In this day and age when screens dominate our lives and the appeal of physical printed products hasn't decreased. Whatever the reason, whether for education, creative projects, or simply adding an element of personalization to your home, printables for free are now a vital resource. This article will take a dive into the world "Are Federal Employee Retirement Benefits Taxable," exploring the benefits of them, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Are Federal Employee Retirement Benefits Taxable Below

Are Federal Employee Retirement Benefits Taxable

Are Federal Employee Retirement Benefits Taxable -

Federal employees hired on or after 1984 are covered by the Federal Employee Pension Benefits System FERS CSRS and FERS participants must contribute money to their pensions through a payroll tax This

This publication explains how the federal income tax rules apply to civil service retirement benefits received by retired federal employees including those disabled or their

Are Federal Employee Retirement Benefits Taxable encompass a wide array of printable materials available online at no cost. These resources come in many styles, from worksheets to templates, coloring pages, and much more. The appealingness of Are Federal Employee Retirement Benefits Taxable lies in their versatility and accessibility.

More of Are Federal Employee Retirement Benefits Taxable

Weekly Quiz 29 Federal Employee Retirement Benefits

Weekly Quiz 29 Federal Employee Retirement Benefits

The TSP for federal employees Salary reduction simplified employee pension plans SARSEP plans Savings incentive match plans for employees SIMPLE plans Tax

Federal employees and retirees will encounter taxes on benefits they receive spanning Social Security annuities insurance premiums and health savings accounts Taxes on

Are Federal Employee Retirement Benefits Taxable have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Customization: We can customize printables to fit your particular needs for invitations, whether that's creating them making your schedule, or even decorating your house.

-

Educational Worth: Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a useful tool for parents and teachers.

-

The convenience of The instant accessibility to the vast array of design and templates reduces time and effort.

Where to Find more Are Federal Employee Retirement Benefits Taxable

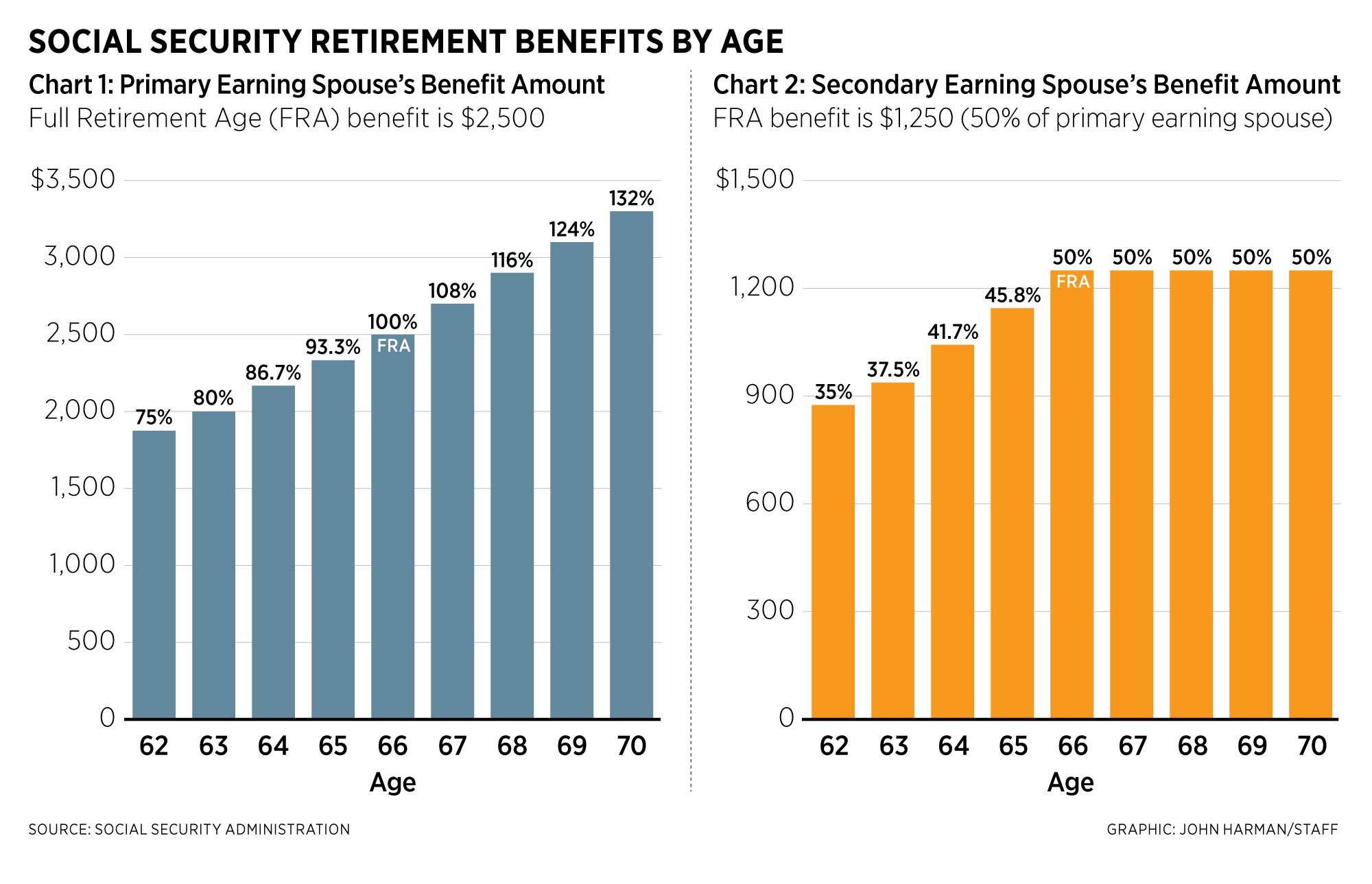

Is Social Security Taxable Retirement Benefits Institute

Is Social Security Taxable Retirement Benefits Institute

Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security

Like other types of income retirement income is subject to federal income tax rules This column is the first of six FEDZONE columns discussing how the IRS taxes federal retirement benefits This column

We hope we've stimulated your interest in Are Federal Employee Retirement Benefits Taxable Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Are Federal Employee Retirement Benefits Taxable for a variety applications.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free with flashcards and other teaching tools.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a wide spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Are Federal Employee Retirement Benefits Taxable

Here are some creative ways in order to maximize the use of Are Federal Employee Retirement Benefits Taxable:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Federal Employee Retirement Benefits Taxable are a treasure trove of creative and practical resources that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make them an essential part of your professional and personal life. Explore the endless world of Are Federal Employee Retirement Benefits Taxable to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use free printables to make commercial products?

- It's dependent on the particular terms of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Are Federal Employee Retirement Benefits Taxable?

- Certain printables may be subject to restrictions on use. Be sure to read the terms and regulations provided by the designer.

-

How do I print Are Federal Employee Retirement Benefits Taxable?

- Print them at home with either a printer or go to the local print shop for high-quality prints.

-

What program will I need to access printables at no cost?

- The majority of PDF documents are provided in the PDF format, and can be opened using free software, such as Adobe Reader.

How Federal Employee Retirement Benefits Are Taxed By The IRS Part III

Questions To Help You Start Planning For Retirement

Check more sample of Are Federal Employee Retirement Benefits Taxable below

Social Security Retirement Age Chart Early Retirement

Federal Employee Retirement Claims Fall In March Pay Benefits

How Much Does A Gs 14 Make In Retirement Greatsenioryears

Federal Employee Retirement Basics

Are Retirement Benefits Taxable

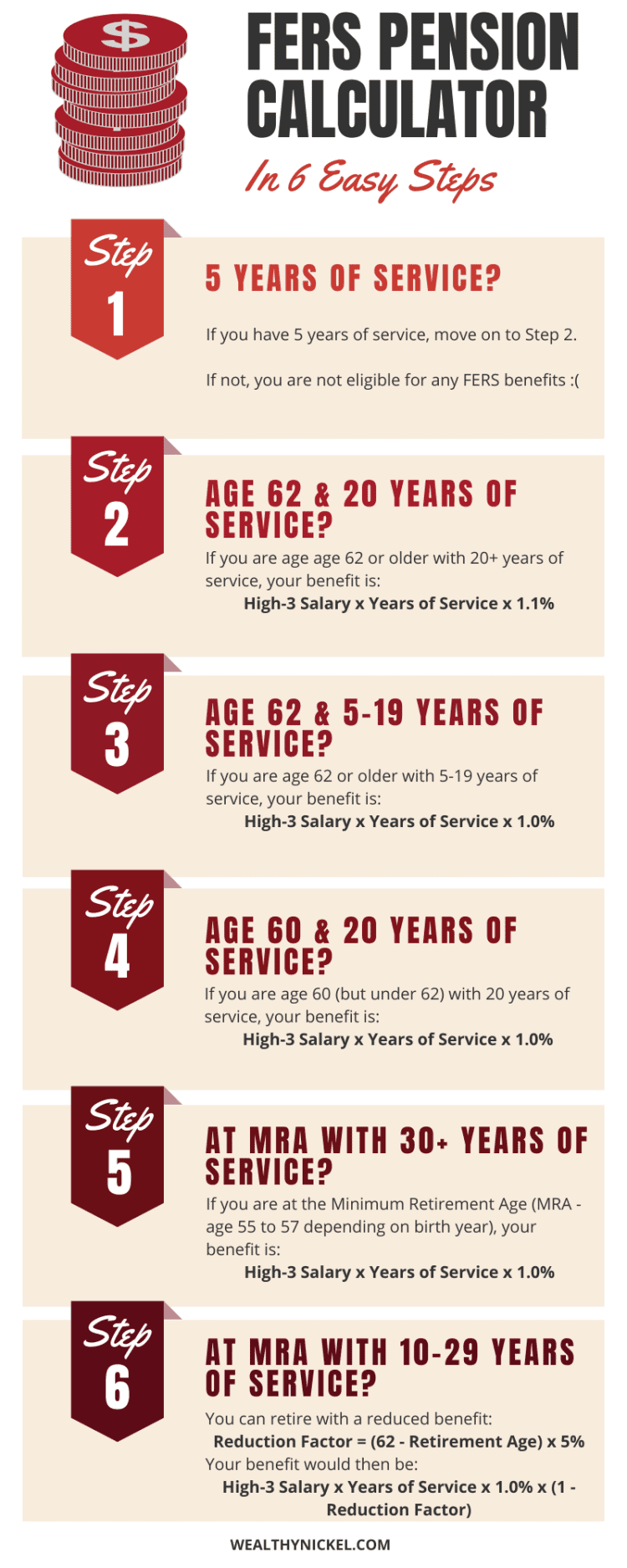

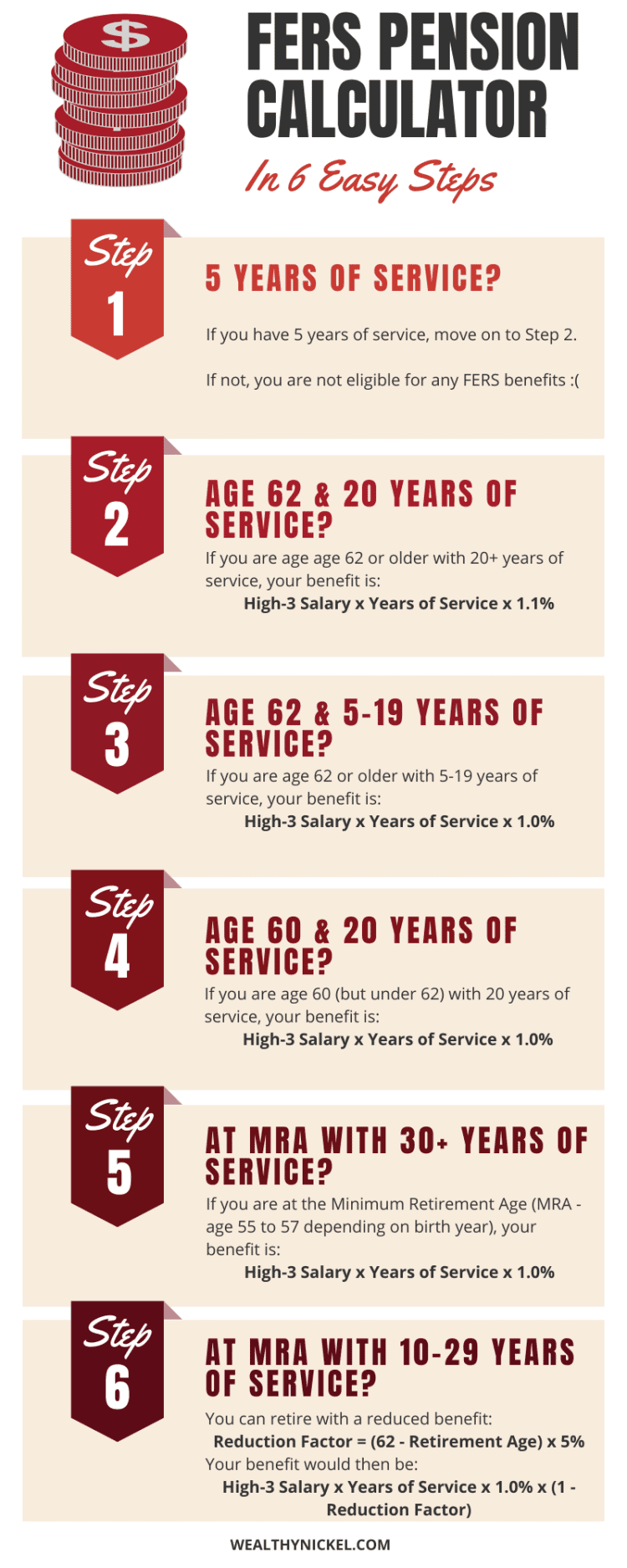

FERS Retirement Calculator 6 Steps To Estimate Your Federal Pension

https://www.irs.gov/publications/p721

This publication explains how the federal income tax rules apply to civil service retirement benefits received by retired federal employees including those disabled or their

https://plan-your-federal-retirement.com/taxation...

Federal employees sometimes forget that their federal retirement pension is taxable Your CSRS or FERS Pension will be taxed at ordinary income tax rates Now you will

This publication explains how the federal income tax rules apply to civil service retirement benefits received by retired federal employees including those disabled or their

Federal employees sometimes forget that their federal retirement pension is taxable Your CSRS or FERS Pension will be taxed at ordinary income tax rates Now you will

Federal Employee Retirement Basics

Federal Employee Retirement Claims Fall In March Pay Benefits

Are Retirement Benefits Taxable

FERS Retirement Calculator 6 Steps To Estimate Your Federal Pension

Federal Employees Retirement Benefits Institute LLC

Free Retirement Guide For Federal Employees My Federal Plan Federal

Free Retirement Guide For Federal Employees My Federal Plan Federal

Taxes In Retirement Retirement Benefits Institute Federal