In this day and age in which screens are the norm it's no wonder that the appeal of tangible printed materials hasn't faded away. Be it for educational use and creative work, or simply to add an individual touch to the space, Are Federal Pensions Taxed In North Carolina are a great resource. We'll dive through the vast world of "Are Federal Pensions Taxed In North Carolina," exploring what they are, how to get them, as well as how they can enrich various aspects of your lives.

Get Latest Are Federal Pensions Taxed In North Carolina Below

Are Federal Pensions Taxed In North Carolina

Are Federal Pensions Taxed In North Carolina -

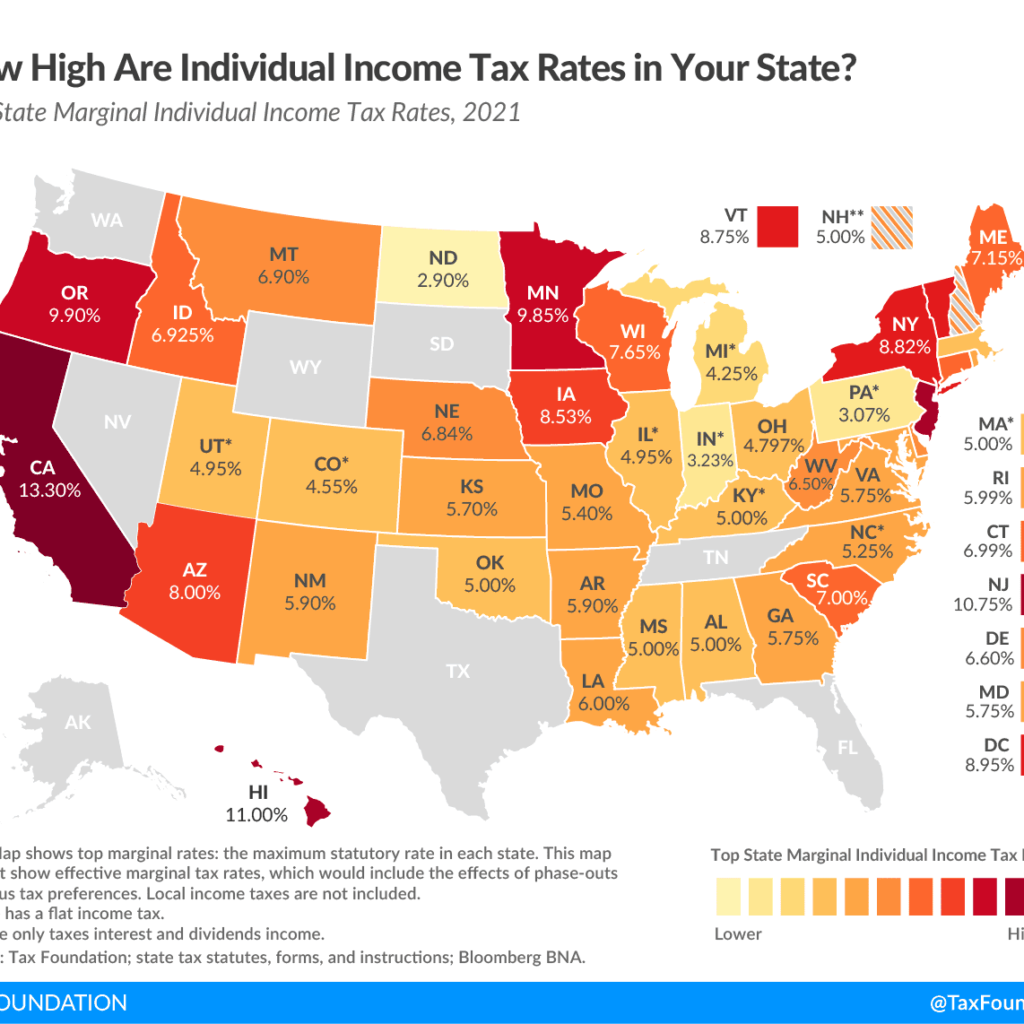

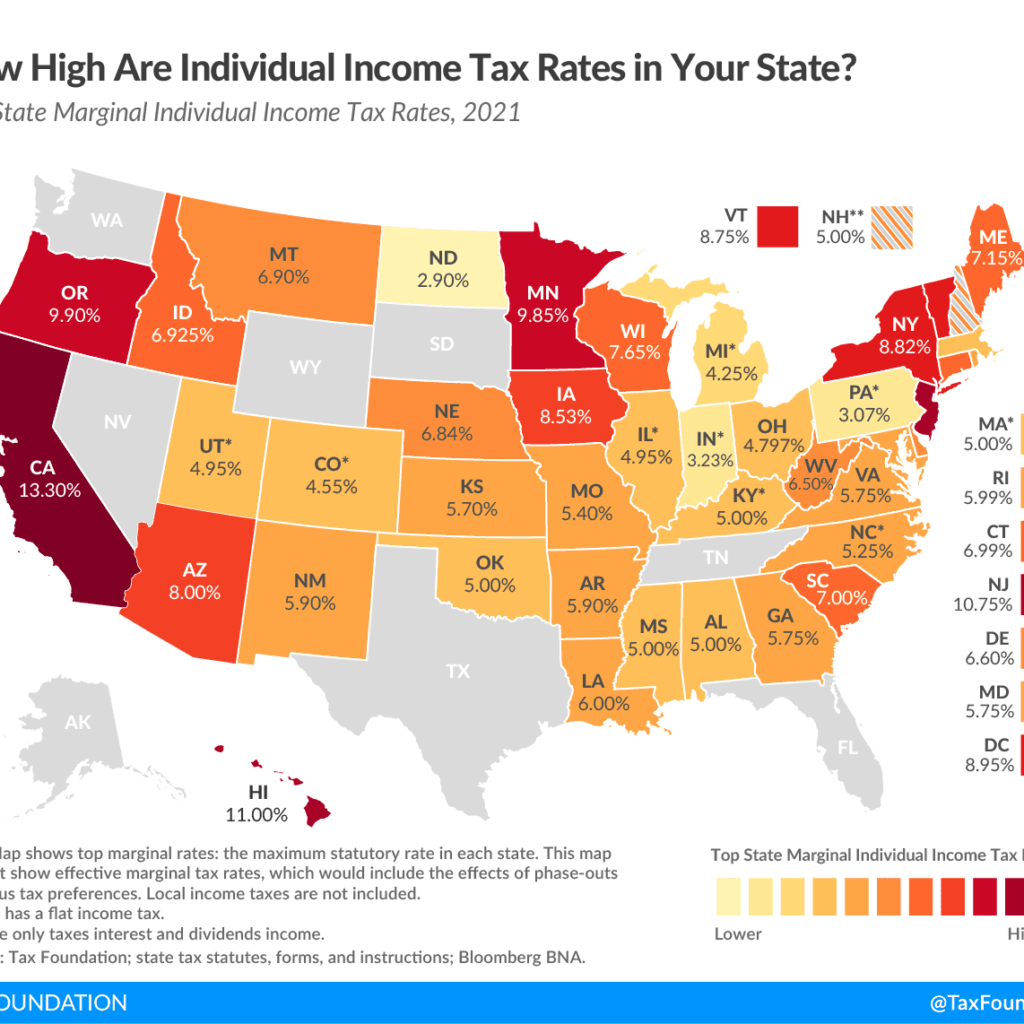

This alphabetical list provides an overview of how income from employment investments a pension retirement distributions and Social Security are taxed in every state and the District of

North Carolina exempts all Social Security retirement benefits from income taxes Other forms of retirement income are taxed at the North Carolina flat income tax rate of 4 75 Other taxes seniors and retirees in North Carolina may have to pay include the state s sales and property taxes both of which are moderate

Are Federal Pensions Taxed In North Carolina cover a large range of printable, free items that are available online at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and more. The attraction of printables that are free is in their versatility and accessibility.

More of Are Federal Pensions Taxed In North Carolina

Free North Carolina Veterans Month Events

Free North Carolina Veterans Month Events

In North Carolina all Social Security and Railroad Retirement benefits are exempt from state income taxes which is a great advantage for retirees relying on these sources of income There is also no inheritance tax estate tax or

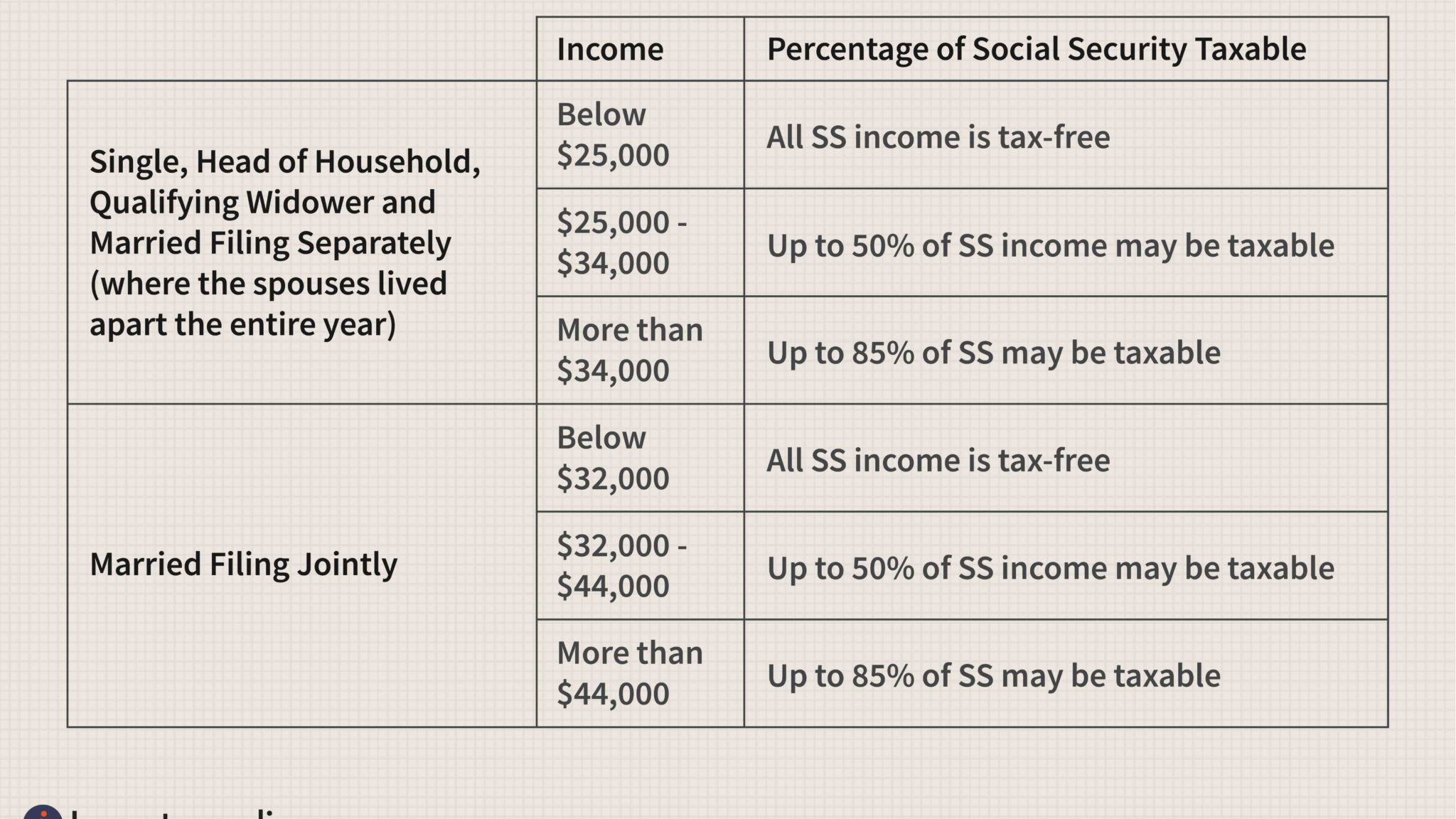

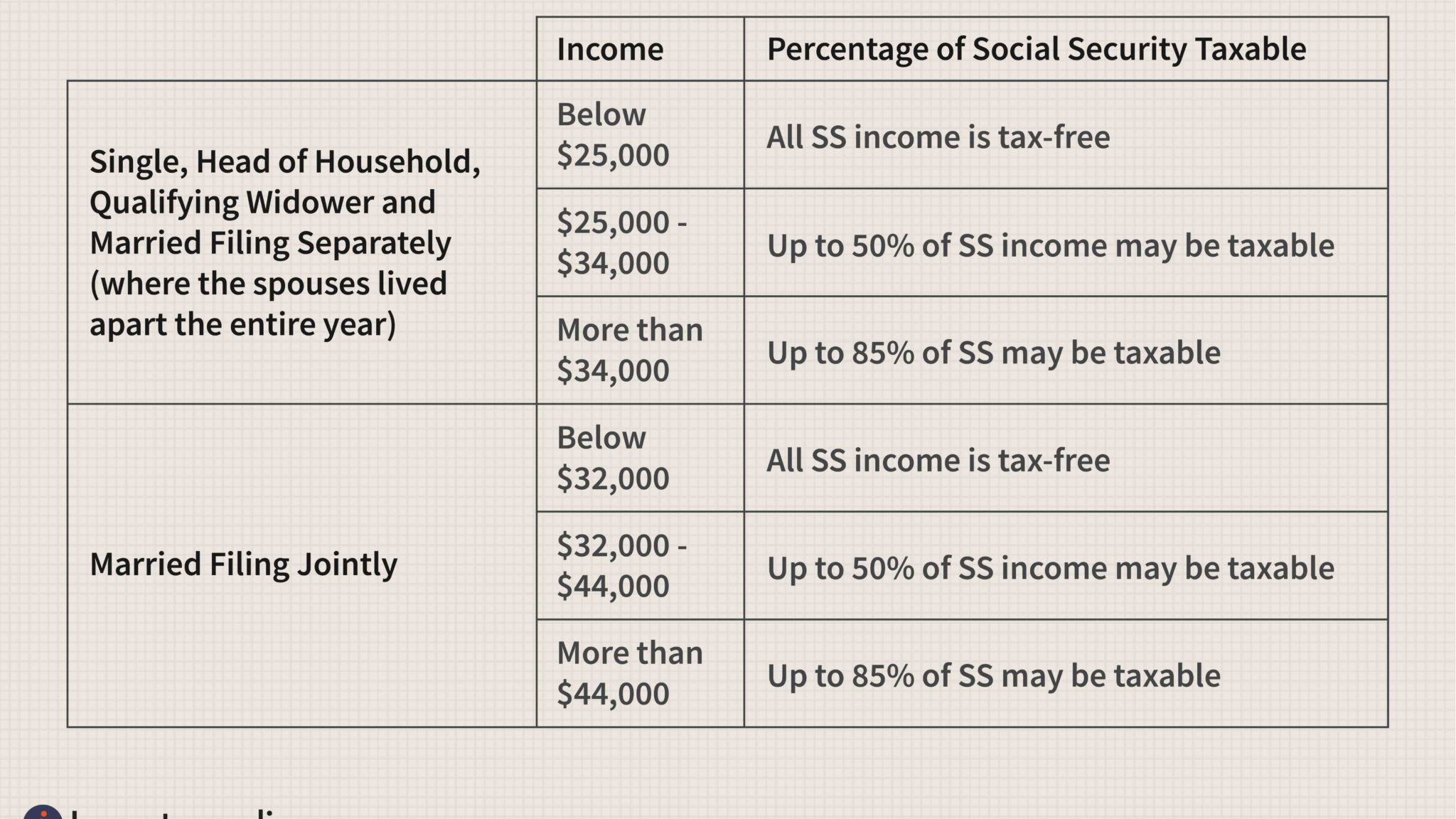

The majority of states do not charge Social Security benefits taxes including North Carolina You do have to watch out for the taxes on retirement benefit distributions and pensions though These are taxed in North Carolina if your adjusted gross income is more than Single 10 750 Married Filing Joint Return 21 500

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: They can make printed materials to meet your requirements be it designing invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them an essential aid for parents as well as educators.

-

Accessibility: Access to various designs and templates saves time and effort.

Where to Find more Are Federal Pensions Taxed In North Carolina

How Are US Pensions Taxed In Canada

How Are US Pensions Taxed In Canada

As soon as you begin taking payments from your retirement accounts and pension funds the federal government will charge you an income tax Because this tax occurs during retirement it will not apply when you receive your payment beforehand

Federal Taxes Unless you specify a monthly withholding rate or amount for federal taxes your pension account will default to the rate of married with three allowances If you have already designated a withholding preference no action is required

Now that we've ignited your interest in Are Federal Pensions Taxed In North Carolina, let's explore where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Are Federal Pensions Taxed In North Carolina for a variety objectives.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide variety of topics, everything from DIY projects to planning a party.

Maximizing Are Federal Pensions Taxed In North Carolina

Here are some fresh ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are Federal Pensions Taxed In North Carolina are an abundance of innovative and useful resources designed to meet a range of needs and pursuits. Their access and versatility makes them a wonderful addition to each day life. Explore the plethora of Are Federal Pensions Taxed In North Carolina today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I download free printouts for commercial usage?

- It's all dependent on the terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may contain restrictions regarding usage. Be sure to read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using any printer or head to any local print store for better quality prints.

-

What program do I require to open printables at no cost?

- Most PDF-based printables are available in the format PDF. This is open with no cost software, such as Adobe Reader.

Valuing Pension Rights On Divorce Bowcock Cuerden

Pension Re enrolment Is Here EPayMe

Check more sample of Are Federal Pensions Taxed In North Carolina below

How Much Will My Pension Be Taxed In South Carolina Retire Gen Z

Is Federal Pension Taxed Government Deal Funding

Workers Pension Fund Not For Borrowing NLC Warn Governors

Finally No More Income Tax On Military Pensions In North Carolina

North Carolina Governor Signs Law Declaring Body Camera Footage Will

Local Government Pensions The 95k Cap On Exit Payments

https://smartasset.com/retirement/north-carolina-retirement-taxes

North Carolina exempts all Social Security retirement benefits from income taxes Other forms of retirement income are taxed at the North Carolina flat income tax rate of 4 75 Other taxes seniors and retirees in North Carolina may have to pay include the state s sales and property taxes both of which are moderate

https://support.taxslayer.com/hc/en-us/articles/...

North Carolina cannot tax certain retirement benefits received by retirees or by beneficiaries of retirees of the U S government and the state of North Carolina and its local governments as a result of the North Carolina Supreme Court s decision in

North Carolina exempts all Social Security retirement benefits from income taxes Other forms of retirement income are taxed at the North Carolina flat income tax rate of 4 75 Other taxes seniors and retirees in North Carolina may have to pay include the state s sales and property taxes both of which are moderate

North Carolina cannot tax certain retirement benefits received by retirees or by beneficiaries of retirees of the U S government and the state of North Carolina and its local governments as a result of the North Carolina Supreme Court s decision in

Finally No More Income Tax On Military Pensions In North Carolina

Is Federal Pension Taxed Government Deal Funding

North Carolina Governor Signs Law Declaring Body Camera Footage Will

Local Government Pensions The 95k Cap On Exit Payments

North Carolina State Taxes Taxed Right

The Federal Insurance Fund Protecting Millions Of Pensions Is Running

The Federal Insurance Fund Protecting Millions Of Pensions Is Running

Sales Tax By State Here s How Much You re Really Paying Sales Tax