In this day and age with screens dominating our lives, the charm of tangible, printed materials hasn't diminished. For educational purposes and creative work, or simply to add personal touches to your area, Are Gift Cards Taxable Income In California have become a valuable resource. The following article is a take a dive deeper into "Are Gift Cards Taxable Income In California," exploring their purpose, where to find them and ways they can help you improve many aspects of your lives.

Get Latest Are Gift Cards Taxable Income In California Below

Are Gift Cards Taxable Income In California

Are Gift Cards Taxable Income In California -

Thus the default rule is that gifts provided to employees should be reported as taxable compensation but employers might be able to provide some gifts tax free under one of several exceptions Prop Regs Sec 1 102

Gifts are generally not considered taxable income for the recipient in California However if the gift generates income such as interest or dividends the recipient may be required to report

Are Gift Cards Taxable Income In California include a broad range of downloadable, printable resources available online for download at no cost. These printables come in different types, such as worksheets coloring pages, templates and many more. The appealingness of Are Gift Cards Taxable Income In California is in their versatility and accessibility.

More of Are Gift Cards Taxable Income In California

Are Gift Cards Taxable Income Sapling

Are Gift Cards Taxable Income Sapling

The revenue procedure states that to avoid disputes about the proper characterization of gift cards issued for returned goods provide better matching of income and costs and simplify recordkeeping the IRS will permit a

The Gift of Cash Gift Certificates or Gift Cards Cash is never a de minimis fringe benefit and always taxable no matter how little except in the limited cases of money paid for

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor the templates to meet your individual needs such as designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Downloads of educational content for free are designed to appeal to students from all ages, making them an invaluable source for educators and parents.

-

Convenience: Fast access a variety of designs and templates will save you time and effort.

Where to Find more Are Gift Cards Taxable Income In California

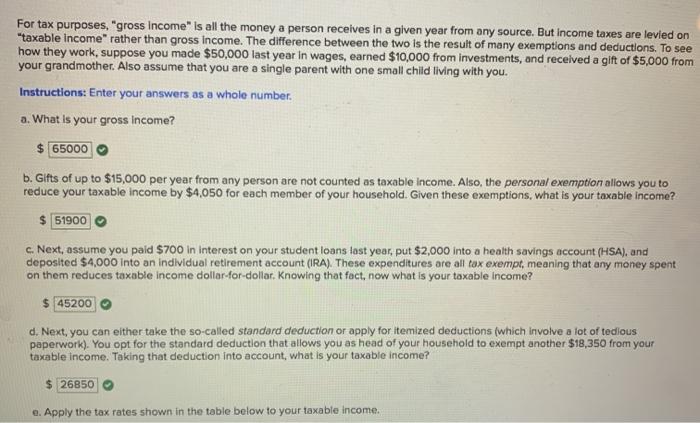

Solved E Apply The Tax Rates Shown In The Table Below To Chegg

Solved E Apply The Tax Rates Shown In The Table Below To Chegg

Some employers believe that gift cards are not taxable and qualify as excludable from income as a de minimis fringe benefit because they meet the example of traditional birthday or holidays

The current annual gift tax exclusion as of 2021 applies to assets up to 15 000 in value It is counted per recipient meaning you can give up to 15 000 to however many people you like without having to file a gift tax return

After we've peaked your interest in Are Gift Cards Taxable Income In California and other printables, let's discover where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Are Gift Cards Taxable Income In California for all reasons.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Are Gift Cards Taxable Income In California

Here are some innovative ways ensure you get the very most use of Are Gift Cards Taxable Income In California:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Are Gift Cards Taxable Income In California are a treasure trove of practical and imaginative resources for a variety of needs and passions. Their access and versatility makes them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast world of Are Gift Cards Taxable Income In California and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can print and download these resources at no cost.

-

Does it allow me to use free printables in commercial projects?

- It's all dependent on the rules of usage. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright violations with Are Gift Cards Taxable Income In California?

- Some printables may contain restrictions in use. Make sure to read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home using an printer, or go to a print shop in your area for better quality prints.

-

What software do I need to run printables at no cost?

- The majority are printed in the format of PDF, which can be opened using free software like Adobe Reader.

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Opinion The Real Tax Scandal Is What s Legal The New York Times

Check more sample of Are Gift Cards Taxable Income In California below

Are Gift Cards Taxable IRS Rules Explained

Best Gift Cards To Give For The Holidays 2017 Money

Are Gift Cards Taxable Taxation Examples More

What Income Is Subject To The 3 8 Medicare Tax

For Tax Purposes gross Income Is All The Money A Person Receives In

Are Gift Cards Taxable Employee Benefits

https://hermancelaw.com › blog › california-gift-tax

Gifts are generally not considered taxable income for the recipient in California However if the gift generates income such as interest or dividends the recipient may be required to report

https://www.taxes.ca.gov › sales_and_use_tax › whatstaxable.html

What Is Taxable Retail sales of tangible items in California are generally subject to sales tax Examples include furniture giftware toys antiques and clothing Some labor services and

Gifts are generally not considered taxable income for the recipient in California However if the gift generates income such as interest or dividends the recipient may be required to report

What Is Taxable Retail sales of tangible items in California are generally subject to sales tax Examples include furniture giftware toys antiques and clothing Some labor services and

What Income Is Subject To The 3 8 Medicare Tax

Best Gift Cards To Give For The Holidays 2017 Money

For Tax Purposes gross Income Is All The Money A Person Receives In

Are Gift Cards Taxable Employee Benefits

Are Gift Cards Taxable Income To Employees

Is There Tax On Gift Cards Are Gift Cards Taxable

Is There Tax On Gift Cards Are Gift Cards Taxable

Gift Cards Become Taxable Income When Gifted To An Employee Be