In this age of technology, where screens rule our lives yet the appeal of tangible printed materials hasn't faded away. For educational purposes or creative projects, or simply adding the personal touch to your space, Are Federal Employee Pensions Taxed have become a valuable source. Through this post, we'll dive deep into the realm of "Are Federal Employee Pensions Taxed," exploring the different types of printables, where you can find them, and how they can enrich various aspects of your life.

Get Latest Are Federal Employee Pensions Taxed Below

Are Federal Employee Pensions Taxed

Are Federal Employee Pensions Taxed -

Federal employees sometimes forget that their federal retirement pension is taxable Your CSRS or FERS Pension will be taxed at ordinary income tax rates Now you will get your contributions back tax free since you already paid taxes on the money when it was taken out of your pay check

Your pension could be fully or partially taxable depending on how the money was put into the pension plan If all the money was contributed by the employer or the money was not taxed before going into the plan pre tax it would be taxable

Are Federal Employee Pensions Taxed include a broad selection of printable and downloadable materials that are accessible online for free cost. These resources come in various kinds, including worksheets coloring pages, templates and much more. The value of Are Federal Employee Pensions Taxed lies in their versatility as well as accessibility.

More of Are Federal Employee Pensions Taxed

Workers Pension Fund Not For Borrowing NLC Warn Governors

Workers Pension Fund Not For Borrowing NLC Warn Governors

This publication explains how the federal income tax rules apply to civil service retirement benefits received by retired federal employees including those disabled or their survivors These benefits are paid primarily under the Civil Service Retirement System CSRS or the Federal Employees Retirement System FERS

Payments from private and government pensions are usually taxable at your ordinary income rate Rubio says Pensions are normally taxed on the federal side

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization This allows you to modify print-ready templates to your specific requirements be it designing invitations to organize your schedule or even decorating your home.

-

Education Value Printing educational materials for no cost provide for students of all ages, making these printables a powerful instrument for parents and teachers.

-

It's easy: Quick access to an array of designs and templates saves time and effort.

Where to Find more Are Federal Employee Pensions Taxed

Pensions Bulletin 2023 36 Lane Clark Peacock LLP

Pensions Bulletin 2023 36 Lane Clark Peacock LLP

Federal employees hired on or after 1984 are covered by the Federal Employee Pension Benefits System FERS CSRS and FERS participants must contribute money to their pensions through a payroll tax This money goes into the Civil Service Retirement and Disability Fund CSRDF

The vast majority of your FERS annuity will be federally taxable You will not be taxed on the portion of your FERS annuity that is due to your already taxed contributions but because you

Now that we've ignited your interest in Are Federal Employee Pensions Taxed Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Are Federal Employee Pensions Taxed for different goals.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide range of topics, all the way from DIY projects to party planning.

Maximizing Are Federal Employee Pensions Taxed

Here are some unique ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Are Federal Employee Pensions Taxed are a treasure trove filled with creative and practical information that cater to various needs and passions. Their access and versatility makes these printables a useful addition to every aspect of your life, both professional and personal. Explore the wide world of Are Federal Employee Pensions Taxed to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes, they are! You can download and print these tools for free.

-

Can I use free printables for commercial uses?

- It depends on the specific rules of usage. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright concerns with Are Federal Employee Pensions Taxed?

- Some printables could have limitations on usage. Be sure to check the terms of service and conditions provided by the creator.

-

How do I print Are Federal Employee Pensions Taxed?

- You can print them at home with either a printer at home or in an in-store print shop to get higher quality prints.

-

What software do I require to open printables for free?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software, such as Adobe Reader.

How To Assess If You re Mentally Ready For Retirement Vision Retirement

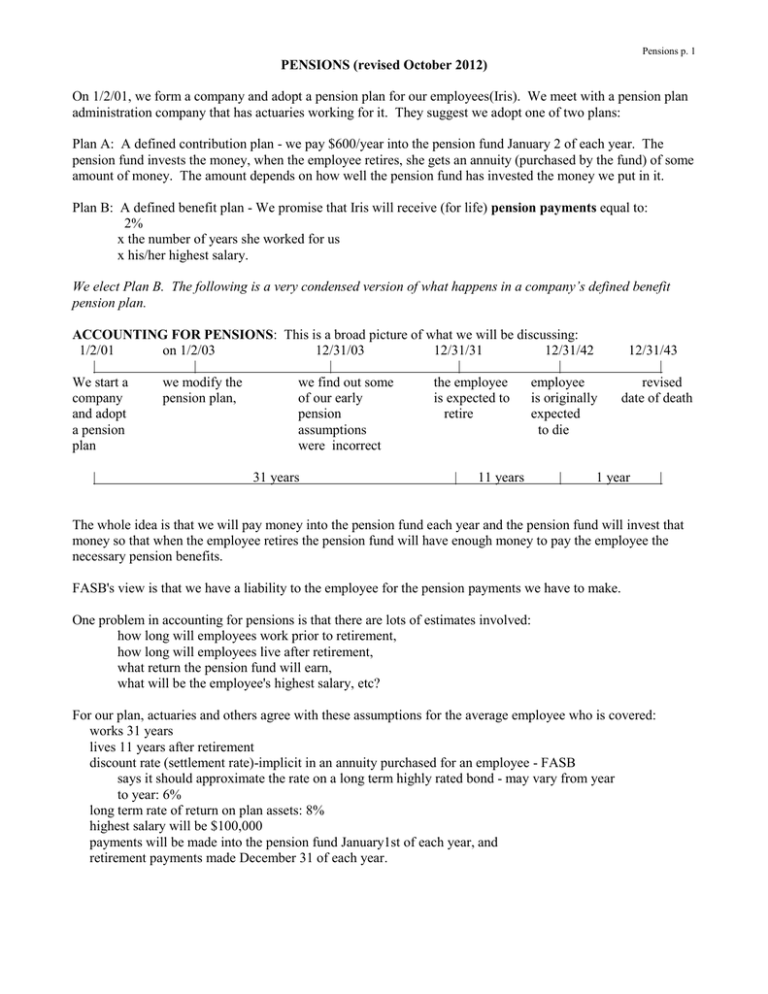

PENSIONS

Check more sample of Are Federal Employee Pensions Taxed below

Do Federal Retirees Need Medicare Part B ClearMatch Medicare

Pensions F d rales

Kentucky Teachers Defend A Broken Pension System National Review

Pensions The Table Reopens This Is Why There Will Be No Reform In

Sovereign Pensions International Pension Services Offshore Pensions

Beneficiaries Could See Inherited Pensions Taxed As New Proposals By

https://www.irs.gov › pub › irs-pdf

Your pension could be fully or partially taxable depending on how the money was put into the pension plan If all the money was contributed by the employer or the money was not taxed before going into the plan pre tax it would be taxable

https://www.fedsmith.com › taxes-federal...

Federal Pensions As a federal employee you are contributing to your pension CSRS or FERS out of already taxed dollars You will not be double taxed on your contributions You will be taxed on the government s untaxed contributions as well as on the earnings that accrue on both your contributions and the government s contributions

Your pension could be fully or partially taxable depending on how the money was put into the pension plan If all the money was contributed by the employer or the money was not taxed before going into the plan pre tax it would be taxable

Federal Pensions As a federal employee you are contributing to your pension CSRS or FERS out of already taxed dollars You will not be double taxed on your contributions You will be taxed on the government s untaxed contributions as well as on the earnings that accrue on both your contributions and the government s contributions

Pensions The Table Reopens This Is Why There Will Be No Reform In

Pensions F d rales

Sovereign Pensions International Pension Services Offshore Pensions

Beneficiaries Could See Inherited Pensions Taxed As New Proposals By

Employee Benefits Free Of Charge Creative Commons Office Worker

Act Now To Maximise Your Pension Contributions

Act Now To Maximise Your Pension Contributions

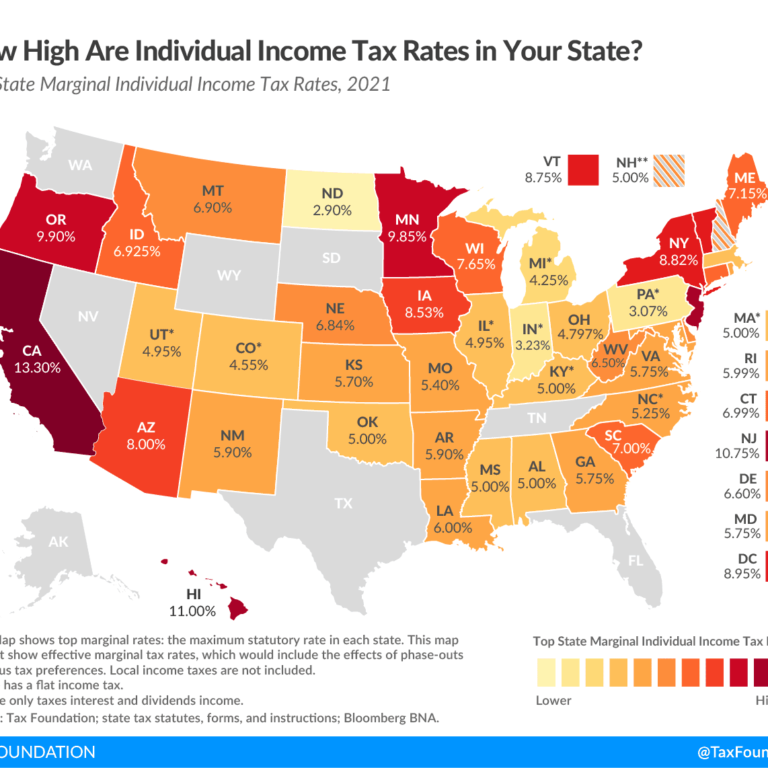

What States Do Not Tax Federal Pensions Government Deal Funding