In this digital age, where screens rule our lives but the value of tangible printed materials isn't diminishing. Be it for educational use or creative projects, or simply to add the personal touch to your area, Are Retirement Contributions Pre Tax are a great source. With this guide, you'll dive deeper into "Are Retirement Contributions Pre Tax," exploring what they are, where to get them, as well as how they can be used to enhance different aspects of your daily life.

Get Latest Are Retirement Contributions Pre Tax Below

Are Retirement Contributions Pre Tax

Are Retirement Contributions Pre Tax -

Traditional pre tax 401 k Reduces your ordinary taxable income for the year When the money is taken out it s taxed as regular income Subject to required minimum distributions at age 72 Roth

A pretax or traditional non Roth contribution is made to a designated pension plan retirement account or other tax deferred investment vehicle before federal and municipal taxes are

Are Retirement Contributions Pre Tax offer a wide range of printable, free materials online, at no cost. They come in many types, such as worksheets coloring pages, templates and many more. The beauty of Are Retirement Contributions Pre Tax is their flexibility and accessibility.

More of Are Retirement Contributions Pre Tax

Four Ways To Increase Employee Retirement Contributions EisnerAmper

Four Ways To Increase Employee Retirement Contributions EisnerAmper

If a plan permits designated Roth contributions it must also offer pre tax elective deferral contributions After tax contributions are contributions from compensation other than Roth contributions that an employee must include in income on his or her tax return

By reducing taxable income pre tax contributions lower an individual s tax liability providing immediate tax savings and potentially increased take home pay Various types of accounts are available for pre tax contributions including retirement savings plans health savings accounts and flexible spending accounts

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: This allows you to modify the templates to meet your individual needs whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: Downloads of educational content for free cater to learners of all ages. This makes them an invaluable source for educators and parents.

-

Simple: Instant access to a variety of designs and templates reduces time and effort.

Where to Find more Are Retirement Contributions Pre Tax

The Road To Retirement Savings With RRSPs Osoyoos Credit Union

The Road To Retirement Savings With RRSPs Osoyoos Credit Union

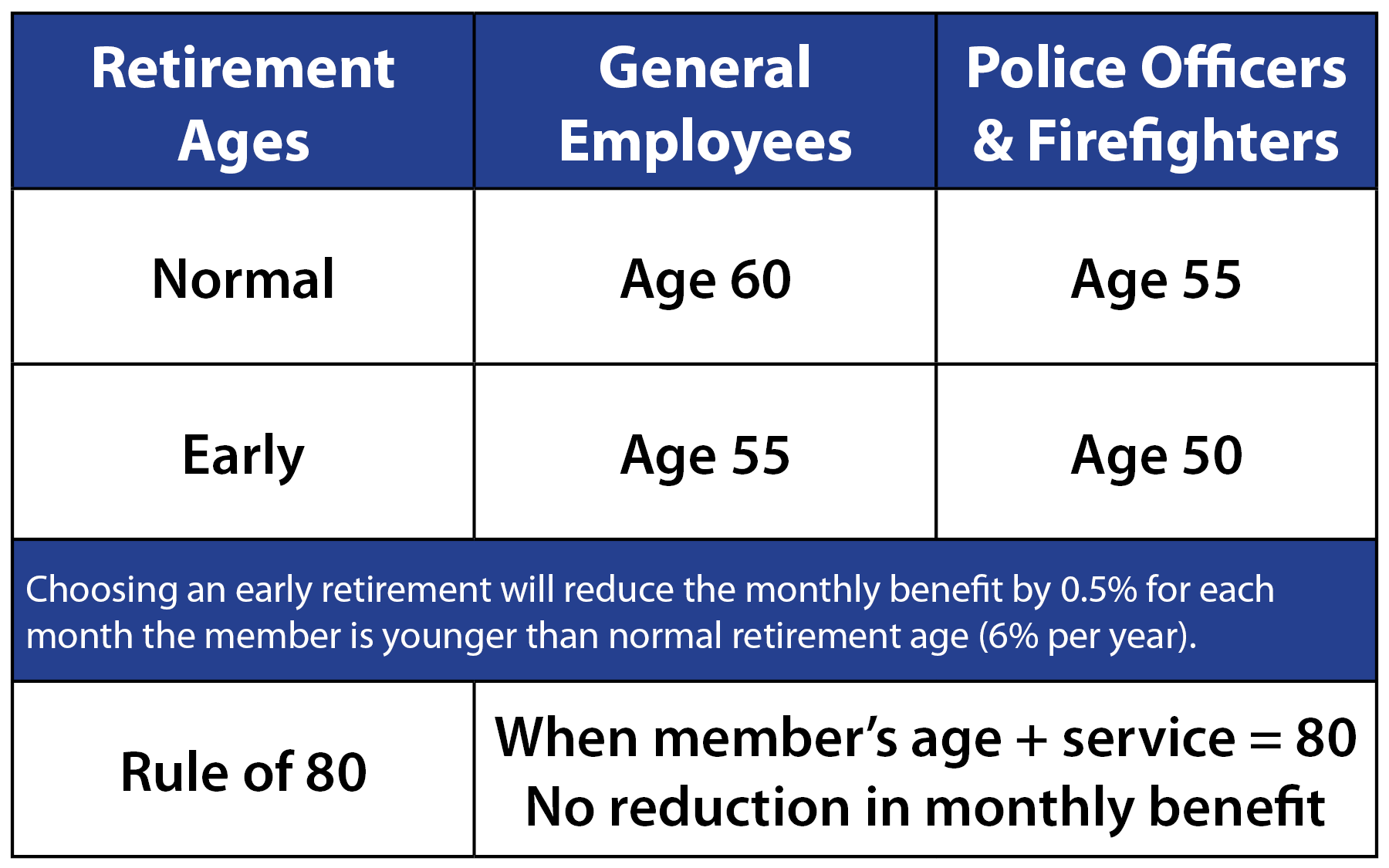

457 plans are non qualified tax advantaged deferred compensation retirement plans available for government and certain non government employees Contributions are made pre tax and earnings grow tax deferred Unlike 401 k and 403 b plans 457 plans do not impose a penalty for withdrawals if you retire before age 59

Box 1 Wages Don t include pre tax contributions made under a salary reduction agreement Box 3 5 Social Security and Medicare wages Include all employee pre tax after tax and designated Roth contributions Box 12 Codes Enter appropriate codes to show elective deferrals and designated Roth contributions to

If we've already piqued your interest in Are Retirement Contributions Pre Tax, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Are Retirement Contributions Pre Tax for different goals.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs covered cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Are Retirement Contributions Pre Tax

Here are some new ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Retirement Contributions Pre Tax are an abundance with useful and creative ideas that cater to various needs and preferences. Their access and versatility makes them a fantastic addition to each day life. Explore the vast world of Are Retirement Contributions Pre Tax today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes they are! You can download and print these resources at no cost.

-

Are there any free printables to make commercial products?

- It's determined by the specific rules of usage. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations on use. Make sure you read the terms of service and conditions provided by the author.

-

How can I print Are Retirement Contributions Pre Tax?

- Print them at home using any printer or head to any local print store for better quality prints.

-

What software do I need to open printables free of charge?

- The majority of printables are as PDF files, which is open with no cost software such as Adobe Reader.

Guide To Retirement Savings Stride Blog

Back By Popular Demand When Is The Best Day To Retire Missouri Lagers

Check more sample of Are Retirement Contributions Pre Tax below

IRS Announces 2023 HSA Limits Blog Medcom Benefits

Plan Your 2022 Retirement Contributions

The Once in a Lifetime IRA Transfer To An HSA The Wealthy Accountant

Maximizing Your Retirement Contributions How To Save On Taxes And

What You Need To Know About Investing Retirement Planning And More

10 Employer Retirement Contributions Stock Photos Pictures Clip Art

https://www.investopedia.com/pre-tax-and-roth-contributions-5219963

A pretax or traditional non Roth contribution is made to a designated pension plan retirement account or other tax deferred investment vehicle before federal and municipal taxes are

https://smartasset.com/retirement/pretax-contributions

The concept of pretax contributions might seem complicated but it essentially refers to the funds you invest into specific types of retirement accounts before income tax is withdrawn

A pretax or traditional non Roth contribution is made to a designated pension plan retirement account or other tax deferred investment vehicle before federal and municipal taxes are

The concept of pretax contributions might seem complicated but it essentially refers to the funds you invest into specific types of retirement accounts before income tax is withdrawn

Maximizing Your Retirement Contributions How To Save On Taxes And

Plan Your 2022 Retirement Contributions

What You Need To Know About Investing Retirement Planning And More

10 Employer Retirement Contributions Stock Photos Pictures Clip Art

How To Maximize Retirement Contributions Retire Gen Z

Tax Implications For Retirement Savings By Account Type

Tax Implications For Retirement Savings By Account Type

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog