In the age of digital, in which screens are the norm yet the appeal of tangible printed materials isn't diminishing. For educational purposes, creative projects, or simply adding an individual touch to your home, printables for free are now a vital resource. In this article, we'll take a dive through the vast world of "Are Ira Contributions Taxable In Ma," exploring their purpose, where to find them, and ways they can help you improve many aspects of your daily life.

Get Latest Are Ira Contributions Taxable In Ma Below

/tradition-ira-roth-ira-contribution-limits-5a01592613f1290037067ebc.jpg)

Are Ira Contributions Taxable In Ma

Are Ira Contributions Taxable In Ma -

Massachusetts fully exempts Social Security retirement benefits while taxing most other forms of retirement income The Massachusetts estate tax has an exemption of just 2 million which is one of the lowest in the

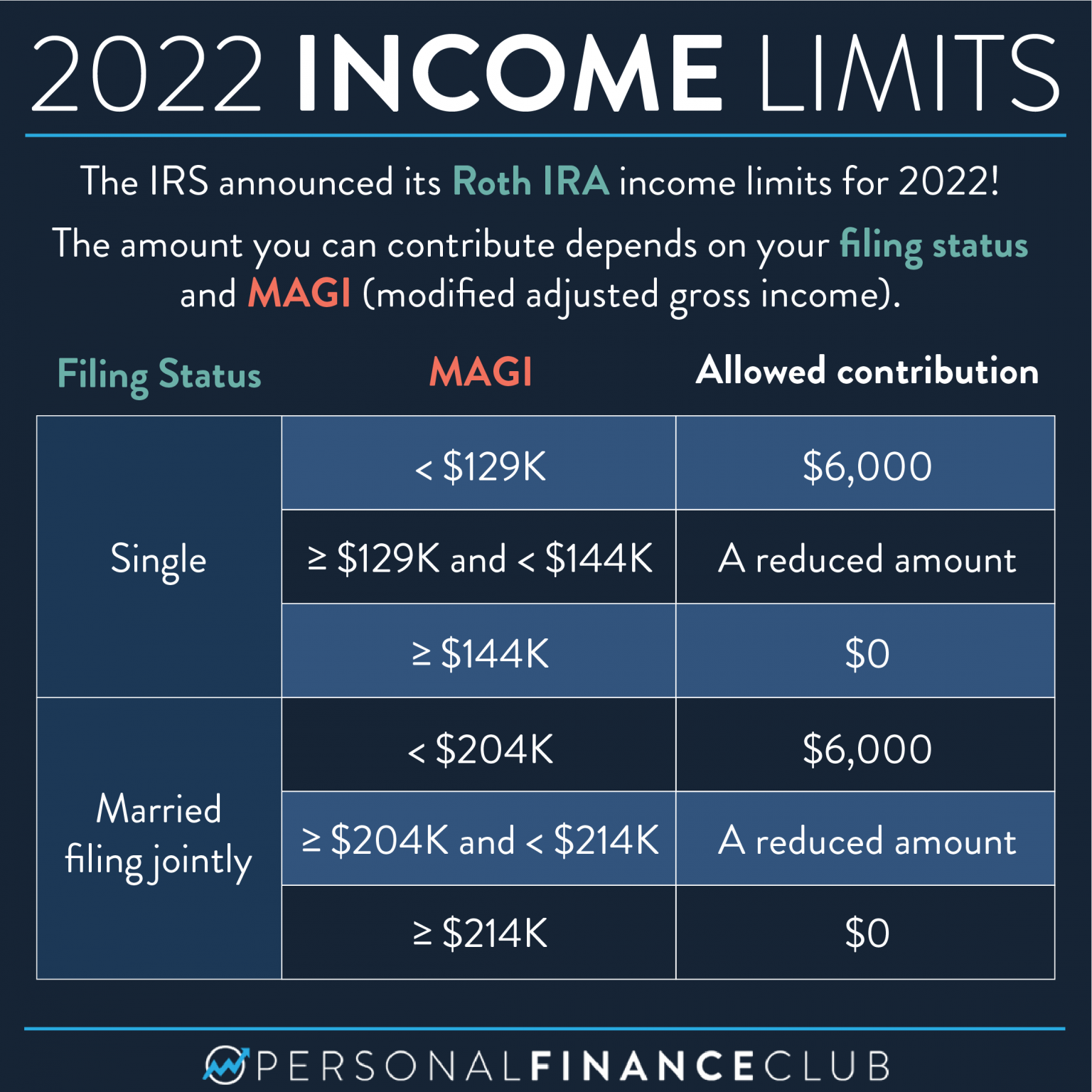

Traditional IRA Contributions are not deductible for Massachusetts personal income tax purposes However they may be deductible for federal tax purposes depending on the

Are Ira Contributions Taxable In Ma include a broad collection of printable items that are available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and many more. The appeal of printables for free lies in their versatility and accessibility.

More of Are Ira Contributions Taxable In Ma

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Massachusetts does not recognize the deductibility of contributions that you make when you put money into an IRA and as a result in the year of the contribution

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it

Are Ira Contributions Taxable In Ma have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization: We can customize print-ready templates to your specific requirements whether you're designing invitations making your schedule, or decorating your home.

-

Educational Use: Printing educational materials for no cost can be used by students from all ages, making them a valuable instrument for parents and teachers.

-

Easy to use: Quick access to many designs and templates reduces time and effort.

Where to Find more Are Ira Contributions Taxable In Ma

401 k Contribution Limits In 2023 Meld Financial

401 k Contribution Limits In 2023 Meld Financial

Common questions about Massachusetts IRAs and pensions in Lacerte SOLVED by Intuit 2 Updated September 29 2023 Below you ll find answers to

Common questions about Massachusetts IRAs and pensions in ProConnect Tax SOLVED by Intuit Updated September 29 2023 Below you ll find

If we've already piqued your interest in printables for free Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Are Ira Contributions Taxable In Ma for different applications.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs are a vast array of topics, ranging that range from DIY projects to party planning.

Maximizing Are Ira Contributions Taxable In Ma

Here are some ideas how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Are Ira Contributions Taxable In Ma are an abundance filled with creative and practical information that can meet the needs of a variety of people and pursuits. Their accessibility and versatility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the wide world of Are Ira Contributions Taxable In Ma today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Ira Contributions Taxable In Ma really absolutely free?

- Yes, they are! You can download and print these tools for free.

-

Are there any free printables for commercial purposes?

- It's all dependent on the conditions of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright issues with Are Ira Contributions Taxable In Ma?

- Certain printables may be subject to restrictions in their usage. Make sure you read the terms and conditions set forth by the creator.

-

How can I print Are Ira Contributions Taxable In Ma?

- Print them at home with your printer or visit a local print shop for high-quality prints.

-

What software will I need to access Are Ira Contributions Taxable In Ma?

- Most printables come in the format PDF. This is open with no cost programs like Adobe Reader.

IRS Announces 2023 HSA Limits Blog Medcom Benefits

3 IRA Rules To Live By The Motley Fool

Check more sample of Are Ira Contributions Taxable In Ma below

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

How IRA Contributions Can Reduce Adjusted Gross Income AGI Dechtman

Max Ira Contribution 2022 Over 50 Choosing Your Gold IRA

5498 Tax Forms For IRA Contributions Participant Copy B ZBPforms

2023 Roth Ira Limits W2023G

Could A Last Minute IRA Contribution Lower Your Taxes Forbes Advisor

/tradition-ira-roth-ira-contribution-limits-5a01592613f1290037067ebc.jpg?w=186)

https://www.mass.gov/info-details/differences...

Traditional IRA Contributions are not deductible for Massachusetts personal income tax purposes However they may be deductible for federal tax purposes depending on the

https://www.mass.gov/info-details/tax-treatment-of...

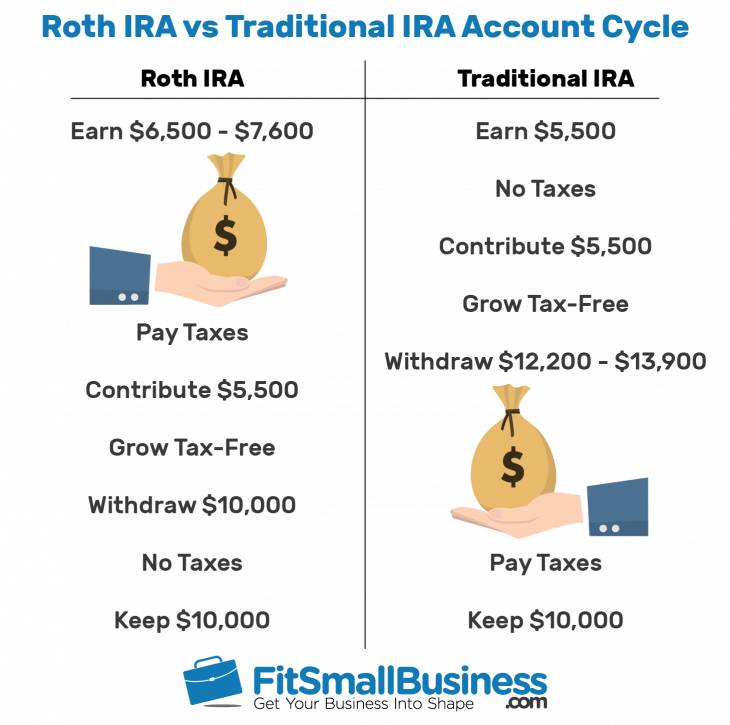

Earnings accumulate tax free on IRA contributions and depending on the type of IRA distributions may or may not be taxable There are 2 types of IRAs

Traditional IRA Contributions are not deductible for Massachusetts personal income tax purposes However they may be deductible for federal tax purposes depending on the

Earnings accumulate tax free on IRA contributions and depending on the type of IRA distributions may or may not be taxable There are 2 types of IRAs

5498 Tax Forms For IRA Contributions Participant Copy B ZBPforms

How IRA Contributions Can Reduce Adjusted Gross Income AGI Dechtman

2023 Roth Ira Limits W2023G

Could A Last Minute IRA Contribution Lower Your Taxes Forbes Advisor

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

Roth Ira Growth Calculator GarveenIndia

Roth Ira Growth Calculator GarveenIndia

Roth IRA Rules Contribution Limits Deadlines Best Practice In HR