In this digital age, in which screens are the norm it's no wonder that the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply adding an individual touch to your area, Are 401 K Contributions Taxable In California are now a useful source. We'll dive deeper into "Are 401 K Contributions Taxable In California," exploring the different types of printables, where they can be found, and what they can do to improve different aspects of your life.

Get Latest Are 401 K Contributions Taxable In California Below

Are 401 K Contributions Taxable In California

Are 401 K Contributions Taxable In California -

California implemented a new mandatory law requiring all companies with more than five employees to offer a retirement plan to their workers by June 30 2022 Companies that don t will be required to enroll in CalSavers

Are 401k contributions considered taxable income in California No 401 k contributions are exempt from federal income tax and from California state income tax ftb ca gov

Are 401 K Contributions Taxable In California encompass a wide variety of printable, downloadable items that are available online at no cost. They come in many kinds, including worksheets templates, coloring pages, and much more. One of the advantages of Are 401 K Contributions Taxable In California is in their variety and accessibility.

More of Are 401 K Contributions Taxable In California

401 k Contribution Limits Rising Next Year Kiplinger

401 k Contribution Limits Rising Next Year Kiplinger

Fact checked by Suzanne Kvilhaug Contributions to qualified retirement plans such as traditional 401 k s tax deductible However you don t have to report them on your tax return as

It says that employees older than 50 who make more than 145 000 a year adjusted for inflation can put their catch up contributions only into after tax Roth 401 k 403 b

Are 401 K Contributions Taxable In California have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Flexible: You can tailor the design to meet your needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: The free educational worksheets can be used by students of all ages, making these printables a powerful instrument for parents and teachers.

-

Convenience: Quick access to various designs and templates cuts down on time and efforts.

Where to Find more Are 401 K Contributions Taxable In California

What Are The Benefits Of Having 401 k Plan

What Are The Benefits Of Having 401 k Plan

Unless you re a business owner you won t claim your 401 k contributions as tax deductible when you fill out your Form 1040 Instead the money is taken out of your paycheck before federal taxes on your income are figured This is

Key Points 401 k contributions are not tax deductible but they lower your taxable income Roth 401 k contributions are made with after tax money and do not provide tax deductions Contributions

Now that we've piqued your interest in Are 401 K Contributions Taxable In California Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Are 401 K Contributions Taxable In California to suit a variety of purposes.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning tools.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing Are 401 K Contributions Taxable In California

Here are some ideas how you could make the most of Are 401 K Contributions Taxable In California:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Are 401 K Contributions Taxable In California are a treasure trove of fun and practical tools that satisfy a wide range of requirements and pursuits. Their availability and versatility make them a fantastic addition to both personal and professional life. Explore the wide world of Are 401 K Contributions Taxable In California to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can download and print these tools for free.

-

Can I use the free printables to make commercial products?

- It's determined by the specific usage guidelines. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may have restrictions in use. Make sure you read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- You can print them at home using an printer, or go to a local print shop to purchase premium prints.

-

What software will I need to access printables for free?

- Most printables come as PDF files, which is open with no cost software like Adobe Reader.

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

2023 Retirement Plan Contribution Limits 401 k IRA Roth IRA

Check more sample of Are 401 K Contributions Taxable In California below

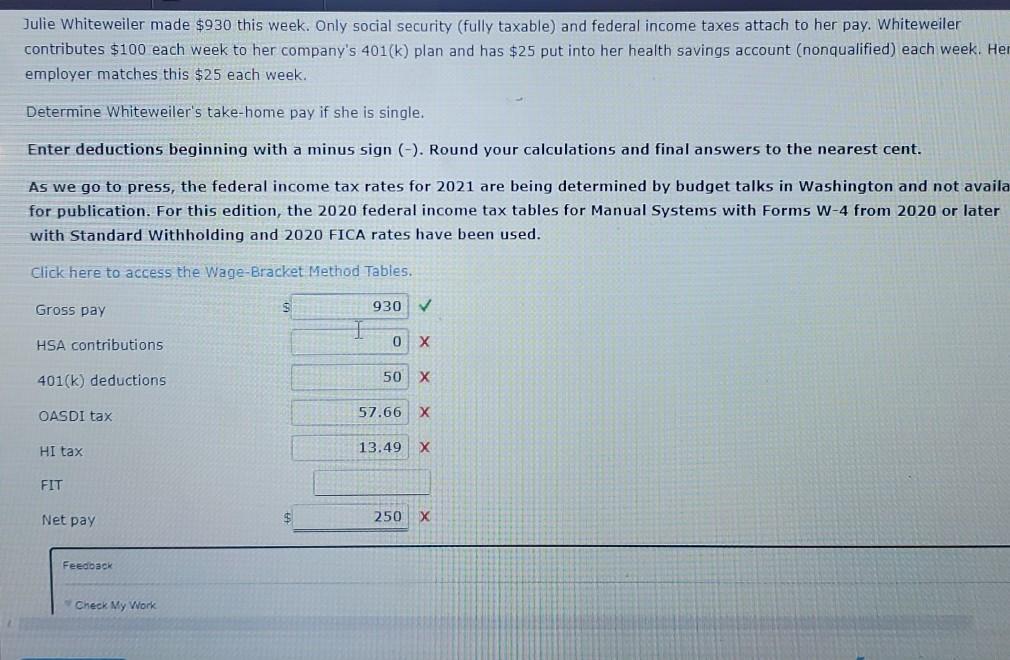

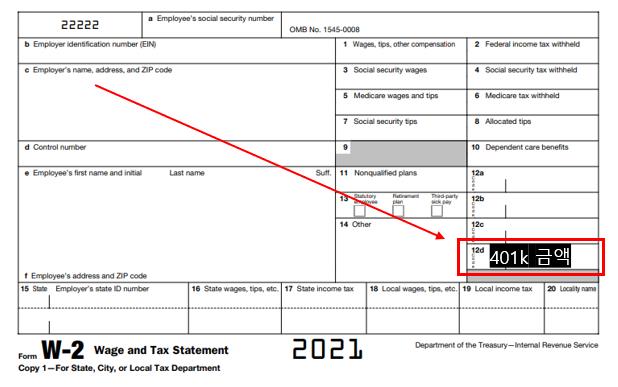

Solved Julie Whiteweiler Made 930 This Week Only Social Chegg

Are 401 k Contributions Subject To FICA Taxes

Are 401 K Contributions Tax Deductible

Social Security Cost Of Living Adjustments 2023

401 K A Smart Investment That Can Significantly Lower Your Taxes

After Tax 401 k Contribution Definition Pros Cons Rollover

https://ttlc.intuit.com/community/retirement/...

Are 401k contributions considered taxable income in California No 401 k contributions are exempt from federal income tax and from California state income tax ftb ca gov

https://smartasset.com/retirement/california...

Are other forms of retirement income taxable in California Retirement account income including withdrawals from a 401 k or IRA is considered taxable income in California So is all pension income whether from a

Are 401k contributions considered taxable income in California No 401 k contributions are exempt from federal income tax and from California state income tax ftb ca gov

Are other forms of retirement income taxable in California Retirement account income including withdrawals from a 401 k or IRA is considered taxable income in California So is all pension income whether from a

Social Security Cost Of Living Adjustments 2023

Are 401 k Contributions Subject To FICA Taxes

401 K A Smart Investment That Can Significantly Lower Your Taxes

After Tax 401 k Contribution Definition Pros Cons Rollover

Are 401 K Contributions Pre Tax

Traditional 401k USA

Traditional 401k USA

Are 401 K Contributions Pre Tax