In this day and age where screens dominate our lives, the charm of tangible printed objects isn't diminished. Be it for educational use project ideas, artistic or simply adding some personal flair to your home, printables for free have become an invaluable resource. Here, we'll dive deeper into "Are 401k Losses Tax Deductible," exploring the different types of printables, where they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Are 401k Losses Tax Deductible Below

Are 401k Losses Tax Deductible

Are 401k Losses Tax Deductible -

You won t need to claim your 401 k contributions as tax deductible when filing your taxes While contributions to qualified retirement plans such as traditional 401

For these reasons it s unwise to claim a tax deduction on a 401 k loss unless you re older than 59 1 2 and plan to use the money to cover your retirement expenses in

Are 401k Losses Tax Deductible include a broad range of downloadable, printable documents that can be downloaded online at no cost. These resources come in many forms, including worksheets, coloring pages, templates and much more. The benefit of Are 401k Losses Tax Deductible is their flexibility and accessibility.

More of Are 401k Losses Tax Deductible

Why Declining 401k Balances Are A Good Thing

Why Declining 401k Balances Are A Good Thing

You won t face tax consequences but you also won t get to deduct the loss on your taxes for the year However in some instances you may qualify for a tax break if you

The tax treatment of 401 k distributions depends on the type of account traditional or Roth Traditional 401 k withdrawals are taxed at the account owner s current income tax rate

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: There is the possibility of tailoring print-ready templates to your specific requirements for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making these printables a powerful tool for teachers and parents.

-

Affordability: Quick access to various designs and templates reduces time and effort.

Where to Find more Are 401k Losses Tax Deductible

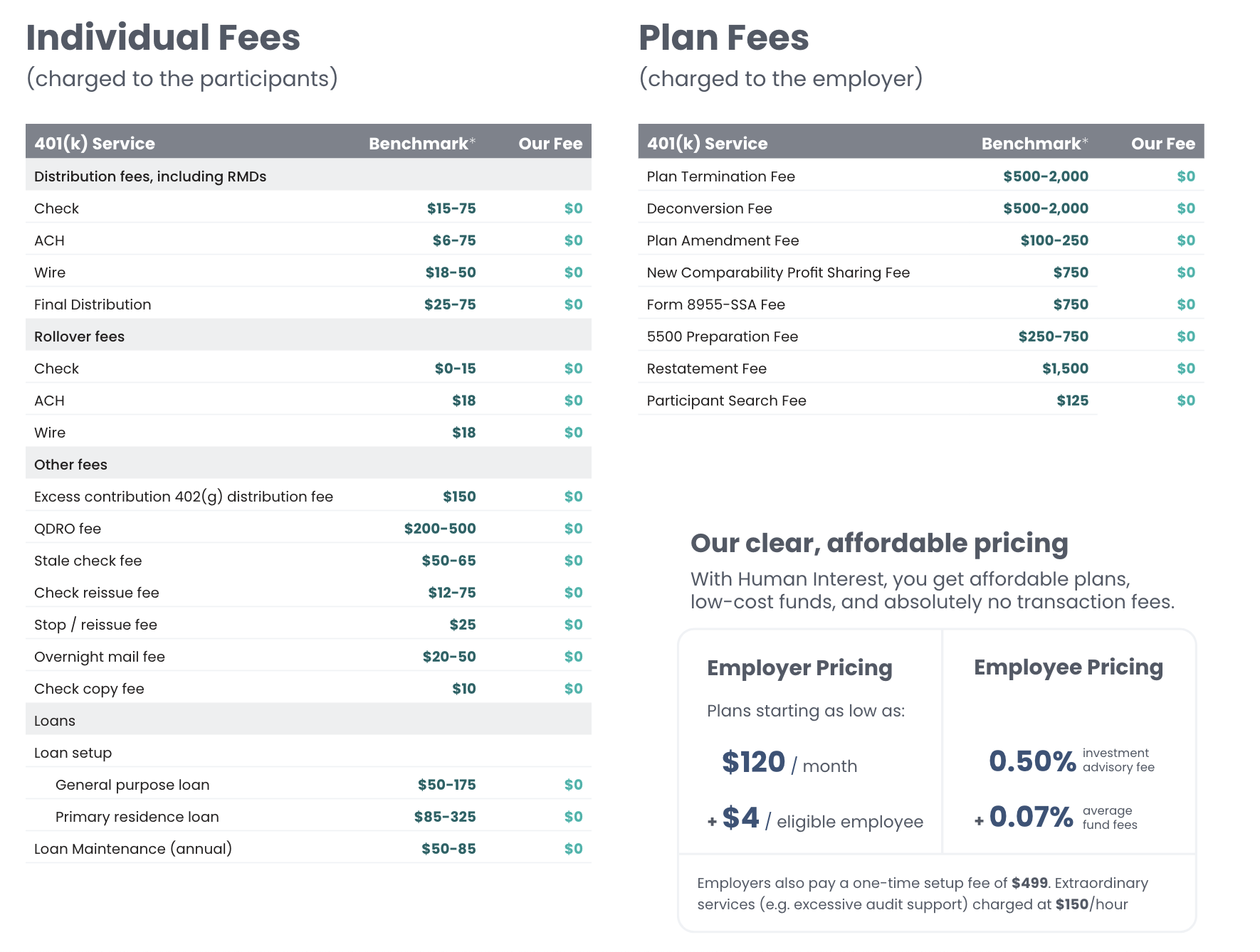

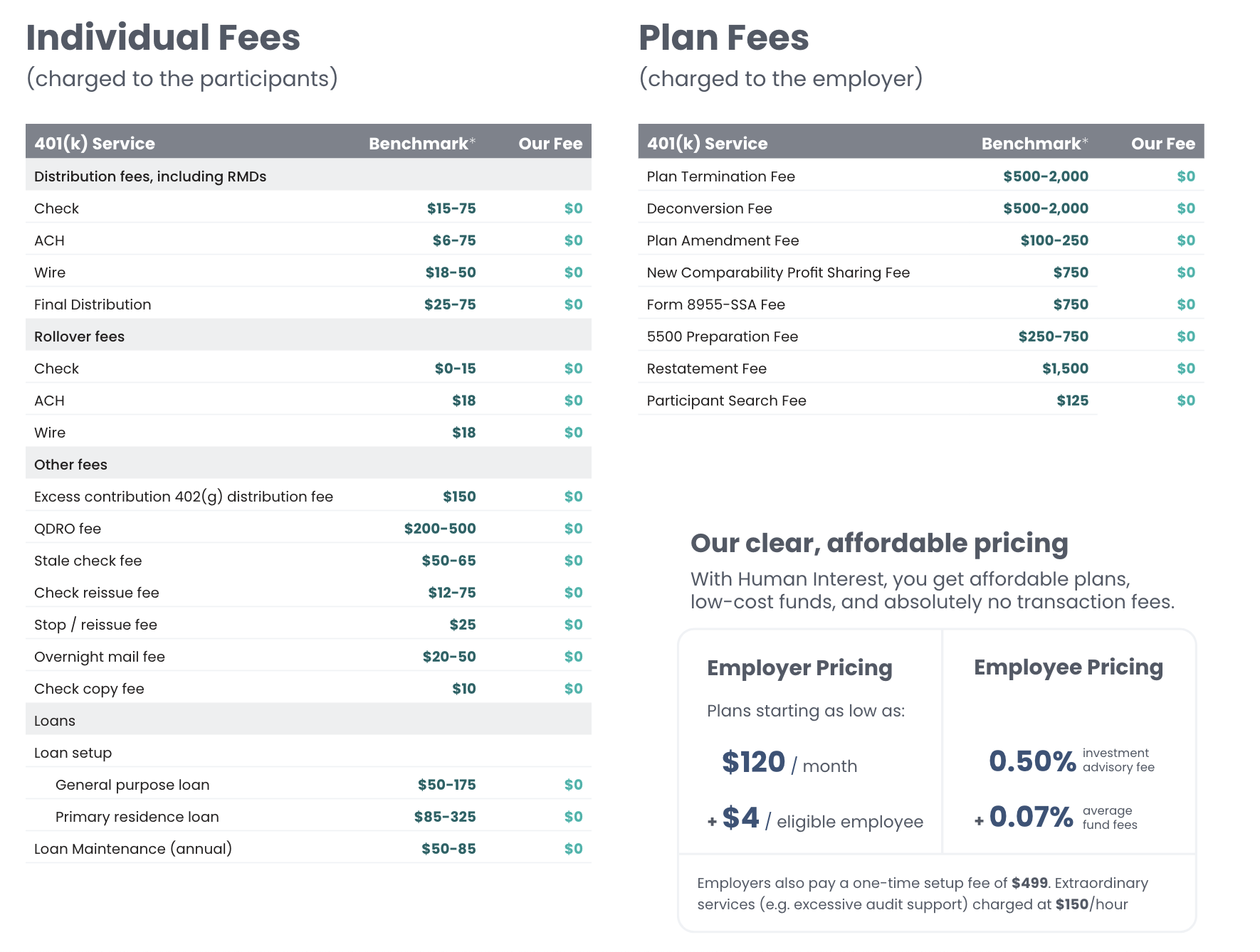

401 K Losses Tax Deductible 2024 Fees BBB Legit Complaints Metals

401 K Losses Tax Deductible 2024 Fees BBB Legit Complaints Metals

Contributions to a 401 k are not subject to income taxes but are subject to Medicare and Social Security taxes You pay income taxes on withdrawals

Traditional 401 k plans are tax deferred You don t have to pay income taxes on your contributions though you will have to pay other payroll taxes like Social Security and Medicare taxes You won t pay income tax on 401 k money until you withdraw it

In the event that we've stirred your curiosity about Are 401k Losses Tax Deductible Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Are 401k Losses Tax Deductible to suit a variety of needs.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad spectrum of interests, that includes DIY projects to party planning.

Maximizing Are 401k Losses Tax Deductible

Here are some unique ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Are 401k Losses Tax Deductible are an abundance of practical and imaginative resources for a variety of needs and hobbies. Their accessibility and flexibility make these printables a useful addition to each day life. Explore the wide world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can print and download these files for free.

-

Can I make use of free printables for commercial purposes?

- It depends on the specific conditions of use. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables could be restricted in use. Be sure to read the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home using a printer or visit a local print shop for more high-quality prints.

-

What program is required to open printables free of charge?

- A majority of printed materials are in the PDF format, and can be opened with free programs like Adobe Reader.

Your Claim For A Business Tax Loss Can Be Denied Tax Store

Michigan Gambling Losses Tax Deductible State Joins Slew Of Others

Check more sample of Are 401k Losses Tax Deductible below

How To Deduct Stock Losses From Your Taxes Picnic Tax

401 k Tips Advice How To Make Up For Losses In Retirement Accounts

What Are The Benefits Of Having 401 k Plan

Are Cryptocurrency Losses Tax Deductible AZexplained

Are Your 401k Losses Tax Deductible Gold IRA Explained

Are 401K Contributions Tax Deductible

https://www.fool.com/retirement/plans/401k/losing-money

For these reasons it s unwise to claim a tax deduction on a 401 k loss unless you re older than 59 1 2 and plan to use the money to cover your retirement expenses in

https://finance.zacks.com/tax-deductions-ira-401k-losses-4615.html

IRA and 401 k losses are an itemized deduction so you can t claim it unless you give up the standard deduction It also is categorized as a miscellaneous deduction subject to the 2 percent

For these reasons it s unwise to claim a tax deduction on a 401 k loss unless you re older than 59 1 2 and plan to use the money to cover your retirement expenses in

IRA and 401 k losses are an itemized deduction so you can t claim it unless you give up the standard deduction It also is categorized as a miscellaneous deduction subject to the 2 percent

Are Cryptocurrency Losses Tax Deductible AZexplained

401 k Tips Advice How To Make Up For Losses In Retirement Accounts

Are Your 401k Losses Tax Deductible Gold IRA Explained

Are 401K Contributions Tax Deductible

Pre tax Vs Roth 401 k Contributions YouTube

Are Stock Losses Tax Deductible

Are Stock Losses Tax Deductible

After Tax 401 k Contribution Definition Pros Cons Rollover