In the age of digital, where screens rule our lives, the charm of tangible, printed materials hasn't diminished. Be it for educational use as well as creative projects or simply adding an element of personalization to your home, printables for free can be an excellent source. With this guide, you'll take a dive in the world of "Are Company Pension Plan Contributions Tax Deductible," exploring the benefits of them, where they can be found, and how they can add value to various aspects of your lives.

Get Latest Are Company Pension Plan Contributions Tax Deductible Below

Are Company Pension Plan Contributions Tax Deductible

Are Company Pension Plan Contributions Tax Deductible -

This is because pension contributions are not a business cost and therefore can t be classified as a tax deductible expense in the self employed section of your tax return However these contributions should qualify for income tax relief

The tax deductibility of your pension plan contributions usually depends on the type of program you have The number of employees covered by traditional pension plans has dramatically declined

Are Company Pension Plan Contributions Tax Deductible cover a large variety of printable, downloadable materials online, at no cost. These resources come in many forms, including worksheets, templates, coloring pages and more. The appeal of printables for free is their versatility and accessibility.

More of Are Company Pension Plan Contributions Tax Deductible

Are Retirement Plan Contributions Tax Deductible Human Interest

Are Retirement Plan Contributions Tax Deductible Human Interest

Similarly for employers contributions to employees plans are tax deductible Under defined benefit plans which employees generally do not contribute to benefits received are subject to income tax Other retirement savings vehicles e g Roth IRAs are not subject to this common tax treatment

Consistent with IRC Section 404 a 6 however Q A 11 indicates that these contributions must be made by the tax return s extended due date October 15 2020 for a C corporation with a calendar year tax year to be deductible on the 2019 tax return

Are Company Pension Plan Contributions Tax Deductible have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Flexible: There is the possibility of tailoring printed materials to meet your requirements, whether it's designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value Educational printables that can be downloaded for free provide for students from all ages, making them an essential tool for teachers and parents.

-

The convenience of instant access a variety of designs and templates cuts down on time and efforts.

Where to Find more Are Company Pension Plan Contributions Tax Deductible

Living Stingy The Pension Crisis

Living Stingy The Pension Crisis

You won t need to claim your 401 k contributions as tax deductible when filing your taxes While contributions to qualified retirement plans such as traditional 401

If a plan allows after tax contributions they are not excluded from income and an employee cannot deduct them on his or her tax return

If we've already piqued your interest in Are Company Pension Plan Contributions Tax Deductible, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Are Company Pension Plan Contributions Tax Deductible to suit a variety of objectives.

- Explore categories like decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing, flashcards, and learning tools.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a broad spectrum of interests, including DIY projects to party planning.

Maximizing Are Company Pension Plan Contributions Tax Deductible

Here are some new ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Are Company Pension Plan Contributions Tax Deductible are a treasure trove of innovative and useful resources catering to different needs and interest. Their availability and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast collection of Are Company Pension Plan Contributions Tax Deductible to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Company Pension Plan Contributions Tax Deductible really absolutely free?

- Yes you can! You can print and download these tools for free.

-

Can I use free printables for commercial purposes?

- It's based on the terms of use. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables could have limitations on use. Be sure to review the terms and regulations provided by the author.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in the local print shops for more high-quality prints.

-

What program do I require to open printables at no cost?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software such as Adobe Reader.

Are Thrift Savings Plan Contributions Tax Deductible TSP Tax Free Pay

Are Roth Contributions Right For Me

Check more sample of Are Company Pension Plan Contributions Tax Deductible below

How Pension Contributions Work

Are Pension Plan Contributions Tax Deductible In Canada Blog

/mitch-mclean---mandeville-copy/pexels-andrea-piacquadio-3768131-baa13.jpg)

Public Pension Funding It s No Easy Task Opinion Pennlive

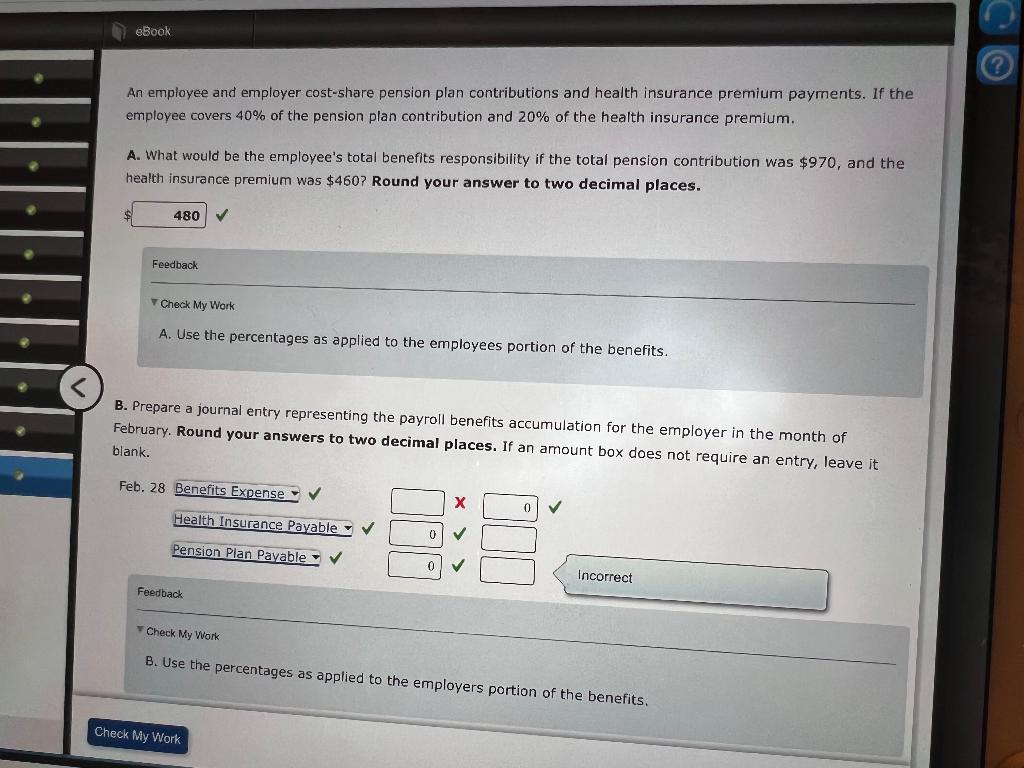

Solved An Employee And Employer Cost share Pension Plan Chegg

2024 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal

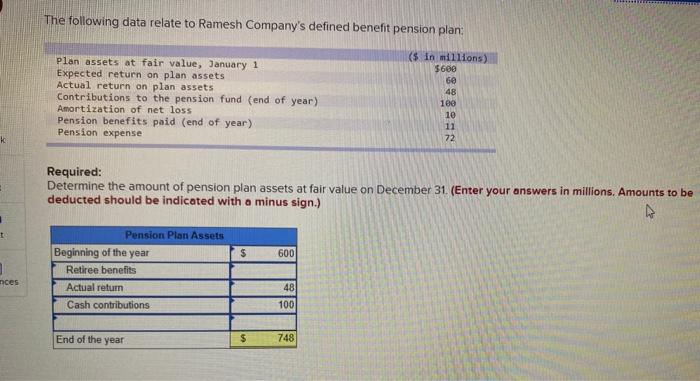

Solved The Following Data Relate To Ramesh Company s Defined Chegg

https://finance.zacks.com

The tax deductibility of your pension plan contributions usually depends on the type of program you have The number of employees covered by traditional pension plans has dramatically declined

https://adviser.royallondon.com › technical-central › ...

Company employer contributions and tax relief 26 March 2024 6 min read How much can a company or employer pay into a pension plan Key facts Company and employer contributions are not restricted however they must satisfy the wholly and exclusively requirement to receive tax relief

The tax deductibility of your pension plan contributions usually depends on the type of program you have The number of employees covered by traditional pension plans has dramatically declined

Company employer contributions and tax relief 26 March 2024 6 min read How much can a company or employer pay into a pension plan Key facts Company and employer contributions are not restricted however they must satisfy the wholly and exclusively requirement to receive tax relief

Solved An Employee And Employer Cost share Pension Plan Chegg

/mitch-mclean---mandeville-copy/pexels-andrea-piacquadio-3768131-baa13.jpg)

Are Pension Plan Contributions Tax Deductible In Canada Blog

2024 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal

Solved The Following Data Relate To Ramesh Company s Defined Chegg

Are Cash Balance Plan Contributions Tax Deductible

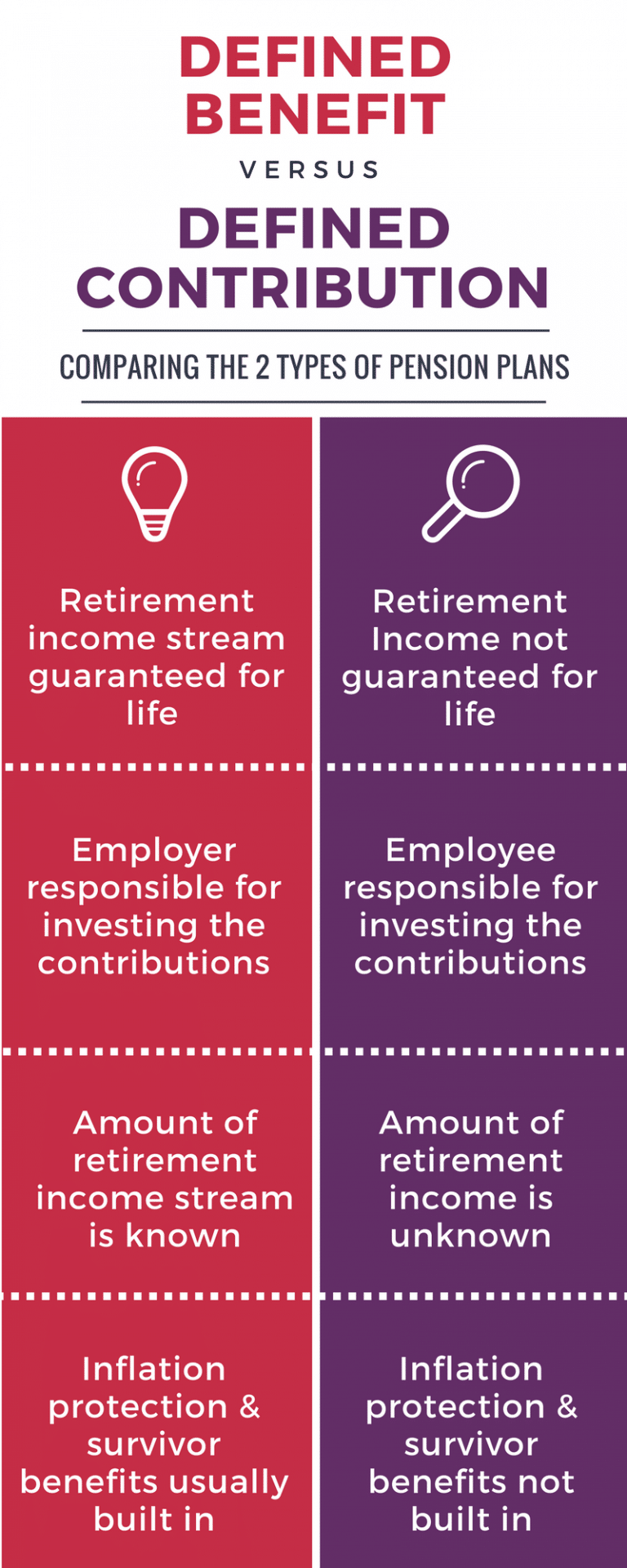

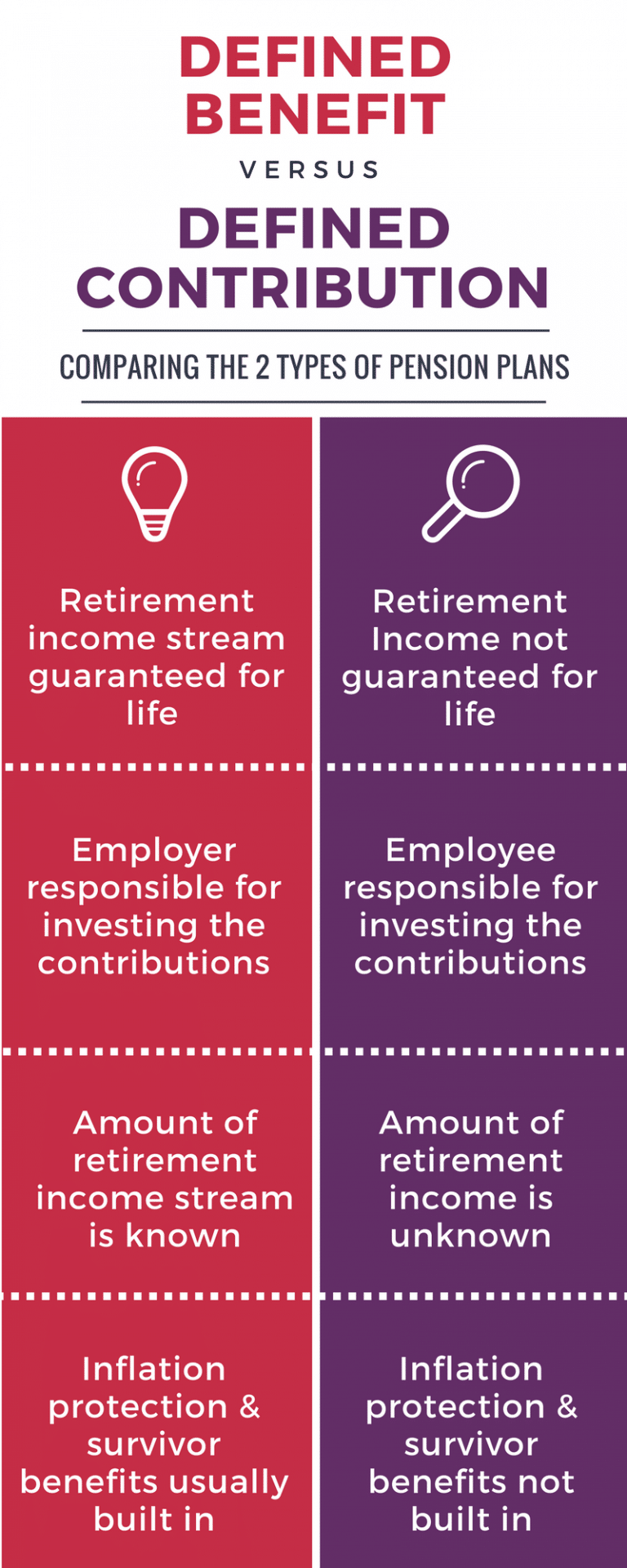

Infographic Defined Benefit Vs Defined Contribution Pension Plan

Infographic Defined Benefit Vs Defined Contribution Pension Plan

State Pension MbarakDaeney