In this age of electronic devices, where screens dominate our lives yet the appeal of tangible printed materials hasn't faded away. In the case of educational materials project ideas, artistic or simply adding the personal touch to your home, printables for free are now a useful source. With this guide, you'll take a dive to the depths of "Are 401k Contributions Tax Deductible In Canada," exploring the different types of printables, where to get them, as well as how they can enhance various aspects of your life.

Get Latest Are 401k Contributions Tax Deductible In Canada Below

Are 401k Contributions Tax Deductible In Canada

Are 401k Contributions Tax Deductible In Canada -

In the case of a 401 k there will be no tax liability on any after tax contributions including contributions to a Roth option if available in the plan Canadian employers can offer a Roth like option to their GRSP plans called a group TFSA which stands for Tax Free Savings Account

Is a 401 k taxable in Canada The earnings in 401 k and 403 b s are tax sheltered from Canadian taxes however withdrawals from these plans are taxable and must be reported on your Canadian tax return

The Are 401k Contributions Tax Deductible In Canada are a huge variety of printable, downloadable resources available online for download at no cost. These resources come in various forms, including worksheets, coloring pages, templates and much more. The attraction of printables that are free is their flexibility and accessibility.

More of Are 401k Contributions Tax Deductible In Canada

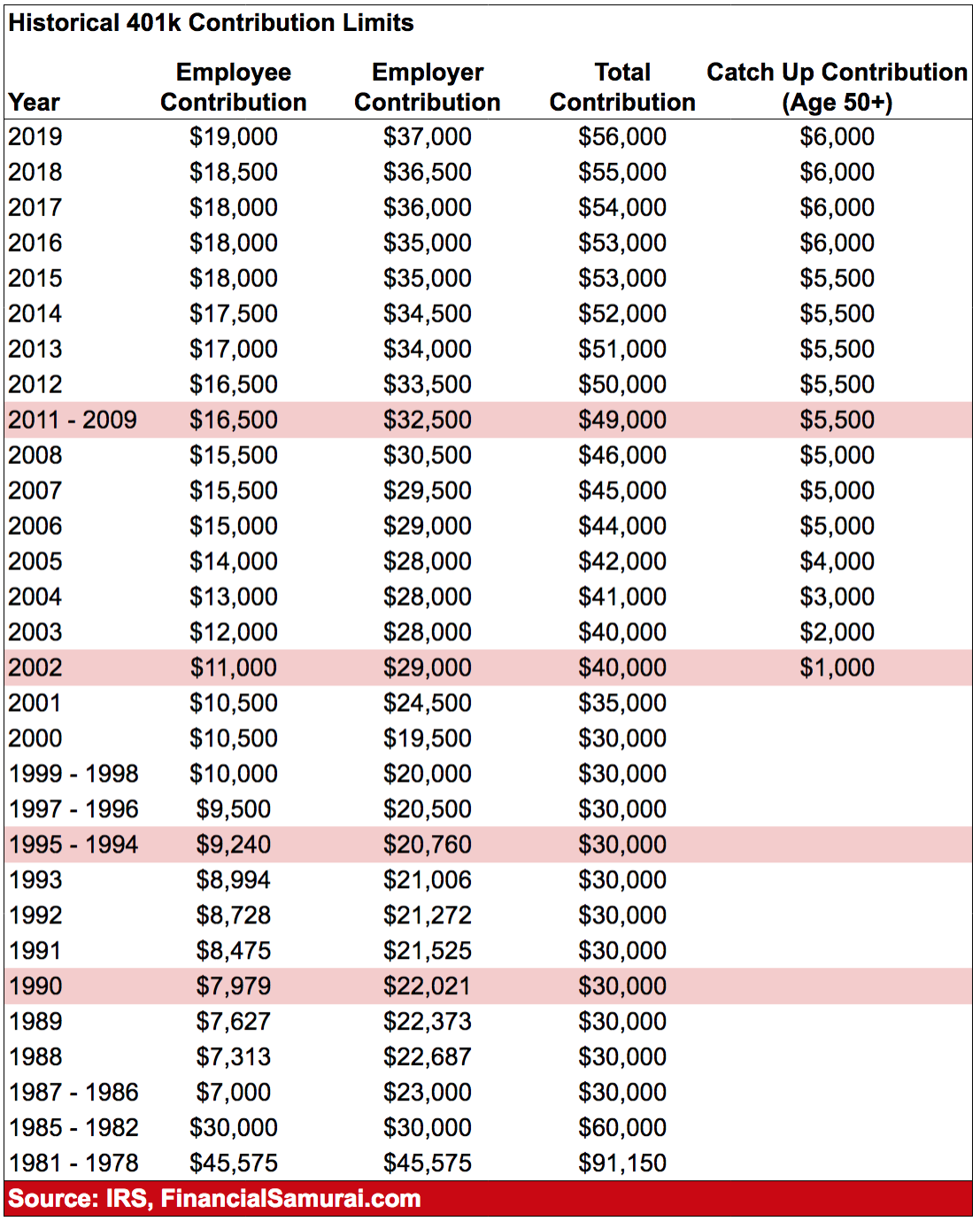

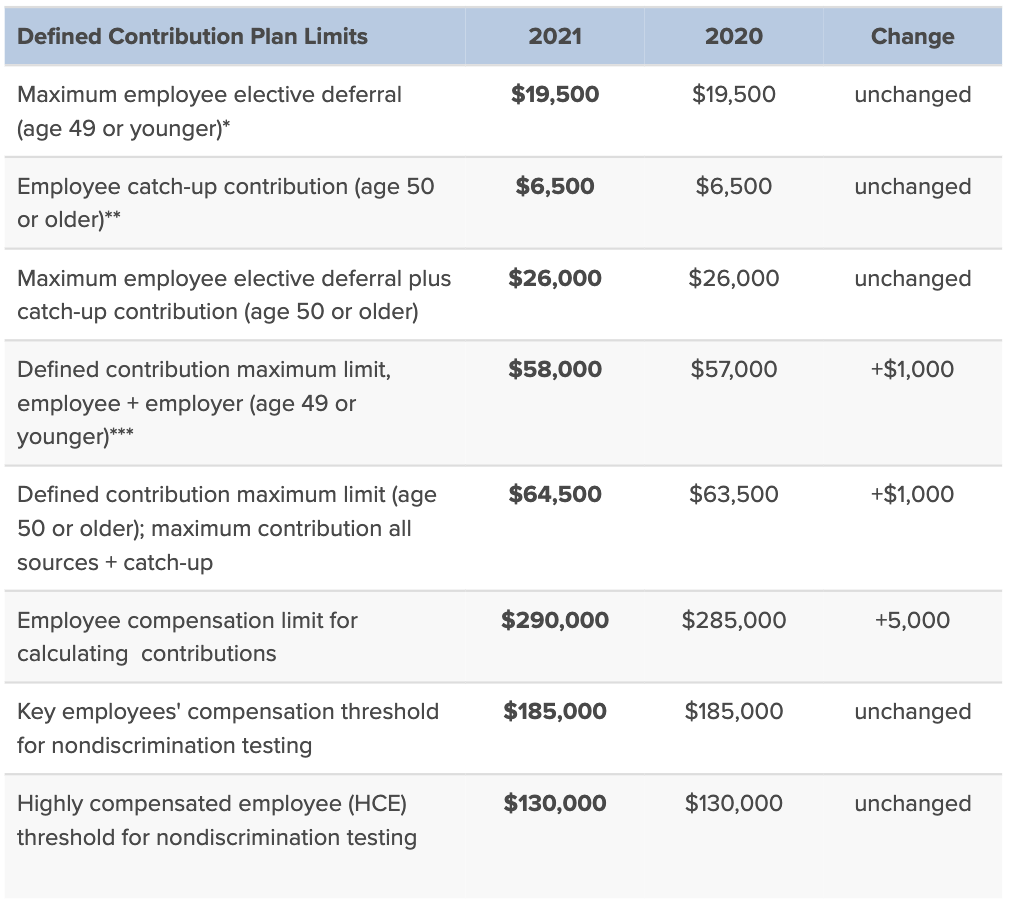

401 k Maximum Employee Contribution Limit 2020 19 500

401 k Maximum Employee Contribution Limit 2020 19 500

RRSP contributions are deductible and can reduce your taxes Deduct them on line 20800 of your tax return There is a maximum annual limit on how much you can contribute to your RRSP

In Canada most group retirement plans use these types of accounts Group Registered Retirement Savings Plans Group RRSP are the most popular account type used in Canada Employee contributions

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize designs to suit your personal needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: Free educational printables are designed to appeal to students of all ages. This makes them an invaluable tool for teachers and parents.

-

An easy way to access HTML0: Instant access to numerous designs and templates will save you time and effort.

Where to Find more Are 401k Contributions Tax Deductible In Canada

401k Tax Deductible Contributions What You Need To Know To Avoid

401k Tax Deductible Contributions What You Need To Know To Avoid

Contributions to a 401 k plan are redirected from your pre tax income and the funds can grow tax free until withdrawn IRA An IRA is similar to a Canadian RRSP and allows you to make tax deductible contributions

If you live in Canada and participated in a foreign pension plan in 2023 you may have to enter an amount on line 20600 For more information Contact the Canada Revenue Agency Special situations

We hope we've stimulated your interest in Are 401k Contributions Tax Deductible In Canada Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of objectives.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs are a vast selection of subjects, ranging from DIY projects to party planning.

Maximizing Are 401k Contributions Tax Deductible In Canada

Here are some fresh ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are 401k Contributions Tax Deductible In Canada are an abundance of practical and innovative resources catering to different needs and passions. Their access and versatility makes these printables a useful addition to your professional and personal life. Explore the wide world that is Are 401k Contributions Tax Deductible In Canada today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are 401k Contributions Tax Deductible In Canada truly cost-free?

- Yes they are! You can download and print these materials for free.

-

Can I use free printables to make commercial products?

- It is contingent on the specific rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Are 401k Contributions Tax Deductible In Canada?

- Some printables may contain restrictions in use. Be sure to review the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home with an printer, or go to an area print shop for more high-quality prints.

-

What program do I require to view printables for free?

- Most PDF-based printables are available in PDF format. These can be opened using free software like Adobe Reader.

After Tax 401 k Contribution Definition Pros Cons Rollover

Are Your 401k Losses Tax Deductible Gold IRA Explained

Check more sample of Are 401k Contributions Tax Deductible In Canada below

401 k Plans Are Employer sponsored Retirement Plans Where Employees

Here s The Latest 401k IRA And Other Contribution Limits For 2023

What S The Maximum 401k Contribution Limit In 2022 Hanover Mortgages

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog

2019 IRA Contribution Limits Unchanged For 2020 401k And HSA Caps Rise

Best Guide To 401k For Business Owners 401k Small Business Owner Tips

https://www.plenawealth.ca/401k-in-canada

Is a 401 k taxable in Canada The earnings in 401 k and 403 b s are tax sheltered from Canadian taxes however withdrawals from these plans are taxable and must be reported on your Canadian tax return

https://www.canada.ca/en/revenue-agency/services/...

Find out if you have contributed too much to the CPP or QPP and how to calculate and claim this credit All deductions credits and expenses Find a list of all deductions credits and expenses you may be able to claim on your income tax and benefit return

Is a 401 k taxable in Canada The earnings in 401 k and 403 b s are tax sheltered from Canadian taxes however withdrawals from these plans are taxable and must be reported on your Canadian tax return

Find out if you have contributed too much to the CPP or QPP and how to calculate and claim this credit All deductions credits and expenses Find a list of all deductions credits and expenses you may be able to claim on your income tax and benefit return

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog

Here s The Latest 401k IRA And Other Contribution Limits For 2023

2019 IRA Contribution Limits Unchanged For 2020 401k And HSA Caps Rise

Best Guide To 401k For Business Owners 401k Small Business Owner Tips

401k Savings By Age How Much Should You Save For Retirement

Contributions Tax

Contributions Tax

Are 401k Contributions Tax Deductible The Starving Graduate