In this age of electronic devices, where screens rule our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. If it's to aid in education project ideas, artistic or simply adding personal touches to your area, Are Non Qualified Annuity Death Benefits Taxable are now a useful source. Through this post, we'll dive into the sphere of "Are Non Qualified Annuity Death Benefits Taxable," exploring their purpose, where to find them and how they can enrich various aspects of your life.

Get Latest Are Non Qualified Annuity Death Benefits Taxable Below

Are Non Qualified Annuity Death Benefits Taxable

Are Non Qualified Annuity Death Benefits Taxable -

What Is a Non Qualified Annuity and How Are They Taxed While you can t deduct contributions from nonqualified variable annuities your money will grow tax deferred and withdrawals are taxed as ordinary income

When it comes to the tax treatment of annuity death benefits for non qualified annuities the earnings portion of the annuity is subject to taxation upon withdrawal

Printables for free include a vast selection of printable and downloadable materials online, at no cost. These resources come in many types, like worksheets, coloring pages, templates and much more. The benefit of Are Non Qualified Annuity Death Benefits Taxable is their flexibility and accessibility.

More of Are Non Qualified Annuity Death Benefits Taxable

Are Ss Death Benefits Taxable

Are Ss Death Benefits Taxable

When you receive money from a nonqualified variable annuity only your net gain the earnings on your investment is taxable The money you contributed to the annuity isn t taxed because you

Understanding how non qualified annuities are taxed to beneficiaries is essential for effective financial planning

Are Non Qualified Annuity Death Benefits Taxable have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: They can make printing templates to your own specific requirements such as designing invitations planning your schedule or even decorating your home.

-

Educational Value: The free educational worksheets can be used by students from all ages, making them a great resource for educators and parents.

-

Accessibility: Instant access to a plethora of designs and templates saves time and effort.

Where to Find more Are Non Qualified Annuity Death Benefits Taxable

Difference Between Qualified And Non Qualified Annuity Pulptastic

Difference Between Qualified And Non Qualified Annuity Pulptastic

Fortunately there is a little known way for a non spouse beneficiary to spread out payments and taxes continue to benefit from tax deferral and thus ultimately receive more money But first

It depends on whether the owner purchased the annuity with qualified or non qualified funds Inherited Qualified Annuity Taxes With qualified annuities the initial funding comes from pre tax money This means that so far the owner

Now that we've piqued your interest in Are Non Qualified Annuity Death Benefits Taxable and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Are Non Qualified Annuity Death Benefits Taxable for a variety motives.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs are a vast selection of subjects, ranging from DIY projects to party planning.

Maximizing Are Non Qualified Annuity Death Benefits Taxable

Here are some inventive ways how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are Non Qualified Annuity Death Benefits Taxable are an abundance of fun and practical tools that satisfy a wide range of requirements and preferences. Their accessibility and flexibility make them a valuable addition to both professional and personal life. Explore the vast world of Are Non Qualified Annuity Death Benefits Taxable today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use free printouts for commercial usage?

- It's all dependent on the usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions in their usage. Be sure to check the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using any printer or head to a local print shop for better quality prints.

-

What program do I need to open printables that are free?

- The majority of PDF documents are provided in PDF format, which can be opened using free software like Adobe Reader.

Are Annuity Death Benefits Taxable How Are They Paid Out

Inherited Annuity Taxation Irs Showy Microblog Picture Galleries

Check more sample of Are Non Qualified Annuity Death Benefits Taxable below

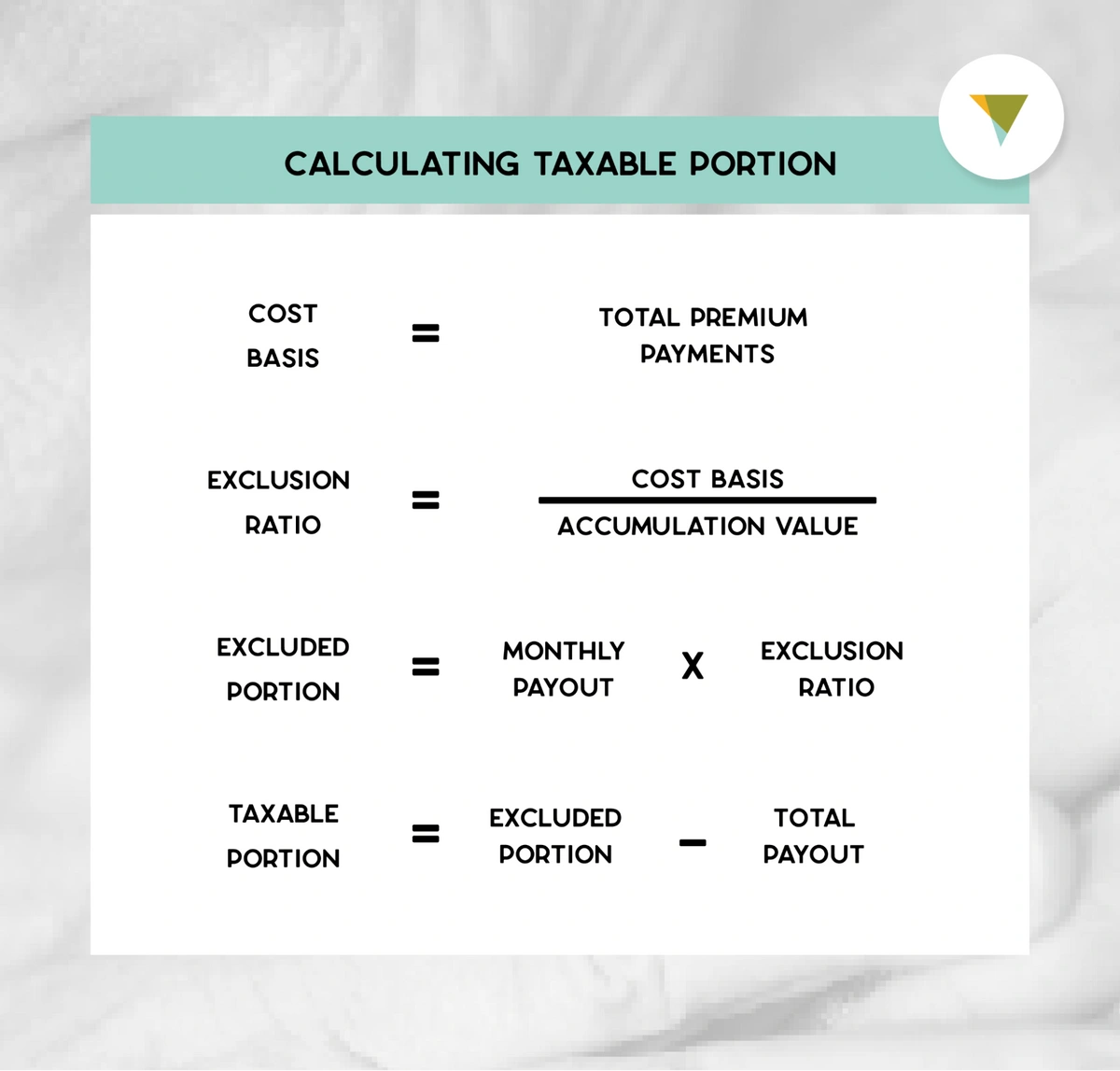

How To Calculate The Taxable Income Of An Annuity

What Is A Non Qualified Annuity Due

Are Annuity Death Benefits Tax Free YouTube

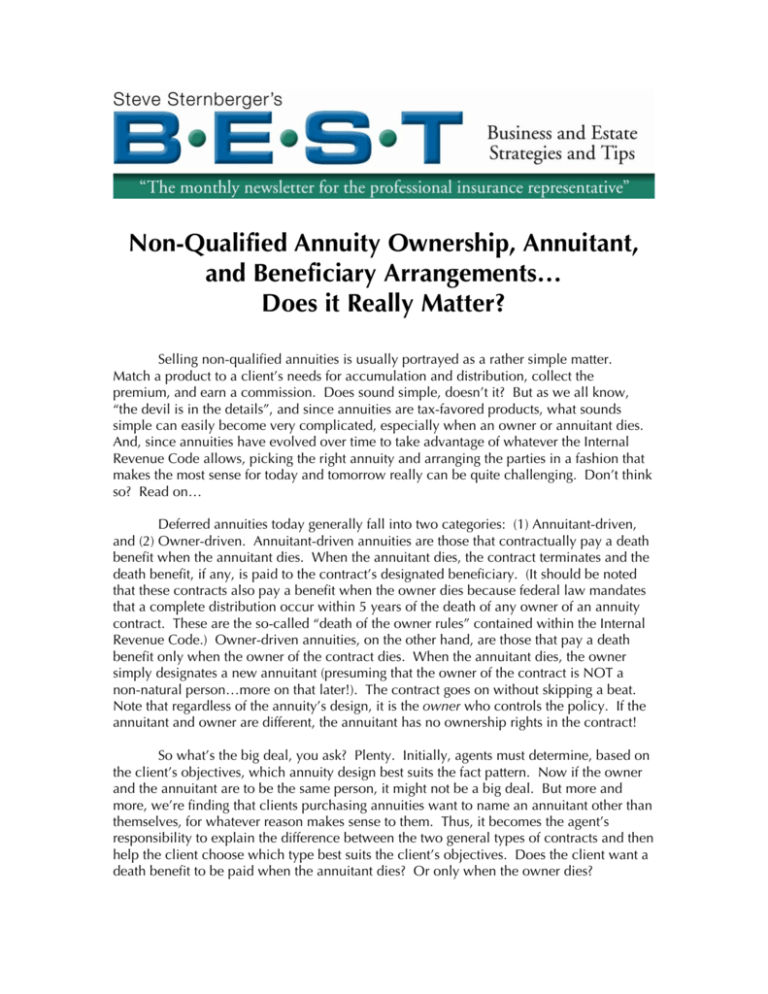

Non Qualified Annuity Ownership Annuitant And Beneficiary

Are Annuity Death Benefits Taxable How Are They Paid Out

Understanding Qualified Vs Non Qualified Annuities Simplified Seinor

https://johnstevenson.com › annuity-death-benefits-taxation

When it comes to the tax treatment of annuity death benefits for non qualified annuities the earnings portion of the annuity is subject to taxation upon withdrawal

https://johnstevenson.com › inherited-no…

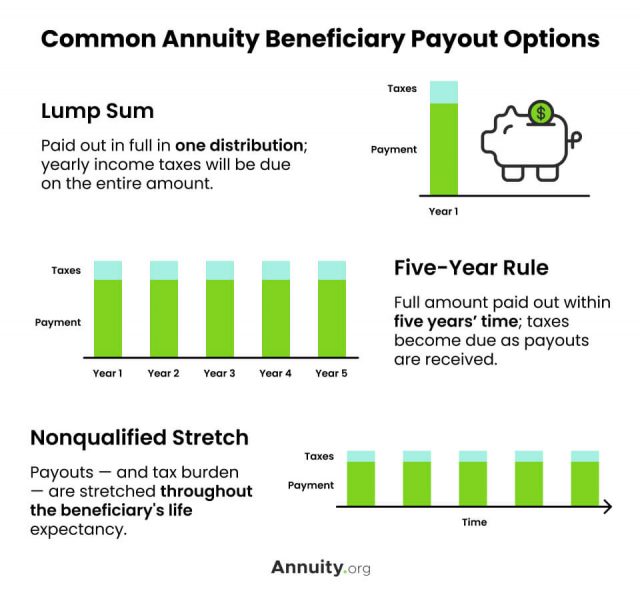

The Five Year Rule allows beneficiaries to withdraw the entire balance of the inherited non qualified annuity within five years of the original owner s death While this offers more flexibility than a lump sum payout each

When it comes to the tax treatment of annuity death benefits for non qualified annuities the earnings portion of the annuity is subject to taxation upon withdrawal

The Five Year Rule allows beneficiaries to withdraw the entire balance of the inherited non qualified annuity within five years of the original owner s death While this offers more flexibility than a lump sum payout each

Non Qualified Annuity Ownership Annuitant And Beneficiary

What Is A Non Qualified Annuity Due

Are Annuity Death Benefits Taxable How Are They Paid Out

Understanding Qualified Vs Non Qualified Annuities Simplified Seinor

How Annuity Death Benefits Work And Their Payout Options

Annuities Vs Mutual Funds The Complete Guide Trust Point

Annuities Vs Mutual Funds The Complete Guide Trust Point

Qualified Non Qualified Annuities What Is The Difference YouTube