In this day and age where screens dominate our lives but the value of tangible, printed materials hasn't diminished. No matter whether it's for educational uses in creative or artistic projects, or simply to add a personal touch to your area, Are Inherited Roth Ira Distributions Taxable have become an invaluable resource. For this piece, we'll take a dive deeper into "Are Inherited Roth Ira Distributions Taxable," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Are Inherited Roth Ira Distributions Taxable Below

Are Inherited Roth Ira Distributions Taxable

Are Inherited Roth Ira Distributions Taxable -

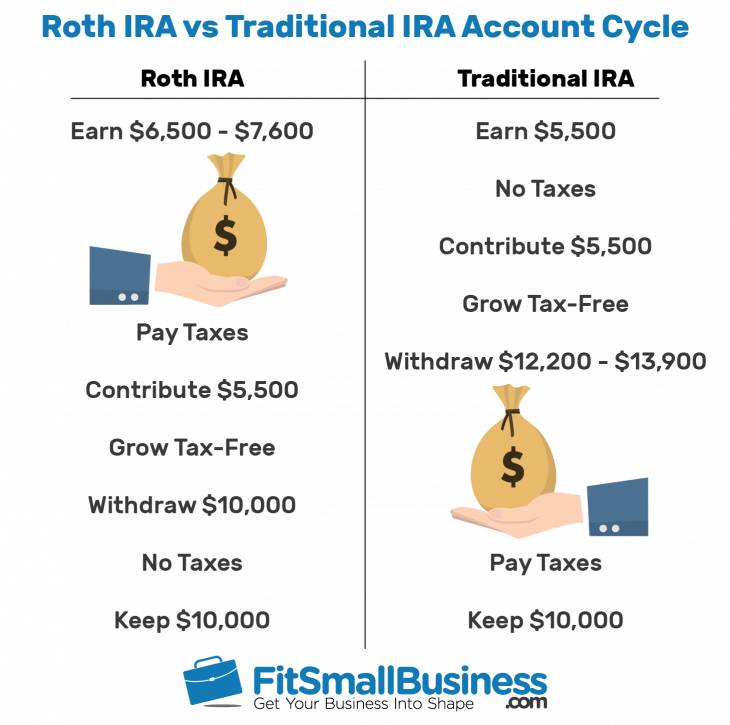

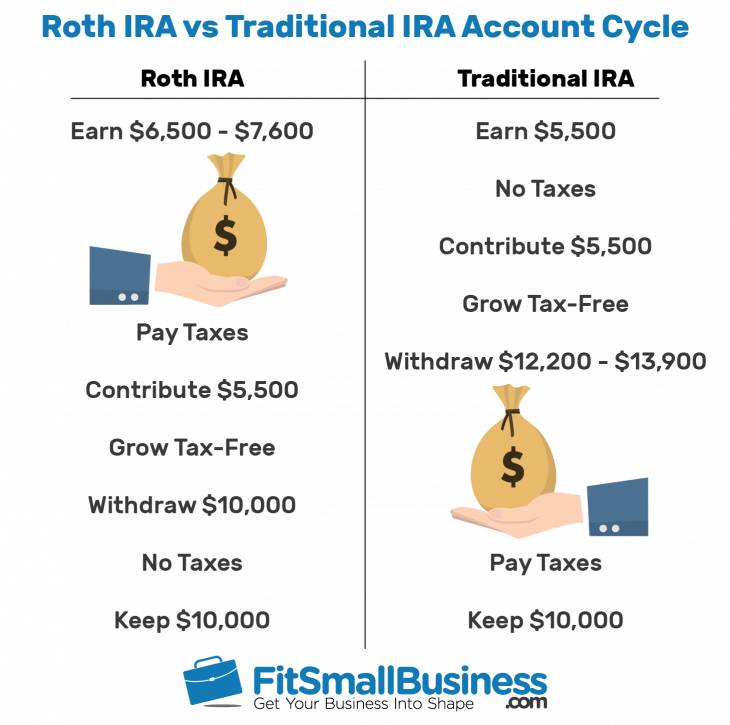

Distributions of regular contributions from your Roth IRA aren t taxable either That also goes for distributions rolled over into another Roth IRA assuming that you choose a direct

Most of the time yes It would be unusual for any taxes to be due on an RMD from an inherited Roth IRA The only portion of an inherited IRA that could be subject to tax is earnings

Printables for free include a vast range of printable, free resources available online for download at no cost. These materials come in a variety of types, like worksheets, templates, coloring pages, and many more. The appealingness of Are Inherited Roth Ira Distributions Taxable is their versatility and accessibility.

More of Are Inherited Roth Ira Distributions Taxable

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

IRAs and inherited IRAs are tax deferred accounts That means that tax is paid when the holder of an IRA account or the beneficiary takes distributions in the case of an inherited IRA

Most withdrawals of earnings from an inherited Roth IRA account are also tax free However withdrawals of earnings may be subject to income tax if the Roth account is less than 5 years old at the time of the withdrawal Distributions from another Roth IRA cannot be substituted for these distributions unless the other Roth IRA was

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

The ability to customize: We can customize printed materials to meet your requirements be it designing invitations making your schedule, or decorating your home.

-

Education Value Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a great instrument for parents and teachers.

-

Easy to use: Quick access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Are Inherited Roth Ira Distributions Taxable

Qualified Vs Non Qualified Roth IRA Distributions

Qualified Vs Non Qualified Roth IRA Distributions

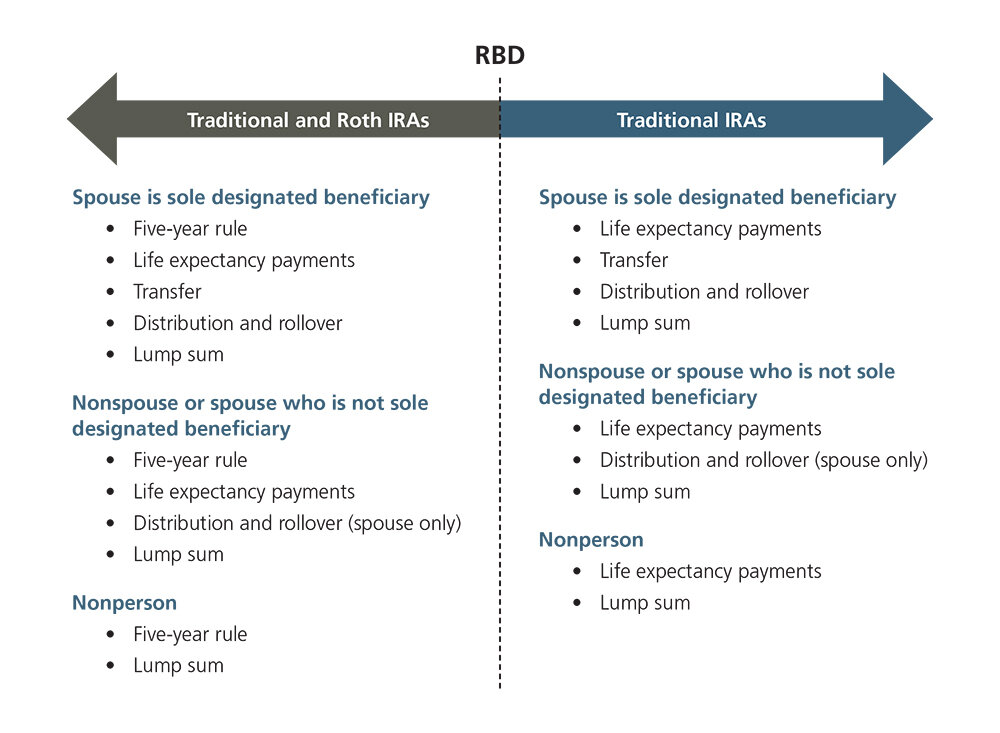

The good news is that you re not subject to the 10 penalty tax if you re younger than 59 5 when you start taking distributions You do however have to take distributions fairly quickly Generally speaking you must take the first distribution by December 31 of the year the original plan recipient passed away

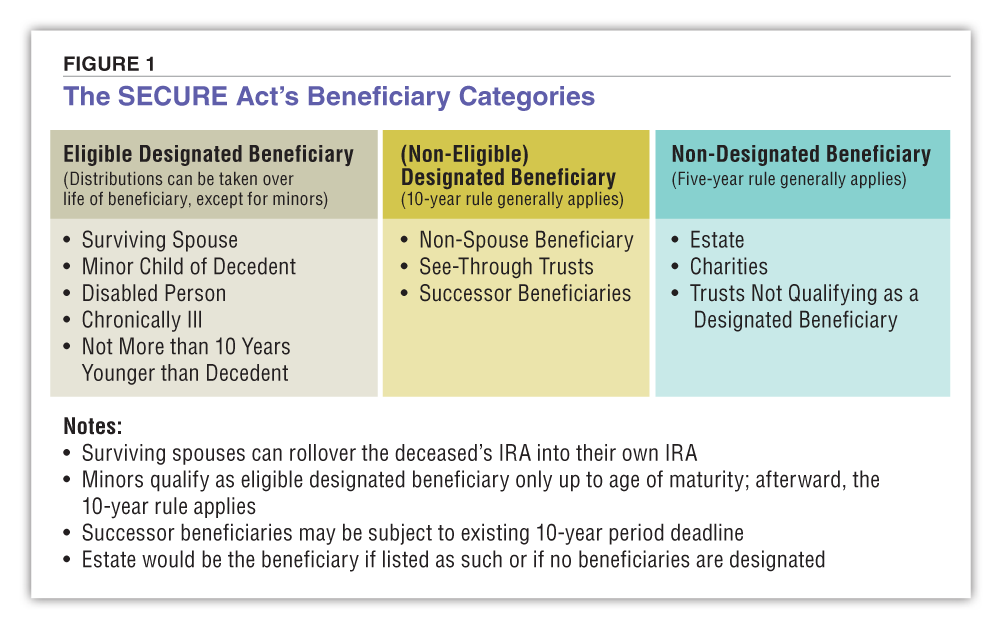

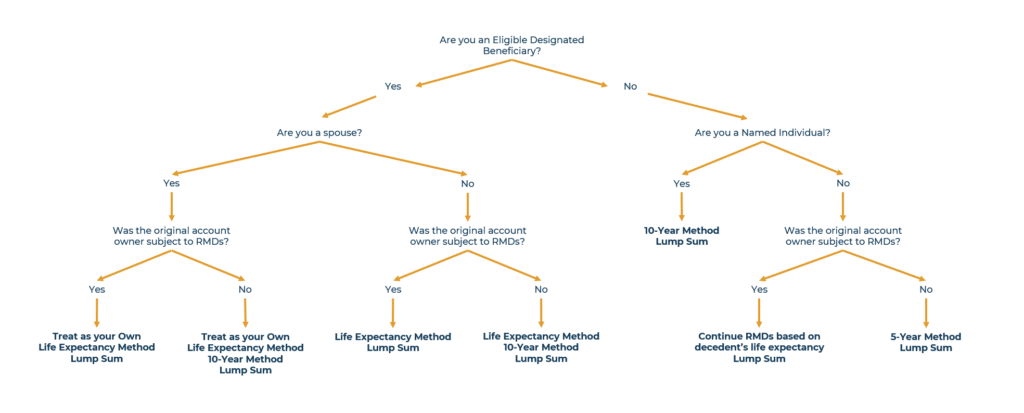

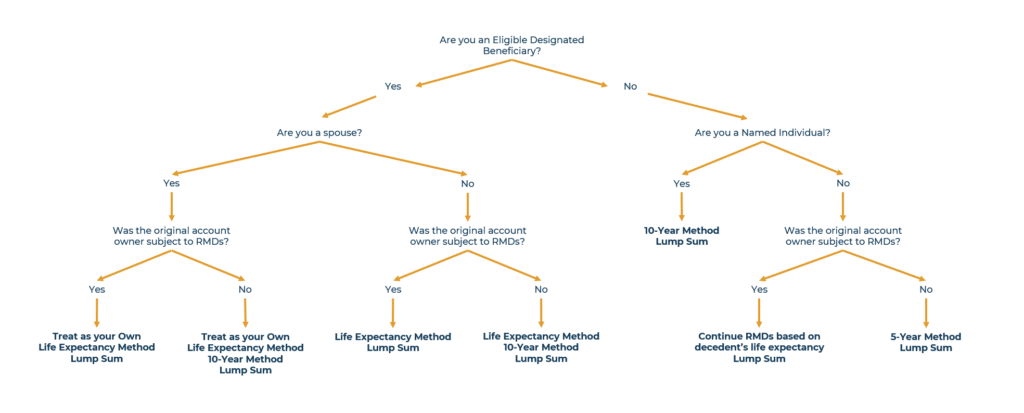

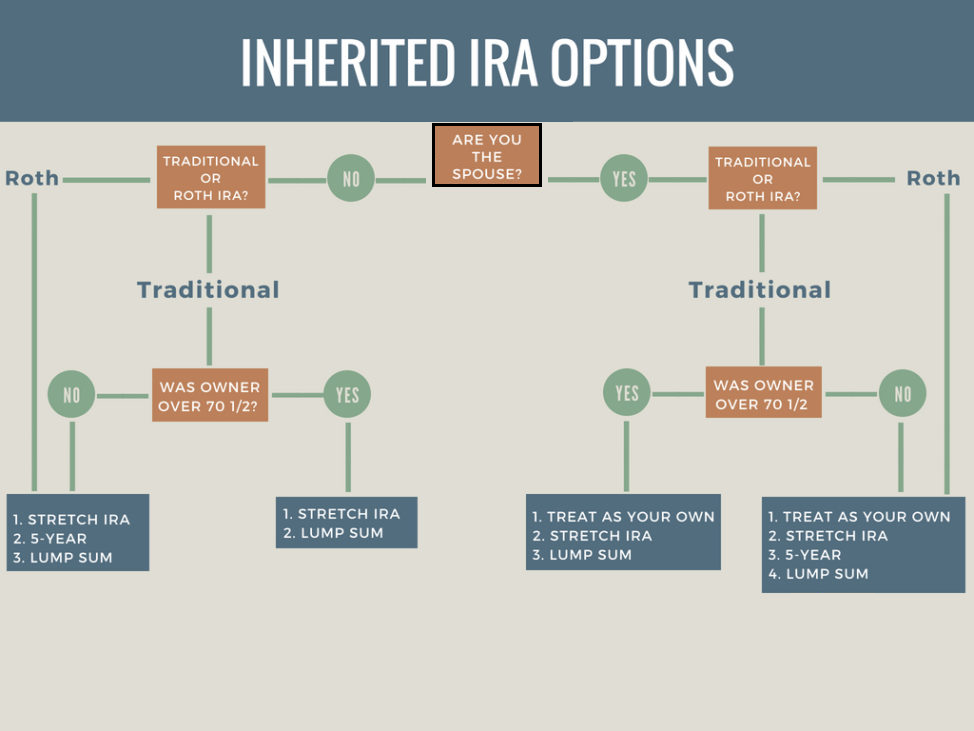

If you are inheriting a Roth IRA as a spouse you have several options including opening an Inherited IRA Option 1 Spousal transfer treat as your own Option 2 Open an Inherited Roth IRA Life expectancy method Option 3 Open a Roth Inherited IRA 10 year method Option 4 Lump sum distribution Non Spousal Options

We've now piqued your interest in printables for free Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Are Inherited Roth Ira Distributions Taxable suitable for many reasons.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a broad range of topics, everything from DIY projects to party planning.

Maximizing Are Inherited Roth Ira Distributions Taxable

Here are some unique ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Are Inherited Roth Ira Distributions Taxable are an abundance filled with creative and practical information for a variety of needs and preferences. Their availability and versatility make them a great addition to each day life. Explore the plethora of Are Inherited Roth Ira Distributions Taxable today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can download and print these files for free.

-

Can I make use of free printing templates for commercial purposes?

- It's contingent upon the specific terms of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations in their usage. You should read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- You can print them at home with an printer, or go to the local print shop for superior prints.

-

What software do I require to view Are Inherited Roth Ira Distributions Taxable?

- The majority are printed in PDF format. They is open with no cost software like Adobe Reader.

Roth IRA Withdrawal Rules Oblivious Investor

Rules For Inherited Roth IRAs Fee Only Fiduciary Financial Planning

Check more sample of Are Inherited Roth Ira Distributions Taxable below

Understanding Non Qualified Roth IRA Distributions

/shutterstock_240823573.Roth.IRA.cropped-fd86349be2cd4f42a0ea35dd6956813d.jpg)

2022 Rmd Calculator KatiaKaylan

IRA Beneficiary Options For Deaths Before January 1 2020 Ascensus

+1000px.jpg)

What Is A Roth IRA The Fancy Accountant

Roth IRA Withdrawals Read This First

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Schwab Inherited Ira Rmd Calculator NirvannaAnhad

https://www.marketwatch.com/story/if-i-inherit-a...

Most of the time yes It would be unusual for any taxes to be due on an RMD from an inherited Roth IRA The only portion of an inherited IRA that could be subject to tax is earnings

https://www.fool.com/retirement/plans/roth-ira/inherited

You can inherit a Roth individual retirement account IRA and avoid a lengthy court process known as probate as long as the person who passed away listed you as a beneficiary and you are still

Most of the time yes It would be unusual for any taxes to be due on an RMD from an inherited Roth IRA The only portion of an inherited IRA that could be subject to tax is earnings

You can inherit a Roth individual retirement account IRA and avoid a lengthy court process known as probate as long as the person who passed away listed you as a beneficiary and you are still

What Is A Roth IRA The Fancy Accountant

2022 Rmd Calculator KatiaKaylan

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Roth IRA Withdrawals Read This First

Schwab Inherited Ira Rmd Calculator NirvannaAnhad

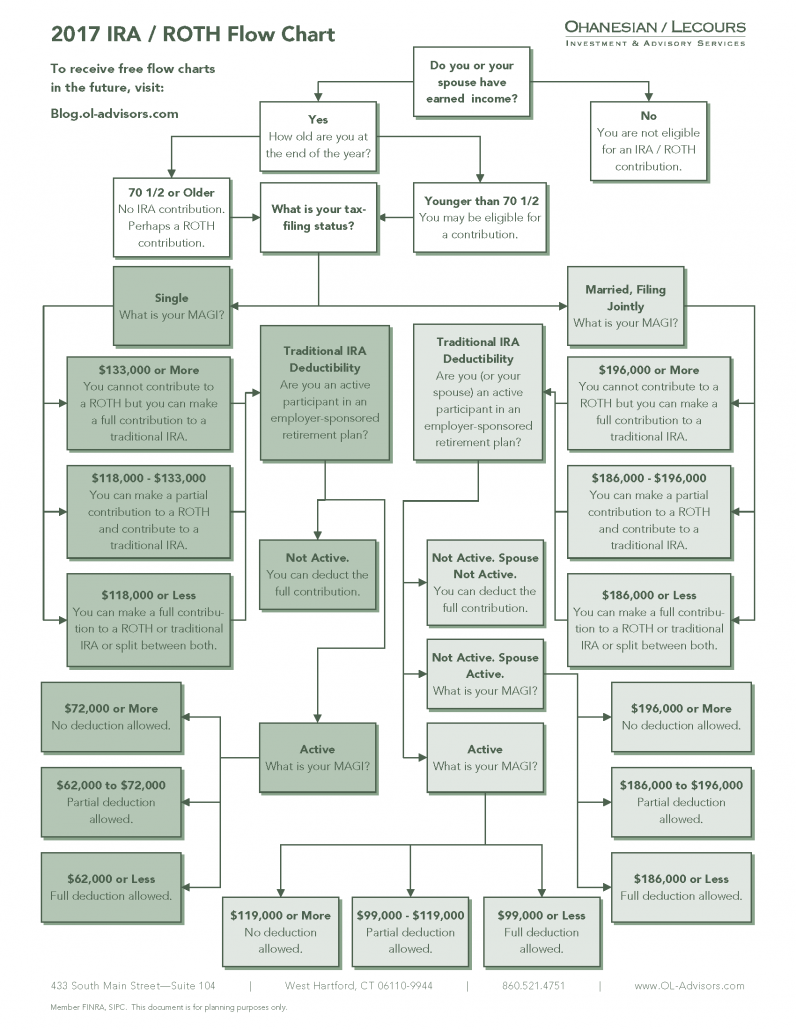

Visualizing IRA Rules Using Flowcharts

Roth IRA Rules Contribution Limits Deadlines Best Practice In HR

Roth IRA Rules Contribution Limits Deadlines Best Practice In HR

Inheriting An IRA From Your Spouse Know Your Options New Century