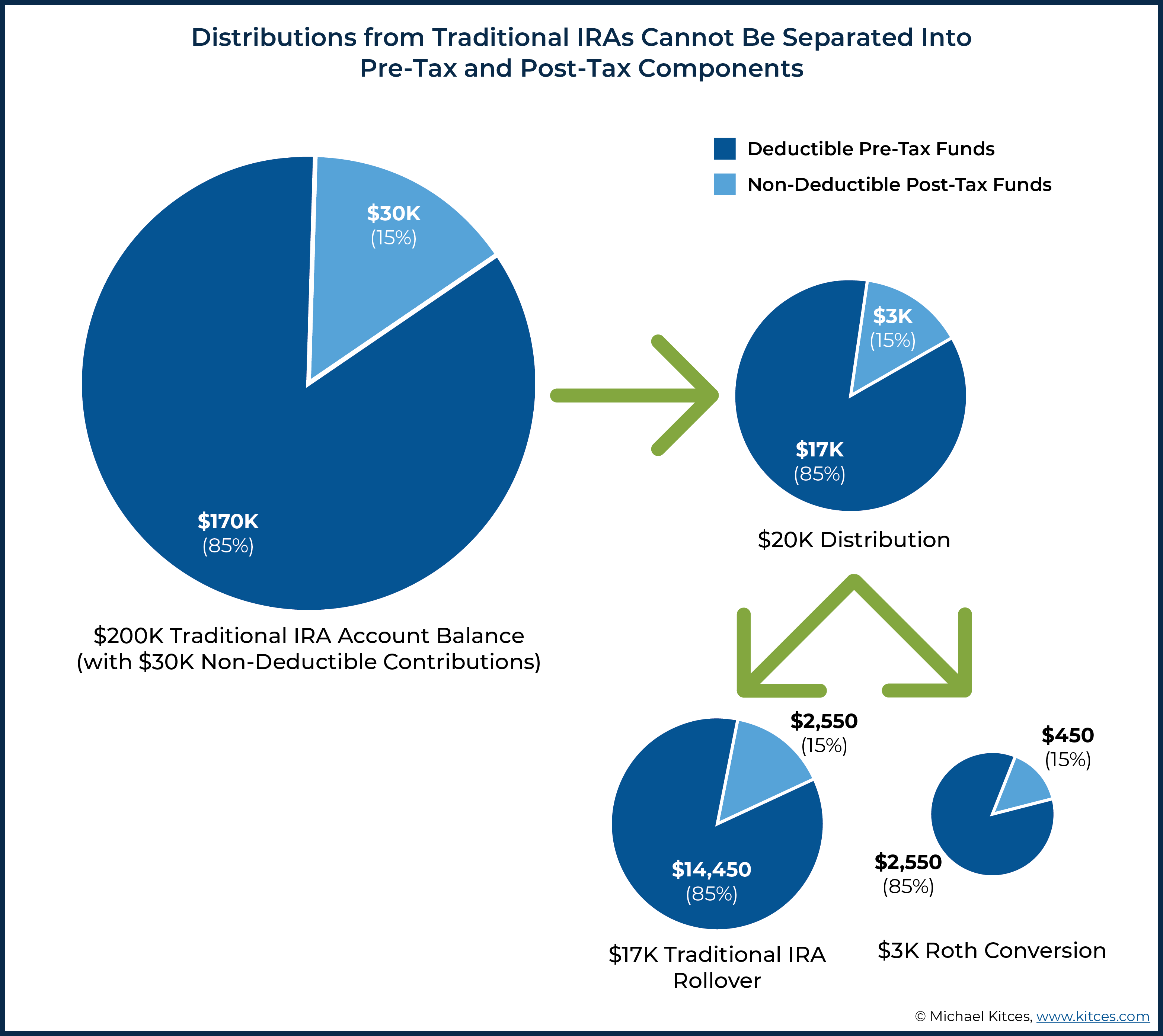

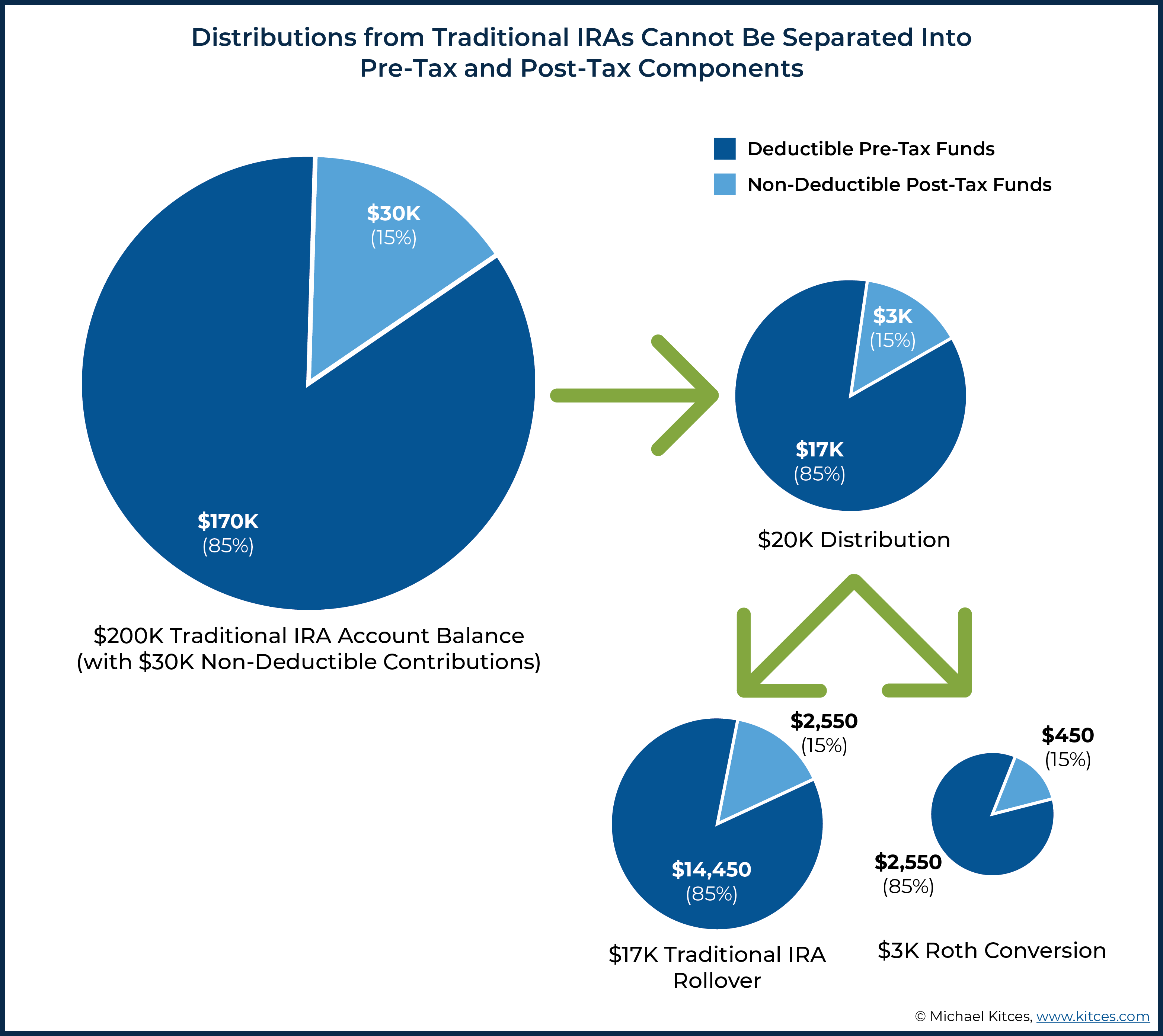

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Roth IRA Strategies For Physicians WealthKeel

Understanding Non Qualified Roth IRA Distributions

/shutterstock_240823573.Roth.IRA.cropped-fd86349be2cd4f42a0ea35dd6956813d.jpg)

https://www.investopedia.com › retiremen…

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However distributions on

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png?w=186)

https://www.investopedia.com

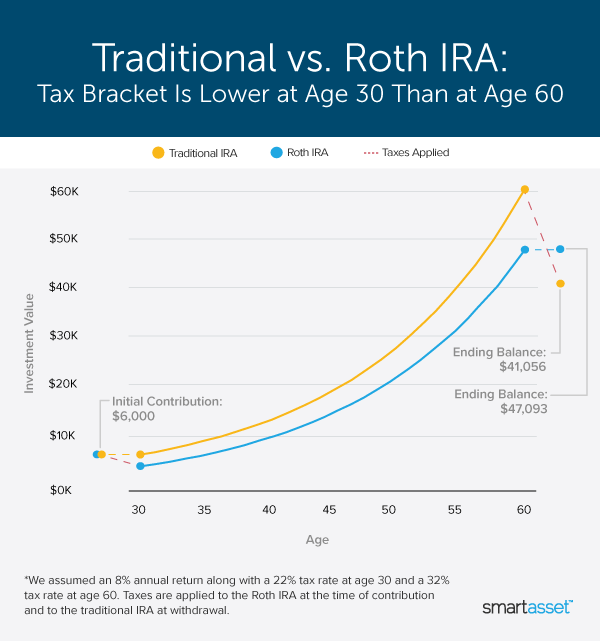

While there s no deduction for Roth IRA contributions qualified distributions from a Roth account are tax free Savers can also withdraw their original contributions

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However distributions on

While there s no deduction for Roth IRA contributions qualified distributions from a Roth account are tax free Savers can also withdraw their original contributions

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

When Can I Withdraw From Roth IRA Retirement News Daily

Roth IRA Strategies For Physicians WealthKeel

/shutterstock_240823573.Roth.IRA.cropped-fd86349be2cd4f42a0ea35dd6956813d.jpg)

Understanding Non Qualified Roth IRA Distributions

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Roth Ira Growth Calculator GarveenIndia

Roth Ira Growth Calculator GarveenIndia

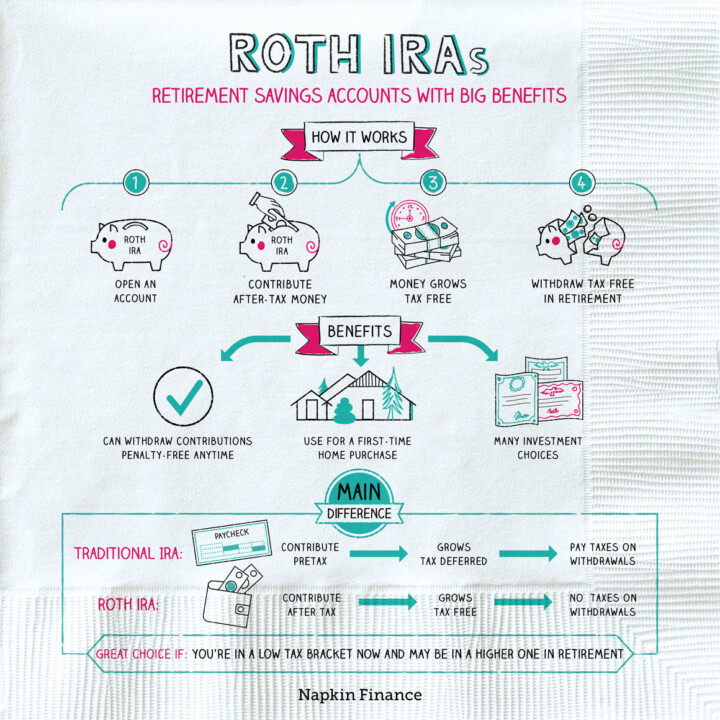

Roth IRAs Benefits Napkin Finance