In this digital age, where screens have become the dominant feature of our lives but the value of tangible printed material hasn't diminished. In the case of educational materials and creative work, or simply adding an extra personal touch to your area, Are 401 K Contributions Tax Exempt can be an excellent source. This article will dive through the vast world of "Are 401 K Contributions Tax Exempt," exploring what they are, where you can find them, and how they can enhance various aspects of your life.

Get Latest Are 401 K Contributions Tax Exempt Below

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

Are 401 K Contributions Tax Exempt

Are 401 K Contributions Tax Exempt -

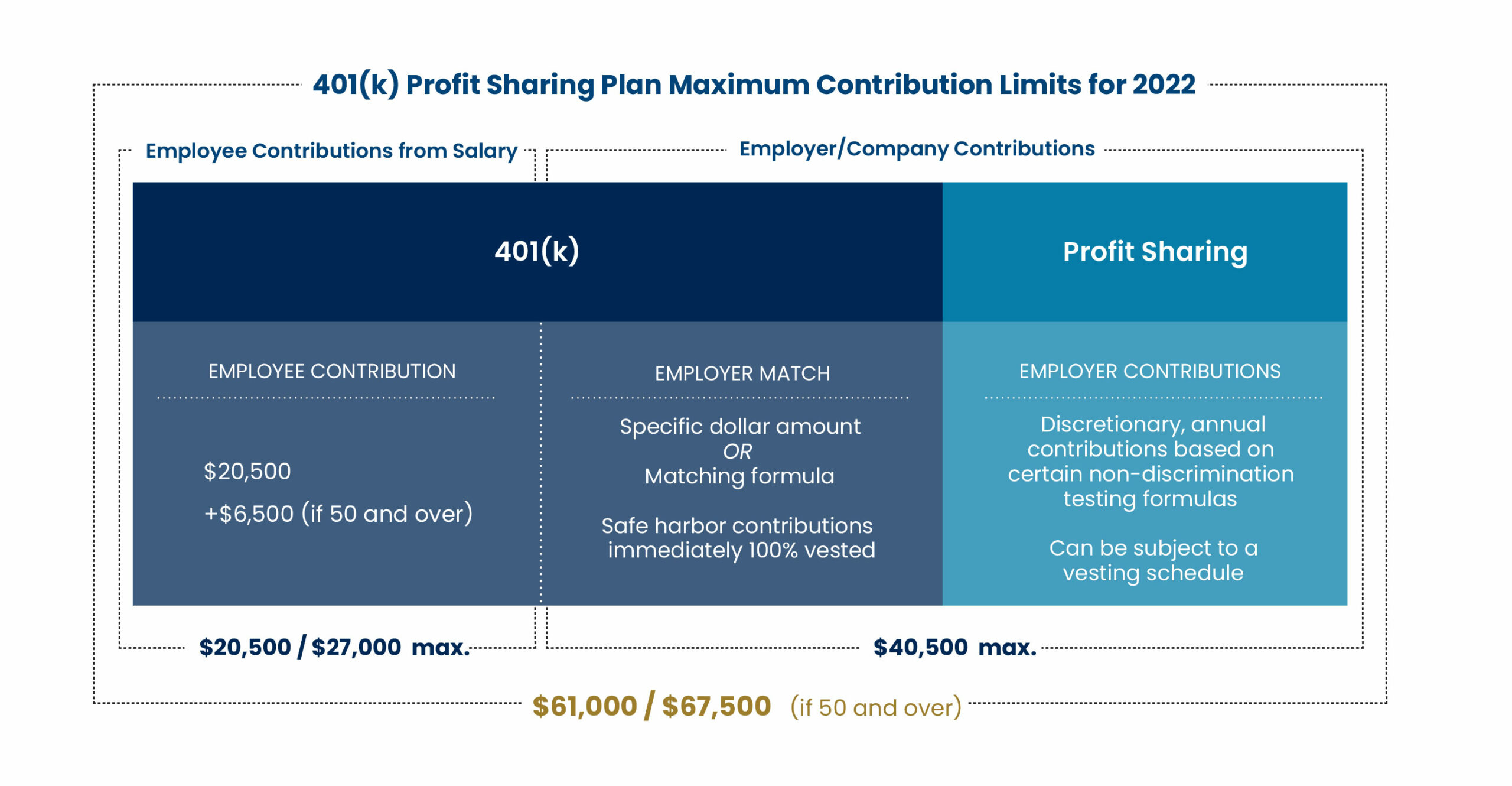

Key Points 401 k contributions are not tax deductible but they lower your taxable income Roth 401 k contributions are made with after tax money and do not provide tax deductions Contributions to employer sponsored plans

Traditional 401 k s SIMPLE 401 k s and safe harbor 401 k s all accept pre tax contributions Roth 401 k s on the other hand were introduced in 2006 and accept post tax

Are 401 K Contributions Tax Exempt offer a wide collection of printable documents that can be downloaded online at no cost. They come in many forms, including worksheets, templates, coloring pages, and much more. The value of Are 401 K Contributions Tax Exempt is their versatility and accessibility.

More of Are 401 K Contributions Tax Exempt

Best Guide To 401k For Business Owners 401k Small Business Owner Tips

Best Guide To 401k For Business Owners 401k Small Business Owner Tips

Common tax deferred retirement accounts are traditional IRAs and 401 k s Popular tax exempt retirement accounts are Roth IRAs and Roth 401 k s An ideal tax optimization strategy

Do You Pay Tax on 401 k Contributions A 401 k is a tax deferred account That means you do not pay income taxes when you contribute money Instead your employer withholds your contribution from your paycheck before the

The Are 401 K Contributions Tax Exempt have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Customization: There is the possibility of tailoring the design to meet your needs whether you're designing invitations planning your schedule or decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free provide for students of all ages, making the perfect source for educators and parents.

-

Convenience: immediate access many designs and templates cuts down on time and efforts.

Where to Find more Are 401 K Contributions Tax Exempt

How To Choose Between A Traditional And Roth 401 k

How To Choose Between A Traditional And Roth 401 k

With a traditional 401 k your entire withdrawal contributions and earnings will be taxed as income These distributions are taxed like the money you earn from a job

A 401 k is a feature of a qualified profit sharing plan that allows employees to contribute a portion of their wages to individual accounts Elective salary deferrals are excluded from the

After we've peaked your interest in printables for free Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Are 401 K Contributions Tax Exempt for various uses.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets as well as flashcards and other learning materials.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a wide range of topics, including DIY projects to planning a party.

Maximizing Are 401 K Contributions Tax Exempt

Here are some ideas create the maximum value of Are 401 K Contributions Tax Exempt:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are 401 K Contributions Tax Exempt are an abundance of useful and creative resources that can meet the needs of a variety of people and hobbies. Their availability and versatility make them a fantastic addition to both personal and professional life. Explore the many options of Are 401 K Contributions Tax Exempt today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are 401 K Contributions Tax Exempt truly completely free?

- Yes they are! You can download and print these materials for free.

-

Do I have the right to use free printables to make commercial products?

- It is contingent on the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright rights issues with Are 401 K Contributions Tax Exempt?

- Certain printables may be subject to restrictions concerning their use. You should read the terms and conditions offered by the creator.

-

How can I print Are 401 K Contributions Tax Exempt?

- Print them at home using a printer or visit any local print store for top quality prints.

-

What program do I need to run printables at no cost?

- Many printables are offered in PDF format. They can be opened using free software such as Adobe Reader.

401 k Contribution Limits In 2023 Meld Financial

Suspending 401 k Matching Contributions During Tough Times Greenwalt

Check more sample of Are 401 K Contributions Tax Exempt below

401 k Contributions Pre tax Vs Post tax YouTube

401 k Contribution Limits Rising Next Year Kiplinger

What Are The Benefits Of Having 401 k Plan

Are 401 K Contributions Tax Deductible

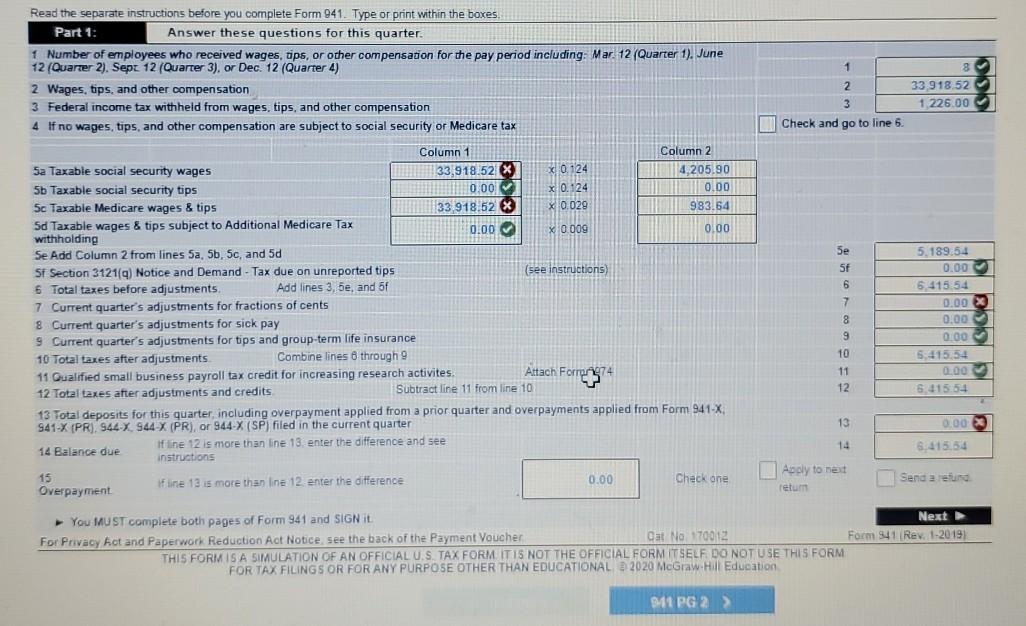

Solved The First Quarter Tax Return Needs To Be Filed For Chegg

The Road To Retirement Savings With RRSPs Osoyoos Credit Union

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png?w=186)

https://humaninterest.com/learn/articles/401k-tax...

Traditional 401 k s SIMPLE 401 k s and safe harbor 401 k s all accept pre tax contributions Roth 401 k s on the other hand were introduced in 2006 and accept post tax

https://www.irs.gov/.../401k-plan-overview

Safe harbor 401 k plans that do not provide any additional contributions in a year are exempted from the top heavy rules of section 416 of the Internal Revenue Code Employers

Traditional 401 k s SIMPLE 401 k s and safe harbor 401 k s all accept pre tax contributions Roth 401 k s on the other hand were introduced in 2006 and accept post tax

Safe harbor 401 k plans that do not provide any additional contributions in a year are exempted from the top heavy rules of section 416 of the Internal Revenue Code Employers

Are 401 K Contributions Tax Deductible

401 k Contribution Limits Rising Next Year Kiplinger

Solved The First Quarter Tax Return Needs To Be Filed For Chegg

The Road To Retirement Savings With RRSPs Osoyoos Credit Union

Are 401 k Contributions Subject To FICA Taxes

Are 401 k Contributions Tax Deductible Limits Explained MediaFeed

Are 401 k Contributions Tax Deductible Limits Explained MediaFeed

Understanding 401 k And IRA Options Capital Flow