In this age of technology, with screens dominating our lives yet the appeal of tangible printed objects isn't diminished. In the case of educational materials as well as creative projects or simply adding personal touches to your home, printables for free are now a vital resource. Through this post, we'll take a dive into the world "Are Reimbursements Taxable," exploring what they are, how to get them, as well as how they can enhance various aspects of your lives.

Get Latest Are Reimbursements Taxable Below

Are Reimbursements Taxable

Are Reimbursements Taxable -

Are reimbursements taxable for the employee Can expenses be reimbursed through payroll How do accountable and non accountable plans work How do you report reimbursements To begin let s examine the following question in more detail

Reimbursements under a nonaccountable plan are wages and are subject to taxes You must report these wages and deposit taxes on them Include the reimbursements and taxes on the employee s Form W 2

Printables for free cover a broad range of downloadable, printable materials that are accessible online for free cost. They are available in a variety of types, like worksheets, templates, coloring pages, and many more. The appealingness of Are Reimbursements Taxable is their flexibility and accessibility.

More of Are Reimbursements Taxable

Are QSEHRA Reimbursements Taxable

Are QSEHRA Reimbursements Taxable

In short no But that s provided your employer completes the pay stub accurately as part of their expense reimbursement process If they incorrectly lump the reimbursed amount with your wages it s taxed If you re worried talk to your accounting department before your employer reimburses you

In general reimbursements are not taxable to the employee because you re simply paying back them back for money they spent on company related expenses It s often best to set up an accountable plan as described below so that the expense can be treated as a non taxable reimbursement How do I set up an accountable plan for reimbursements

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization This allows you to modify printables to fit your particular needs be it designing invitations planning your schedule or even decorating your house.

-

Educational Benefits: Printables for education that are free are designed to appeal to students from all ages, making them an essential instrument for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to the vast array of design and templates will save you time and effort.

Where to Find more Are Reimbursements Taxable

Are Health Care Reimbursements Taxable AZexplained

Are Health Care Reimbursements Taxable AZexplained

If you are reimbursed under an accountable plan and you are deducting amounts that are more than your reimbursements you can deduct only 50 of the excess amount The 50 Limit is discussed in more detail in chapter 2 and accountable and nonaccountable plans are discussed in chapter 6

Are Reimbursements Taxable Paying wages to employees always involves withholding and contributing taxes but with reimbursements it all revolves around accountable and non accountable plans That s because IRS reporting requirements are built around these two types of plans

We've now piqued your interest in printables for free, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Are Reimbursements Taxable for various needs.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets, flashcards, and learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs covered cover a wide selection of subjects, from DIY projects to party planning.

Maximizing Are Reimbursements Taxable

Here are some creative ways create the maximum value of Are Reimbursements Taxable:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Are Reimbursements Taxable are an abundance of creative and practical resources that satisfy a wide range of requirements and pursuits. Their accessibility and flexibility make them an essential part of every aspect of your life, both professional and personal. Explore the world of Are Reimbursements Taxable today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Reimbursements Taxable truly gratis?

- Yes you can! You can download and print these tools for free.

-

Are there any free templates for commercial use?

- It depends on the specific conditions of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may contain restrictions on their use. Be sure to check the terms and condition of use as provided by the author.

-

How can I print Are Reimbursements Taxable?

- Print them at home with any printer or head to a local print shop to purchase better quality prints.

-

What program do I require to open printables that are free?

- The majority of PDF documents are provided with PDF formats, which can be opened with free programs like Adobe Reader.

Fidel In Focus Introducing Reimbursements

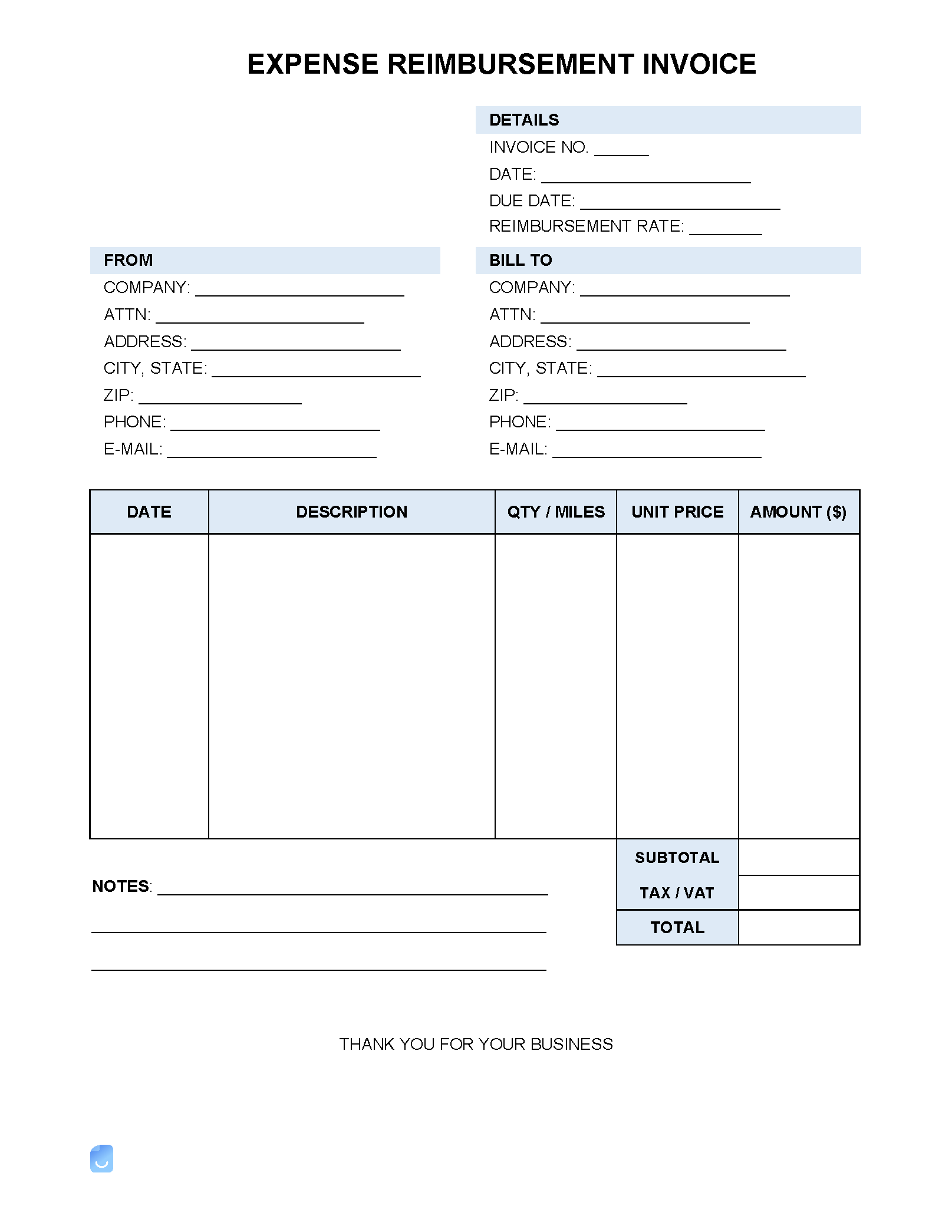

Expense Reimbursement Invoice Template Invoice Maker

Check more sample of Are Reimbursements Taxable below

Are QSEHRA Reimbursements Taxable

Are SECA And Income Tax Reimbursements Taxable

IRS Reimbursements What Kind Of Reimbursements Are Taxable Marca

Are Health Insurance Reimbursements Taxable HealthPlanRate

Are Travel Reimbursements Taxable Exploring Leisure

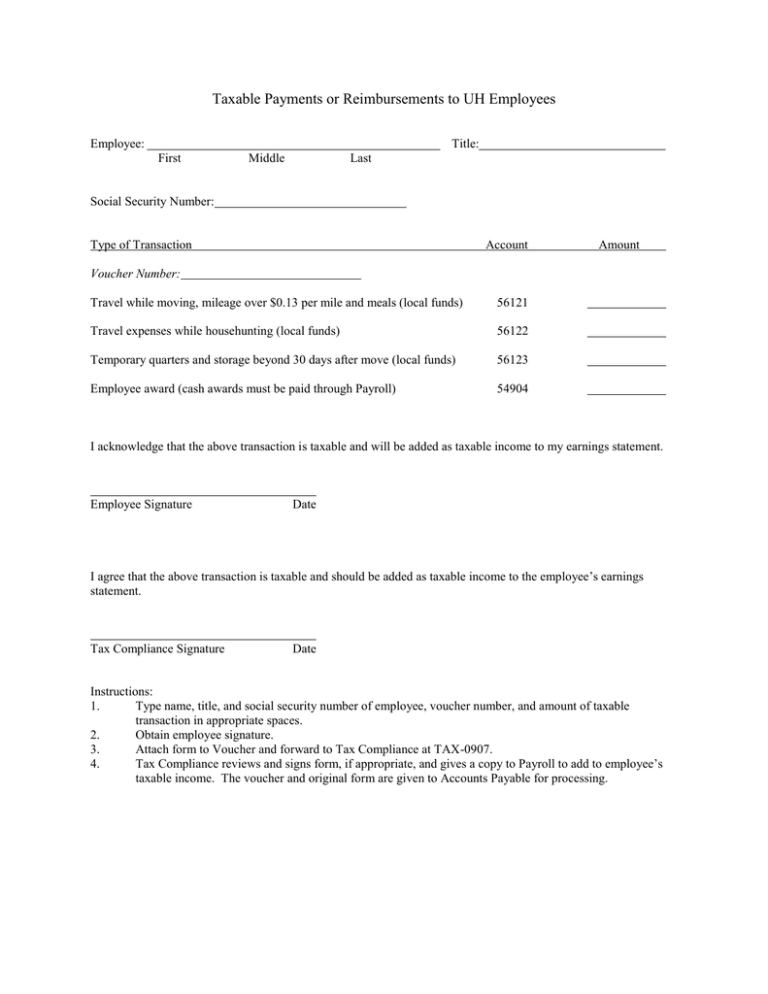

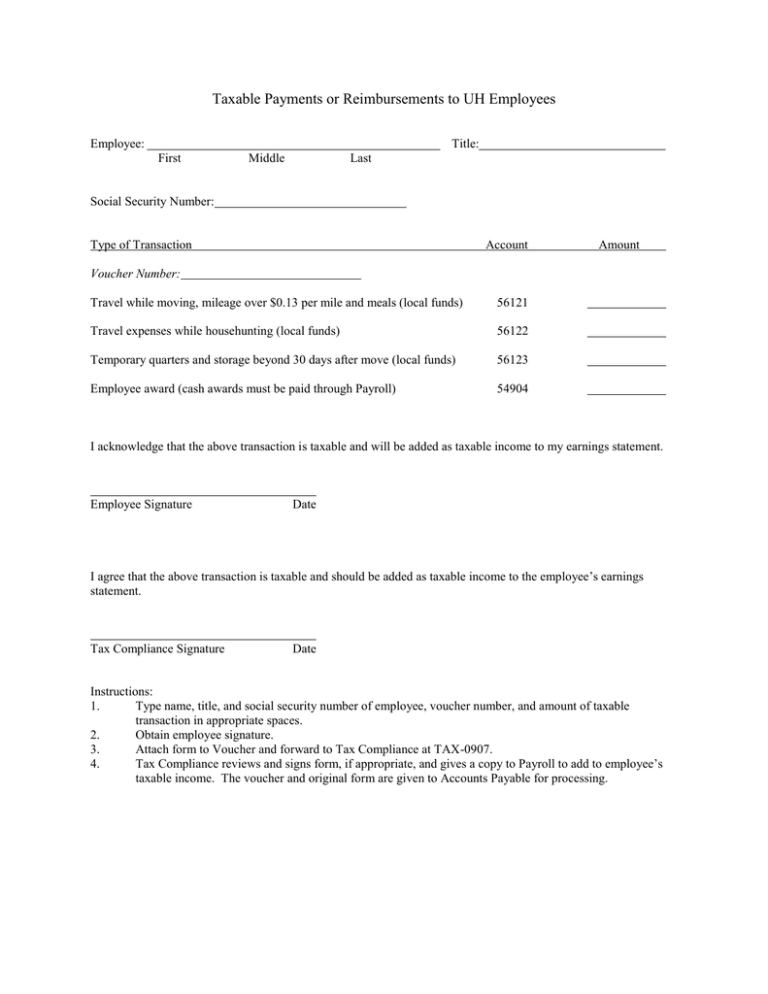

Taxable Payments Or Reimbursements To UH Employees

https://www.patriotsoftware.com/blog/payroll/are...

Reimbursements under a nonaccountable plan are wages and are subject to taxes You must report these wages and deposit taxes on them Include the reimbursements and taxes on the employee s Form W 2

https://www.irs.gov/publications/p525

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

Reimbursements under a nonaccountable plan are wages and are subject to taxes You must report these wages and deposit taxes on them Include the reimbursements and taxes on the employee s Form W 2

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

Are Health Insurance Reimbursements Taxable HealthPlanRate

Are SECA And Income Tax Reimbursements Taxable

Are Travel Reimbursements Taxable Exploring Leisure

Taxable Payments Or Reimbursements To UH Employees

Enhancing Claim Reimbursements Imburse

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

Frequently Asked Questions Accounts Payable And Travel Services