In the age of digital, where screens rule our lives, the charm of tangible, printed materials hasn't diminished. In the case of educational materials project ideas, artistic or simply to add an element of personalization to your home, printables for free are a great source. Here, we'll take a dive deep into the realm of "80gg Income Tax Rebate," exploring what they are, where to get them, as well as how they can improve various aspects of your daily life.

Get Latest 80gg Income Tax Rebate Below

80gg Income Tax Rebate

80gg Income Tax Rebate - 80gg Income Tax Deduction, Who Is Eligible For 80gg Deduction, What Is 80gg Deduction, What Is 80gg In Itr, What Is 80gg In Income Tax

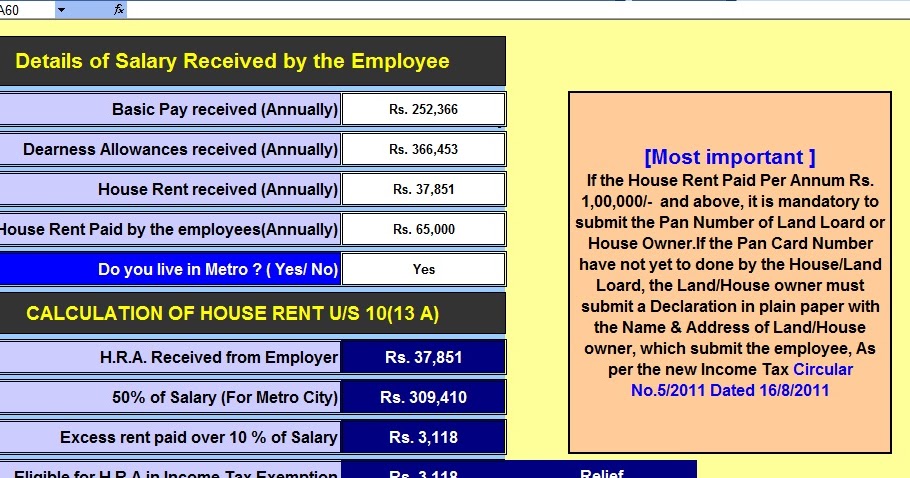

Web 5 juin 2023 nbsp 0183 32 What is Section 80GG of Income Tax Act Check out how to claim deduction under Section 80GG House Rent Allowance HRA calculation Eligibility criteria and more

Web Section 80GG of Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment he she

Printables for free cover a broad range of printable, free materials online, at no cost. They come in many types, like worksheets, templates, coloring pages and many more. The great thing about 80gg Income Tax Rebate lies in their versatility and accessibility.

More of 80gg Income Tax Rebate

House Rent Allowance 80GG Of Income Tax Act HRA Rebate U S 80GG In

House Rent Allowance 80GG Of Income Tax Act HRA Rebate U S 80GG In

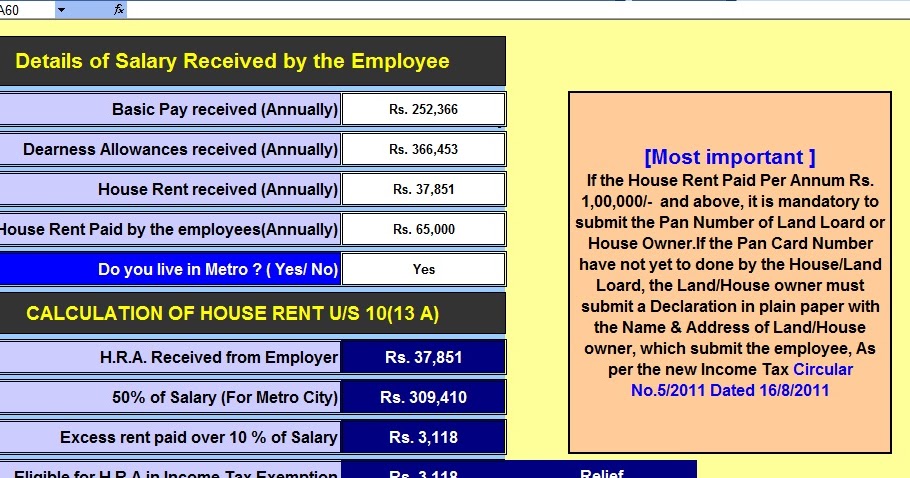

Web Section 80GG of the Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment

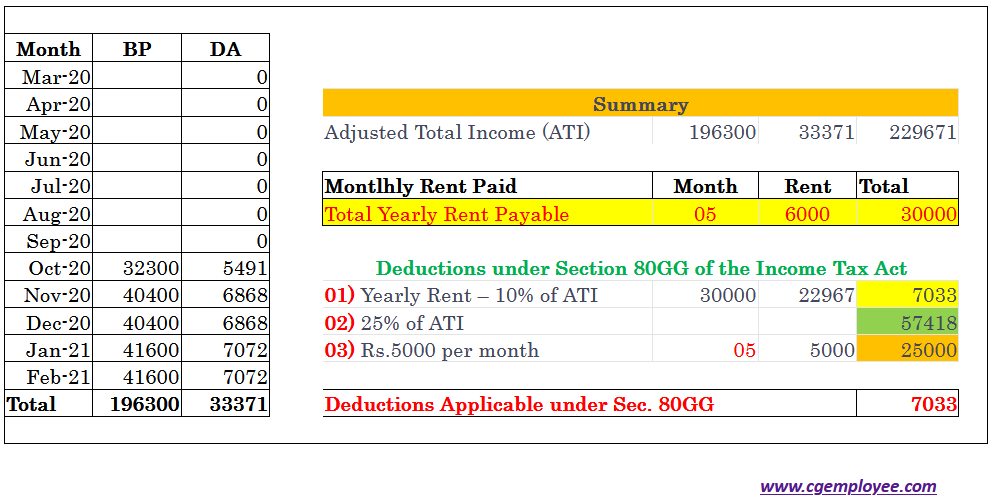

Web 26 juin 2018 nbsp 0183 32 Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is

80gg Income Tax Rebate have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: This allows you to modify the templates to meet your individual needs such as designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Printing educational materials for no cost can be used by students from all ages, making the perfect instrument for parents and teachers.

-

Accessibility: instant access an array of designs and templates can save you time and energy.

Where to Find more 80gg Income Tax Rebate

Beyond Section 80C 10 Ways To Save Taxes The Fact Eye

Beyond Section 80C 10 Ways To Save Taxes The Fact Eye

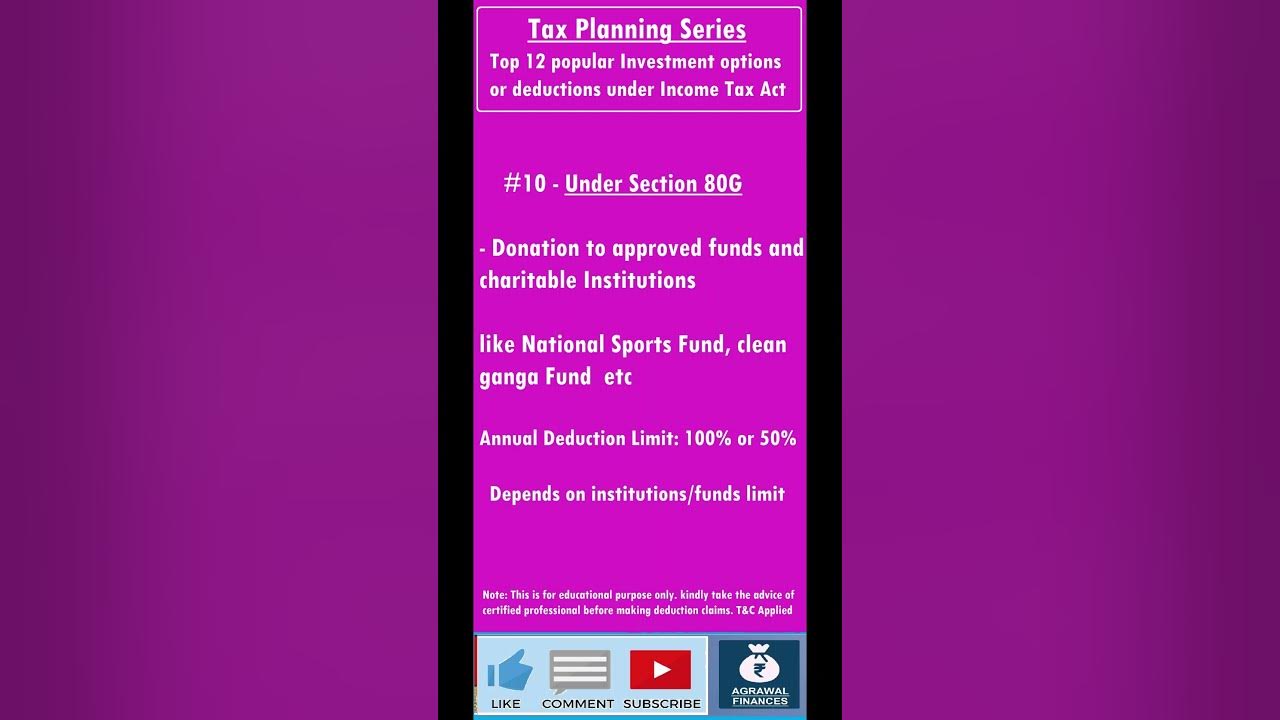

Web 80GG is a deduction under Chapter VI A of the Income Tax Act 1961 It has been introduced to provide relief to those individuals who do not receive any house rent

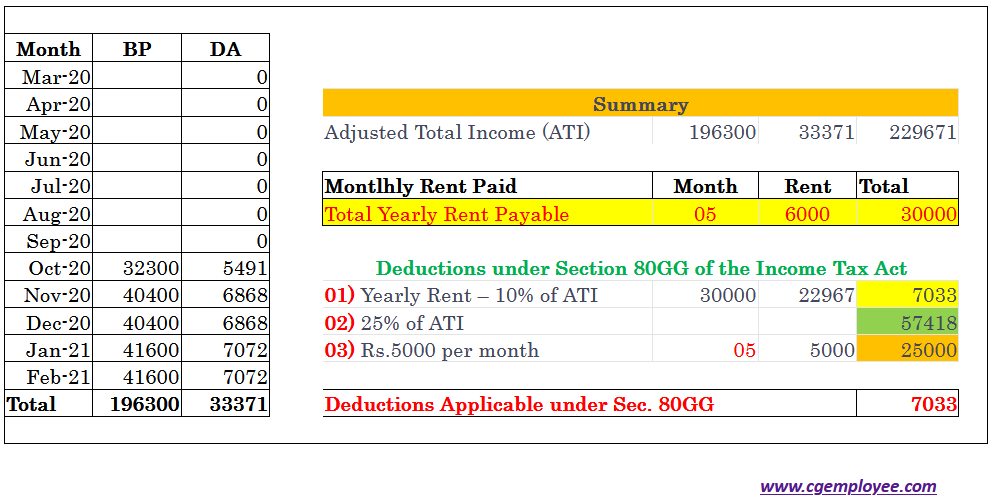

Web How to Calculate Tax Deduction Under Section 80GG Tax deductions under Section 80GG of the Income Tax Act 1961 are based on Tax Rule 2A a Rs 5000 per month or Rs

Now that we've ignited your interest in 80gg Income Tax Rebate We'll take a look around to see where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of 80gg Income Tax Rebate for various applications.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets as well as flashcards and other learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, from DIY projects to planning a party.

Maximizing 80gg Income Tax Rebate

Here are some creative ways to make the most use of 80gg Income Tax Rebate:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

80gg Income Tax Rebate are an abundance filled with creative and practical information which cater to a wide range of needs and pursuits. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the endless world of 80gg Income Tax Rebate today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can print and download the resources for free.

-

Can I utilize free printables for commercial uses?

- It's based on specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables could be restricted regarding usage. Be sure to check the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home with either a printer or go to a local print shop to purchase superior prints.

-

What software do I need in order to open printables that are free?

- Most PDF-based printables are available in the format of PDF, which is open with no cost software such as Adobe Reader.

Form 10BA Claim Deduction Under Section 80GG Learn By Quicko

80GG Deduction Under Income Tax Rent Paid HRA Deduction How To

Check more sample of 80gg Income Tax Rebate below

10 Section 80G SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

Section 80GG Income Tax Deduction On House Rent Paid Section 80GG

Tips And Tricks Follow THESE 5 Techniques To SAVE Income Tax News

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

Section 80GG Deduction Get Tax Benefit On Rent Paid If Not Getting HRA

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

https://groww.in/p/tax/section-80gg

Web Section 80GG of Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment he she

https://navi.com/blog/section-80gg

Web 30 mai 2022 nbsp 0183 32 Why is the Deduction Limit Kept Low Under Section 80GG of Income Tax Act The maximum limit for claiming deduction is Rs 60 000 under Section 80GG This is kept low because the rent across cities has

Web Section 80GG of Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment he she

Web 30 mai 2022 nbsp 0183 32 Why is the Deduction Limit Kept Low Under Section 80GG of Income Tax Act The maximum limit for claiming deduction is Rs 60 000 under Section 80GG This is kept low because the rent across cities has

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

Section 80GG Income Tax Deduction On House Rent Paid Section 80GG

Section 80GG Deduction Get Tax Benefit On Rent Paid If Not Getting HRA

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Deduction In Respect Of Rent Paid 80GG EZTax

80GG Deduction On House Rent Paid With Automated Income Tax

80GG Deduction On House Rent Paid With Automated Income Tax

Section 80GG Of Income Tax Act II Rent Paid Deduction U s 80GG II Tax