In this digital age, where screens rule our lives but the value of tangible printed materials hasn't faded away. If it's to aid in education and creative work, or simply adding an extra personal touch to your area, Are Private Equity Management Fees Tax Deductible are a great resource. With this guide, you'll take a dive in the world of "Are Private Equity Management Fees Tax Deductible," exploring what they are, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Are Private Equity Management Fees Tax Deductible Below

Are Private Equity Management Fees Tax Deductible

Are Private Equity Management Fees Tax Deductible -

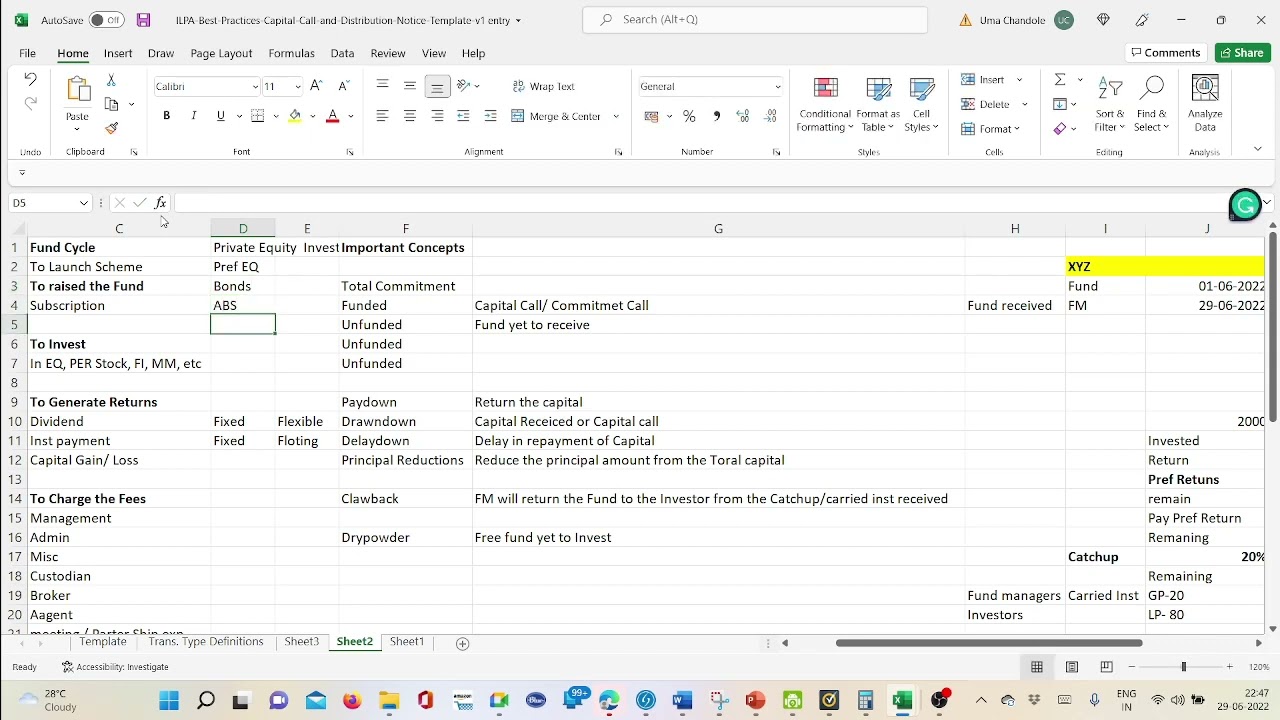

For example a fund including a private equity fund may own an equity position in an operating company that is treated as a partnership for tax purposes The ruling implies that the business of the operating company is not taken into account for purposes of determining the deductibility of management fees paid by the fund

In 2023 for example the exemption avoids 15 3 in taxes on the first 160 200 in 2023 in income a potential benefit of 24 510 60 The exemption increases to 168 600 for 2024 General

Printables for free include a vast range of printable, free resources available online for download at no cost. They come in many forms, like worksheets templates, coloring pages, and more. The great thing about Are Private Equity Management Fees Tax Deductible is in their variety and accessibility.

More of Are Private Equity Management Fees Tax Deductible

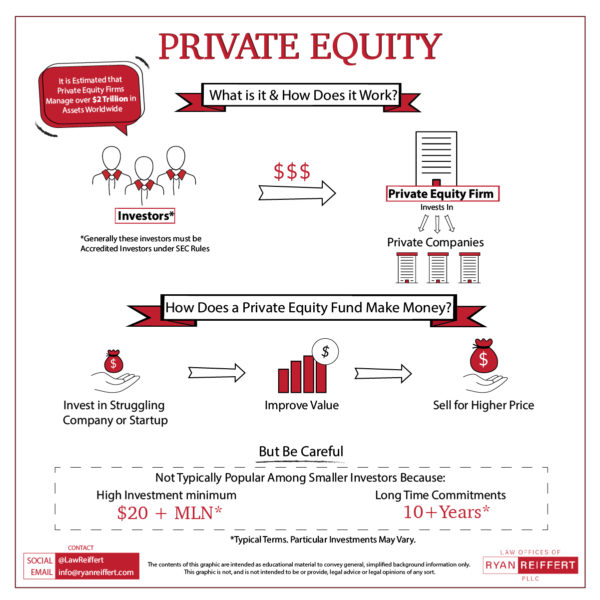

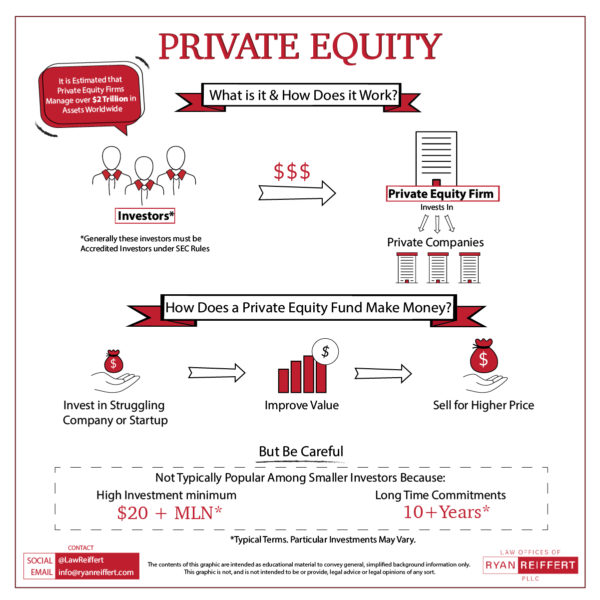

What Is Private Equity Ryan Reiffert PLLC

What Is Private Equity Ryan Reiffert PLLC

Monitoring fees are a tax deductible expense for the portfolio companies owned by PE funds and greatly reduce the taxes these companies pay In many cases however no monitoring services are actually provided and the Management Fee Waivers In a management fee waiver the private equity fund s GP waives

When classified under Sec 212 the advisory fees and other investment expenses of the fund are now no longer deductible to fund investors that are individuals or similarly taxed entities such as trusts

Are Private Equity Management Fees Tax Deductible have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize the templates to meet your individual needs such as designing invitations to organize your schedule or decorating your home.

-

Educational Impact: Printables for education that are free are designed to appeal to students of all ages, which makes them a valuable resource for educators and parents.

-

Affordability: Fast access many designs and templates will save you time and effort.

Where to Find more Are Private Equity Management Fees Tax Deductible

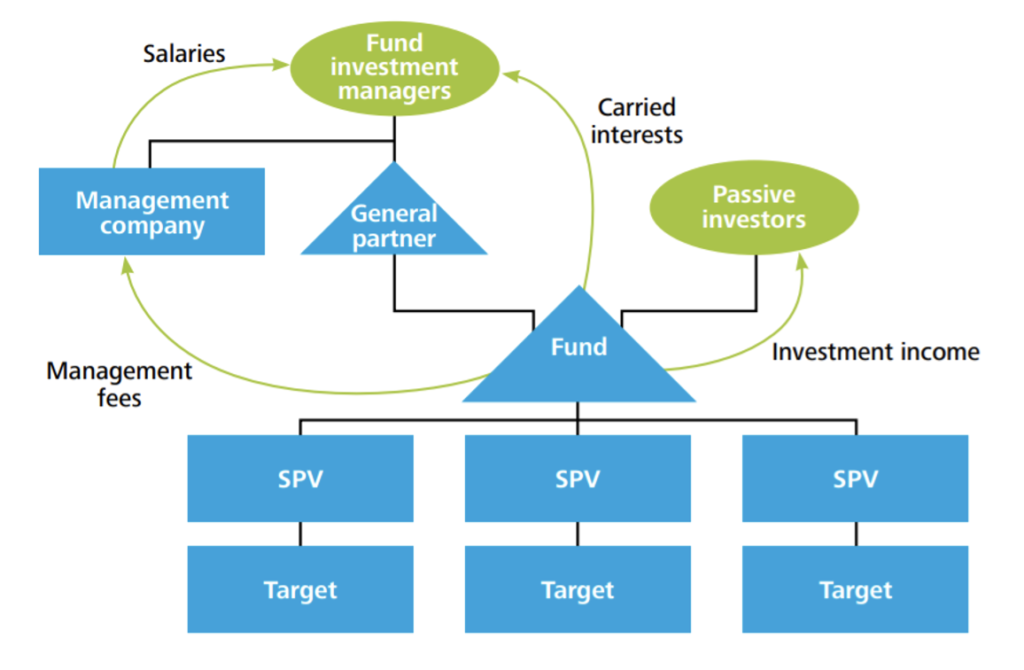

Private Equity In China BSPEClub

Private Equity In China BSPEClub

The Tax Court agreed with the IRS that the claimed management fees were not deductible as ordinary and necessary business expenses concluding that Aspro failed to connect the dots between the services performed and the management fees it paid Instead the court held that the payments were disguised non deductible earnings

As discussed below H R 5376 would if enacted still make certain changes to the taxation of private equity The current bill would also impose a 5 or 8 surtax on wealthy individuals including wealthy fund investors i e a 5 surtax on individual incomes over 10 million and an additional 3 surtax on incomes over 25 million

In the event that we've stirred your curiosity about Are Private Equity Management Fees Tax Deductible we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Are Private Equity Management Fees Tax Deductible for various reasons.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs covered cover a wide range of topics, that includes DIY projects to planning a party.

Maximizing Are Private Equity Management Fees Tax Deductible

Here are some innovative ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Private Equity Management Fees Tax Deductible are an abundance of creative and practical resources that cater to various needs and interests. Their access and versatility makes they a beneficial addition to each day life. Explore the vast collection of Are Private Equity Management Fees Tax Deductible right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can download and print the resources for free.

-

Can I use the free printouts for commercial usage?

- It's based on specific conditions of use. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may have restrictions regarding usage. Always read the terms and regulations provided by the creator.

-

How do I print Are Private Equity Management Fees Tax Deductible?

- Print them at home with a printer or visit the local print shops for premium prints.

-

What software must I use to open printables at no cost?

- Many printables are offered in the PDF format, and can be opened with free software like Adobe Reader.

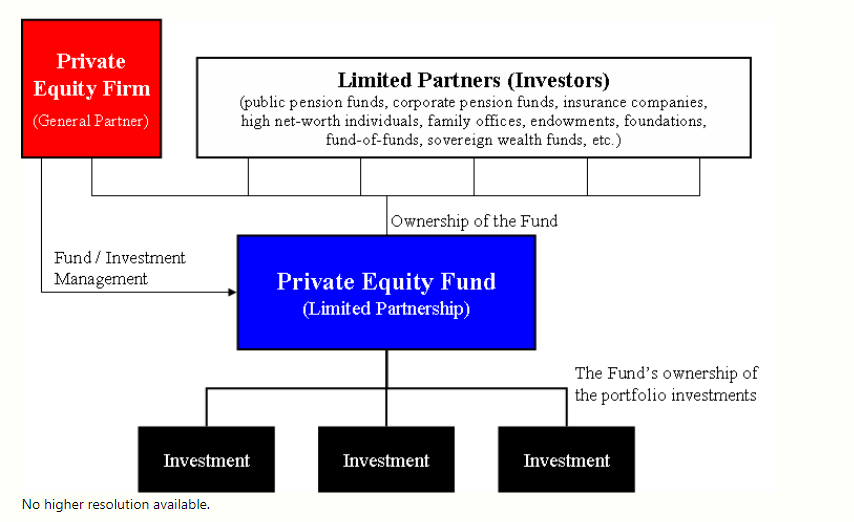

Private Equity Fund Encyclopedia MDPI

How To Simplify Property Management Tax Deductions For Rental Homes

Check more sample of Are Private Equity Management Fees Tax Deductible below

Private Equity Funds Meaning Benefits Types

Are Wealth Management Fees Tax Deducti

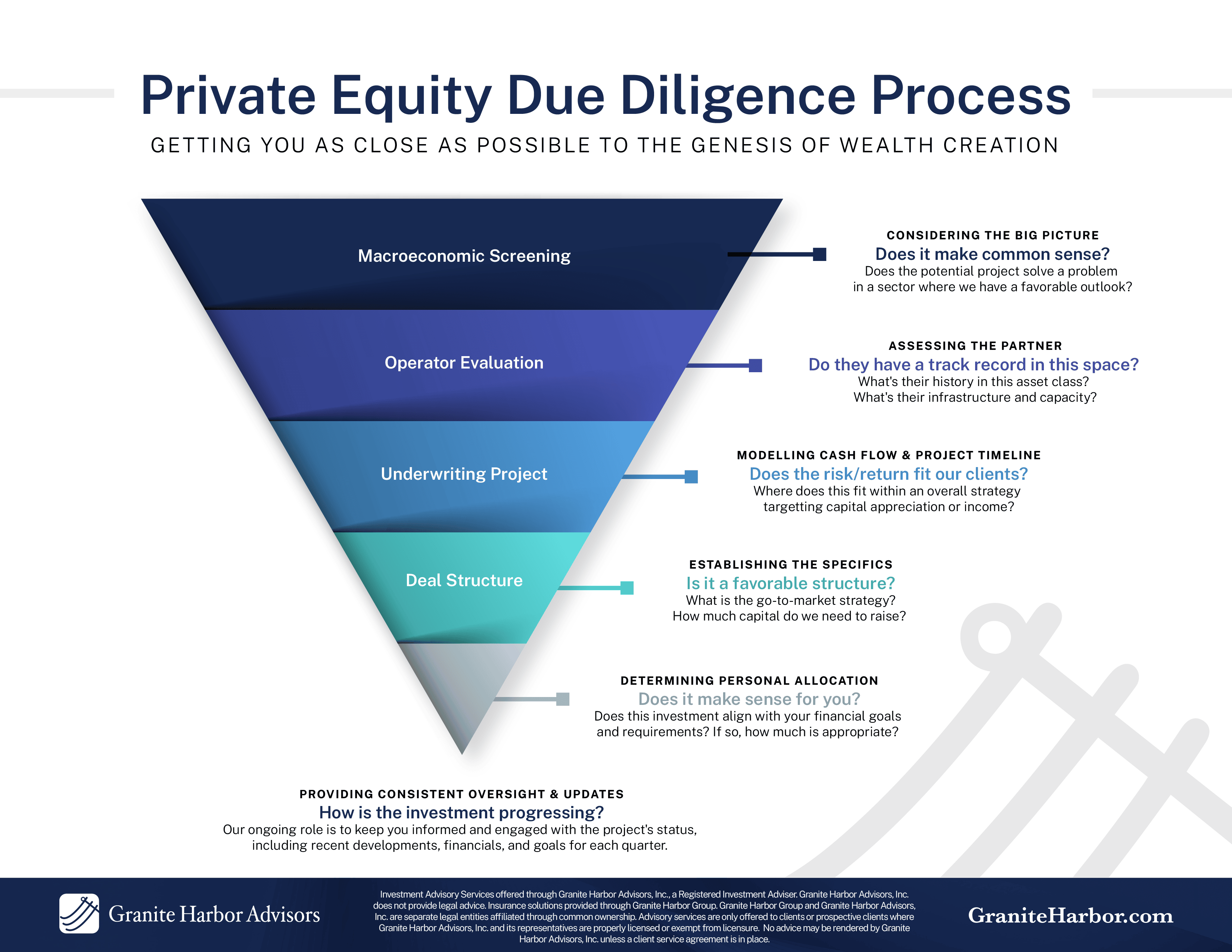

A Comprehensive Guide To The Private Equity Due Diligence Process

The 25 Largest Private Equity Firms In One Chart Private Equity

Private Equity Overview

Private Equity Definition Firms Funds And Effect Cambrian Mill

https://www.investopedia.com/articles/investing/...

In 2023 for example the exemption avoids 15 3 in taxes on the first 160 200 in 2023 in income a potential benefit of 24 510 60 The exemption increases to 168 600 for 2024 General

https://www.ropesgray.com/en/insights/alerts/2019/...

Historically deductions have been enhanced by using shareholder debt New rules impacting deductibility of interest discussed below are therefore of particular relevance in modelling returns on private equity deals Secondly there is a focus on exit and distribution of proceeds to investors

In 2023 for example the exemption avoids 15 3 in taxes on the first 160 200 in 2023 in income a potential benefit of 24 510 60 The exemption increases to 168 600 for 2024 General

Historically deductions have been enhanced by using shareholder debt New rules impacting deductibility of interest discussed below are therefore of particular relevance in modelling returns on private equity deals Secondly there is a focus on exit and distribution of proceeds to investors

The 25 Largest Private Equity Firms In One Chart Private Equity

Are Wealth Management Fees Tax Deducti

Private Equity Overview

Private Equity Definition Firms Funds And Effect Cambrian Mill

The Strategic Secret Of Private Equity 2022

The OfficeHours Guide To Private Equity Part 3

The OfficeHours Guide To Private Equity Part 3

The Officehours Guide To Private Equity OfficeHours