In the digital age, with screens dominating our lives but the value of tangible printed materials hasn't faded away. Whether it's for educational purposes, creative projects, or just adding an element of personalization to your space, 2023 Energy Tax Credits have become a valuable resource. For this piece, we'll dive into the world of "2023 Energy Tax Credits," exploring the benefits of them, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest 2023 Energy Tax Credits Below

2023 Energy Tax Credits

2023 Energy Tax Credits -

Eligibility for the credit Residential Energy Property Credit Section 25D Through 2019 taxpayers could claim a Section 25D credit worth up to 30 of qualifying expenditures The credit s rate was scheduled to be reduced to 26 through 2022 and 22 in 2023 expiring after 2023

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

2023 Energy Tax Credits provide a diverse array of printable resources available online for download at no cost. These printables come in different designs, including worksheets coloring pages, templates and many more. The value of 2023 Energy Tax Credits is in their versatility and accessibility.

More of 2023 Energy Tax Credits

The Climate Benefits From Clean Energy Tax Credits Are About Four Times

The Climate Benefits From Clean Energy Tax Credits Are About Four Times

One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of installing clean energy systems in your home including solar panels wind turbines battery storage and more

Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity 30 of cost Fuel Cells Wind Turbine Battery Storage N A 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water

2023 Energy Tax Credits have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations and schedules, or decorating your home.

-

Educational Worth: Printables for education that are free provide for students from all ages, making them a great tool for parents and teachers.

-

Simple: The instant accessibility to various designs and templates will save you time and effort.

Where to Find more 2023 Energy Tax Credits

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The Inflation Reduction Act P L 117 169 rejuvenated and expanded an energy credit program under Sec 48C e that now provides for up to 10 billion in tax credits for qualified investments in new expanded or reequipped manufacturing facilities that produce certain emissions reducing technologies The IRS in February 2023

Electric vehicles There are two relevant tax credits for new and used EVs each with different income limits and price caps The way it works for new vehicles is if you earn under 150 000

We've now piqued your curiosity about 2023 Energy Tax Credits and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of purposes.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing 2023 Energy Tax Credits

Here are some unique ways that you can make use of 2023 Energy Tax Credits:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

2023 Energy Tax Credits are an abundance of useful and creative resources catering to different needs and pursuits. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the vast world of 2023 Energy Tax Credits right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can download and print the resources for free.

-

Are there any free printables for commercial use?

- It depends on the specific rules of usage. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download 2023 Energy Tax Credits?

- Certain printables may be subject to restrictions concerning their use. Be sure to read the terms and condition of use as provided by the designer.

-

How can I print 2023 Energy Tax Credits?

- Print them at home with a printer or visit a local print shop for top quality prints.

-

What program do I require to view printables at no cost?

- Most printables come in PDF format, which can be opened using free programs like Adobe Reader.

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Heat Pump Tax Credits And Rebates Now Available For Homeowners Moneywise

Check more sample of 2023 Energy Tax Credits below

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

2023 Energy Efficient Home Credits Tax Benefits Tips

Federal Solar Tax Credits For Businesses Department Of Energy

Federal Solar Tax Credit What It Is How To Claim It For 2023

Irs Solar Tax Credit 2022 Form

Receive Your Tax Credits

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.irs.gov/pub/irs-pdf/p5797.pdf

2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit

Federal Solar Tax Credit What It Is How To Claim It For 2023

2023 Energy Efficient Home Credits Tax Benefits Tips

Irs Solar Tax Credit 2022 Form

Receive Your Tax Credits

2023 Residential Clean Energy Credit Guide ReVision Energy

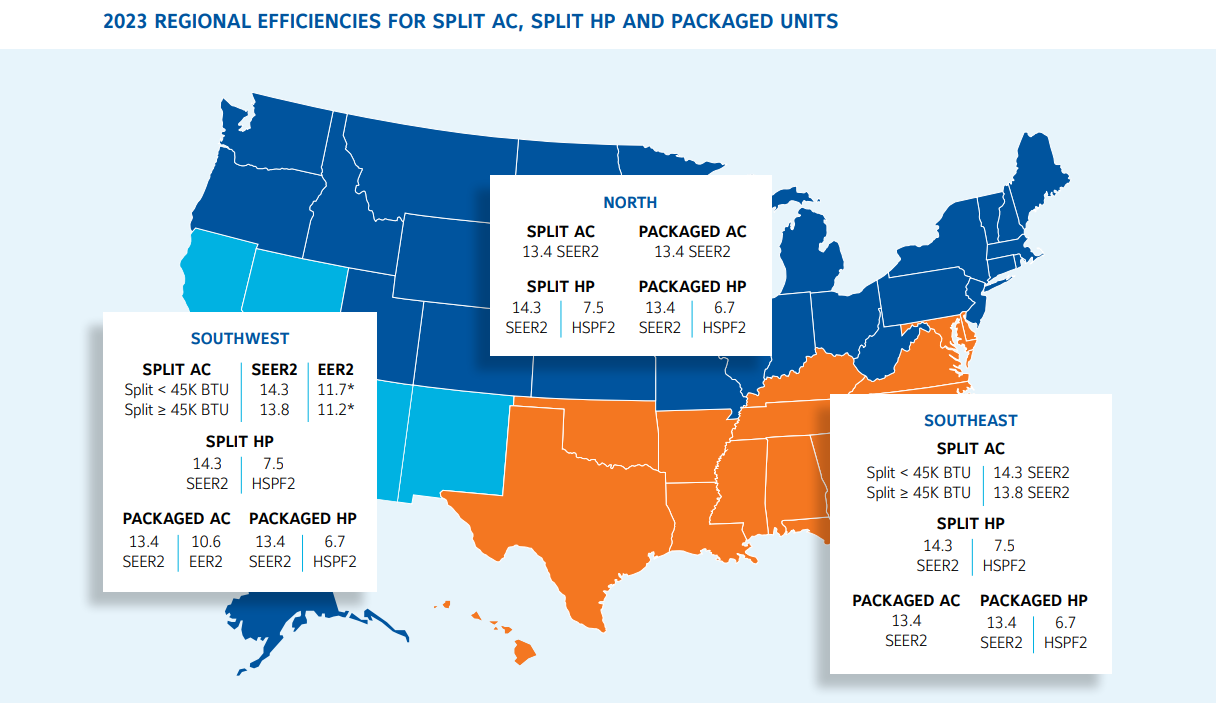

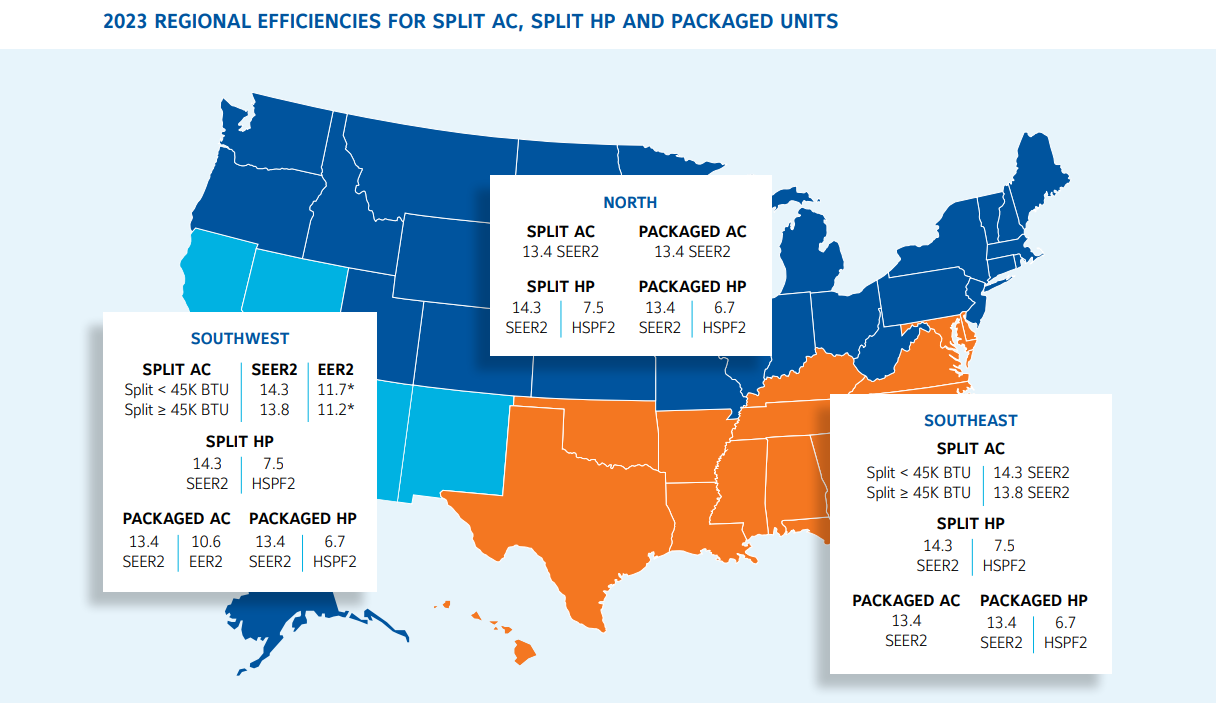

Manasota Air Conditioning Contractors Association Prepare Now For

Manasota Air Conditioning Contractors Association Prepare Now For

Tasha Randnotizen