In a world where screens dominate our lives but the value of tangible printed material hasn't diminished. If it's to aid in education for creative projects, simply to add an element of personalization to your area, Are Annuity Withdrawals Taxed As Ordinary Income have become a valuable resource. For this piece, we'll take a dive deeper into "Are Annuity Withdrawals Taxed As Ordinary Income," exploring their purpose, where to find them and how they can improve various aspects of your lives.

Get Latest Are Annuity Withdrawals Taxed As Ordinary Income Below

Are Annuity Withdrawals Taxed As Ordinary Income

Are Annuity Withdrawals Taxed As Ordinary Income -

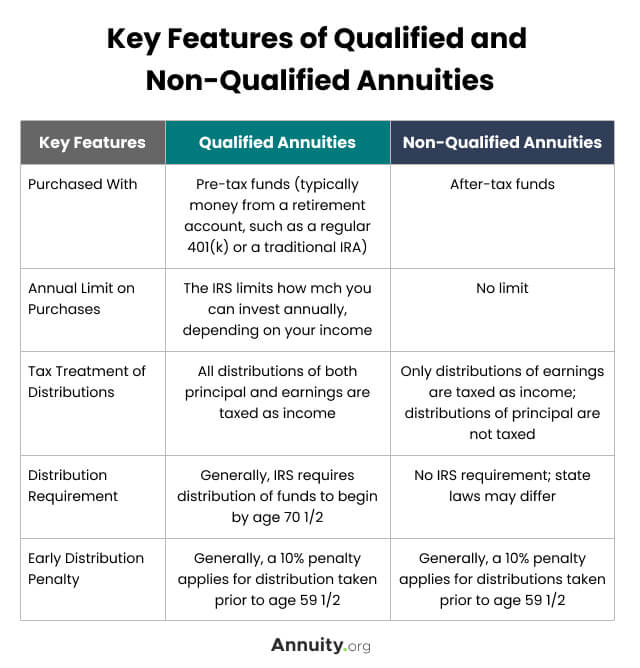

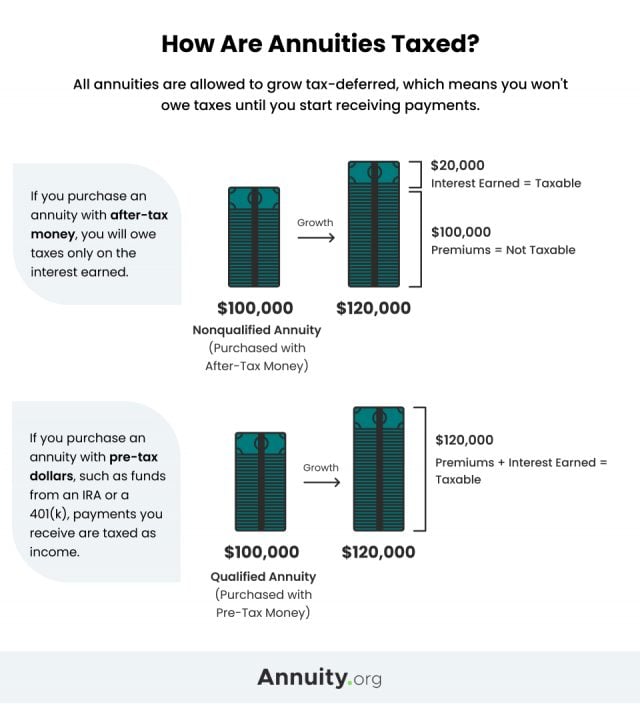

You pay taxes on the money you receive from a non qualified annuity whether that comes in the form of the contract s structured payouts or through a withdrawal This money is taxed as ordinary income not as capital gains

Income withdrawn from all types of deferred annuities is taxed as ordinary income not long term capital gain income This tax treatment applies to fixed rate fixed indexed variable

Are Annuity Withdrawals Taxed As Ordinary Income encompass a wide variety of printable, downloadable documents that can be downloaded online at no cost. They come in many designs, including worksheets templates, coloring pages and more. The value of Are Annuity Withdrawals Taxed As Ordinary Income is their flexibility and accessibility.

More of Are Annuity Withdrawals Taxed As Ordinary Income

3 Types Of Fixed Annuity Withdrawals How They Work For Income

3 Types Of Fixed Annuity Withdrawals How They Work For Income

You will pay normal income taxes on any future qualified annuity payments Note that annuity payments count as ordinary income which is generally speaking not a favorable capital gains rate A non qualified annuity is you purchased with money you have already paid taxes on

For example pre tax contributions to a 401 k annuity can lower your taxable income However you must eventually pay taxes when you take distributions from pre tax accounts That money has never been taxed and the IRS treats the entirety of those distributions as ordinary taxable income

Are Annuity Withdrawals Taxed As Ordinary Income have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: The Customization feature lets you tailor the templates to meet your individual needs for invitations, whether that's creating them planning your schedule or even decorating your home.

-

Educational Worth: Printables for education that are free are designed to appeal to students of all ages, making them an essential source for educators and parents.

-

Accessibility: The instant accessibility to the vast array of design and templates, which saves time as well as effort.

Where to Find more Are Annuity Withdrawals Taxed As Ordinary Income

Are Traditional Ira Withdrawals Taxed Ordinary Income

Are Traditional Ira Withdrawals Taxed Ordinary Income

While the money in an annuity will grow tax deferred once you start withdrawing your money that growth will be taxed as ordinary income But what about the money you paid into your annuity The way this money is

If you bought the annuity with pre tax funds the entire withdrawal amount is subject to taxation as ordinary income However if you used after tax money to purchase it only the earnings on the annuity are taxed The Basics Are Annuities Tax Free or Tax Deferred Contrary to what some may believe annuities are not entirely tax free

If we've already piqued your interest in Are Annuity Withdrawals Taxed As Ordinary Income Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Are Annuity Withdrawals Taxed As Ordinary Income suitable for many uses.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad spectrum of interests, that range from DIY projects to party planning.

Maximizing Are Annuity Withdrawals Taxed As Ordinary Income

Here are some innovative ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are Annuity Withdrawals Taxed As Ordinary Income are an abundance of fun and practical tools for a variety of needs and interests. Their accessibility and flexibility make these printables a useful addition to both personal and professional life. Explore the wide world of Are Annuity Withdrawals Taxed As Ordinary Income today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can download and print these materials for free.

-

Can I make use of free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues when you download Are Annuity Withdrawals Taxed As Ordinary Income?

- Some printables may come with restrictions in use. Make sure to read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home with any printer or head to the local print shop for the highest quality prints.

-

What software do I require to open printables free of charge?

- The majority of printed documents are in the PDF format, and can be opened with free software such as Adobe Reader.

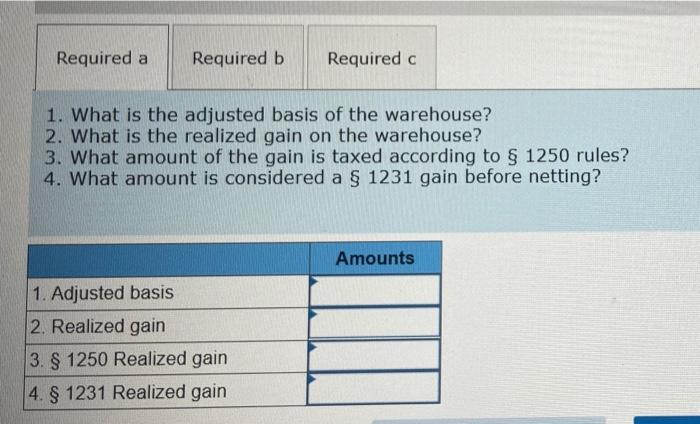

Solved Patel Industries A Sole Proprietorship Sold The Chegg

What Is Business Income Definition How It s Taxed And Example

:max_bytes(150000):strip_icc()/businessincome_final-fdcbc653a7e049bab4707c62cf9cc407.png)

Check more sample of Are Annuity Withdrawals Taxed As Ordinary Income below

California Income Tax And Residency Part 2 Equity Compensation And

Expected Present Value Formula Expected Monetary Value Writflx

How Annuity Withdrawals Are Taxed Kiplinger

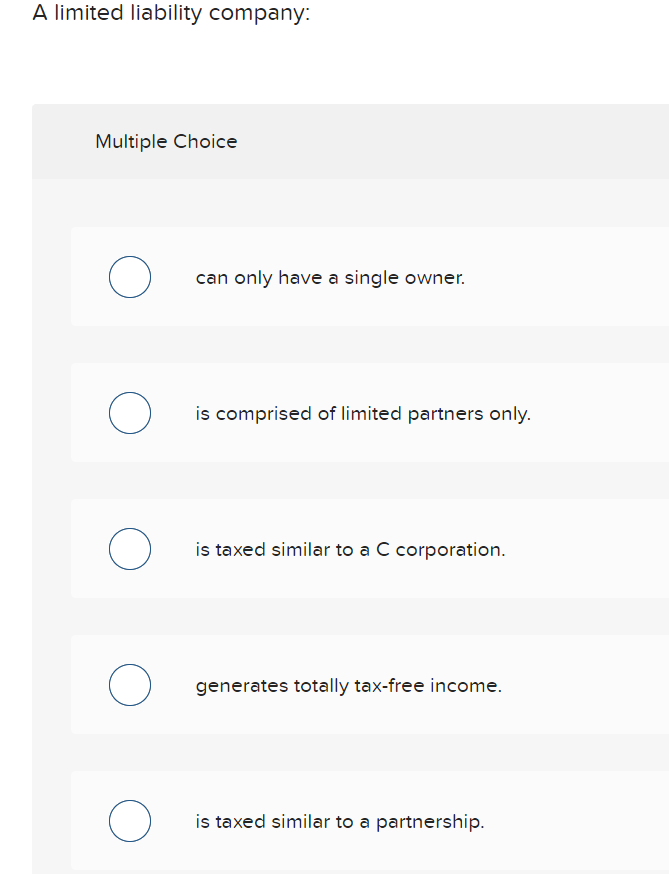

Solved A Limited Liability Company Multiple Choice Can Only Chegg

Solved LO 1 2 5 Harper Is Considering Three Alternative Chegg

What Is The Employee Retention Credit Retirement Daily On TheStreet

https://www.kiplinger.com/.../how-annuities-are-taxed

Income withdrawn from all types of deferred annuities is taxed as ordinary income not long term capital gain income This tax treatment applies to fixed rate fixed indexed variable

https://www.forbes.com/advisor/retirement/annuity-taxes

Withdrawals From Qualified Annuities Money taken out of a qualified annuity is subject to ordinary marginal tax rates rather than long term capital gains tax rates

Income withdrawn from all types of deferred annuities is taxed as ordinary income not long term capital gain income This tax treatment applies to fixed rate fixed indexed variable

Withdrawals From Qualified Annuities Money taken out of a qualified annuity is subject to ordinary marginal tax rates rather than long term capital gains tax rates

Solved A Limited Liability Company Multiple Choice Can Only Chegg

Expected Present Value Formula Expected Monetary Value Writflx

Solved LO 1 2 5 Harper Is Considering Three Alternative Chegg

What Is The Employee Retention Credit Retirement Daily On TheStreet

Tax Deferral How Do Tax Deferred Products Work

Present Value Of An Annuity Definition Interpretation

Present Value Of An Annuity Definition Interpretation

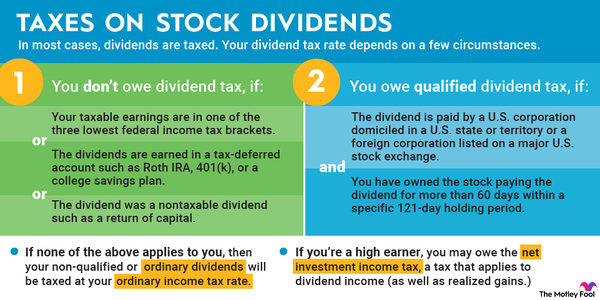

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool