In this digital age, with screens dominating our lives and the appeal of physical printed materials hasn't faded away. In the case of educational materials as well as creative projects or simply adding an individual touch to your space, Are 401 K Contributions Subject To Social Security And Medicare Tax have become an invaluable source. We'll dive through the vast world of "Are 401 K Contributions Subject To Social Security And Medicare Tax," exploring the different types of printables, where you can find them, and what they can do to improve different aspects of your life.

Get Latest Are 401 K Contributions Subject To Social Security And Medicare Tax Below

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Are 401 K Contributions Subject To Social Security And Medicare Tax

Are 401 K Contributions Subject To Social Security And Medicare Tax -

Advertiser disclosure 401 k Taxes on Withdrawals and Contributions Contributing to a traditional 401 k could help reduce your taxable income now but in most cases you ll pay taxes

Tip Since FICA tax applies to all your gross earnings you still pay FICA taxes on your 401 k contributions However you won t pay income tax on those contributions until you begin receiving

Printables for free cover a broad variety of printable, downloadable materials online, at no cost. These resources come in many types, such as worksheets templates, coloring pages, and much more. The appealingness of Are 401 K Contributions Subject To Social Security And Medicare Tax is their flexibility and accessibility.

More of Are 401 K Contributions Subject To Social Security And Medicare Tax

What Does 401 Mean Meaning Of Number

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Does 401 Mean Meaning Of Number

Key Takeaways The tax treatment of 401 k distributions depends on the type of account traditional or Roth Traditional 401 k withdrawals are taxed at the account owner s current income tax

FICA Taxes Explained FICA taxes are the taxes imposed on your employee income FICA taxes include the Social Security tax and the Medicare tax Each tax is split equally between the employee and the company The Social Security tax is 12 4 percent so 6 2 percent is taken out of your paycheck and your employer pays an additional 6 2

Are 401 K Contributions Subject To Social Security And Medicare Tax have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: They can make print-ready templates to your specific requirements for invitations, whether that's creating them, organizing your schedule, or even decorating your house.

-

Educational Impact: Printing educational materials for no cost can be used by students of all ages. This makes them an essential tool for teachers and parents.

-

Affordability: The instant accessibility to a myriad of designs as well as templates reduces time and effort.

Where to Find more Are 401 K Contributions Subject To Social Security And Medicare Tax

Opinion Biden s Promises On Social Security And Medicare Have No

Opinion Biden s Promises On Social Security And Medicare Have No

When you contribute to a pre tax retirement account such as a 401 k the IRS still charges FICA taxes on that money You only get to deduct those contributions from your federal income tax If you contribute to a post tax account such as a Roth account or an ordinary portfolio then you have again already paid FICA taxes on those contributions

Although elective deferrals are not treated as current income for federal income tax purposes they are included as wages subject to Social Security FICA Medicare and federal unemployment taxes FUTA Refer to Publication 525 Taxable and Nontaxable Income PDF for more information about elective deferrals

In the event that we've stirred your interest in printables for free we'll explore the places you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of needs.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets including flashcards, learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing Are 401 K Contributions Subject To Social Security And Medicare Tax

Here are some ways ensure you get the very most of Are 401 K Contributions Subject To Social Security And Medicare Tax:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets to build your knowledge at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Are 401 K Contributions Subject To Social Security And Medicare Tax are an abundance with useful and creative ideas for a variety of needs and desires. Their availability and versatility make them a wonderful addition to any professional or personal life. Explore the vast collection of Are 401 K Contributions Subject To Social Security And Medicare Tax today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes they are! You can print and download these items for free.

-

Are there any free templates for commercial use?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright violations with Are 401 K Contributions Subject To Social Security And Medicare Tax?

- Certain printables may be subject to restrictions concerning their use. Check the conditions and terms of use provided by the author.

-

How do I print printables for free?

- Print them at home with your printer or visit an in-store print shop to get higher quality prints.

-

What program is required to open printables for free?

- A majority of printed materials are in the format PDF. This is open with no cost programs like Adobe Reader.

401 k Contribution Limits In 2023 Meld Financial

Solved Compute c State Unemployment Compensation At 5 4 On The

Check more sample of Are 401 K Contributions Subject To Social Security And Medicare Tax below

Are 401 k Contributions Subject To FICA Taxes

What Income Is Subject To The 3 8 Medicare Tax

Social Security GuangGurpage

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From

Social Security Tax Wage Base For 2023 Kiplinger

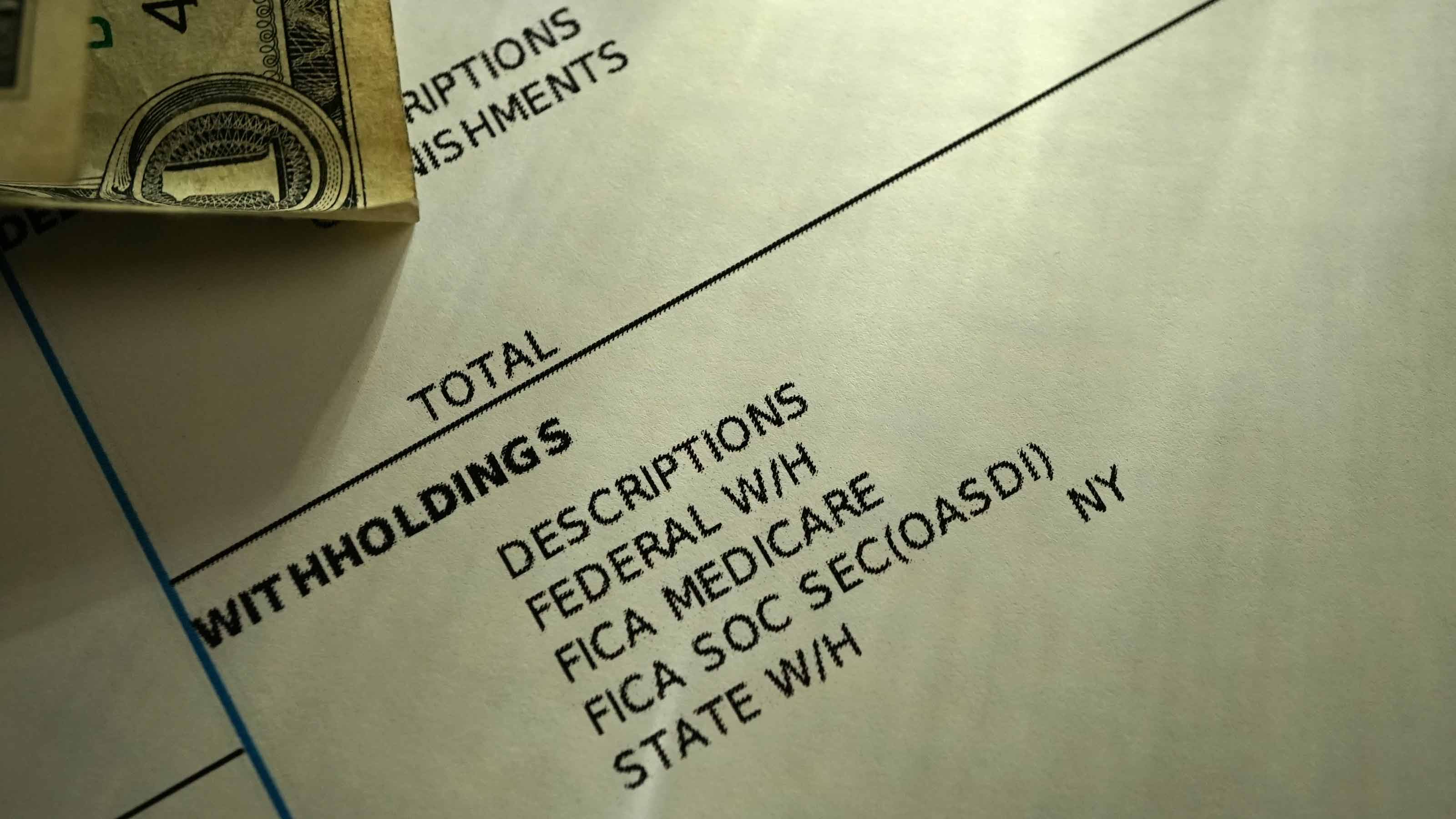

Solved Julie Whiteweiler Made 930 This Week Only Social Chegg

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png?w=186)

https:// finance.zacks.com /401k-deductions-reduce-fica-wages-2641.html

Tip Since FICA tax applies to all your gross earnings you still pay FICA taxes on your 401 k contributions However you won t pay income tax on those contributions until you begin receiving

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png?w=186)

https:// smartasset.com /retirement/401k-tax

Traditional 401 k plans are tax deferred You don t have to pay income taxes on your contributions though you will have to pay other payroll taxes like Social Security and Medicare taxes You won t pay

Tip Since FICA tax applies to all your gross earnings you still pay FICA taxes on your 401 k contributions However you won t pay income tax on those contributions until you begin receiving

Traditional 401 k plans are tax deferred You don t have to pay income taxes on your contributions though you will have to pay other payroll taxes like Social Security and Medicare taxes You won t pay

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From

What Income Is Subject To The 3 8 Medicare Tax

Social Security Tax Wage Base For 2023 Kiplinger

Solved Julie Whiteweiler Made 930 This Week Only Social Chegg

What Is The Employee Medicare Tax

Medicare Part B Premium 2024 Chart

Medicare Part B Premium 2024 Chart

Are 401 K Contributions Pre Tax