In this age of technology, with screens dominating our lives The appeal of tangible printed items hasn't gone away. For educational purposes or creative projects, or simply adding some personal flair to your space, Are Early Retirement Distributions Taxable In Pa have become an invaluable resource. In this article, we'll dive in the world of "Are Early Retirement Distributions Taxable In Pa," exploring the benefits of them, where they are, and how they can add value to various aspects of your lives.

Get Latest Are Early Retirement Distributions Taxable In Pa Below

Are Early Retirement Distributions Taxable In Pa

Are Early Retirement Distributions Taxable In Pa -

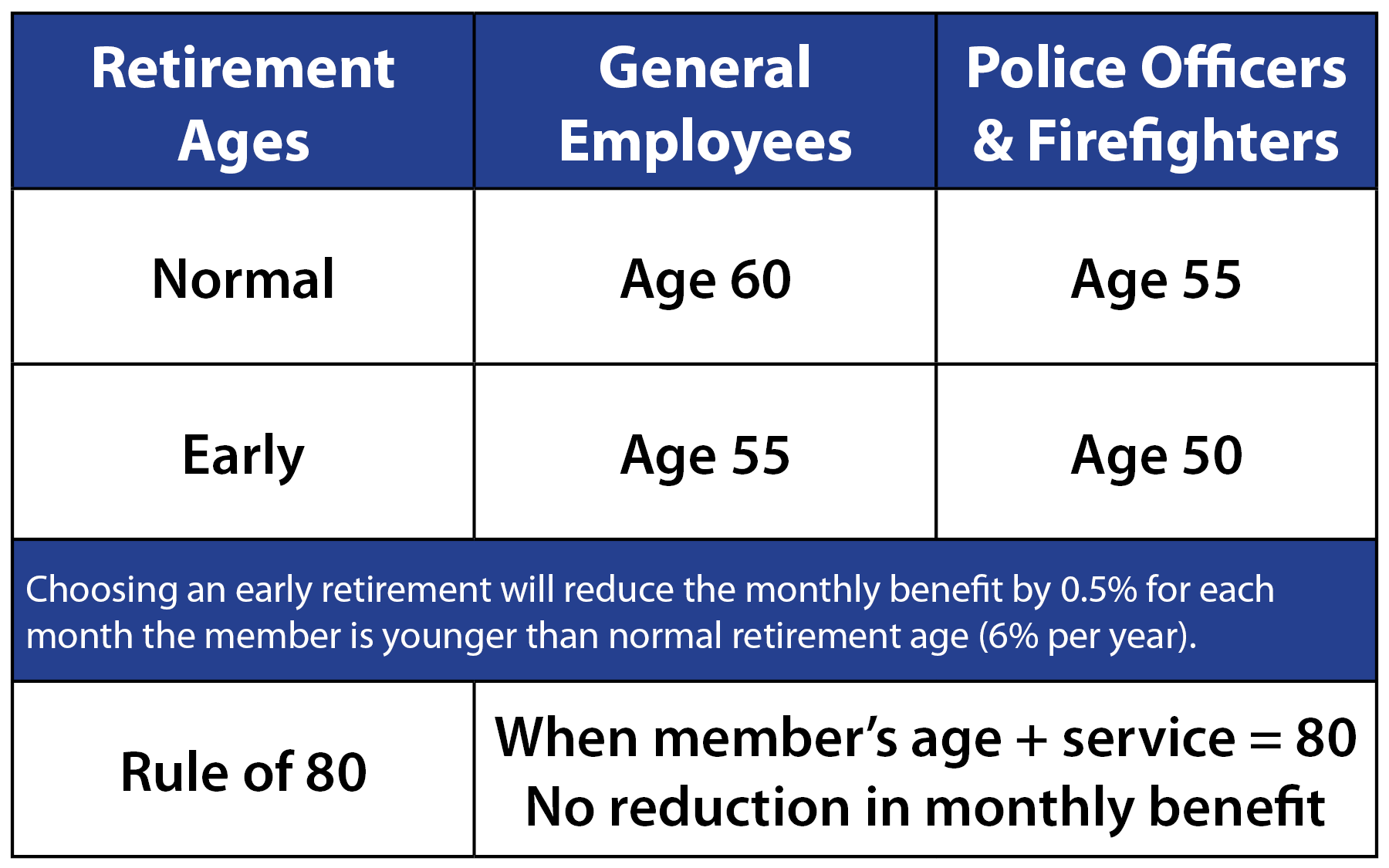

Code 1 or 2 Early Distribution is generally taxable for Pennsylvania purposes unless it was an eligible plan and you retired after meeting the plan age requirement or years of service requirement Code 3 or 4 Death Disability is not taxable for Pennsylvania tax purposes Code 5 Prohibited Transaction is generally taxable

Distributions you receive before age 59 1 2 even if you are retired are taxable even if you receive substantially equal payments and for federal purposes you do not pay a penalty for an early withdrawal Distributions from an IRA including a federal Roth IRA are taxable to the extent the distribution exceeds your previously taxed

Printables for free include a vast collection of printable documents that can be downloaded online at no cost. These resources come in various types, such as worksheets templates, coloring pages and more. The great thing about Are Early Retirement Distributions Taxable In Pa is their versatility and accessibility.

More of Are Early Retirement Distributions Taxable In Pa

Required Minimum Distributions From Retirement Accounts Summitry

Required Minimum Distributions From Retirement Accounts Summitry

Distributions from an eligible Pennsylvania retirement plan before retirement age or years of service are taxable in the year received to the extent that the distributions exceed previously taxed contributions Early distributions are deemed to come from previously taxed contributions first cost recovery method

Yes All IRA distributions should be reported on PA Schedule W 2S Wage Statement Summary whether or not some or all of the distributions are taxable If a taxpayer receives distributions before he she reaches 59 years of age some of the distributions may be taxable

Are Early Retirement Distributions Taxable In Pa have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: This allows you to modify designs to suit your personal needs for invitations, whether that's creating them planning your schedule or decorating your home.

-

Educational value: Printables for education that are free offer a wide range of educational content for learners from all ages, making them a great instrument for parents and teachers.

-

Accessibility: The instant accessibility to the vast array of design and templates reduces time and effort.

Where to Find more Are Early Retirement Distributions Taxable In Pa

Back By Popular Demand When Is The Best Day To Retire Missouri Lagers

Back By Popular Demand When Is The Best Day To Retire Missouri Lagers

Pennsylvania fully exempts all income from Social Security as well as payments from retirement accounts like 401 k s and IRAs It also exempts pension income for seniors age 60 or older While its property tax rates are higher than average the average total sales tax rate is among the lowest in the country

For instance some early distributions for a first time homebuyer or medical expenses avoid a penalty for federal purposes but they d still be taxed in Pennsylvania The key takeaway is that

In the event that we've stirred your interest in printables for free and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Are Early Retirement Distributions Taxable In Pa suitable for many objectives.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs are a vast range of interests, that range from DIY projects to planning a party.

Maximizing Are Early Retirement Distributions Taxable In Pa

Here are some new ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are Early Retirement Distributions Taxable In Pa are a treasure trove of practical and imaginative resources designed to meet a range of needs and hobbies. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the many options of Are Early Retirement Distributions Taxable In Pa right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can print and download these materials for free.

-

Can I utilize free printing templates for commercial purposes?

- It's based on specific terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables could be restricted regarding their use. Be sure to read the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home with an printer, or go to a local print shop for higher quality prints.

-

What program do I need to run printables free of charge?

- The majority of printables are with PDF formats, which can be opened with free software like Adobe Reader.

Early Retirement Distributions And Your Taxes Early Retirement

Early Retirement Tax Planning Retirement Planning ProVise

Check more sample of Are Early Retirement Distributions Taxable In Pa below

What Are The Options For Early Retirement Distributions YouTube

Early Retirement Distributions SEPP Early Retirement Retirement

Understanding Penalty Free Early Retirement Distributions Qwoter

What Are Retirement Distributions Retire Gen Z

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Required Retirement Plan Distributions Deadline Approaching

https:// revenue-pa.custhelp.com /app/answers/detail/a_id/365

Distributions you receive before age 59 1 2 even if you are retired are taxable even if you receive substantially equal payments and for federal purposes you do not pay a penalty for an early withdrawal Distributions from an IRA including a federal Roth IRA are taxable to the extent the distribution exceeds your previously taxed

https://www. fool.com /knowledge-center/does...

Early withdrawals no exceptions IRA distributions received before turning 59 1 2 aren t eligible for the exemption and are therefore fully taxable under Pennsylvania income tax law This

Distributions you receive before age 59 1 2 even if you are retired are taxable even if you receive substantially equal payments and for federal purposes you do not pay a penalty for an early withdrawal Distributions from an IRA including a federal Roth IRA are taxable to the extent the distribution exceeds your previously taxed

Early withdrawals no exceptions IRA distributions received before turning 59 1 2 aren t eligible for the exemption and are therefore fully taxable under Pennsylvania income tax law This

What Are Retirement Distributions Retire Gen Z

Early Retirement Distributions SEPP Early Retirement Retirement

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Required Retirement Plan Distributions Deadline Approaching

Early Retirement Distributions And Your Taxes

Early Retirement Distribution How To Get The Most Out Of Yours

Early Retirement Distribution How To Get The Most Out Of Yours

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial