In this day and age where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education project ideas, artistic or simply adding an extra personal touch to your area, Are Fuel Reimbursements Taxable are a great resource. With this guide, you'll dive to the depths of "Are Fuel Reimbursements Taxable," exploring what they are, how to get them, as well as how they can improve various aspects of your daily life.

Get Latest Are Fuel Reimbursements Taxable Below

Are Fuel Reimbursements Taxable

Are Fuel Reimbursements Taxable -

Learn how to determine the tax treatment and reporting of employee fringe benefits such as health transportation education and more This publication covers the rules procedures and

Most travel reimbursements under an accountable plan are non taxable This means that if employees properly account for their expenses and return excess

Are Fuel Reimbursements Taxable offer a wide variety of printable, downloadable materials online, at no cost. They come in many styles, from worksheets to coloring pages, templates and much more. The beauty of Are Fuel Reimbursements Taxable is in their variety and accessibility.

More of Are Fuel Reimbursements Taxable

Non taxable Allowance For Transport Costs

Non taxable Allowance For Transport Costs

If your reimbursements are considered taxable income you can offset this income by claiming a deduction for the actual expense

Learn how to determine if employee reimbursements are taxable income based on the type of plan accountable or nonaccountable and the purpose of the expense Find out the rules guidelines and exceptions for different types of

Are Fuel Reimbursements Taxable have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize printables to your specific needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Value Educational printables that can be downloaded for free are designed to appeal to students of all ages. This makes them a great source for educators and parents.

-

The convenience of Quick access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Are Fuel Reimbursements Taxable

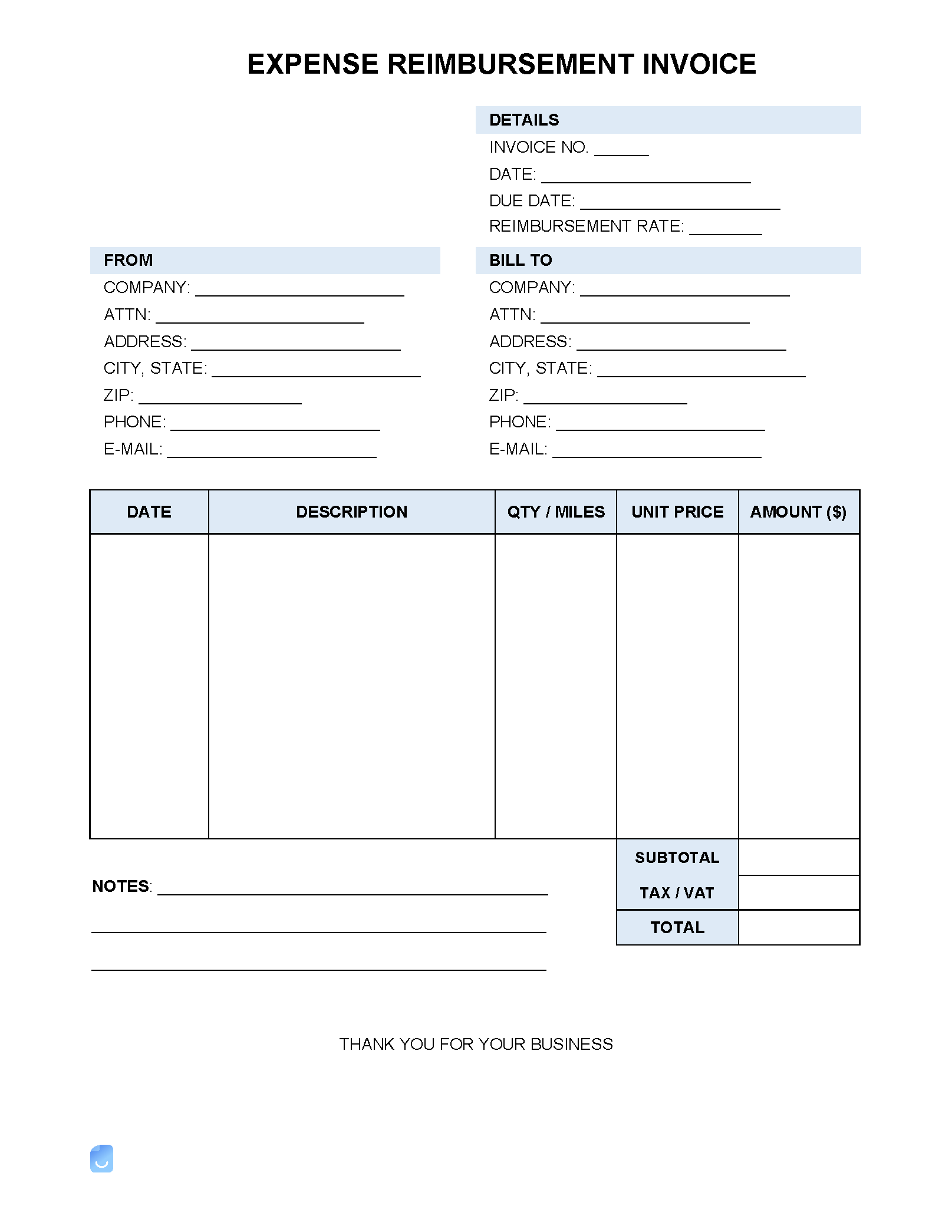

Expense Reimbursement Invoice Template Invoice Maker

Expense Reimbursement Invoice Template Invoice Maker

Are Reimbursements Taxable Paying wages to employees always involves withholding and contributing taxes but with reimbursements it all revolves around accountable and non accountable plans That s because

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that

Now that we've ignited your curiosity about Are Fuel Reimbursements Taxable Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Are Fuel Reimbursements Taxable for different goals.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing including flashcards, learning materials.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs are a vast variety of topics, including DIY projects to party planning.

Maximizing Are Fuel Reimbursements Taxable

Here are some inventive ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home for the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Fuel Reimbursements Taxable are an abundance of creative and practical resources designed to meet a range of needs and passions. Their accessibility and versatility make these printables a useful addition to the professional and personal lives of both. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Fuel Reimbursements Taxable truly free?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free printables for commercial uses?

- It's all dependent on the rules of usage. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables could have limitations on their use. Be sure to read the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home with either a printer or go to an area print shop for more high-quality prints.

-

What software do I need to open printables free of charge?

- The majority of printed documents are in PDF format. These can be opened with free software such as Adobe Reader.

Fuel Management System Fuel Card Management IntelliShift

Are Health Insurance Reimbursements Taxable HealthPlanRate

Check more sample of Are Fuel Reimbursements Taxable below

Are QSEHRA Reimbursements Taxable

Free Images Advertising Environment Industry Stadium Public

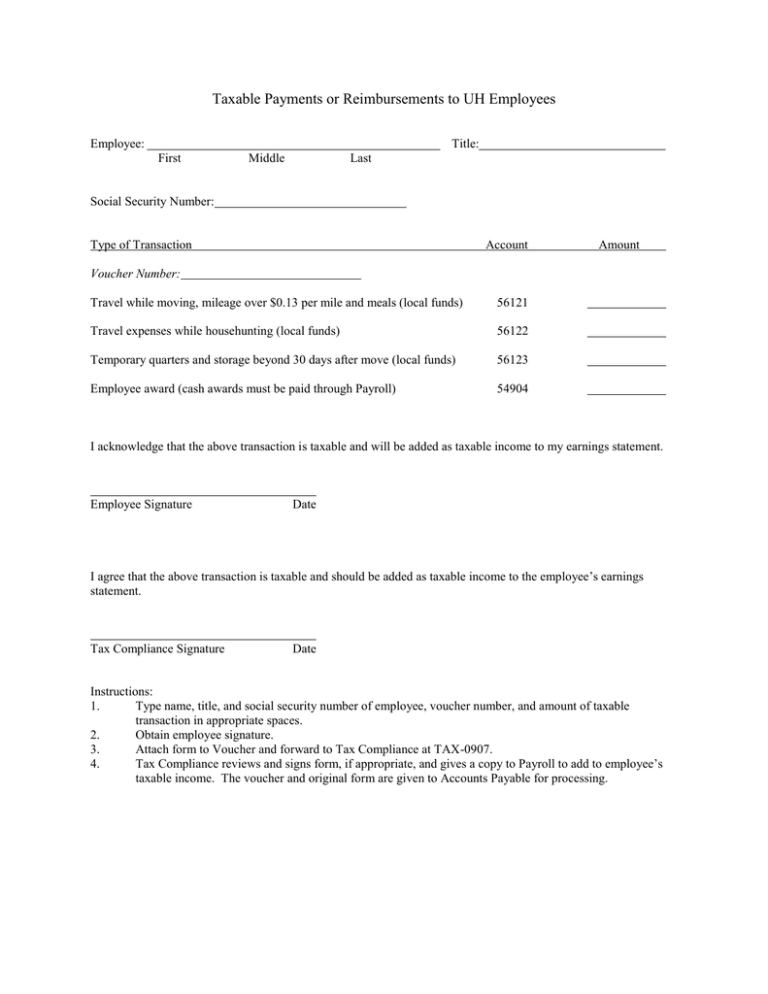

Taxable Payments Or Reimbursements To UH Employees

Fuel EPayCard

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

Are SECA And Income Tax Reimbursements Taxable

https://www.fylehq.com › blog › travel-expense-reimbursement

Most travel reimbursements under an accountable plan are non taxable This means that if employees properly account for their expenses and return excess

https://www.mburse.com › blog › should …

The short answer is Yes The way many companies administer their gas card or fuel reimbursement programs they absolutely should be taxing these expenditures But under certain conditions you can avoid taxation

Most travel reimbursements under an accountable plan are non taxable This means that if employees properly account for their expenses and return excess

The short answer is Yes The way many companies administer their gas card or fuel reimbursement programs they absolutely should be taxing these expenditures But under certain conditions you can avoid taxation

Fuel EPayCard

Free Images Advertising Environment Industry Stadium Public

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

Are SECA And Income Tax Reimbursements Taxable

Are Reimbursements Taxable IRS Guidelines On Reimbursements

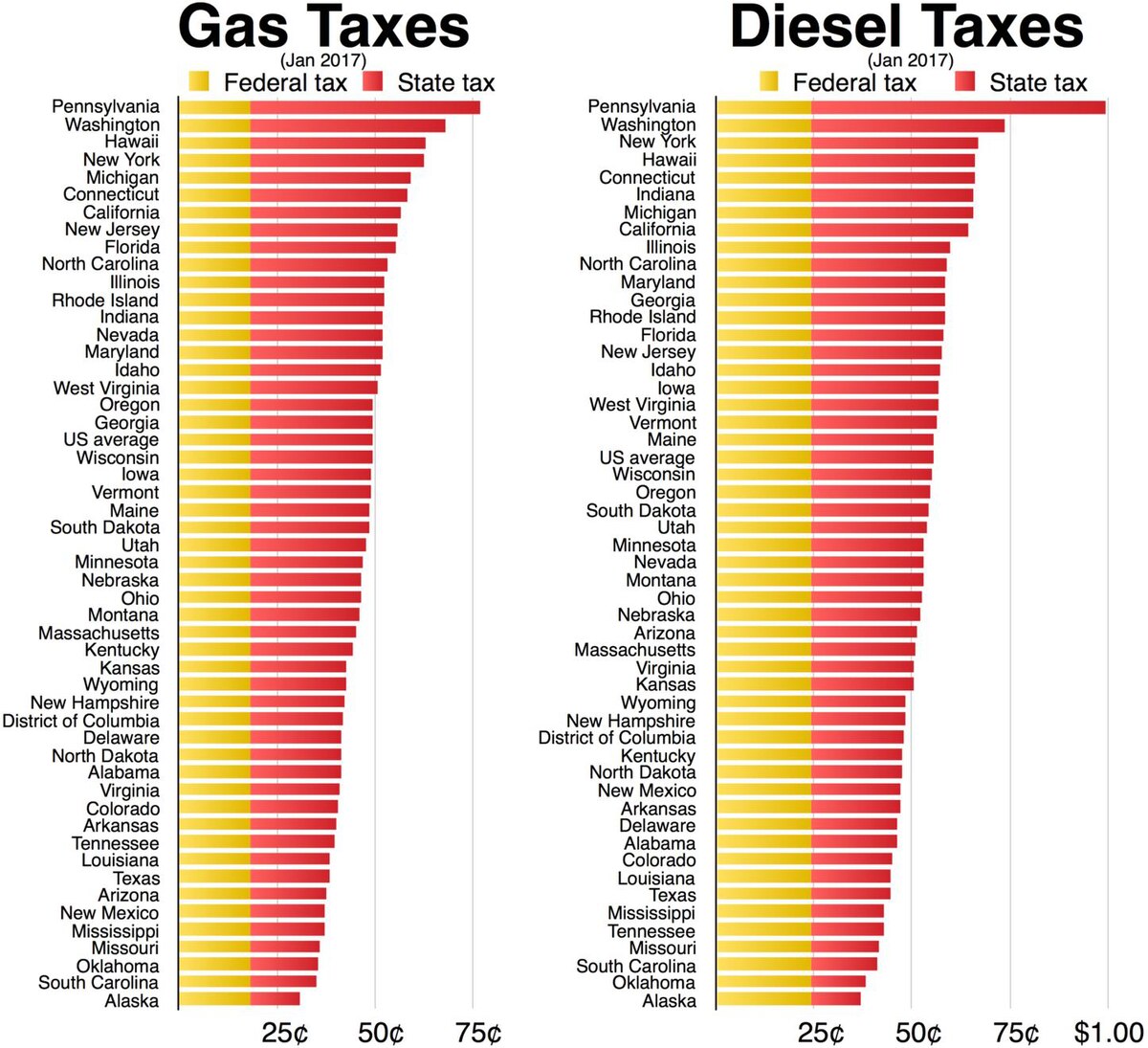

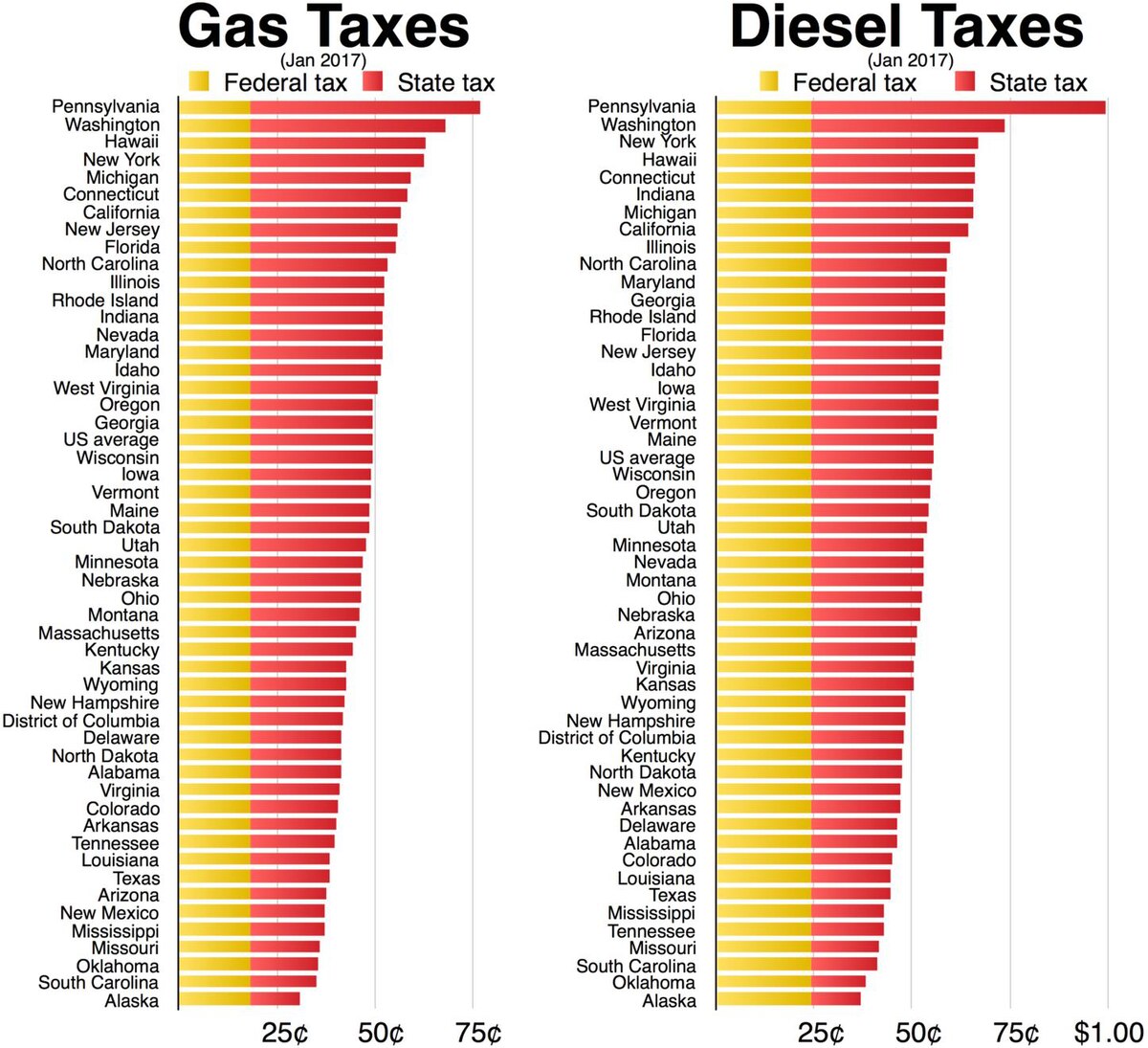

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Wiring Diagram Honda Manual Pdf