In this digital age, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. For educational purposes or creative projects, or just adding the personal touch to your area, Are Roth Ira Distributions Considered Earned Income are a great source. For this piece, we'll take a dive into the world "Are Roth Ira Distributions Considered Earned Income," exploring what they are, how to find them and how they can improve various aspects of your daily life.

What Are Are Roth Ira Distributions Considered Earned Income?

Are Roth Ira Distributions Considered Earned Income include a broad variety of printable, downloadable items that are available online at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and much more. The beauty of Are Roth Ira Distributions Considered Earned Income is in their variety and accessibility.

Are Roth Ira Distributions Considered Earned Income

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Are Roth Ira Distributions Considered Earned Income

Are Roth Ira Distributions Considered Earned Income -

[desc-5]

[desc-1]

Are Roth IRA Distributions Taxable

Are Roth IRA Distributions Taxable

[desc-4]

[desc-6]

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

[desc-9]

[desc-7]

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Roth IRA Withdrawal Rules Oblivious Investor

+1000px.jpg)

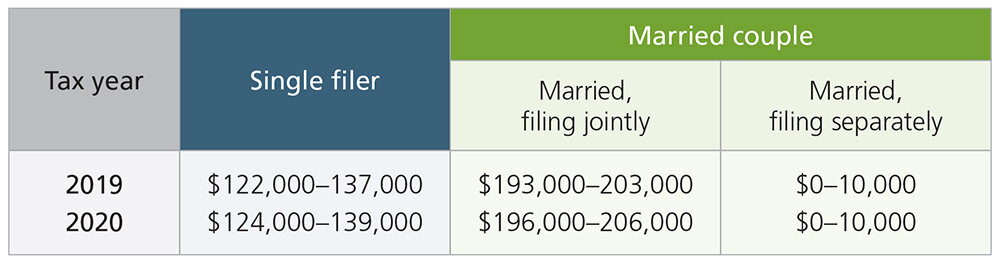

How To Determine Roth IRA Contribution Eligibility Ascensus

Roth IRA Rules Contribution Limits And How To Get Started The

Roth Ira Growth Calculator GarveenIndia

What Is Considered Earned Income For A Custodial Roth Ira

What Is Considered Earned Income For A Custodial Roth Ira

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Roth IRA Withdrawals Read This First