In a world with screens dominating our lives however, the attraction of tangible printed material hasn't diminished. Whatever the reason, whether for education in creative or artistic projects, or simply adding personal touches to your space, Are Disabled Veterans Exempt From Property Taxes In Texas have proven to be a valuable resource. With this guide, you'll take a dive to the depths of "Are Disabled Veterans Exempt From Property Taxes In Texas," exploring their purpose, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Are Disabled Veterans Exempt From Property Taxes In Texas Below

Are Disabled Veterans Exempt From Property Taxes In Texas

Are Disabled Veterans Exempt From Property Taxes In Texas -

Any honorably discharged Veteran with a service connected total disability is exempt from all property taxes on the assessed value of homestead property Unmarried surviving

Disabled veterans owning property other than a residence homestead may qualify for a different exemption under Tax Code Section 11 22 which can be applied to any property

Printables for free include a vast collection of printable content that can be downloaded from the internet at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and much more. The value of Are Disabled Veterans Exempt From Property Taxes In Texas is their versatility and accessibility.

More of Are Disabled Veterans Exempt From Property Taxes In Texas

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children of deceased disabled veterans An

Requirements Be a Texas resident Receive 10 disability compensation from the U S Department of Veterans Affairs for a service connected disability Have a disability rating

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization: Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Value Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a useful device for teachers and parents.

-

It's easy: Fast access the vast array of design and templates, which saves time as well as effort.

Where to Find more Are Disabled Veterans Exempt From Property Taxes In Texas

100 Va Disability Military Veteran Benefits Discounts

100 Va Disability Military Veteran Benefits Discounts

Q How much of my home s value will the new exemption exempt Your home will be totally exempt from property taxes Q I meet all of the qualifications for the new exemption I

The disabled veteran must be a Texas resident and must choose one property to receive the exemption In Texas veterans with a disability rating of 100 are exempt from all

In the event that we've stirred your curiosity about Are Disabled Veterans Exempt From Property Taxes In Texas We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Are Disabled Veterans Exempt From Property Taxes In Texas for all uses.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs covered cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Are Disabled Veterans Exempt From Property Taxes In Texas

Here are some creative ways for you to get the best use of Are Disabled Veterans Exempt From Property Taxes In Texas:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Are Disabled Veterans Exempt From Property Taxes In Texas are an abundance of creative and practical resources that meet a variety of needs and desires. Their access and versatility makes them a wonderful addition to the professional and personal lives of both. Explore the vast array that is Are Disabled Veterans Exempt From Property Taxes In Texas today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use free printables for commercial uses?

- It is contingent on the specific terms of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may contain restrictions in their usage. Be sure to read the terms and conditions offered by the creator.

-

How do I print Are Disabled Veterans Exempt From Property Taxes In Texas?

- You can print them at home with your printer or visit a local print shop for superior prints.

-

What software do I require to view printables for free?

- The majority of PDF documents are provided in the format PDF. This can be opened using free software like Adobe Reader.

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

Nh Property Tax Rates By Town 2022

Check more sample of Are Disabled Veterans Exempt From Property Taxes In Texas below

Hecht Group Disabled Veterans In Wisconsin Exempt From Property Taxes

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Texas Disabled Veteran Benefits Explained The Insider s Guide

Hecht Group Do Disabled Veterans Pay Property Taxes In Kentucky

Property Tax Litigation Across Ontario NextGenLaw LLP

Hecht Group Disabled Veterans In Georgia Exempt From Property Taxes

https://comptroller.texas.gov/taxes/property-tax/...

Disabled veterans owning property other than a residence homestead may qualify for a different exemption under Tax Code Section 11 22 which can be applied to any property

https://comptroller.texas.gov/taxes/property-tax/...

A disabled veteran may also qualify for an exemption of 12 000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least 10 percent

Disabled veterans owning property other than a residence homestead may qualify for a different exemption under Tax Code Section 11 22 which can be applied to any property

A disabled veteran may also qualify for an exemption of 12 000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least 10 percent

Hecht Group Do Disabled Veterans Pay Property Taxes In Kentucky

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Property Tax Litigation Across Ontario NextGenLaw LLP

Hecht Group Disabled Veterans In Georgia Exempt From Property Taxes

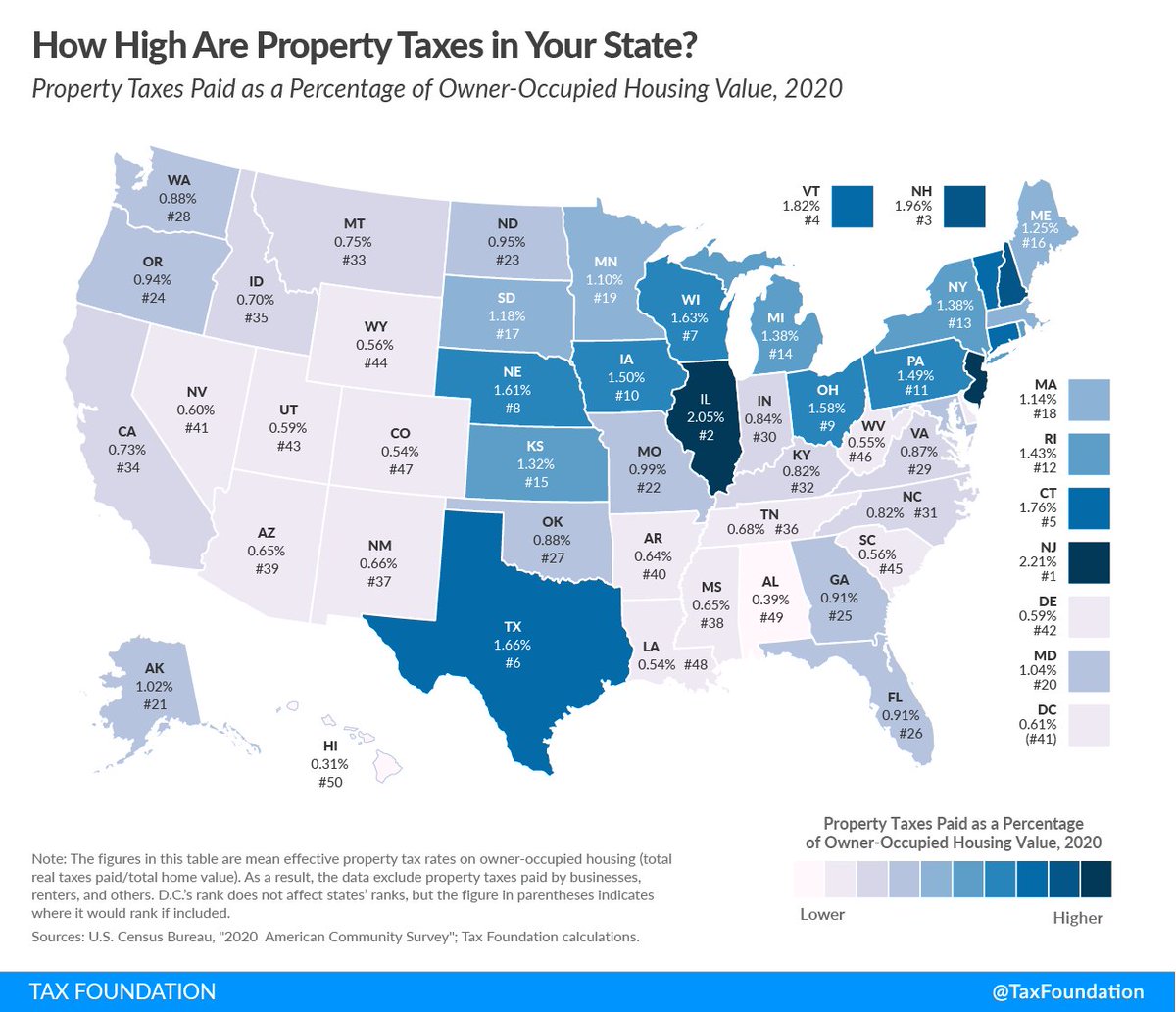

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

Disabled Veterans Should Never Have To Pay Property Taxes Editorial

Disabled Veterans Should Never Have To Pay Property Taxes Editorial

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue