In a world with screens dominating our lives but the value of tangible printed products hasn't decreased. In the case of educational materials as well as creative projects or simply adding an element of personalization to your space, Are 401 K Contributions Tax Deductible In New Jersey can be an excellent resource. The following article is a dive into the sphere of "Are 401 K Contributions Tax Deductible In New Jersey," exploring what they are, how they can be found, and how they can improve various aspects of your lives.

Get Latest Are 401 K Contributions Tax Deductible In New Jersey Below

Are 401 K Contributions Tax Deductible In New Jersey

Are 401 K Contributions Tax Deductible In New Jersey -

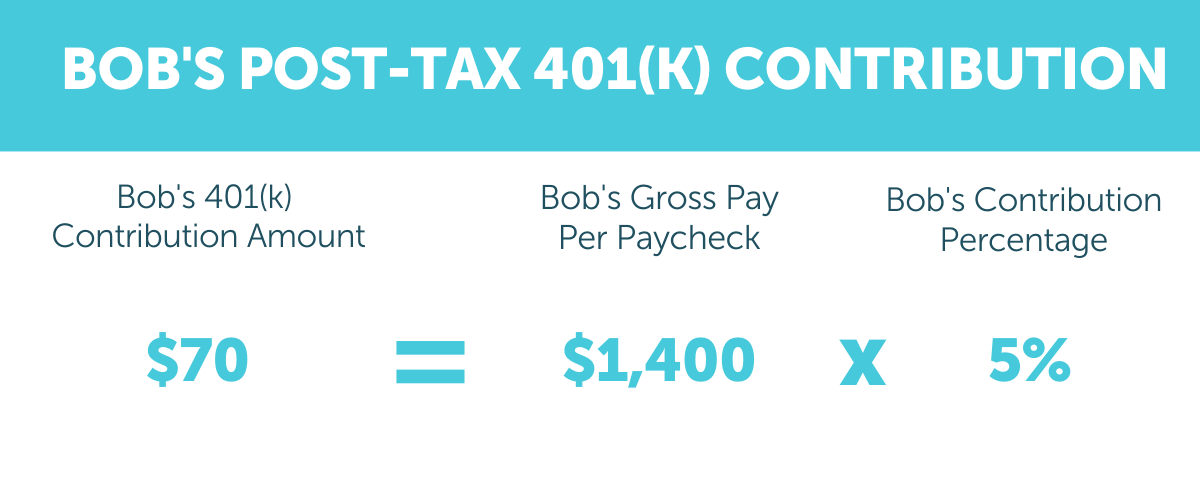

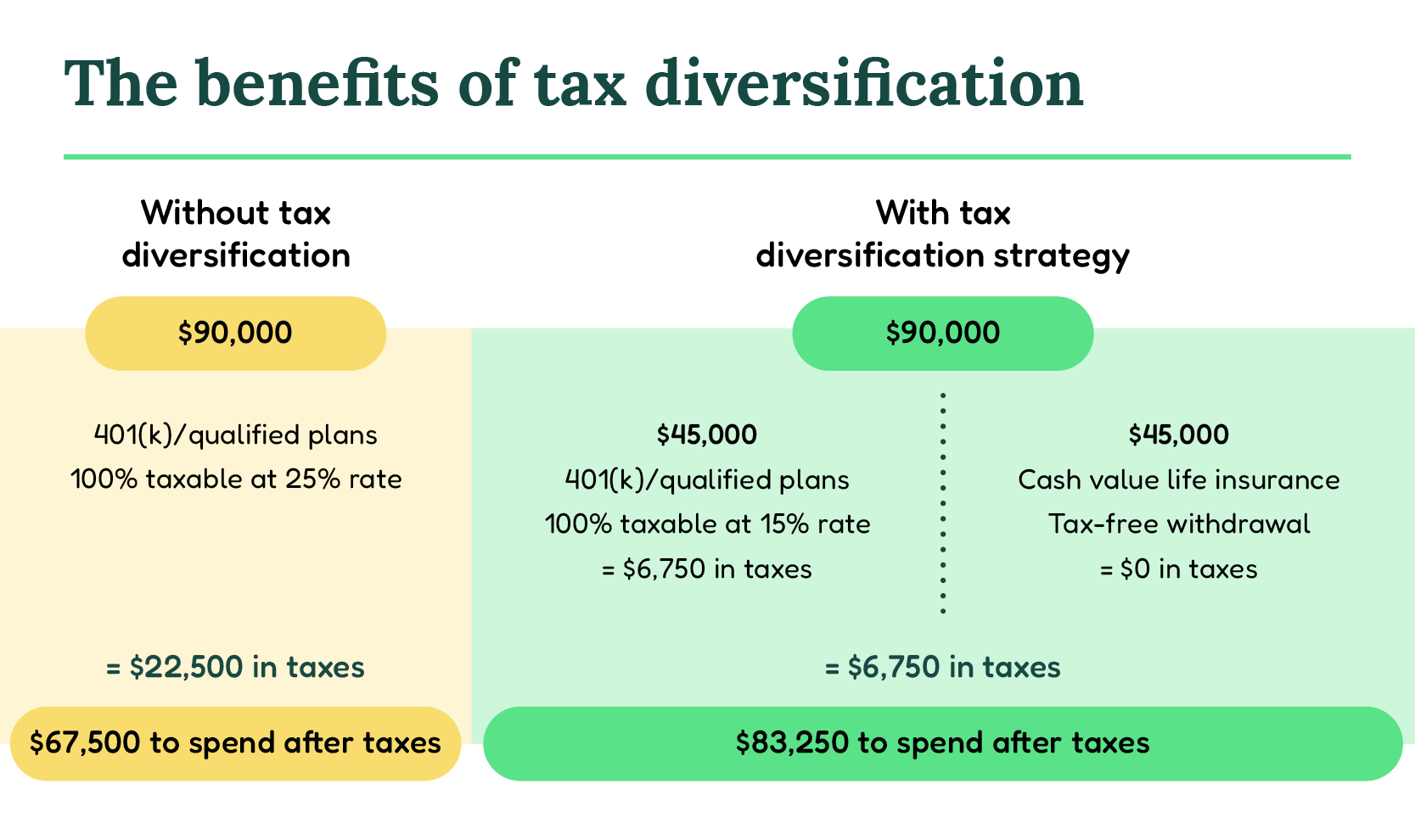

Contributions are usually made through payroll deductions and in general have already been taxed Your contributions are not taxed when withdrawn However any employer contributions and earnings that have not been taxed must be reported You will need to determine the taxable and excludable parts of your distribution

Contributions Not Deductible Many people are surprised to learn that New Jersey does not allow a deduction for contributions to IRAs and 403 b plans even if they are deductible for

Printables for free cover a broad range of downloadable, printable items that are available online at no cost. These resources come in many types, like worksheets, coloring pages, templates and many more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Are 401 K Contributions Tax Deductible In New Jersey

What Does 401 Mean Meaning Of Number

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Does 401 Mean Meaning Of Number

Many people are surprised to learn that New Jersey does not allow a deduction for contributions to IRAs and 403 b plans even if they are deductible for federal income tax purposes It is only since 1984 that New Jersey began to allow a deduction for employee contributions to 401 k plans

A New Jersey known for its high taxes enacted the pension exclusion as incentive for retirees to stay in the state Yes your 401 k distributions are eligible for the pension

The Are 401 K Contributions Tax Deductible In New Jersey have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization This allows you to modify the templates to meet your individual needs, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Education Value Educational printables that can be downloaded for free can be used by students from all ages, making them a valuable instrument for parents and teachers.

-

It's easy: Quick access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Are 401 K Contributions Tax Deductible In New Jersey

How To Choose Between A Traditional And Roth 401 k

How To Choose Between A Traditional And Roth 401 k

Deduct the remaining 50 of meal and entertainment expenses that were not allowed on the federal return Deduct qualified contributions to a self employed 401 k Plan Contributions that exceeded the federal limits are not deductible for New Jersey purposes Add interest and dividends derived in the conduct of a trade or business

New Jersey does not allow you to exclude from wages amounts you contribute to deferred compensation and retirement plans other than 401 k Plans New Jersey does not allow you to deduct moving expenses or employee business expenses from wages although you can exclude reimbursements for certain expenses if they are included in wages on your

We've now piqued your curiosity about Are 401 K Contributions Tax Deductible In New Jersey we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Are 401 K Contributions Tax Deductible In New Jersey for different purposes.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide selection of subjects, starting from DIY projects to planning a party.

Maximizing Are 401 K Contributions Tax Deductible In New Jersey

Here are some ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Are 401 K Contributions Tax Deductible In New Jersey are an abundance of innovative and useful resources that satisfy a wide range of requirements and needs and. Their accessibility and versatility make they a beneficial addition to the professional and personal lives of both. Explore the vast world of Are 401 K Contributions Tax Deductible In New Jersey and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are 401 K Contributions Tax Deductible In New Jersey really absolutely free?

- Yes they are! You can download and print these materials for free.

-

Do I have the right to use free templates for commercial use?

- It is contingent on the specific conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions regarding their use. You should read these terms and conditions as set out by the designer.

-

How can I print Are 401 K Contributions Tax Deductible In New Jersey?

- You can print them at home with either a printer or go to an in-store print shop to get better quality prints.

-

What program do I need to open Are 401 K Contributions Tax Deductible In New Jersey?

- The majority of printables are as PDF files, which can be opened with free software, such as Adobe Reader.

401 k Contribution Limits In 2023 Meld Financial

401k Reduce Taxable Income Calculator ArmaanHakeem

Check more sample of Are 401 K Contributions Tax Deductible In New Jersey below

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

What Are The Benefits Of Having 401 k Plan

2023 Retirement Plan Contribution Limits 401 k IRA Roth IRA

Are Your 401k Losses Tax Deductible Gold IRA Explained

Are 401 k Contributions Subject To FICA Taxes

Investment Expenses What s Tax Deductible Charles Schwab

https://www.natlawreview.com/article/don-t-forget...

Contributions Not Deductible Many people are surprised to learn that New Jersey does not allow a deduction for contributions to IRAs and 403 b plans even if they are deductible for

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png?w=186)

https://ttlc.intuit.com/community/retirement/...

Yes contributions to your 401 k are excludable for New Jersey NJ income tax Here is an excerpt from the NJ Department of Revenue If you are a New Jersey resident wages you receive from all employers are subject to

Contributions Not Deductible Many people are surprised to learn that New Jersey does not allow a deduction for contributions to IRAs and 403 b plans even if they are deductible for

Yes contributions to your 401 k are excludable for New Jersey NJ income tax Here is an excerpt from the NJ Department of Revenue If you are a New Jersey resident wages you receive from all employers are subject to

Are Your 401k Losses Tax Deductible Gold IRA Explained

What Are The Benefits Of Having 401 k Plan

Are 401 k Contributions Subject To FICA Taxes

Investment Expenses What s Tax Deductible Charles Schwab

Are 401 K Contributions Tax Deductible

Are 401k Losses Tax Deductible Gold IRA Explained

Are 401k Losses Tax Deductible Gold IRA Explained

Do Employer Contributions Affect The 401 k Contribution Limit Titan