In this age of electronic devices, where screens dominate our lives however, the attraction of tangible printed materials hasn't faded away. Be it for educational use project ideas, artistic or just adding an element of personalization to your space, Are 401k Withdrawals Taxed In Georgia have become an invaluable source. With this guide, you'll take a dive in the world of "Are 401k Withdrawals Taxed In Georgia," exploring the benefits of them, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Are 401k Withdrawals Taxed In Georgia Below

Are 401k Withdrawals Taxed In Georgia

Are 401k Withdrawals Taxed In Georgia -

Retirement Planning Financial Planning Annuities IRAs CDs Bonds 401 k s Mutual Funds Estate Pensions Georgia Retirement Most forms of retirement income are exempt from Georgia s state income tax if

Retirees FAQ Does Georgia tax Social Security No Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax The

Are 401k Withdrawals Taxed In Georgia include a broad range of printable, free documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and much more. The benefit of Are 401k Withdrawals Taxed In Georgia lies in their versatility and accessibility.

More of Are 401k Withdrawals Taxed In Georgia

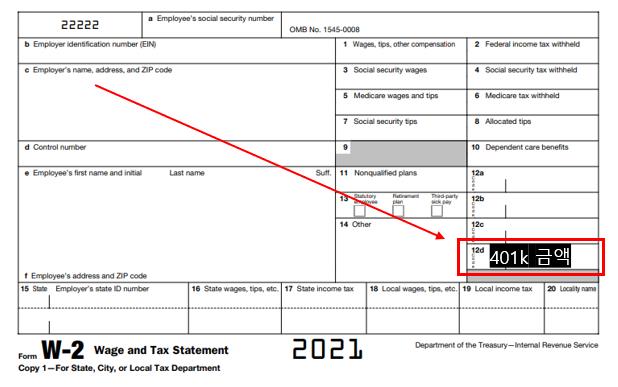

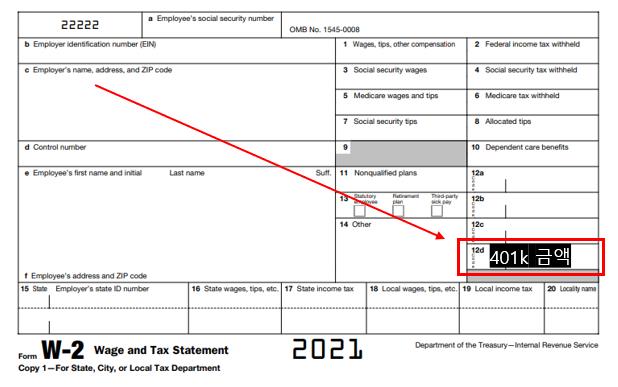

Here s How 401k Withdrawals Are Taxed

Here s How 401k Withdrawals Are Taxed

Military Retirement Income Exclusion Beginning January 1 2022 17 500 of military retirement income can be excluded for taxpayers under 62 years of age and an

Is my retirement income taxable to Georgia Georgia allows for taxpayers to subtract a portion of their retirement income on their Georgia return The maximum retirement

Are 401k Withdrawals Taxed In Georgia have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Customization: We can customize designs to suit your personal needs for invitations, whether that's creating them, organizing your schedule, or even decorating your home.

-

Education Value Free educational printables cater to learners of all ages, making them a valuable device for teachers and parents.

-

Simple: Fast access various designs and templates is time-saving and saves effort.

Where to Find more Are 401k Withdrawals Taxed In Georgia

Can You Withdraw Money From 401k 401kInfoClub

Can You Withdraw Money From 401k 401kInfoClub

You only pay taxes on contributions and earnings when the money is withdrawn Plus many employers provide matching contributions Use this calculator to see how increasing

Withdrawals of contributions and earnings are taxed Distributions may be penalized if taken before age 59 unless you meet one of the IRS exceptions

In the event that we've stirred your curiosity about Are 401k Withdrawals Taxed In Georgia Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of applications.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs are a vast range of topics, all the way from DIY projects to party planning.

Maximizing Are 401k Withdrawals Taxed In Georgia

Here are some ideas in order to maximize the use use of Are 401k Withdrawals Taxed In Georgia:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are 401k Withdrawals Taxed In Georgia are an abundance with useful and creative ideas that can meet the needs of a variety of people and desires. Their availability and versatility make they a beneficial addition to each day life. Explore the vast array of Are 401k Withdrawals Taxed In Georgia today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can download and print these documents for free.

-

Does it allow me to use free printables for commercial purposes?

- It's determined by the specific rules of usage. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables could have limitations concerning their use. You should read these terms and conditions as set out by the creator.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit a local print shop to purchase high-quality prints.

-

What software do I require to open printables free of charge?

- The majority are printed as PDF files, which is open with no cost programs like Adobe Reader.

Sava Secures 2 Million Pre seed Funding To Build A Spend Management

The IRS Just Announced The 2022 401 k And IRA Contribution Limits

Check more sample of Are 401k Withdrawals Taxed In Georgia below

Can I Rollover 401k While Still Employed 401kInfoClub

WITHDRAWALS Unless Clearly Indicated Otherwise

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

After Tax 401 k Contribution Definition Pros Cons Rollover

Traditional 401k USA

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog

https://dor.georgia.gov/retirees-faq

Retirees FAQ Does Georgia tax Social Security No Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax The

https://smartasset.com/retirement/401k-tax

Whenever you withdraw money from a 401 k you have 60 days to put the money into another tax deferred retirement plan If you transfer the money within 60 days you will not have to pay any taxes or

Retirees FAQ Does Georgia tax Social Security No Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax The

Whenever you withdraw money from a 401 k you have 60 days to put the money into another tax deferred retirement plan If you transfer the money within 60 days you will not have to pay any taxes or

After Tax 401 k Contribution Definition Pros Cons Rollover

WITHDRAWALS Unless Clearly Indicated Otherwise

Traditional 401k USA

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog

How Are 401k Withdrawals Taxed Newell Wealth Management

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

Forgo 401k Early Withdrawal Penalty WSJ