In this age of electronic devices, when screens dominate our lives but the value of tangible printed material hasn't diminished. No matter whether it's for educational uses project ideas, artistic or just adding an element of personalization to your area, Are Employer Pension Contributions Tax Free are now a useful source. With this guide, you'll dive to the depths of "Are Employer Pension Contributions Tax Free," exploring what they are, where they can be found, and how they can add value to various aspects of your daily life.

Get Latest Are Employer Pension Contributions Tax Free Below

Are Employer Pension Contributions Tax Free

Are Employer Pension Contributions Tax Free -

So for every 1 000 they receive 280 is deducted They can add the 720 they re left with to a pension and receive tax relief but they can t reclaim any National Insurance Tax rules can

Employer s obligations Ty el ke fi Statutory earnings related pension contributions charged from the employee s wage are paid by employers and employees in both the private and public sectors The earnings related pension contribution withheld from the employee is the same under all pension acts and depends on the age of the employee

Printables for free include a vast assortment of printable, downloadable items that are available online at no cost. They are available in numerous forms, including worksheets, coloring pages, templates and many more. The appeal of printables for free is in their versatility and accessibility.

More of Are Employer Pension Contributions Tax Free

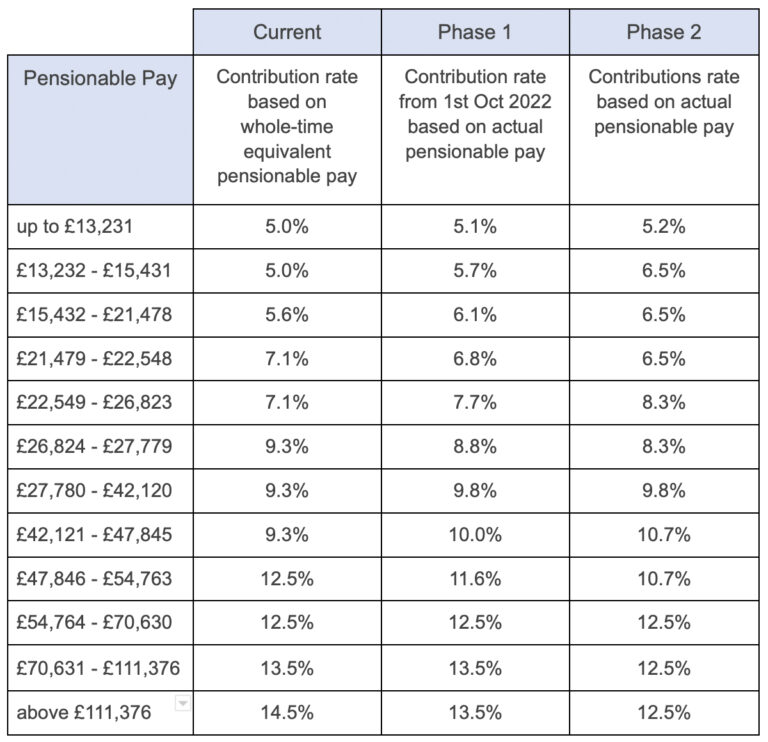

Changes In NHS Pension Contributions Are You A Winner Or Loser

Changes In NHS Pension Contributions Are You A Winner Or Loser

Your private pension contributions are tax free up to certain limits This applies to most private pension schemes for example workplace pensions personal and stakeholder pensions overseas

Home Pensions retirement Tax and pensions Tax relief on pension contributions There are two ways you can get tax relief on your pension contributions If you re in a workplace pension scheme your employer chooses which method to use and must apply it to all staff Find out how tax relief works here What s in this guide

Are Employer Pension Contributions Tax Free have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: You can tailor printed materials to meet your requirements whether it's making invitations to organize your schedule or even decorating your house.

-

Educational Value: Free educational printables cater to learners of all ages. This makes them a valuable source for educators and parents.

-

Convenience: Instant access to numerous designs and templates, which saves time as well as effort.

Where to Find more Are Employer Pension Contributions Tax Free

OS Payroll Your P60 Document Explained

OS Payroll Your P60 Document Explained

Tax relief on your employer s contributions Usually you would have to pay Income Tax on money you receive from your employer But if the money is going into your pension as an employer pension contribution no tax or national insurance is deducted from your employer pension contributions

Tax relief on employer pension contributions When are contributions to a registered pension scheme by an employer allowable as a deduction in computing trade profits Like any business expense to be an allowable deduction against profits pension contributions have to be made wholly and exclusively for the purposes of the business

Since we've got your interest in printables for free Let's find out where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Are Employer Pension Contributions Tax Free designed for a variety objectives.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free or flashcards as well as learning materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Are Employer Pension Contributions Tax Free

Here are some innovative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are Employer Pension Contributions Tax Free are an abundance of creative and practical resources designed to meet a range of needs and pursuits. Their availability and versatility make them a valuable addition to both professional and personal lives. Explore the vast array that is Are Employer Pension Contributions Tax Free today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Employer Pension Contributions Tax Free really completely free?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printables for commercial use?

- It is contingent on the specific rules of usage. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns with Are Employer Pension Contributions Tax Free?

- Some printables may come with restrictions on use. Make sure to read the terms and conditions set forth by the author.

-

How can I print Are Employer Pension Contributions Tax Free?

- You can print them at home using either a printer at home or in a local print shop to purchase higher quality prints.

-

What program do I require to view printables at no cost?

- The majority are printed in PDF format, which can be opened using free software like Adobe Reader.

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

Employer Pension Contributions Calculator Factorial

Check more sample of Are Employer Pension Contributions Tax Free below

EMPLOYER PENSION CONTRIBUTIONS IN IRELAND

Tax Relief On Pension Contributions FKGB Accounting

Employer Contribution May Be Tax Free Under National Pension Scheme

Pension Tax Relief In The United Kingdom UK Pension Help

The Importance Of Employer Pension Contributions

How Pension Contributions Work

https://www.etk.fi/.../financing-and-investments/pension-contributions

Employer s obligations Ty el ke fi Statutory earnings related pension contributions charged from the employee s wage are paid by employers and employees in both the private and public sectors The earnings related pension contribution withheld from the employee is the same under all pension acts and depends on the age of the employee

https://www.which.co.uk/money/pensions-and...

Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief

Employer s obligations Ty el ke fi Statutory earnings related pension contributions charged from the employee s wage are paid by employers and employees in both the private and public sectors The earnings related pension contribution withheld from the employee is the same under all pension acts and depends on the age of the employee

Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief

Pension Tax Relief In The United Kingdom UK Pension Help

Tax Relief On Pension Contributions FKGB Accounting

The Importance Of Employer Pension Contributions

How Pension Contributions Work

More Pension Transfers Help Spur 17 Rise In Pension Payouts

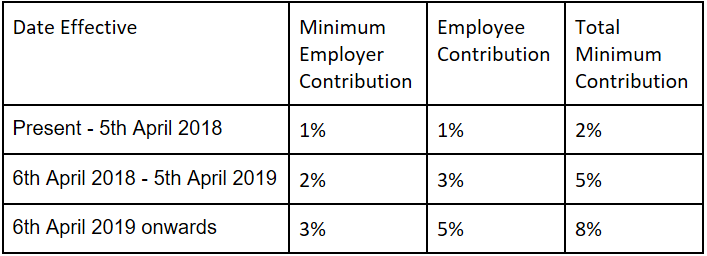

Minimum Pension Contributions Will Increase On The 6th April 2018

Minimum Pension Contributions Will Increase On The 6th April 2018

Employer Pension Contributions Tax Relief Haines Watts